Trump's Tax Bill: Republican Opposition And Potential Blockades

Table of Contents

Fiscal Conservatism Concerns

Many fiscal conservatives within the Republican party voiced serious concerns about the Trump Tax Bill's potential impact on the national debt and its implications for long-term fiscal responsibility.

Increased National Debt

A major point of contention revolved around the projected long-term cost increases associated with the tax cuts.

- Projected long-term cost increases: Critics argued that the significant tax cuts, particularly for corporations and high-income earners, would lead to a substantial increase in the national debt without sufficient offsetting measures. Independent analyses offered varying projections, adding fuel to the debate.

- Lack of sufficient offsetting spending cuts: The absence of corresponding spending cuts to offset the revenue loss from the tax cuts fueled opposition. Conservatives demanded fiscal responsibility and argued that the tax cuts were fiscally unsustainable without significant reductions in government spending.

- Concerns about the sustainability of the national debt: The long-term sustainability of the national debt under the proposed tax plan emerged as a central concern. Opponents warned of potential negative consequences, such as higher interest rates and reduced economic growth, if the debt spiraled out of control.

Tax Cuts for the Wealthy

The bill's substantial tax cuts for corporations and high-income earners drew criticism for potentially exacerbating income inequality.

- Arguments against trickle-down economics: Opponents questioned the effectiveness of trickle-down economics, arguing that tax cuts for the wealthy do not necessarily translate into benefits for the middle class and lower-income individuals.

- Concerns about the fairness and equity of the tax cuts: The perceived unfairness and inequity of the tax cuts fueled opposition. Critics argued that the benefits disproportionately favored the wealthy, while offering limited relief to the middle class and low-income families.

- Calls for more targeted tax relief for the middle class: Many Republicans advocated for more targeted tax relief for the middle class, arguing that it would stimulate consumer spending and drive economic growth more effectively than broad-based tax cuts for the wealthy.

Policy Differences and Ideological Divisions

Beyond fiscal concerns, significant policy differences and ideological divisions within the Republican party further complicated the passage of the Trump Tax Bill.

Differing Approaches to Tax Reform

Republican lawmakers held diverse views on the optimal approach to tax reform, leading to internal disagreements and protracted negotiations.

- Debate between simplification and targeted tax breaks: A key debate centered around the balance between simplifying the tax code and providing specific tax breaks for particular industries or groups. Some favored a simpler, more broadly applicable tax code, while others prioritized targeted incentives.

- Disputes regarding the appropriate level of tax cuts: Lawmakers differed on the appropriate scale of tax cuts. Some favored more aggressive cuts, while others advocated for a more moderate approach to avoid excessive increases in the national debt.

- Varying opinions on the ideal tax structure and its economic impact: Differing opinions existed on the optimal tax structure (e.g., corporate tax rates, individual income tax brackets) and their projected economic impact. These disagreements fueled extensive debates and negotiations.

The Role of the Freedom Caucus

The House Freedom Caucus, a group of conservative Republicans known for its strong ideological stances, played a crucial role in shaping—or attempting to block—the bill's passage.

- Negotiations and compromises with the Freedom Caucus to secure their votes: The Trump administration and Republican leadership engaged in extensive negotiations and compromises to secure the support of the Freedom Caucus, a powerful bloc within the Republican party.

- Their demands and influence on the final version of the bill: The Freedom Caucus's demands significantly influenced the final version of the bill, resulting in certain modifications and concessions.

- Analysis of their impact on the bill's overall trajectory: The Freedom Caucus's actions significantly impacted the bill's overall trajectory, at times delaying its progress and shaping its ultimate form.

Procedural Obstacles and Legislative Challenges

Beyond ideological disagreements, procedural hurdles and legislative challenges posed significant threats to the Trump Tax Bill's success.

Senate Filibuster Threat

The potential for a Senate filibuster presented a major challenge, requiring careful strategic maneuvering and bipartisan compromises to overcome.

- The need for bipartisan support to overcome a filibuster: Given the narrow Republican majority in the Senate, securing enough votes to overcome a filibuster required either substantial bipartisan support or strategic use of procedural mechanisms.

- Strategies employed to secure enough votes to avoid a filibuster: Various strategies were employed, including intense lobbying efforts and concessions to garner support from moderate Democrats or to avoid triggering a filibuster altogether.

- Analysis of the political dynamics involved in navigating the Senate: Navigating the Senate's complex political dynamics involved a delicate balance of negotiation, compromise, and strategic maneuvering.

Reconciliation Process

The use of the budget reconciliation process to bypass a potential Senate filibuster introduced its own set of constraints and challenges.

- Limitations imposed by the reconciliation process on the bill's content: The reconciliation process imposed significant limitations on the bill's content, restricting what could be included and requiring strict adherence to budgetary rules.

- Negotiations and compromises to fit within the reconciliation framework: The need to conform to the reconciliation framework necessitated further negotiations and compromises, potentially limiting the scope and ambition of the tax plan.

- The impact of the reconciliation process on the final outcome: The reconciliation process undeniably influenced the final outcome of the Trump Tax Bill, shaping its provisions and ultimately impacting its overall effectiveness.

Conclusion

The Trump Tax Bill's passage through Congress was a complex and arduous process, characterized by significant internal opposition and numerous near-fatal roadblocks. Fiscal conservatism concerns, deep-seated ideological divisions within the Republican party, and formidable procedural hurdles all played crucial roles in shaping the final legislation. Understanding these factors is crucial for a thorough analysis of the bill's long-term consequences and its implications for future tax policy. To gain a deeper understanding of the intricacies of the Trump Tax Bill and its far-reaching impact, further research into the heated debates, hard-won compromises, and the ultimate legislative outcomes is highly recommended. Continue your exploration into the nuances of the Trump's Tax Bill to fully grasp the complex political landscape that surrounds major legislative initiatives.

Featured Posts

-

Ce Modificari Fiscale Se Pregatesc In Romania Pentru 2025

Apr 29, 2025

Ce Modificari Fiscale Se Pregatesc In Romania Pentru 2025

Apr 29, 2025 -

Early Indicators Could The U S Dollar Face Its Worst 100 Days Since Nixon

Apr 29, 2025

Early Indicators Could The U S Dollar Face Its Worst 100 Days Since Nixon

Apr 29, 2025 -

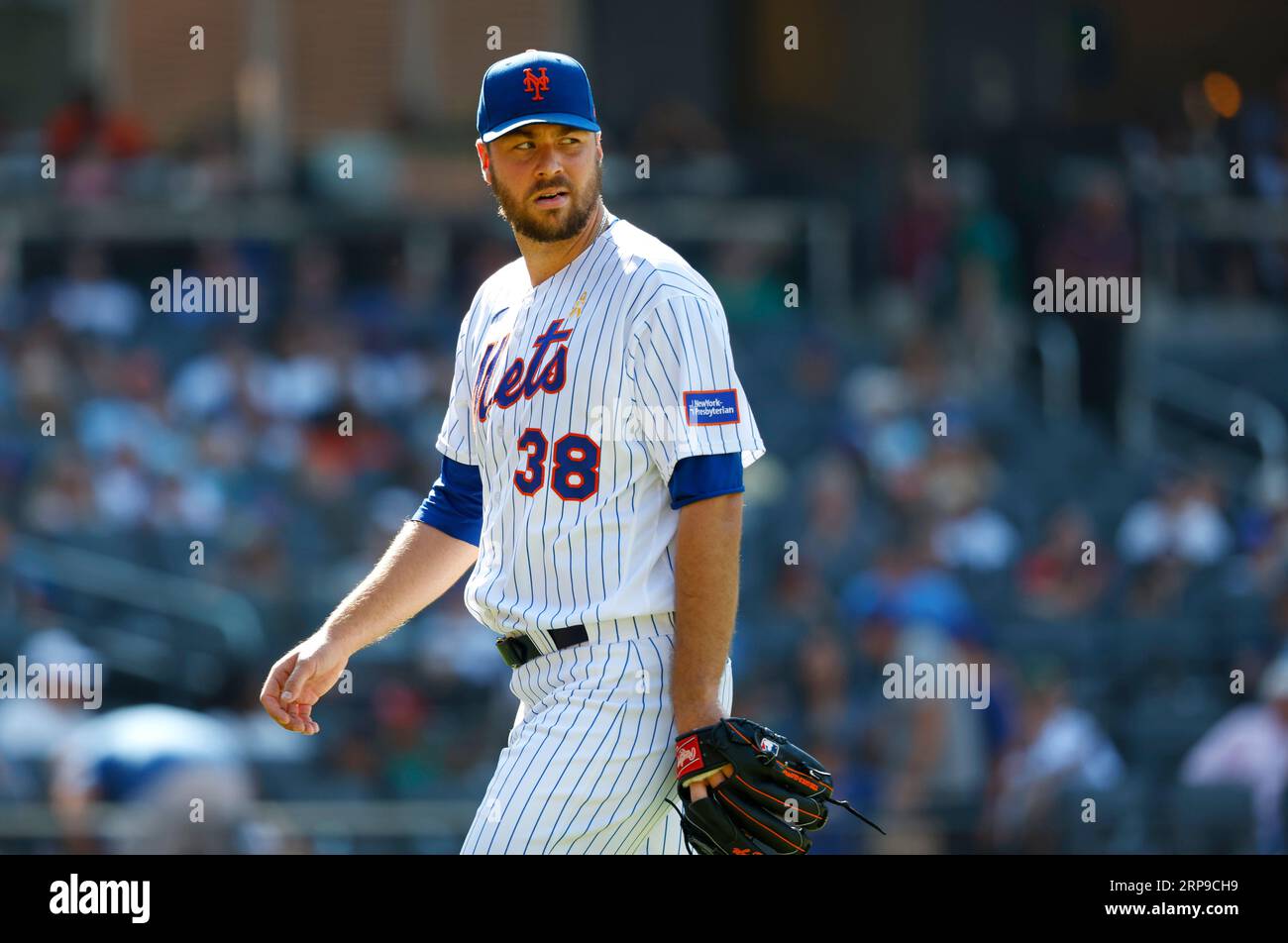

Tylor Megills Success With The Mets Pitching Strategies And Results

Apr 29, 2025

Tylor Megills Success With The Mets Pitching Strategies And Results

Apr 29, 2025 -

Urgent Search For Missing British Paralympian In Las Vegas

Apr 29, 2025

Urgent Search For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

Auto Dealers Push Back Against Mandatory Ev Sales

Apr 29, 2025

Auto Dealers Push Back Against Mandatory Ev Sales

Apr 29, 2025

Latest Posts

-

Fox News And Conor Mc Gregor A Look At Their Relationship

May 12, 2025

Fox News And Conor Mc Gregor A Look At Their Relationship

May 12, 2025 -

Chicago Bulls Vs New York Knicks Latest Injury Reports

May 12, 2025

Chicago Bulls Vs New York Knicks Latest Injury Reports

May 12, 2025 -

Find The Ny Knicks Vs Cleveland Cavaliers Game Time Tv Channel And Live Streaming Information

May 12, 2025

Find The Ny Knicks Vs Cleveland Cavaliers Game Time Tv Channel And Live Streaming Information

May 12, 2025 -

Knicks Vs Bulls Betting Preview Expert Predictions Odds Comparison And Analysis Feb 20 2025

May 12, 2025

Knicks Vs Bulls Betting Preview Expert Predictions Odds Comparison And Analysis Feb 20 2025

May 12, 2025 -

February 20 2025 Knicks Vs Bulls Predictions Odds And Betting Tips

May 12, 2025

February 20 2025 Knicks Vs Bulls Predictions Odds And Betting Tips

May 12, 2025