Investigation: The €18 Million Missing From Deutsche Bank London's Fixed Income Department

Table of Contents

The Discovery of the Missing Funds

The initial discovery of the €18 million shortfall within Deutsche Bank's London fixed income department remains shrouded in some secrecy. However, sources suggest internal discrepancies in financial reporting triggered an internal alarm. These irregularities, initially flagged by the bank's internal audit team, prompted a more thorough investigation. The compliance department also became heavily involved, scrutinizing transactions and internal controls.

- Timeline of Events:

- Q1 20XX: First signs of discrepancies noticed in routine financial reporting.

- Q2 20XX: Internal audit launches preliminary investigation.

- Q3 20XX: Compliance department joins the investigation, escalating concerns.

- Q4 20XX: €18 million shortfall officially confirmed.

The initial discovery highlighted a significant failure in Deutsche Bank's internal controls, a crucial area for preventing financial irregularities and Deutsche Bank scandals. The speed and efficiency of the internal response, however, remain a subject of speculation. Keywords: Deutsche Bank scandal, financial irregularities, internal controls failure.

The Investigation Process: Internal and External Scrutiny

Following the discovery, Deutsche Bank launched a comprehensive internal investigation. This involved a team of experienced financial professionals, including forensic accountants and data analysts. Simultaneously, external auditing firms were brought in to provide independent scrutiny and ensure transparency. Regulatory bodies, likely including the Financial Conduct Authority (FCA), were also informed and may have launched their own parallel investigations.

- Key Investigative Stages:

- Data analysis of relevant financial records.

- Interviews with employees who handled relevant accounts and transactions.

- Forensic accounting techniques to trace the movement of funds.

- Review of internal controls and procedures.

The investigation faced numerous challenges, including gaining access to complex and extensive datasets, securing cooperation from witnesses, and navigating the intricate web of financial transactions within the fixed income department. Keywords: forensic accounting, regulatory investigation, compliance failure, Deutsche Bank audit.

Potential Causes and Suspects

Several potential scenarios could explain the missing €18 million. These include:

- Fraud: Embezzlement by one or more employees, possibly involving complex schemes to conceal the theft.

- Theft: External theft, potentially involving a sophisticated cyberattack targeting the bank's systems.

- Accounting Errors: Though less likely for such a significant amount, complex accounting errors, perhaps due to inadequate software or human error, could theoretically contribute.

- Insider Trading: Though less likely to result in a direct loss of funds from the bank, it is also a possibility that merits investigation and careful consideration.

Identifying potential suspects is crucial, although without concrete evidence, naming individuals would be premature and potentially defamatory. The investigation likely focused on employees with access to the relevant accounts and systems, and it likely scrutinized their financial records and activities. Weaknesses in internal controls, such as insufficient oversight, lack of segregation of duties, or inadequate monitoring of transactions, likely played a significant role in facilitating the loss. Keywords: financial fraud, embezzlement, insider trading, Deutsche Bank security breach.

The Impact and Aftermath

The €18 million loss has had a significant impact on Deutsche Bank. Beyond the immediate financial damage, the incident severely damaged the bank's reputation, eroding trust among investors and clients. This reputational damage could translate into lost business and increased regulatory scrutiny. Depending on the findings of the investigation, regulatory penalties and potential legal actions against the bank or individual employees may ensue. The incident prompted Deutsche Bank to implement significant changes in its internal controls and procedures, aiming to enhance security, improve oversight, and prevent similar incidents in the future.

- Long-Term Consequences:

- Increased regulatory scrutiny.

- Potential loss of investor confidence.

- Higher operating costs due to strengthened internal controls.

Keywords: reputational damage, regulatory fines, Deutsche Bank consequences, financial industry reform.

Lessons Learned and Future Implications

The missing €18 million case serves as a stark reminder of the importance of robust internal controls and risk management within the financial industry. The incident highlights the need for:

- Enhanced fraud prevention measures: Implementing more sophisticated systems to detect anomalies and potential fraudulent activities.

- Improved oversight and monitoring: Strengthening supervisory procedures to ensure proper accountability.

- Regular security audits: Conducting thorough and frequent audits to identify vulnerabilities and potential weaknesses.

- Employee training: Providing regular training on fraud awareness and ethical conduct.

This incident has broader implications for the financial industry's regulatory landscape, prompting a re-evaluation of existing frameworks and potentially leading to more stringent regulations. Keywords: risk management, fraud prevention, internal controls, financial regulation, Deutsche Bank lessons.

Conclusion

The investigation into the missing €18 million from Deutsche Bank's London fixed income department underscores the critical need for robust internal controls and proactive fraud prevention measures within the financial industry. The event's significant impact on Deutsche Bank's reputation and financial stability highlights the devastating consequences of such incidents. Further investigations into similar cases are crucial to enhance transparency and accountability within the financial sector. Stay informed on this developing story and other cases of missing money within large financial institutions by following our updates on [link to related articles/website]. Understanding the complexities of Deutsche Bank's internal workings and the €18 million missing funds case helps everyone involved in the financial world to improve their security protocols and risk management strategies.

Featured Posts

-

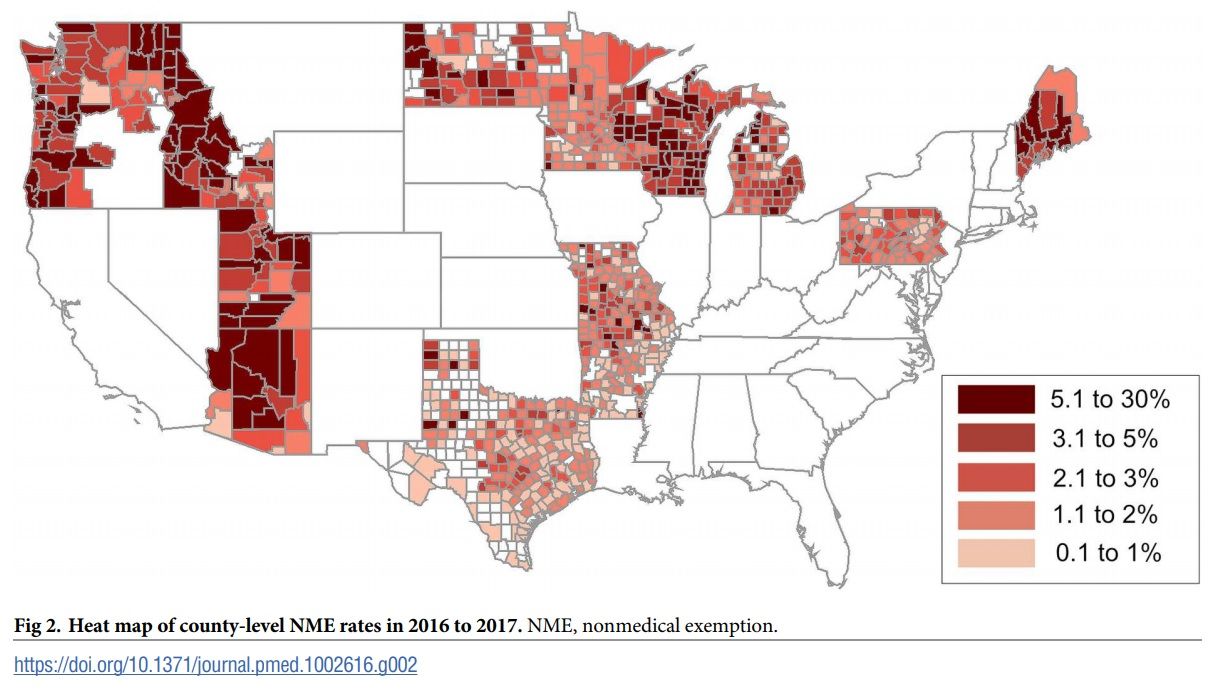

Measles In Texas A Growing Number Of Unconnected Outbreaks

May 30, 2025

Measles In Texas A Growing Number Of Unconnected Outbreaks

May 30, 2025 -

Is Jon Jones Fighting Nate Diaz Aspinall Fight Rumors Debunked

May 30, 2025

Is Jon Jones Fighting Nate Diaz Aspinall Fight Rumors Debunked

May 30, 2025 -

Navigating Economic Uncertainty Inflation And Unemployment Challenges

May 30, 2025

Navigating Economic Uncertainty Inflation And Unemployment Challenges

May 30, 2025 -

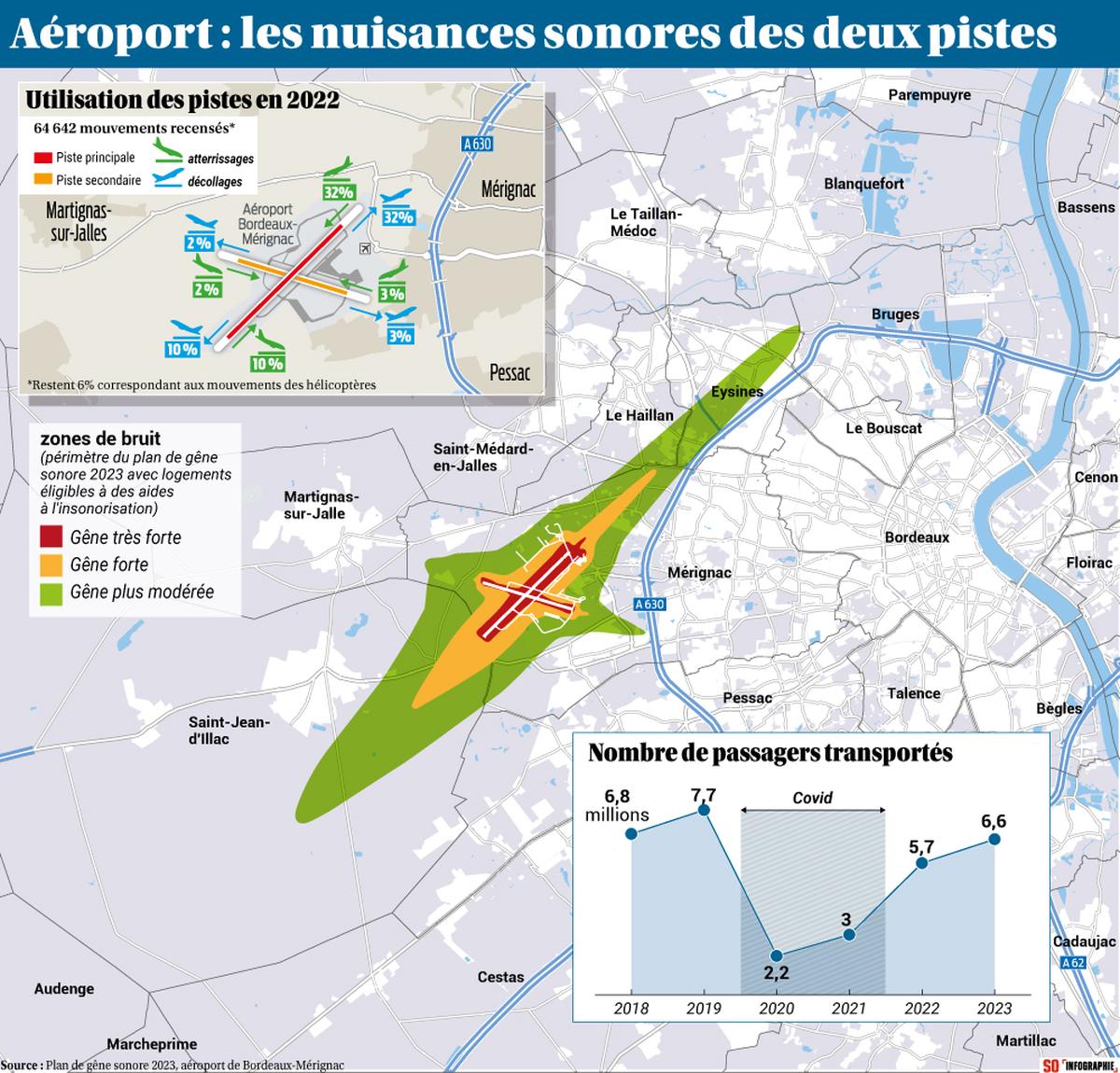

Manifestation A Bordeaux Piste Secondaire De L Aeroport Menacee

May 30, 2025

Manifestation A Bordeaux Piste Secondaire De L Aeroport Menacee

May 30, 2025 -

Quebec Marketing Firm Receives 330 K From Via Rail For High Speed Rail

May 30, 2025

Quebec Marketing Firm Receives 330 K From Via Rail For High Speed Rail

May 30, 2025