Investing In Baazar Style Retail: Considering JM Financial's Rs 400 Target

Table of Contents

Understanding the Baazar Style Retail Sector

Baazar-style retail refers to the traditional, unorganized retail format prevalent across India. Characterized by its fragmented nature, high-volume sales, and low profit margins, it represents a significant portion of the country's retail landscape. Several factors are driving its growth:

- Increasing Urbanization: Rapid urbanization is leading to a higher concentration of population in urban centers, creating greater demand for retail outlets.

- Rising Disposable Incomes: A growing middle class with increased disposable income is fueling consumption across various product categories.

- Preference for Local Products: Consumers increasingly favor locally sourced and familiar products, boosting the popularity of local baazars.

Key players in this sector range from small, independent shopkeepers to larger regional chains. Market trends indicate a shift towards organized formats within the baazar style retail segment, with players focusing on improving supply chains and customer experience.

- Examples of Successful Baazar-Style Retail Businesses: [Provide examples of successful businesses, focusing on their strategies and adaptations].

- Challenges Faced by Businesses in this Sector: Competition from organized retail, logistical challenges in managing inventory and distribution, and the need for technology adoption pose significant hurdles.

- Growth Projections for the Sector: Industry reports predict [Insert growth projections and source] growth for the baazar-style retail sector in the coming years.

JM Financial's Rs 400 Target: Rationale and Implications

JM Financial's Rs 400 target price for [Company Name] is based on a comprehensive analysis of the company's performance and future prospects. Their valuation likely considered:

- Revenue Growth: [Discuss projected revenue growth and its contribution to the target price].

- Profit Margins: [Analyze profit margin expectations and their impact on the valuation].

- Market Share: [Explain how market share projections influenced the target price].

However, the Rs 400 target is not without risks and uncertainties:

- Key Assumptions Made by JM Financial in their Analysis: [List and explain the key assumptions, highlighting potential vulnerabilities].

- Potential Upside and Downside Scenarios for the Stock Price: [Discuss scenarios based on market conditions and company performance].

- Comparison with Other Analyst Estimates: [Compare JM Financial's target price with estimates from other analysts, highlighting any discrepancies and their potential reasons].

Investment Considerations for Baazar Style Retail

Investing in the baazar style retail sector offers various avenues:

- Direct Equity: Investing directly in the shares of companies operating in this sector.

- Mutual Funds: Investing through mutual funds that hold shares of baazar-style retail companies.

- ETFs: Exchange-traded funds (ETFs) that track the performance of a specific index related to this sector.

Investing in this sector presents a unique risk-reward profile. While the potential for high returns exists, it's crucial to conduct thorough due diligence:

- Factors to Consider Before Investing in Baazar Style Retail Companies: Management expertise, financial health, competitive landscape, and regulatory environment.

- Potential Benefits and Drawbacks of Investing in this Sector: High growth potential vs. inherent risks and volatility.

- Strategies for Mitigating Investment Risks: Diversification, thorough research, and a long-term investment horizon.

Analyzing Key Performance Indicators (KPIs)

Evaluating baazar style retail investment opportunities requires careful analysis of relevant KPIs:

- Revenue Growth: Tracks the company's ability to increase sales.

- Customer Acquisition Cost (CAC): Measures the cost of acquiring new customers.

- Customer Lifetime Value (CLTV): Estimates the total revenue generated by a customer throughout their relationship with the company.

Analyzing these KPIs across different companies allows for a comparative assessment of investment potential.

The Future of Baazar Style Retail and Investment Opportunities

The long-term outlook for baazar style retail in India remains positive. Technological advancements are transforming the sector:

- E-commerce: Online platforms are increasingly connecting baazar-style retailers with a wider customer base.

- Digital Payments: Adoption of digital payment methods is enhancing transaction efficiency and convenience.

These changes create exciting investment opportunities:

- Emerging Trends in the Baazar-Style Retail Sector: Omnichannel strategies, data-driven decision-making, and supply chain optimization.

- Opportunities for Innovation and Disruption: Tech-enabled solutions can help bridge the gap between traditional and modern retail.

- Potential for Long-Term Value Creation: Companies that adapt to these changes will likely reap significant long-term benefits.

Conclusion: Making Informed Investment Decisions in Baazar Style Retail

JM Financial's Rs 400 target price for [Company Name] highlights the significant investment potential within the baazar style retail sector. However, successful bazaar style retail investment requires careful consideration of various factors, including the company's financials, market dynamics, and potential risks. Thorough research and due diligence are paramount. While the sector offers attractive returns, it's crucial to understand the inherent volatility and adopt a balanced approach to risk management. Conduct further research, analyze market trends, and consider investing wisely in this dynamic market. Remember to keep a close watch on JM Financial's projections and other relevant market indicators for informed bazaar style retail investment decisions.

Featured Posts

-

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Pal Carsamba Guenue

May 15, 2025

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Pal Carsamba Guenue

May 15, 2025 -

Barbie Ferreiras Euphoria Departure Her Relationship With The Cast Explained

May 15, 2025

Barbie Ferreiras Euphoria Departure Her Relationship With The Cast Explained

May 15, 2025 -

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit

May 15, 2025

Angstcultuur Bij De Npo Tientallen Medewerkers Spreken Zich Uit

May 15, 2025 -

Kiprskiy Vopros Obsuzhdenie Vyvoda Turetskikh Voysk

May 15, 2025

Kiprskiy Vopros Obsuzhdenie Vyvoda Turetskikh Voysk

May 15, 2025 -

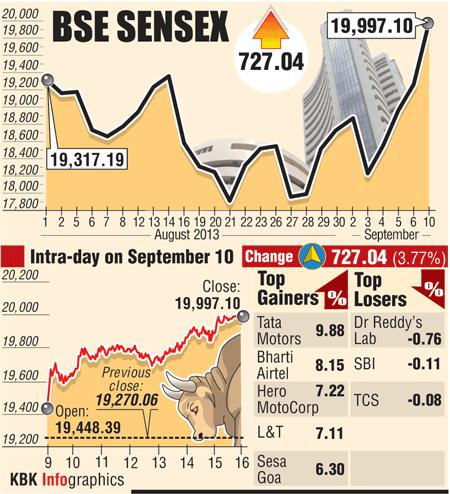

Stocks Surge On Bse Sensex Rises Top Gainers Revealed

May 15, 2025

Stocks Surge On Bse Sensex Rises Top Gainers Revealed

May 15, 2025

Latest Posts

-

The Perilous Practice Of Betting On Wildfires A Los Angeles Perspective

May 15, 2025

The Perilous Practice Of Betting On Wildfires A Los Angeles Perspective

May 15, 2025 -

Analysis Pbocs Reduced Yuan Support And Market Reaction

May 15, 2025

Analysis Pbocs Reduced Yuan Support And Market Reaction

May 15, 2025 -

Disaster Capitalism The Case Of Betting On The Los Angeles Wildfires

May 15, 2025

Disaster Capitalism The Case Of Betting On The Los Angeles Wildfires

May 15, 2025 -

The Fentanyl Problem A Former Us Envoy On Chinas Responsibility

May 15, 2025

The Fentanyl Problem A Former Us Envoy On Chinas Responsibility

May 15, 2025 -

Yuan Support From Pboc Lower Than Predicted Market Implications

May 15, 2025

Yuan Support From Pboc Lower Than Predicted Market Implications

May 15, 2025