Indonesia's Reserve Drop: Rupiah Depreciation And Economic Implications

Table of Contents

Factors Contributing to Indonesia's Reserve Drop

Several interconnected factors contribute to Indonesia's declining foreign exchange reserves and the weakening Rupiah. These factors highlight the vulnerabilities within the Indonesian economy and the challenges faced in maintaining macroeconomic stability.

Reduced Export Earnings

A significant contributor to the reserve drop is the decline in export earnings. This is due to several factors:

- Decline in commodity prices: Indonesia heavily relies on commodity exports, particularly palm oil and coal. Fluctuations in global commodity prices directly impact export revenue. The recent downturn in global commodity markets has significantly reduced the value of Indonesian exports.

- Global demand slowdown: Reduced global demand for Indonesian goods, driven by factors like global inflation and recessionary fears, has further suppressed export earnings. This weakens the Indonesian Rupiah and puts pressure on foreign exchange reserves.

- Increased global competition: Indonesia faces increasing competition from other exporting nations, putting downward pressure on prices and export volumes. This intensifies the challenges faced by Indonesian exporters in maintaining their market share and revenue streams.

Keyword Optimization: Indonesian Exports, Commodity Prices, Global Demand, Palm Oil Exports, Coal Exports

Increased Imports

Simultaneously, Indonesia faces a surge in import costs, further draining its foreign exchange reserves.

- Rising fuel import costs: Indonesia's reliance on imported fuel significantly impacts its trade balance. Soaring global energy prices, driven by geopolitical instability and supply chain disruptions, have drastically increased fuel import costs.

- Increased demand for imported goods: Rising consumer demand for imported goods, coupled with a weaker Rupiah, leads to higher import bills. This puts additional pressure on foreign exchange reserves.

- Dependence on imported raw materials: Many Indonesian industries rely on imported raw materials. The increased cost of these imports due to global inflation and supply chain issues exacerbates the problem.

Keyword Optimization: Indonesian Imports, Fuel Import Costs, Energy Prices, Import Dependence, Trade Balance

Capital Outflows

Global economic uncertainty is driving capital outflows from Indonesia, adding to the pressure on foreign exchange reserves.

- Global economic uncertainty: Concerns about global economic slowdown and geopolitical risks are prompting foreign investors to withdraw funds from emerging markets, including Indonesia.

- Rising US interest rates: The increase in US interest rates makes dollar-denominated assets more attractive, leading to capital flight from Indonesia and other emerging economies. This further weakens the Rupiah and reduces foreign exchange reserves.

- Concerns over Indonesian economic policies: Uncertainty surrounding Indonesian economic policies and potential regulatory changes can also deter foreign investment and lead to capital outflows.

Keyword Optimization: Capital Outflows, US Interest Rates, Foreign Investment in Indonesia, Emerging Market Investment

Impact of Rupiah Depreciation on the Indonesian Economy

The weakening Rupiah has significant consequences for the Indonesian economy:

Inflationary Pressures

Rupiah depreciation leads to increased import costs, resulting in higher consumer prices.

- Increased cost of imported goods: As the Rupiah weakens, the cost of imported goods, including essential commodities and energy, increases significantly, fueling inflation.

- Impact on purchasing power: This higher inflation reduces the purchasing power of Indonesian consumers, impacting their living standards.

- Potential for wage-price spiral: If wages rise to compensate for inflation, it can create a wage-price spiral, further exacerbating inflationary pressures.

Keyword Optimization: Rupiah Depreciation, Inflation Indonesia, Consumer Prices, Purchasing Power

Debt Burden Increase

A weaker Rupiah increases the cost of servicing foreign debt denominated in USD.

- Higher cost of servicing foreign debt: Indonesian businesses and the government have significant foreign debt. A weaker Rupiah increases the Rupiah cost of servicing this debt, putting a strain on government finances and corporate budgets.

- Increased risk of debt distress: This increased debt burden increases the risk of debt distress for Indonesian businesses and the government, potentially leading to financial instability.

- Impact on government spending and development projects: The increased cost of servicing debt may force the government to cut spending on crucial social programs and infrastructure development projects.

Keyword Optimization: Foreign Debt, Indonesian Debt, Debt Servicing Costs, Debt Distress

Impact on Businesses

Indonesian businesses are facing numerous challenges due to the Rupiah depreciation.

- Reduced competitiveness of Indonesian exports: A weaker Rupiah makes Indonesian exports more expensive in international markets, reducing their competitiveness.

- Increased costs for businesses importing raw materials and machinery: Businesses relying on imported raw materials and machinery face higher input costs, squeezing profit margins.

- Potential for job losses and reduced economic activity: These challenges could lead to job losses, reduced investment, and a slowdown in overall economic activity.

Keyword Optimization: Indonesian Businesses, Export Competitiveness, Import Costs, SME Indonesia

Government Responses and Mitigation Strategies

The Indonesian government is implementing various strategies to mitigate the negative effects of the reserve drop and Rupiah depreciation.

Monetary Policy Adjustments

Bank Indonesia is using monetary policy tools to stabilize the Rupiah.

- Interest rate hikes: Raising interest rates makes Indonesian assets more attractive to foreign investors, potentially attracting capital inflows and strengthening the Rupiah.

- Potential impact on economic growth and investment: However, interest rate hikes can also slow down economic growth and reduce investment. A delicate balance is required.

- Balancing inflation control with economic growth: The central bank faces the challenge of balancing the need to control inflation with the need to support economic growth.

Keyword Optimization: Monetary Policy Indonesia, Interest Rate Hikes, Rupiah Stability, Bank Indonesia

Fiscal Policy Measures

Fiscal measures aim to reduce the budget deficit and improve the country's fiscal position.

- Government spending cuts: The government may need to cut spending on certain programs to reduce the budget deficit and improve fiscal sustainability.

- Potential impact on social programs and infrastructure development: However, such cuts could negatively impact social programs and infrastructure development.

- Balancing fiscal prudence with economic stimulus: The government needs to balance fiscal prudence with the need to provide economic stimulus to support growth.

Keyword Optimization: Fiscal Policy Indonesia, Government Spending, Budget Deficit, Fiscal Sustainability

Diversification Strategies

Long-term solutions involve diversifying the Indonesian economy.

- Reducing reliance on commodity exports: Diversifying the export base to reduce reliance on volatile commodity prices is crucial for long-term economic stability.

- Promoting manufacturing and value-added industries: Investing in manufacturing and value-added industries can create higher-paying jobs and reduce dependence on raw material exports.

- Attracting foreign direct investment in diverse sectors: Attracting foreign direct investment (FDI) in diverse sectors can boost economic growth and create employment opportunities.

Keyword Optimization: Economic Diversification, Foreign Direct Investment, Value-Added Industries, Manufacturing Indonesia

Conclusion

The decline in Indonesia's foreign exchange reserves and the subsequent depreciation of the Rupiah present significant challenges. Addressing the root causes – reduced export earnings, increased imports, and capital outflows – requires a multifaceted approach. The government's responses, encompassing monetary and fiscal policy adjustments, and strategies for economic diversification are vital steps toward mitigating negative impacts and securing long-term economic stability. Continuous monitoring of Indonesia's reserve drop and the Rupiah's performance is crucial for investors and policymakers. Staying informed about the latest developments surrounding Indonesia's reserve drop and Rupiah depreciation is essential for navigating this complex economic landscape.

Featured Posts

-

Palantir Technologies Stock Buy Sell Or Hold A Current Market Evaluation

May 09, 2025

Palantir Technologies Stock Buy Sell Or Hold A Current Market Evaluation

May 09, 2025 -

5 Celebrity Disputes That Involved Stephen King

May 09, 2025

5 Celebrity Disputes That Involved Stephen King

May 09, 2025 -

Difficultes D Epicure A La Cite De La Gastronomie De Dijon Implication Municipale

May 09, 2025

Difficultes D Epicure A La Cite De La Gastronomie De Dijon Implication Municipale

May 09, 2025 -

Wall Streets Bullish Prediction Black Rock Etf Poised For 110 Growth In 2025

May 09, 2025

Wall Streets Bullish Prediction Black Rock Etf Poised For 110 Growth In 2025

May 09, 2025 -

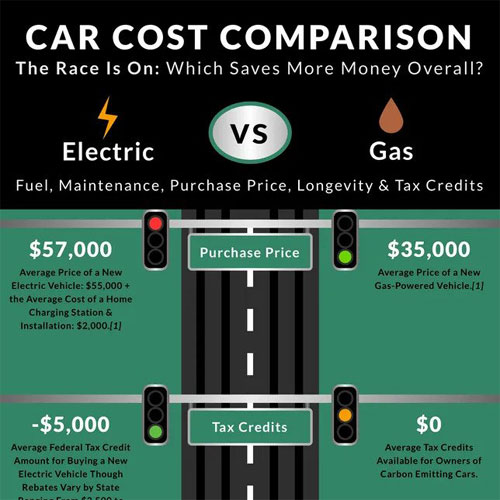

The Auto Industrys Standoff Dealers Vs Electric Vehicle Regulations

May 09, 2025

The Auto Industrys Standoff Dealers Vs Electric Vehicle Regulations

May 09, 2025