Is Live Nation A Monopoly? Examining The Wall Street Journal's Concerns

Table of Contents

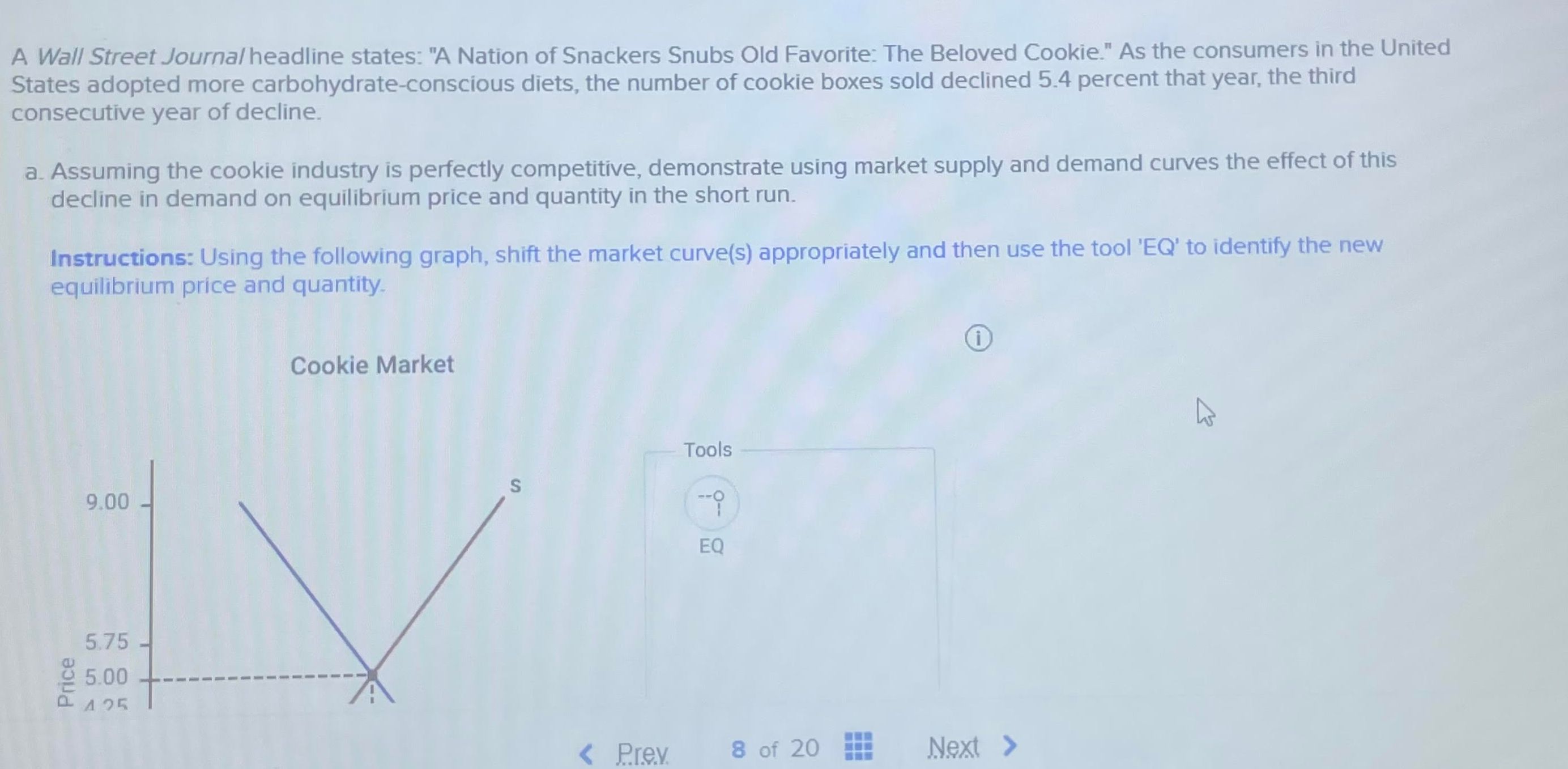

Live Nation's Market Share and Dominance

Live Nation's dominance in the concert industry is undeniable. It holds a significant portion of the market across concert promotion, ticketing (through Ticketmaster), and venue ownership. This vertical integration gives them an unparalleled level of control over the entire live music ecosystem.

- Ticket Sales: Live Nation, through Ticketmaster, controls a substantial percentage of global ticket sales, giving them significant leverage in pricing and distribution. Precise figures fluctuate, but estimates consistently place their market share at a level that raises antitrust concerns.

- Venue Ownership/Operation: Live Nation owns or operates a vast network of venues worldwide, further consolidating its control over where and how concerts are held. This provides them with exclusive access to lucrative locations and significantly limits competition for artists and promoters.

- Market Share Compared to Competitors: Compared to its competitors, Live Nation’s market share vastly outweighs any other single entity in the live music industry. This disparity fuels concerns about its ability to stifle competition and dictate market terms.

[Insert image/graph here visually representing Live Nation's market share across different sectors.]

The Wall Street Journal's Investigation and Concerns

The Wall Street Journal has published several articles expressing serious concerns about Live Nation's market power and potential anti-competitive practices. Their investigations highlight potential abuses of this power, impacting artists, venues, and ultimately, consumers.

- Alleged Anti-Competitive Behavior: The WSJ has cited instances where Live Nation's practices have allegedly stifled competition, such as exclusive contracts that prevent artists from performing at competing venues.

- Impact on Stakeholders: The WSJ's reporting suggests that Live Nation's dominance potentially harms artists by limiting their negotiating power and impacting their earnings, while simultaneously driving up ticket prices for consumers and reducing venue choices.

- Legal Challenges and Investigations: The WSJ's coverage has documented past and ongoing legal challenges and antitrust investigations faced by Live Nation, indicating the seriousness of the concerns raised about its business practices.

Counterarguments and Live Nation's Defense

Live Nation counters these accusations by highlighting its contributions to the live music industry, arguing that its scale allows for greater efficiency and broader reach for artists.

- Contribution to the Industry: Live Nation emphasizes its role in promoting and supporting artists, providing them with resources and platforms to reach larger audiences.

- Justification of Business Practices: Live Nation argues that its business practices are necessary for operating efficiently in a complex and competitive market. They maintain that their scale allows for economies of scale, benefiting artists and consumers alike.

- Refuting Monopolistic Behavior: Live Nation refutes claims of monopolistic behavior by pointing to the existence of competing promoters and venues, albeit smaller and less influential than themselves.

The Impact on Artists and Consumers

Live Nation's market dominance significantly impacts both artists and consumers.

- Artist Compensation: The sheer size of Live Nation gives them substantial leverage in negotiations with artists, potentially impacting artist compensation and creative control. Artists may feel pressured to accept less favorable deals due to Live Nation's control over venues and ticketing.

- Ticket Prices: The WSJ's reports suggest that Live Nation's dominance contributes to inflated ticket prices, making attending live music events less accessible to many consumers. The lack of strong competition can allow for higher profit margins at the expense of affordability for fans.

- Limited Consumer Choice: Live Nation's control over venues and ticketing restricts consumer choice, limiting the range of venues and events available to fans. This reduces competition and the potential for diverse live music experiences.

Regulatory Scrutiny and Potential Outcomes

Live Nation has faced regulatory scrutiny in the past, and the potential for further intervention remains.

- Past Antitrust Investigations: Previous lawsuits and antitrust investigations have focused on Live Nation's practices, highlighting the ongoing concern over its market position.

- Potential Regulatory Actions: Depending on the findings of ongoing investigations, potential regulatory actions could range from fines to structural remedies, such as forced divestiture of certain assets.

- Future Legal Challenges: Given the ongoing concerns, the likelihood of further legal challenges and government intervention remains significant.

Conclusion: Is Live Nation a Monopoly? A Final Assessment

The evidence presented suggests that while Live Nation is undeniably a dominant player in the live music industry, whether it constitutes a monopoly is a complex question with no easy answer. The Wall Street Journal's concerns are significant, highlighting potential anti-competitive practices that harm both artists and consumers. While Live Nation offers counterarguments, the imbalance of power remains a cause for concern. Further investigation and regulatory action are needed to fully address these issues. To form your own informed opinion, research further using keywords like "Live Nation antitrust," "Live Nation monopoly lawsuit," or "Live Nation market share." Understanding the intricacies of this debate is crucial for the future of the live music industry.

Featured Posts

-

Love Islands Liberty Poole Wows In Show Stopping Red Mini

May 29, 2025

Love Islands Liberty Poole Wows In Show Stopping Red Mini

May 29, 2025 -

Luca Marini Weighs In On Aleix Espargaros Moto Gp Return

May 29, 2025

Luca Marini Weighs In On Aleix Espargaros Moto Gp Return

May 29, 2025 -

Joshlin Smith Dismissal Of Charges Investigating Officers Explain

May 29, 2025

Joshlin Smith Dismissal Of Charges Investigating Officers Explain

May 29, 2025 -

Sadie Sink Offers Insights Into Stranger Things Season 5 Production And Character Journeys

May 29, 2025

Sadie Sink Offers Insights Into Stranger Things Season 5 Production And Character Journeys

May 29, 2025 -

Freestyler Angelina Komashko Stays In State Uc Davis Announcement

May 29, 2025

Freestyler Angelina Komashko Stays In State Uc Davis Announcement

May 29, 2025

Latest Posts

-

Finance Minister Holds Talks With Senior Deutsche Bank Officials

May 30, 2025

Finance Minister Holds Talks With Senior Deutsche Bank Officials

May 30, 2025 -

Finance Ministers Meeting With Deutsche Bank Executives Key Discussion Points

May 30, 2025

Finance Ministers Meeting With Deutsche Bank Executives Key Discussion Points

May 30, 2025 -

Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025

Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025 -

Sudden Departure Deutsche Banks Distressed Sales Head Moves To Morgan Stanley

May 30, 2025

Sudden Departure Deutsche Banks Distressed Sales Head Moves To Morgan Stanley

May 30, 2025 -

Data Center Security Breach Deutsche Bank Contractor And Unauthorized Access

May 30, 2025

Data Center Security Breach Deutsche Bank Contractor And Unauthorized Access

May 30, 2025