Is News Corp An Undervalued Asset? A Deep Dive Into Its Business Units

Table of Contents

News Corp's Core Business Segments: A Detailed Breakdown

News Corp's success hinges on its diverse range of business units. Let's dissect each to understand their individual contributions and overall impact on the company's valuation.

News and Information Services

This segment is the cornerstone of News Corp, encompassing globally renowned publications like The Wall Street Journal, The Times, and The Sun. While print media faces significant challenges, News Corp has actively pursued digital transformation. They've implemented robust paywalls, expanded digital subscriptions, and created compelling online content to engage a broader audience.

- WSJ subscription growth: The Wall Street Journal has consistently demonstrated strong digital subscriber growth, mitigating the decline in print readership.

- Digital readership trends: News Corp's digital platforms are experiencing significant readership increases, particularly among younger demographics.

- Impact of declining print advertising: While print advertising revenue continues to decline, News Corp is successfully offsetting this with growth in digital advertising and subscriptions. Diversification into digital platforms is crucial for long-term sustainability. The strategic shift towards a digital-first approach is essential for future profitability.

Digital Real Estate Services

Realtor.com, a leading online real estate platform, represents a significant growth driver for News Corp. The online real estate market shows substantial growth potential, and Realtor.com is well-positioned to capitalize on this trend. Its business model relies on lead generation and advertising revenue from real estate professionals.

- Market share compared to competitors: Realtor.com holds a strong market share, competing effectively against other prominent players in the digital real estate space.

- Revenue growth projections: Analysts predict continued robust revenue growth for Realtor.com, fueled by increasing market penetration and technological advancements.

- Impact of technological advancements: Realtor.com leverages innovative technologies such as AI-powered search and personalized recommendations to enhance user experience and drive engagement.

Book Publishing

HarperCollins Publishers, a major player in the global book publishing industry, contributes significantly to News Corp's revenue. The publishing landscape is constantly evolving, with the rise of ebooks and audiobooks presenting both challenges and opportunities.

- Bestselling titles and authors: HarperCollins consistently publishes bestselling titles and collaborates with renowned authors, strengthening its brand and market position.

- E-book sales trends: While print books remain popular, ebook sales continue to be a key revenue driver for HarperCollins, allowing them to reach a wider audience.

- Impact of changing consumer habits: HarperCollins adapts to evolving consumer habits by offering diverse formats (print, ebook, audiobook), catering to the preferences of different reader demographics.

Other Business Units

While the aforementioned segments are dominant, News Corp also holds smaller business units that contribute to the overall financial performance and should be considered when evaluating the company's overall worth. Their individual contributions and growth potential should be carefully analyzed as part of a comprehensive assessment.

Financial Analysis and Valuation Metrics

A thorough financial analysis is crucial to determine if News Corp is undervalued.

Revenue and Profitability Analysis

Examining News Corp's financial statements reveals key trends in revenue growth, profitability, and debt levels. Analyzing revenue streams from each segment and identifying areas of strength and weakness provides a better understanding of the overall financial health of the corporation. Comparing year-over-year performance and analyzing margins provide vital insights.

Valuation Metrics

Several valuation metrics can help determine whether News Corp trades at a discount to its intrinsic value.

- Price-to-Earnings ratio (P/E): A low P/E ratio might suggest undervaluation.

- Price-to-Book ratio (P/B): This metric compares market value to book value, offering another perspective on potential undervaluation.

- Discounted Cash Flow (DCF) analysis: A DCF analysis projects future cash flows to estimate the present value of the company, offering a more comprehensive valuation.

Comparison to Peers

Comparing News Corp's valuation and performance to competitors in the media and publishing industries provides context and helps identify potential areas of outperformance or underperformance.

Risks and Opportunities for News Corp

Understanding the risks and opportunities facing News Corp is essential for a comprehensive valuation.

Risks

- Competition: Intense competition from other media companies and digital platforms poses a significant risk.

- Regulatory changes: Changes in media regulations can impact News Corp's operations and profitability.

- Economic downturns: Economic downturns can lead to reduced advertising revenue and subscription cancellations.

- Dependence on advertising revenue: While decreasing, reliance on advertising revenue exposes News Corp to market fluctuations.

Opportunities

- Expansion into new markets: Geographic expansion and diversification into new market segments can unlock substantial growth.

- Strategic acquisitions: Acquiring complementary businesses can strengthen News Corp's market position and expand its offerings.

- Further development of digital platforms: Continued investment in digital platforms and technologies can enhance user engagement and drive revenue growth.

Conclusion: Is News Corp a Smart Investment? Weighing the Evidence

After reviewing News Corp's diverse business units and financial performance, a nuanced picture emerges. While facing challenges in the traditional media landscape, News Corp’s strategic shift towards digital platforms and diversification into real estate and book publishing demonstrate resilience and growth potential. The valuation metrics, while requiring further detailed analysis, offer some indications of potential undervaluation. However, inherent risks, particularly competition and economic uncertainty, must be carefully considered. Therefore, whether News Corp represents an undervalued asset warrants further in-depth investigation. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions. After reviewing News Corp's diverse business units and financial performance, you can make an informed decision about whether this media giant presents an undervalued asset worthy of investment.

Featured Posts

-

Musk Al Top La Nuova Classifica Forbes Degli Uomini Piu Ricchi Del Mondo 2025

May 24, 2025

Musk Al Top La Nuova Classifica Forbes Degli Uomini Piu Ricchi Del Mondo 2025

May 24, 2025 -

Prepustanie V Nemecku H Nonline Sk Prinasa Aktualne Informacie O Situacii

May 24, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Aktualne Informacie O Situacii

May 24, 2025 -

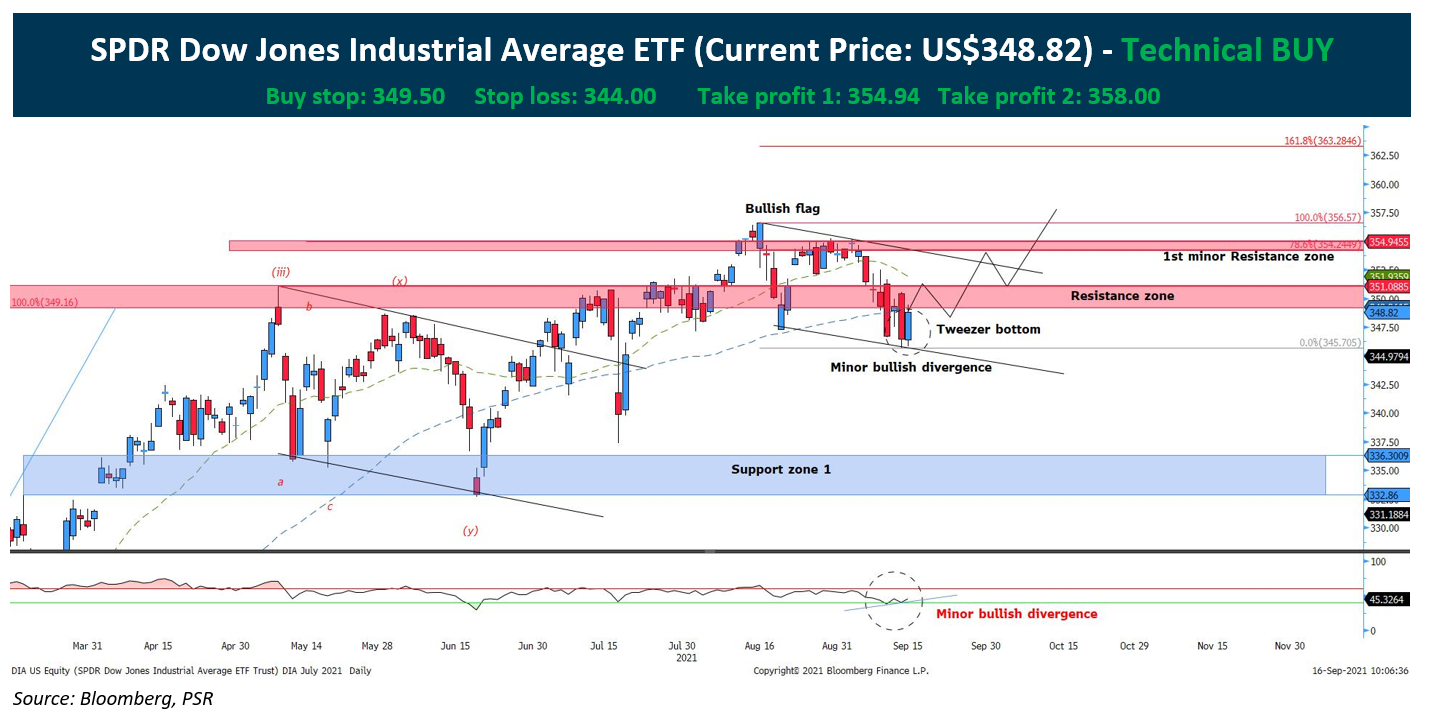

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav And Its Implications

May 24, 2025 -

Dax Stable Frankfurt Stock Market Opens After Record Breaking Run

May 24, 2025

Dax Stable Frankfurt Stock Market Opens After Record Breaking Run

May 24, 2025 -

8 Stock Market Increase On Euronext Amsterdam After Trumps Tariff Action

May 24, 2025

8 Stock Market Increase On Euronext Amsterdam After Trumps Tariff Action

May 24, 2025

Latest Posts

-

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Retirement

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Retirement

May 24, 2025 -

I Phone Ai

May 24, 2025

I Phone Ai

May 24, 2025 -

Ces Unveiled Europe Les Innovations Qui Faconneront Le Futur

May 24, 2025

Ces Unveiled Europe Les Innovations Qui Faconneront Le Futur

May 24, 2025 -

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain Devoilees

May 24, 2025

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain Devoilees

May 24, 2025