Invesco & Barings: Making Private Credit Accessible To All Investors

Table of Contents

Invesco's Approach to Private Credit Accessibility

Invesco, a global leader in investment management, has implemented several strategies to make private credit more accessible to retail investors. Their approach focuses on creating innovative fund structures and employing sophisticated investment strategies to manage risk and generate returns.

Invesco Private Credit Funds: Structure and Accessibility

Invesco offers exposure to private credit through various fund structures, designed to cater to different investor needs and risk tolerances. These include mutual funds and, increasingly, exchange-traded funds (ETFs). While specific minimum investment requirements vary depending on the fund, Invesco aims to lower the barrier to entry compared to traditional private equity investments, making private credit more accessible to a wider investor base. The associated fees are transparently disclosed in the fund prospectuses.

Invesco's Private Credit Investment Strategies

Invesco employs diverse private credit strategies within its offerings. These strategies are carefully selected to balance risk and reward. Key approaches include:

- Direct lending: Invesco directly provides loans to companies, offering potentially higher yields than traditional bonds.

- Collateralized loan obligations (CLOs): Invesco invests in diversified portfolios of leveraged loans, offering a more diversified approach to private credit exposure.

Bullet Points:

- Examples of Invesco private credit funds include [insert specific fund examples here, linking to relevant Invesco pages].

- Invesco's private credit funds aim for risk-adjusted returns that outperform traditional fixed income, though past performance is not indicative of future results.

- Invesco's extensive experience and proven track record in credit markets provides investors with confidence and expertise.

Barings' Initiatives for Broadening Private Credit Access

Barings, another global investment management giant, also actively works to increase private credit accessibility. Their approach leverages innovative product offerings and technological advancements to broaden investor participation.

Innovative Product Offerings from Barings

Barings is known for developing innovative investment vehicles that make private credit more accessible. This includes structuring funds with lower minimum investment requirements and offering access to previously inaccessible private debt markets. These approaches cater to a wider spectrum of investors, promoting inclusivity within the alternative investment space.

Technological Solutions for Efficient Investing

Barings utilizes technology to streamline the investment process. Online platforms and digital tools provide investors with easy access to information, simplifying the complexities of private credit investment and making it more user-friendly for those new to the asset class. This enhanced transparency and accessibility fosters greater participation.

Bullet Points:

- Examples of Barings' private credit funds and investment vehicles include [insert specific fund examples here, linking to relevant Barings pages].

- Barings employs robust risk management techniques, including rigorous due diligence and portfolio diversification strategies.

- Diversification through Barings' private credit offerings allows investors to reduce the overall volatility of their investment portfolios.

The Benefits of Private Credit for All Investors

The inclusion of private credit in a diversified portfolio offers several compelling advantages for investors of all levels.

Portfolio Diversification: Reducing Risk

Private credit often exhibits a low correlation with traditional asset classes like stocks and bonds. This means that adding private credit to a portfolio can help to reduce overall portfolio volatility and improve risk-adjusted returns. Diversification across asset classes is crucial for long-term investment success.

Potential for Higher Returns: Outperforming Traditional Investments

Private credit can offer the potential for higher returns compared to traditional fixed income investments, such as government bonds or corporate bonds. However, it's crucial to understand that this potential comes with a higher level of risk. Thorough research and careful consideration of one's risk tolerance are essential.

Stable Income Generation: Consistent Cash Flow

Private credit investments can generate a relatively stable stream of income through regular interest payments. This income stream can be particularly attractive to investors seeking steady cash flow, complementing other investment strategies.

Bullet Points:

- Statistical data [cite relevant sources] shows that private credit has historically demonstrated [insert specific data points on performance].

- Compared to traditional bonds, private credit carries a higher risk profile but also has the potential for higher yields.

- Successful private credit investments often involve detailed due diligence and selecting well-managed companies with sound business models.

Conclusion: Unlocking the Potential of Private Credit

Invesco and Barings are playing a pivotal role in making private credit more accessible to a wider investor base. Through innovative fund structures, strategic investment approaches, and technological advancements, they are opening up opportunities for diversification, potentially higher returns, and stable income generation. This democratization of access is transforming the private credit landscape, allowing more investors to benefit from this previously exclusive asset class.

Call to Action: Consider diversifying your investment portfolio with private credit solutions offered by leading firms like Invesco and Barings. Explore the opportunities available to you and unlock the potential of private credit investments today. Learn more about Invesco and Barings’ private credit offerings by visiting their respective websites.

Featured Posts

-

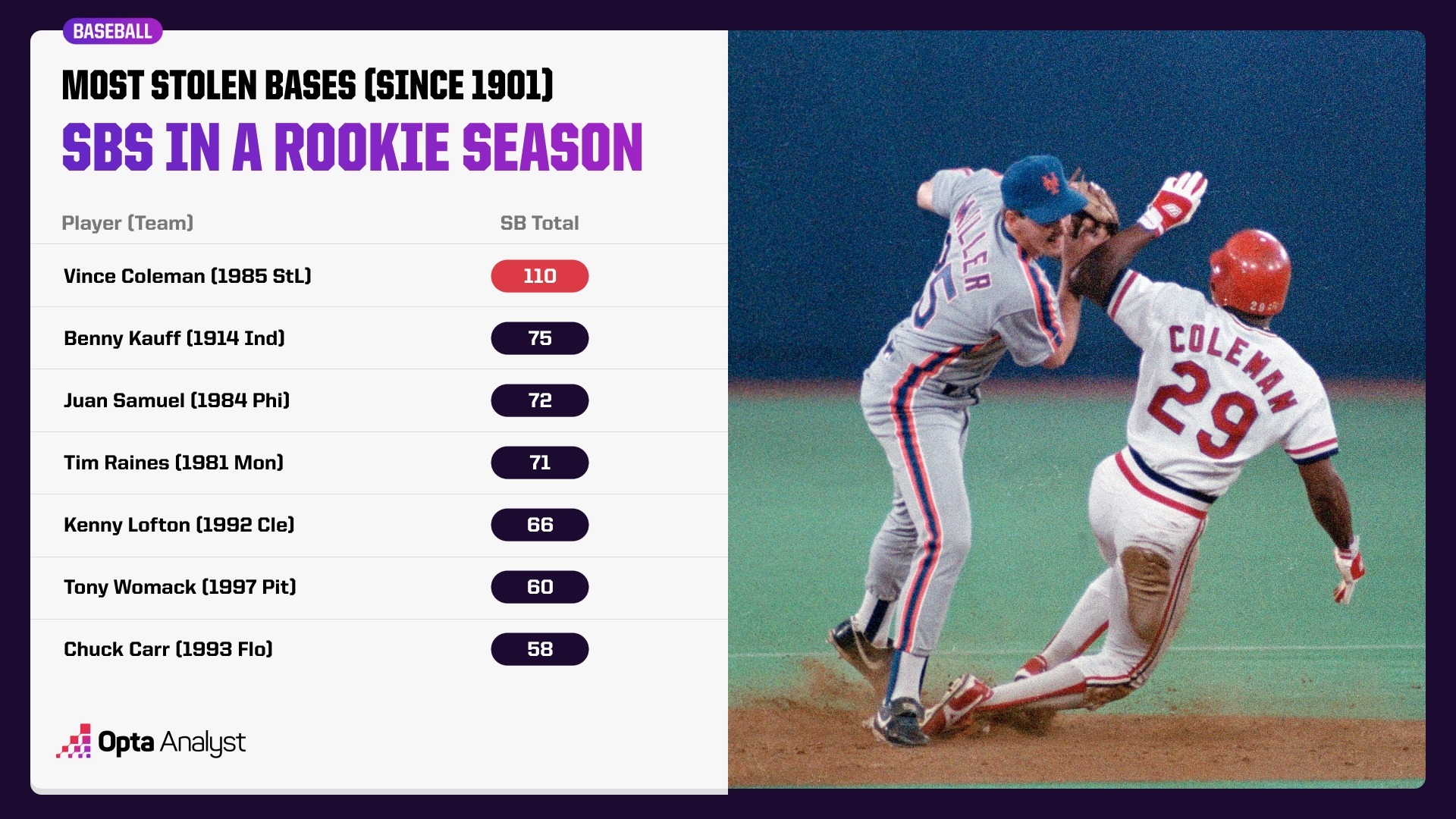

Record Nine Stolen Bases Power Brewers Rout Of As

Apr 23, 2025

Record Nine Stolen Bases Power Brewers Rout Of As

Apr 23, 2025 -

Yankees Broadcaster Under Fire For Mariners Remarks

Apr 23, 2025

Yankees Broadcaster Under Fire For Mariners Remarks

Apr 23, 2025 -

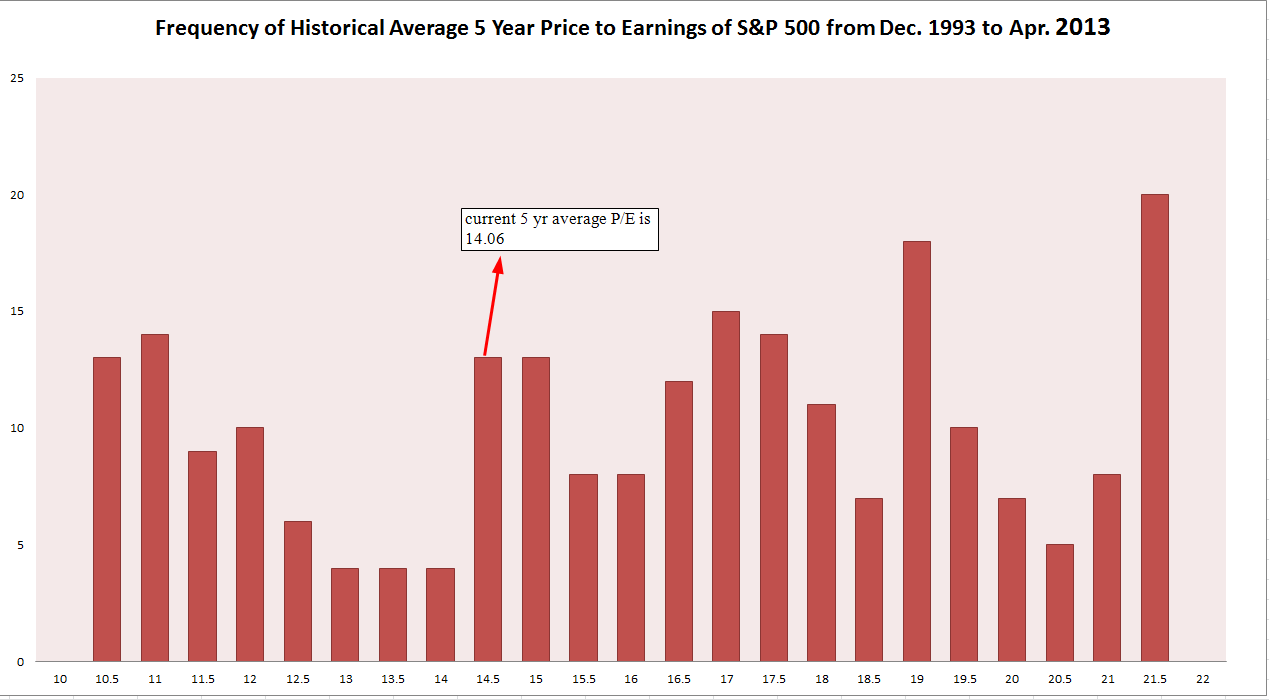

Are High Stock Market Valuations A Concern Bof A Says No

Apr 23, 2025

Are High Stock Market Valuations A Concern Bof A Says No

Apr 23, 2025 -

Why Pope Franciss Signet Ring Will Be Destroyed After His Death

Apr 23, 2025

Why Pope Franciss Signet Ring Will Be Destroyed After His Death

Apr 23, 2025 -

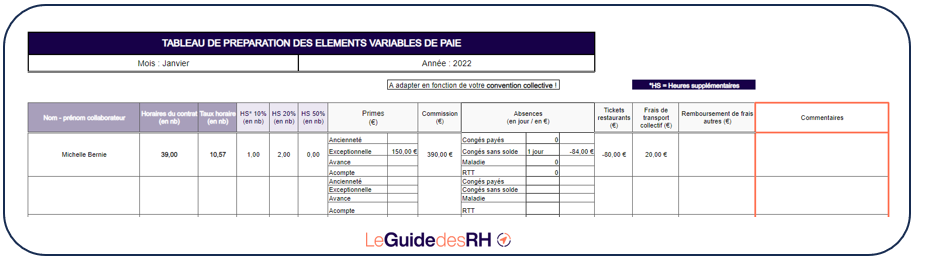

Good Morning Business Du 24 Fevrier Le Recapitulatif Complet

Apr 23, 2025

Good Morning Business Du 24 Fevrier Le Recapitulatif Complet

Apr 23, 2025

Latest Posts

-

Get Elizabeth Arden Skincare On A Budget

May 10, 2025

Get Elizabeth Arden Skincare On A Budget

May 10, 2025 -

Elizabeth Hurleys Bikini Clad Maldives Holiday

May 10, 2025

Elizabeth Hurleys Bikini Clad Maldives Holiday

May 10, 2025 -

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025 -

Discounted Elizabeth Arden Skincare Walmart And More

May 10, 2025

Discounted Elizabeth Arden Skincare Walmart And More

May 10, 2025 -

Elizabeth Hurley Shows Off Her Figure In Maldives Bikinis

May 10, 2025

Elizabeth Hurley Shows Off Her Figure In Maldives Bikinis

May 10, 2025