5 Dos And Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do: Network Strategically

Building a strong network is crucial for success in any field, but especially in the niche world of private credit. Leveraging your network effectively can open doors to opportunities you might not otherwise find.

Attend Industry Events

Actively participate in conferences, workshops, and networking events focused on private credit, alternative lending, and related finance sectors. This is your chance to make meaningful connections.

- Build relationships: Connect with professionals in different areas of private credit, from fund managers to underwriters to legal specialists.

- Learn about trends: Gain insights into emerging trends and opportunities directly from industry leaders. Stay ahead of the curve by understanding the latest developments in private debt, distressed debt, and other private credit strategies.

- Engage meaningfully: Don't just attend; engage in conversations. Showcase your knowledge and enthusiasm for the private credit job market. Prepare insightful questions to demonstrate your interest.

Leverage Online Networking Platforms

LinkedIn is your professional home base. Use it effectively to connect with professionals in private credit firms.

- Follow key players: Follow influential people and companies in the private credit space. This will keep you informed about industry news and job postings.

- Engage with content: Share your expertise and insights on relevant topics. This establishes you as a thought leader and increases your visibility.

- Join relevant groups: Participate actively in discussions within private credit groups on LinkedIn. Contribute valuable comments and engage in thoughtful dialogue.

Informational Interviews

Request informational interviews with professionals working in private credit to gain valuable insights. These conversations are invaluable for learning about different career paths within the sector.

- Prepare thoughtful questions: Demonstrate your genuine interest by asking insightful questions about their career journey, the challenges they face, and their advice for someone entering the private credit job market.

- Express your goals: Clearly articulate your career aspirations and seek advice on navigating the private credit job market effectively.

Don't: Neglect Your Skills Development

The private credit job market is highly competitive, demanding a strong skillset. Ignoring this aspect will significantly hinder your chances of success.

Lack of Relevant Expertise

The private credit job market demands specific skills. Ensure you possess in-depth knowledge of:

- Financial modeling: Proficiency in building complex financial models is essential for analyzing potential investments.

- Credit analysis: A deep understanding of credit risk assessment and due diligence is paramount.

- Legal and regulatory frameworks: Familiarity with relevant laws and regulations governing private credit is critical.

Consider obtaining relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) to demonstrate your expertise. Pursuing an advanced degree in finance or a related field can also be highly beneficial. Practical experience through internships or volunteer work in the finance industry is highly valued.

Overlook Soft Skills

Technical skills alone are insufficient. Develop and highlight these crucial soft skills:

- Communication: Practice your presentation and communication skills to effectively convey complex financial information.

- Teamwork: Demonstrate your ability to collaborate effectively within a team environment. Private credit often involves working closely with colleagues from various backgrounds.

- Problem-solving: Highlight your analytical and problem-solving capabilities. The ability to identify and solve complex financial problems is crucial in this field.

Do: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count!

Highlight Relevant Experience

Showcase experience in areas directly relevant to the private credit sector, including:

- Underwriting: Detail your experience in evaluating the creditworthiness of borrowers.

- Portfolio management: Highlight your skills in managing and monitoring a portfolio of private credit investments.

- Financial analysis: Quantify your achievements whenever possible – use numbers to showcase your impact.

Showcase Private Credit Knowledge

Demonstrate your understanding of:

- Private credit strategies: Show your understanding of different investment strategies, such as direct lending, mezzanine financing, and distressed debt investing.

- Market trends: Stay up-to-date on current market trends and their impact on the private credit industry.

- Deal structures: Display your knowledge of the various structures used in private credit transactions.

Target Your Application

Customize your resume and cover letter for each job application. Generic applications rarely succeed. Tailor your application to match the specific requirements and preferences of each job description.

Don't: Underestimate the Importance of the Interview Process

The interview is your chance to shine. Preparation is key!

Poor Preparation

Thoroughly research the firm and the interviewer before the interview. Prepare answers to common interview questions and practice your responses.

Lack of Enthusiasm

Demonstrate genuine interest in the firm, the role, and the private credit industry. Your passion should be evident.

Failure to Ask Questions

Asking insightful questions shows your engagement and critical thinking skills. Prepare a list of thoughtful questions to ask the interviewer.

Do: Follow Up After the Interview

A strong follow-up can make a difference.

Send a Thank-You Note

Express your gratitude and reiterate your interest in the position. A personalized thank-you note stands out.

Maintain Contact

Stay in touch with the interviewer(s) through professional networking platforms like LinkedIn.

Show Patience

The hiring process can take time. Maintain persistence and professionalism throughout.

Conclusion

Successfully navigating the private credit job market requires a multifaceted approach. By following these dos and don'ts—including strategic networking, continuous skills development, a targeted application strategy, and a professional interview process—you significantly increase your chances of securing your desired position. Remember to highlight your relevant experience, demonstrate your private credit expertise, and actively engage with the industry. Don't delay – start implementing these strategies today to advance your career in the competitive yet rewarding private credit job market.

Featured Posts

-

Actualites Economiques Du 14 Avril Le Journal Du 18h Eco

Apr 23, 2025

Actualites Economiques Du 14 Avril Le Journal Du 18h Eco

Apr 23, 2025 -

Trump Vs Powell Presidents Latest Assault On Federal Reserve Chair

Apr 23, 2025

Trump Vs Powell Presidents Latest Assault On Federal Reserve Chair

Apr 23, 2025 -

High Scoring Affair Brewers Edge Cubs 9 7 In Windy Conditions

Apr 23, 2025

High Scoring Affair Brewers Edge Cubs 9 7 In Windy Conditions

Apr 23, 2025 -

Thlyl Ser Aldhhb Alywm Balsaght Bed Alankhfad

Apr 23, 2025

Thlyl Ser Aldhhb Alywm Balsaght Bed Alankhfad

Apr 23, 2025 -

Two Home Runs By Jackson Chourio Brewers Dominate Reds 8 2

Apr 23, 2025

Two Home Runs By Jackson Chourio Brewers Dominate Reds 8 2

Apr 23, 2025

Latest Posts

-

Dakota Johnsons Spring Outfit A Mother Daughter Fashion Moment

May 10, 2025

Dakota Johnsons Spring Outfit A Mother Daughter Fashion Moment

May 10, 2025 -

Pakistan Sri Lanka Bangladesh To Strengthen Capital Market Ties

May 10, 2025

Pakistan Sri Lanka Bangladesh To Strengthen Capital Market Ties

May 10, 2025 -

Dakota Johnson And Melanie Griffiths Chic Spring Style

May 10, 2025

Dakota Johnson And Melanie Griffiths Chic Spring Style

May 10, 2025 -

Dakota Johnsons Shifting Roles A Relationship Based Analysis

May 10, 2025

Dakota Johnsons Shifting Roles A Relationship Based Analysis

May 10, 2025 -

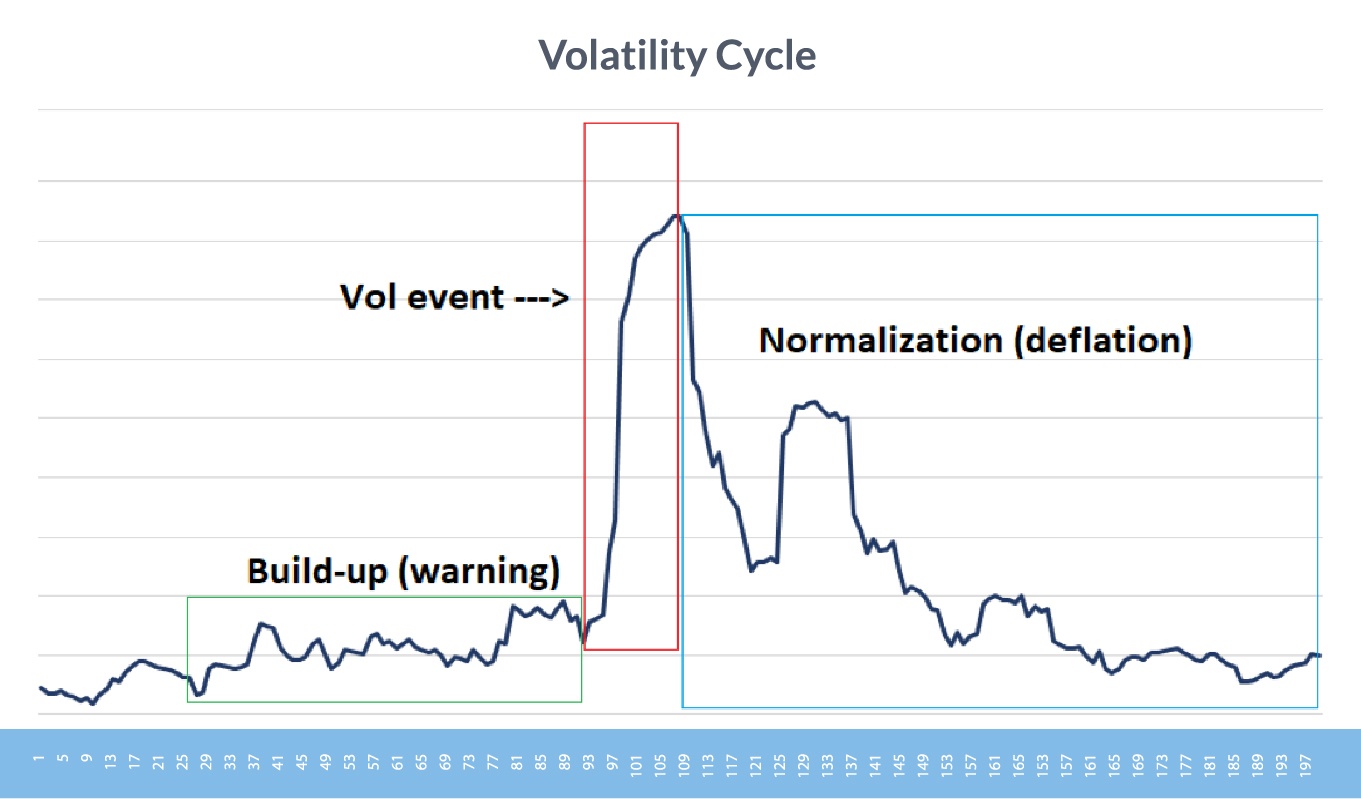

Pakistan Stock Exchange Offline Analysis Of Current Market Volatility

May 10, 2025

Pakistan Stock Exchange Offline Analysis Of Current Market Volatility

May 10, 2025