Internal PwC US Investigation Results In Brokerage Affiliate Purge

Table of Contents

The Scope of the PwC US Internal Investigation

The PwC US internal investigation was launched to address serious concerns regarding [mention the suspected area of misconduct, e.g., potential conflicts of interest, improper trading activities, or non-compliance with regulatory requirements]. While PwC has not publicly disclosed all the specifics, reports suggest the investigation was triggered by [mention trigger if known, e.g., a whistleblower complaint, an internal audit finding, or external regulatory pressure]. The investigation encompassed a broad range of activities, focusing on a period of [mention timeframe if available].

- Specific areas investigated:

- Potential conflicts of interest between brokerage affiliates and PwC's advisory services.

- Allegations of improper trading practices, including insider trading.

- Concerns about the handling of client data and potential breaches of confidentiality.

- Violation of anti-money laundering regulations.

- Number of employees involved: [Insert number if available, otherwise use a general statement like "A substantial number of employees were subject to the investigation."]

- External regulatory bodies: [List any regulatory bodies involved or notified, e.g., SEC, FINRA].

Key Findings and Violations Discovered

The internal investigation uncovered several serious violations of both internal PwC policies and external regulations. The findings revealed a pattern of [summarize the nature of the misconduct, e.g., unethical behavior, disregard for regulatory compliance, or systemic failures in internal controls]. The severity of the violations varied, ranging from minor infractions to more serious breaches with significant potential financial repercussions.

- Specific types of violations:

- Insider trading and other forms of market manipulation.

- Misappropriation of client funds.

- Failure to report suspicious activity, violating anti-money laundering laws.

- Breaches of client confidentiality.

- Evidence presented: [Mention types of evidence used, e.g., emails, financial records, witness testimony].

- Severity of violations: [Describe the range of severity, e.g., some violations resulted in minor penalties, while others could lead to significant legal consequences.]

The Brokerage Affiliate Purge: Who Was Affected?

The consequences of the investigation's findings were swift and severe. PwC US initiated a significant purge of its brokerage affiliates, resulting in the dismissal or termination of [Insert number if available, otherwise use a general statement like "a substantial number"] of individuals. The affected affiliates represent a range of experience levels and affiliations, including [mention types of affiliates affected, e.g., independent agents, employees of larger brokerage firms].

- Number of affiliates dismissed: [Insert number if available, otherwise use a general statement].

- Types of brokerage affiliates affected: [Provide specifics if available].

- Geographic distribution: [Mention geographic regions affected, if known].

Long-Term Implications and Future of PwC's Brokerage Affiliate Program

The PwC US internal investigation and the subsequent affiliate purge will undoubtedly have long-term repercussions. The reputational damage to PwC could significantly impact client trust and future business opportunities. The firm faces potential regulatory scrutiny, investigations, and penalties. In response, PwC is likely to implement significant changes to its compliance programs and internal controls.

- Changes to compliance programs: [Mention anticipated changes, e.g., enhanced training, stricter internal controls, independent audits].

- Impact on PwC’s financial performance: [Discuss potential financial impact, e.g., legal fees, loss of revenue, decreased market share].

- Potential regulatory fines or penalties: [Mention the potential for fines and legal repercussions].

- Long-term impact on client trust: [Discuss the potential loss of client confidence and future business impact].

Conclusion

The PwC US internal investigation and the resulting brokerage affiliate purge represent a significant event with far-reaching implications for the financial services industry. The scale of the violations uncovered highlights the critical need for robust compliance programs, strong ethical standards, and effective internal controls within financial institutions. This case serves as a stark reminder of the potential consequences of regulatory breaches and the importance of prioritizing ethical conduct. Stay informed about this significant PwC US internal investigation and the ongoing implications for brokerage affiliates. Learn more about how to maintain robust compliance in your financial organization and avoid similar internal investigations.

Featured Posts

-

Nfl International Series Justin Herbert And The Chargers In Brazil For 2025

Apr 29, 2025

Nfl International Series Justin Herbert And The Chargers In Brazil For 2025

Apr 29, 2025 -

Trumps Tax Bill Republican Opposition And Potential Blockades

Apr 29, 2025

Trumps Tax Bill Republican Opposition And Potential Blockades

Apr 29, 2025 -

Middle Management Key To Effective Communication And Collaboration

Apr 29, 2025

Middle Management Key To Effective Communication And Collaboration

Apr 29, 2025 -

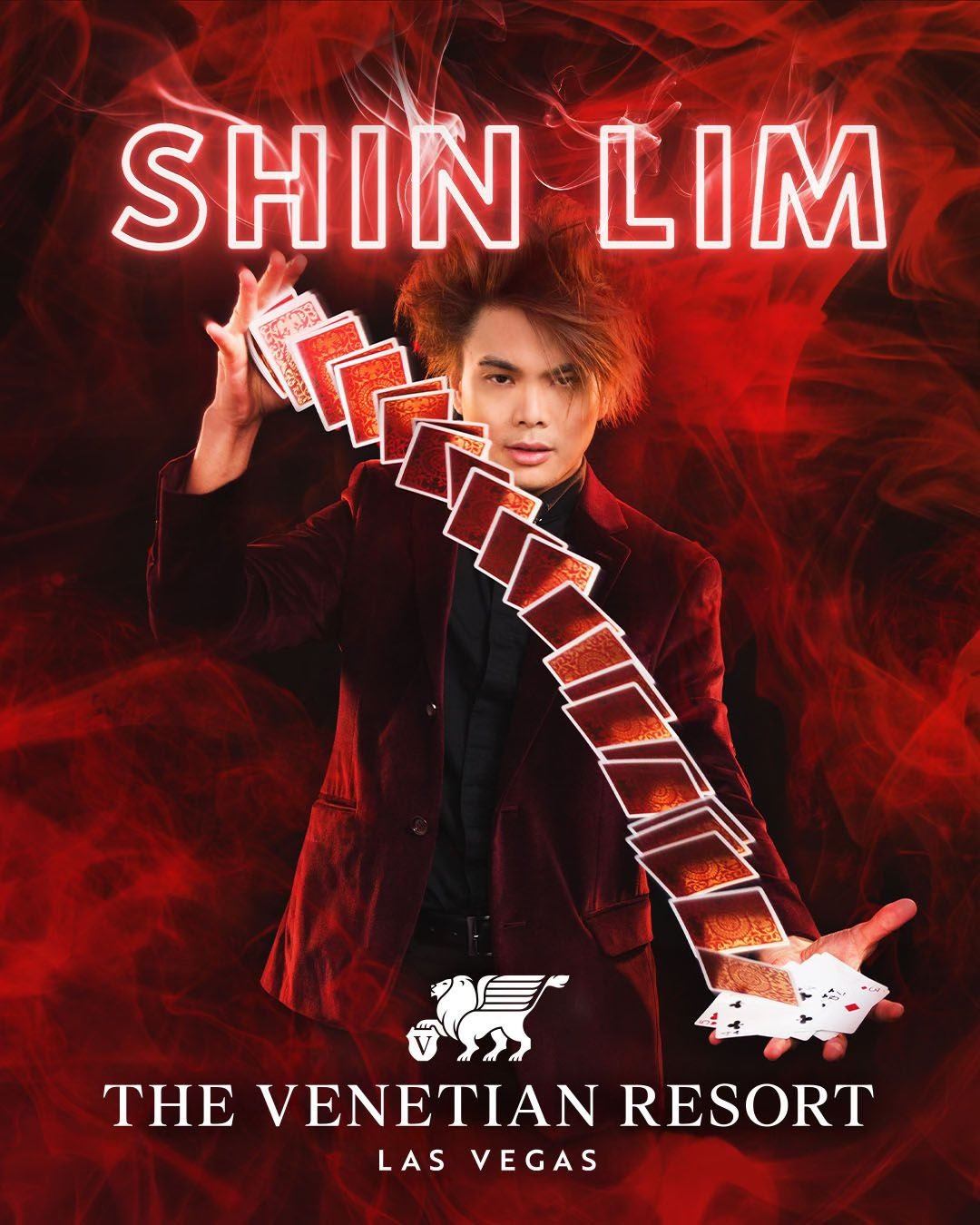

Midland Athlete Vanishes In Las Vegas Family Appeals For Information

Apr 29, 2025

Midland Athlete Vanishes In Las Vegas Family Appeals For Information

Apr 29, 2025 -

Country Music Legends Wife Denies Son Is Caretaker

Apr 29, 2025

Country Music Legends Wife Denies Son Is Caretaker

Apr 29, 2025

Latest Posts

-

Did John Wick Only Appear Once Debunking The Keanu Reeves Franchise Myth

May 12, 2025

Did John Wick Only Appear Once Debunking The Keanu Reeves Franchise Myth

May 12, 2025 -

Everything We Know About The Upcoming John Wick 5 Movie

May 12, 2025

Everything We Know About The Upcoming John Wick 5 Movie

May 12, 2025 -

John Wick Chapter 5 Release Date Plot And Cast Details

May 12, 2025

John Wick Chapter 5 Release Date Plot And Cast Details

May 12, 2025 -

Time To Call It Quits A Discussion About A Potential John Wick 5

May 12, 2025

Time To Call It Quits A Discussion About A Potential John Wick 5

May 12, 2025 -

John Wick 5 A Critical Examination Of The Potential Risks

May 12, 2025

John Wick 5 A Critical Examination Of The Potential Risks

May 12, 2025