Is A Bond Market Crisis Brewing? Understanding The Risks

Table of Contents

Rising Interest Rates and their Impact on Bond Prices

The relationship between interest rates and bond prices is inversely proportional. This means that when interest rates rise, bond prices generally fall, and vice versa. This fundamental principle is at the heart of the current concerns about a bond market crisis. Rising interest rates make newly issued bonds more attractive, reducing demand for existing bonds with lower yields.

This impact is significant for existing bond portfolios. Investors holding bonds with fixed interest payments will see their returns diminished relative to new, higher-yielding bonds. This can lead to capital losses if they decide to sell their holdings before maturity.

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and corporations to borrow money, potentially impacting their ability to service their debt.

- Reduced demand for existing lower-yielding bonds: Investors will naturally gravitate towards newer bonds offering higher yields, reducing the demand and therefore the price of older bonds.

- Potential for capital losses for bondholders: As bond prices fall, investors who sell their bonds before maturity may experience significant capital losses.

- Impact on different types of bonds: The impact of rising interest rates varies depending on the type of bond. Government bonds are generally considered safer than corporate bonds, but both are susceptible to price declines in a rising rate environment. Long-term bonds are typically more sensitive to interest rate changes than short-term bonds.

Inflation's Squeeze on Bond Yields

High inflation erodes the real return on bond investments. While a bond may offer a nominal yield, if inflation is higher than that yield, the investor's purchasing power actually decreases over time. This is a critical factor contributing to the potential for a bond market crisis, as investors become increasingly wary of holding bonds that offer negative real returns. Inflation expectations also play a crucial role. If investors anticipate higher inflation in the future, they will demand higher yields on bonds to compensate for the expected erosion of purchasing power.

- The relationship between inflation and real interest rates: The real interest rate is the nominal interest rate minus the inflation rate. A negative real interest rate means that the return on a bond is less than the rate of inflation.

- How inflation affects purchasing power of bond returns: High inflation reduces the value of future payments from bonds, making them less attractive to investors.

- Strategies for mitigating inflation risk in bond investments: Investors can mitigate inflation risk by investing in inflation-protected securities (TIPS), which adjust their principal value based on the inflation rate, or by investing in assets that tend to perform well during inflationary periods, such as commodities or real estate.

Geopolitical Instability and its Influence

Geopolitical events, such as wars, political instability, and trade disputes, significantly impact bond markets. These events often lead to increased uncertainty and risk aversion among investors, causing a "flight to safety." During these periods, investors tend to flock to government bonds, particularly those issued by countries perceived as safe havens, such as the US or Germany. This increased demand drives up the prices of these bonds and pushes down their yields. However, other less secure bonds can experience significant volatility and price drops.

- Impact of geopolitical risks on investor confidence: Geopolitical uncertainty can lead to a decrease in investor confidence, causing them to pull back from riskier assets, including corporate bonds.

- Increased demand for government bonds as safe haven assets: Government bonds are often seen as a safe haven during times of uncertainty, leading to increased demand and higher prices.

- Potential for increased volatility in bond markets: Geopolitical events can create significant volatility in bond markets, making it difficult to predict price movements.

Assessing the Risk of a Bond Market Crisis

Several factors could trigger a full-blown bond market crisis. A sudden, sharp increase in interest rates, a major sovereign debt default, or a significant loss of confidence in the financial system could all potentially destabilize the bond market. The consequences of such a crisis could be severe, potentially leading to a recession, financial contagion, and widespread economic disruption.

- Stress testing of financial systems' vulnerability to bond market shocks: Regularly assessing the resilience of financial institutions to potential bond market shocks is crucial for preventing a wider crisis.

- Early warning signals of a potential crisis: Monitoring key indicators, such as credit spreads, bond yields, and investor sentiment, can provide early warning signs of potential problems.

- Potential mitigation strategies for governments and central banks: Governments and central banks can use various tools, such as interest rate adjustments and quantitative easing, to mitigate the impact of a bond market crisis.

Diversification and Risk Management Strategies

Diversification is key to managing risk in the bond market. Investors should spread their investments across different types of bonds, maturities, and issuers to reduce their exposure to any single risk factor. Furthermore, a comprehensive risk management strategy is vital, encompassing careful analysis of credit quality, interest rate sensitivity, and potential geopolitical influences.

- Strategies for managing interest rate risk: Investors can manage interest rate risk by investing in shorter-term bonds or using interest rate derivatives.

- Importance of credit quality assessment in bond selection: Thoroughly assessing the creditworthiness of bond issuers is crucial to minimize the risk of default.

- Considering alternative investments to reduce bond market exposure: Diversifying into other asset classes, such as equities or real estate, can help reduce overall exposure to bond market risks.

Conclusion

The potential for a bond market crisis is a significant concern. Rising interest rates, persistent inflation, and geopolitical uncertainty all contribute to this risk. Understanding these factors is critical for investors and policymakers alike. By understanding these risks and actively managing your investments, you can navigate the complexities of the bond market and potentially mitigate the impact of a future bond market crisis. For further information on bond market analysis and risk management, consult reputable financial resources and seek professional advice.

Featured Posts

-

Lakasodban Rejlo Kincs Szazezres Erteku Targyak Felkutatasa

May 29, 2025

Lakasodban Rejlo Kincs Szazezres Erteku Targyak Felkutatasa

May 29, 2025 -

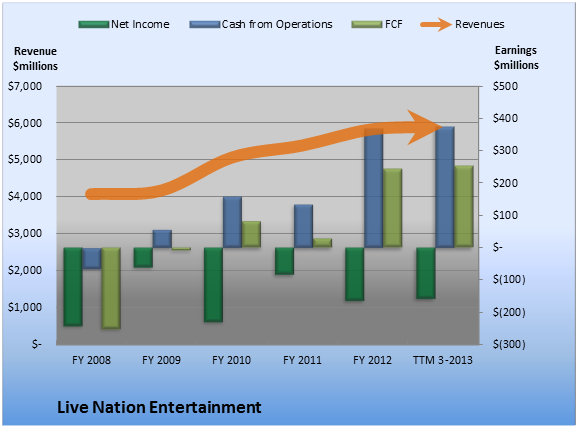

Decoding Live Nation Entertainment Lyv A Deep Dive Into Investment Strategies

May 29, 2025

Decoding Live Nation Entertainment Lyv A Deep Dive Into Investment Strategies

May 29, 2025 -

Netflixs Stranger Things Expands Tales From 85 Spin Off Announced

May 29, 2025

Netflixs Stranger Things Expands Tales From 85 Spin Off Announced

May 29, 2025 -

Bayrn Mywnkh Wbrshlwnt Ytnafsan Ela Dm Sfqt Jdydt

May 29, 2025

Bayrn Mywnkh Wbrshlwnt Ytnafsan Ela Dm Sfqt Jdydt

May 29, 2025 -

Nike Sneaker Releases May 2025 Calendar And Buying Guide

May 29, 2025

Nike Sneaker Releases May 2025 Calendar And Buying Guide

May 29, 2025

Latest Posts

-

Samsung Undercuts Apple 101 Tablet Deal Announced

May 31, 2025

Samsung Undercuts Apple 101 Tablet Deal Announced

May 31, 2025 -

Is Samsungs 101 Tablet A Smart I Pad Alternative

May 31, 2025

Is Samsungs 101 Tablet A Smart I Pad Alternative

May 31, 2025 -

Samsungs 101 Tablet A Competitive I Pad Alternative

May 31, 2025

Samsungs 101 Tablet A Competitive I Pad Alternative

May 31, 2025 -

Cheaper Than An I Pad Samsungs 101 Tablet Deal

May 31, 2025

Cheaper Than An I Pad Samsungs 101 Tablet Deal

May 31, 2025 -

Budget Tablet Showdown Samsungs 101 Offer Vs Apple I Pad

May 31, 2025

Budget Tablet Showdown Samsungs 101 Offer Vs Apple I Pad

May 31, 2025