Investor Concerns About Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's valuation analysis considers a range of market capitalization levels and employs several key valuation metrics to gauge the overall health and potential risks within the market. They utilize traditional methods like price-to-earnings ratios (P/E) and price-to-sales ratios, complemented by more nuanced analyses of sector-specific valuations and relative valuations compared to historical averages. Their assessment involves a comprehensive look at the entire market landscape, rather than focusing solely on individual stocks.

- Summary of BofA's key valuation findings: BofA's recent reports suggest that while some sectors appear overvalued based on historical P/E ratios, others present more attractive entry points. The overall picture is nuanced, highlighting the importance of careful sector analysis rather than broad generalizations about the entire market.

- Specific examples of overvalued and undervalued sectors (with supporting data): (Note: Specific data points would need to be sourced from actual BofA reports for accuracy and would vary depending on the timing of this article's publication. This section would include examples like: "BofA highlights the technology sector as potentially overvalued, citing high P/E ratios compared to historical averages and future earnings projections," or "Conversely, BofA suggests that certain undervalued sectors, such as [specific sector], offer potential for growth.")

- Comparison of current valuations to historical averages: BofA's analysis likely compares current valuation multiples to long-term averages to provide context. This historical perspective allows investors to assess whether current valuations are exceptionally high or within a typical range, aiding in risk assessment.

Identifying Key Investor Concerns

Several significant factors are fueling current investor anxieties and impacting stock market valuations. These concerns are interconnected and contribute to a climate of uncertainty.

- Detailed explanation of each major investor concern:

- Inflation Concerns: Persistently high inflation erodes purchasing power and increases the cost of borrowing, impacting corporate profitability and consumer spending.

- Interest Rate Hikes: Central banks' efforts to combat inflation through interest rate hikes increase borrowing costs for businesses and individuals, potentially slowing economic growth and impacting stock prices.

- Geopolitical Risks: Global political instability, such as the ongoing war in Ukraine, creates uncertainty and disrupts supply chains, negatively affecting market confidence.

- Economic Uncertainty: Concerns about a potential recession or significant economic slowdown contribute to investor apprehension and market volatility.

- How each concern impacts stock market valuations: Each of these concerns directly or indirectly affects company earnings and future growth prospects, leading to adjustments in stock valuations. Higher interest rates, for example, discount future earnings more heavily, leading to lower present valuations.

- Examples of recent events that have fueled these concerns: (This section would include specific, recent news events – economic data releases, geopolitical developments, or central bank announcements – that have contributed to investor anxieties.)

BofA's Recommendations and Strategies for Investors

Given their valuation analysis and the identified investor concerns, BofA likely recommends a cautious, yet strategic approach to investing. Their advice emphasizes long-term investment horizons and diversification.

- Specific investment recommendations from BofA: (Again, this would require access to recent BofA reports and would likely include advice on sector selection, focusing on companies with strong fundamentals and sustainable growth prospects.)

- Strategies for mitigating risks associated with high valuations: This includes diversification across asset classes (stocks, bonds, etc.), focusing on undervalued sectors, and employing risk management strategies like stop-loss orders.

- Advice on adjusting investment portfolios based on current market conditions: BofA might advise investors to rebalance their portfolios to reduce exposure to overvalued sectors and increase allocation to potentially undervalued ones. They may also emphasize the importance of maintaining sufficient liquidity.

Conclusion

BofA's analysis highlights a complex and nuanced picture of current stock market valuations. While certain sectors may appear overvalued, others present opportunities. Key investor concerns – inflation, interest rate hikes, geopolitical risks, and economic uncertainty – continue to shape market sentiment. BofA's recommendations emphasize the importance of a long-term perspective, diversification, and strategic risk management. Understanding these factors and BofA's insights is critical for making informed investment decisions. Stay informed on current stock market valuations and navigate the complexities of the market with insightful analysis from BofA. Visit [link to BofA's relevant resources] to learn more.

Featured Posts

-

Middle Managers The Unsung Heroes Driving Business Performance And Employee Engagement

Apr 23, 2025

Middle Managers The Unsung Heroes Driving Business Performance And Employee Engagement

Apr 23, 2025 -

Die 50 2025 Teilnehmer Sendetermine Streaming Infos

Apr 23, 2025

Die 50 2025 Teilnehmer Sendetermine Streaming Infos

Apr 23, 2025 -

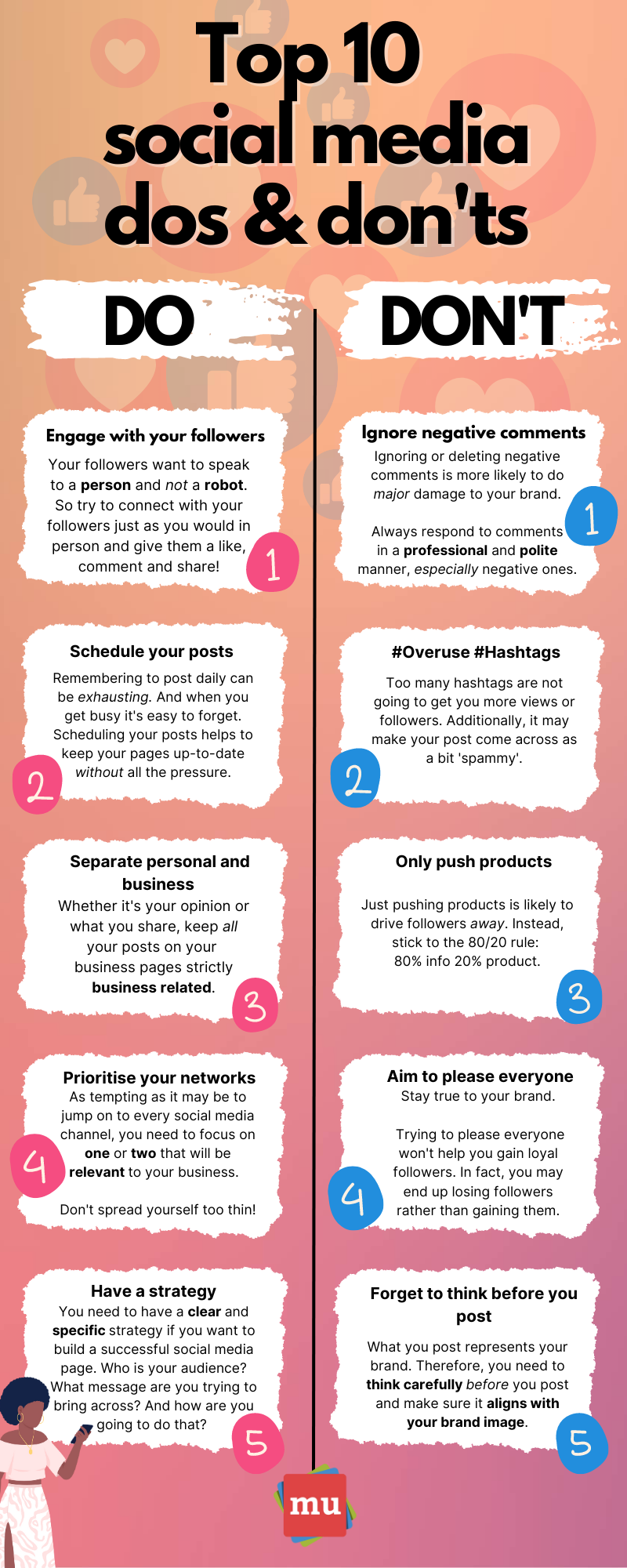

5 Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 23, 2025

5 Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 23, 2025 -

Progression Fdj Impact Des Resultats Du 17 Fevrier

Apr 23, 2025

Progression Fdj Impact Des Resultats Du 17 Fevrier

Apr 23, 2025 -

5 6 Billion Jeppesen Acquisition Thoma Bravo Buys From Boeing Ba

Apr 23, 2025

5 6 Billion Jeppesen Acquisition Thoma Bravo Buys From Boeing Ba

Apr 23, 2025

Latest Posts

-

Rejoignez Notre Equipe A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025

Rejoignez Notre Equipe A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025 -

Postes Vacants Dijon Restaurants Et Rooftop

May 10, 2025

Postes Vacants Dijon Restaurants Et Rooftop

May 10, 2025 -

Increased Scrutiny Of Student Visas From Pakistan Asylum Implications For The Uk

May 10, 2025

Increased Scrutiny Of Student Visas From Pakistan Asylum Implications For The Uk

May 10, 2025 -

Potential Uk Crackdown On Student Visas From Pakistan And Other Countries

May 10, 2025

Potential Uk Crackdown On Student Visas From Pakistan And Other Countries

May 10, 2025 -

Enquete Ouverte Apres La Chute Mortelle D Un Ouvrier A Dijon

May 10, 2025

Enquete Ouverte Apres La Chute Mortelle D Un Ouvrier A Dijon

May 10, 2025