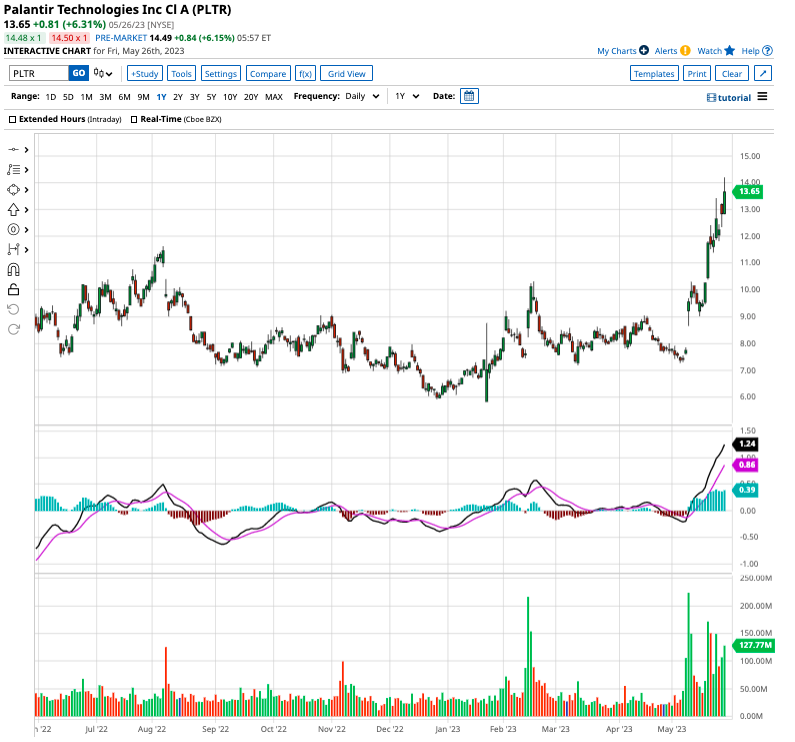

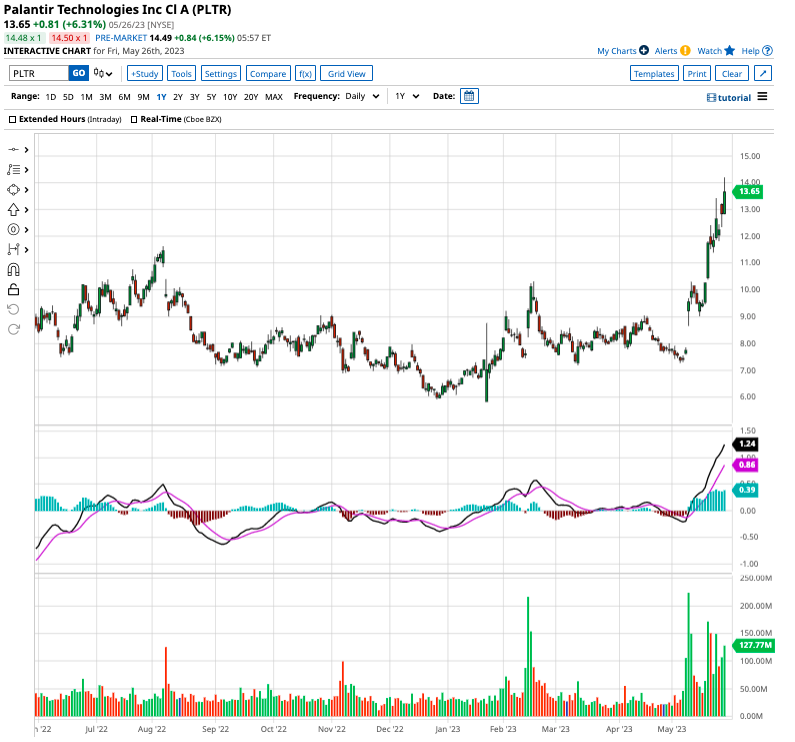

Is Palantir Stock A Bargain After Its 30% Fall?

Table of Contents

Palantir Technologies (PLTR) has experienced a substantial 30% drop in its stock price recently. This significant decline has left many investors questioning whether this represents a compelling bargain or a continuation of a downward trend. This in-depth analysis will explore the various factors influencing Palantir's valuation, examining its financial performance, future growth potential, and competitive landscape to determine if now is the time to buy, hold, or sell PLTR stock.

Palantir's Recent Financial Performance and Key Metrics

Analyzing Palantir's recent financial performance is crucial to understanding its current valuation. We need to look beyond the headline stock price and delve into the specifics of its revenue growth, profitability, and cash flow. Examining quarterly and annual reports provides a comprehensive picture of the company's financial health.

-

Revenue Growth Rate: Palantir has demonstrated consistent revenue growth, although the rate of growth may have fluctuated in recent quarters. Comparing this growth rate to previous years helps determine if the company is maintaining its momentum or experiencing a slowdown. Investors should carefully analyze whether the revenue growth justifies the current market capitalization.

-

Profit Margin Analysis: Palantir's profitability, or lack thereof, is a key concern for many investors. Analyzing its gross profit margin, operating profit margin, and net profit margin reveals the efficiency of its operations and its ability to translate revenue into profit. A shrinking profit margin could signal underlying issues that need attention.

-

Cash Flow from Operations: A strong cash flow from operations is a vital indicator of a company's financial stability. Positive and growing cash flow demonstrates Palantir's ability to generate funds from its core business activities, supporting further investments and growth.

-

Debt Levels and Leverage: High levels of debt can significantly impact a company's financial flexibility and profitability. Analyzing Palantir's debt-to-equity ratio and other leverage metrics is essential in assessing its financial risk.

-

Key Performance Indicators (KPIs): Understanding KPIs specific to Palantir's business model, such as customer acquisition cost, customer churn rate, and average revenue per user (ARPU), provides crucial insights into its operational performance and long-term sustainability.

Assessing Palantir's Growth Potential and Future Outlook

Palantir's future prospects are equally important in determining if its stock is undervalued. The company's long-term strategic goals, addressable market, and ability to secure government contracts and commercial partnerships will significantly impact its future performance.

-

Market Size and Growth Projections: The market for big data analytics and artificial intelligence is vast and rapidly expanding. Determining Palantir's share of this market and projecting its future growth based on market trends is crucial.

-

Potential for New Product Development and Innovation: Palantir's ability to innovate and develop new products and services will be essential for maintaining its competitive advantage. Analyzing its R&D spending and its pipeline of future products can provide valuable insights into its growth potential.

-

Competitive Analysis: Palantir faces stiff competition from established tech giants like Microsoft and Amazon, as well as other specialized data analytics firms. Analyzing the competitive landscape and Palantir's strategic position within it is crucial.

-

Risks and Challenges: Factors such as increasing regulatory scrutiny, data privacy concerns, and potential shifts in government spending could negatively impact Palantir's future growth.

Valuation and Comparison to Peers

Comparing Palantir's valuation to its peers provides crucial context. By analyzing its Price-to-Sales (P/S) ratio, Price-to-Earnings (P/E) ratio, and other valuation multiples relative to competitors, we can gauge whether its current stock price reflects its true worth. The recent 30% stock price drop significantly impacts these valuation multiples.

-

Comparison of Key Valuation Metrics: Comparing Palantir's key valuation metrics to those of similar companies in the big data and analytics space provides a benchmark for assessing its relative valuation.

-

Undervaluation or Overvaluation: Determining whether the current valuation reflects the company's future prospects requires a comprehensive analysis, incorporating both quantitative and qualitative factors. Different valuation models, such as discounted cash flow (DCF) analysis and comparable company analysis, can provide different perspectives.

Risks and Considerations Before Investing in Palantir Stock

Before investing in Palantir stock, it's crucial to acknowledge the potential downsides and risks.

-

Dependence on Government Contracts: Palantir's revenue is significantly reliant on government contracts, making it susceptible to changes in government spending and policy.

-

Competition from Tech Giants: The competitive landscape is intense, with established tech giants possessing significant resources and market share.

-

Data Privacy and Security Concerns: Operating in the sensitive field of data analytics exposes Palantir to potential legal and reputational risks related to data privacy and security.

-

Stock Price Volatility: Palantir's stock price has historically been volatile, indicating potential for further significant price fluctuations.

Conclusion

This analysis of Palantir's recent stock performance, financial health, growth prospects, and valuation reveals a complex picture. While the 30% drop presents a potentially attractive entry point for some investors, significant risks remain. Careful consideration of the factors discussed above is crucial before making any investment decisions.

Call to Action: Ultimately, the question of whether Palantir stock is a bargain after its 30% fall depends on your individual risk tolerance and investment strategy. Conduct thorough due diligence and consult with a financial advisor before investing in Palantir (PLTR) or any other stock. Further research into Palantir's financials and market position is recommended before deciding if it's right for your portfolio.

Featured Posts

-

Britannian Kruununperimysjaerjestys Paeivitetty Katso Uusi Lista

May 09, 2025

Britannian Kruununperimysjaerjestys Paeivitetty Katso Uusi Lista

May 09, 2025 -

Pogoda V Yaroslavskoy Oblasti Snegopady I Ikh Posledstviya

May 09, 2025

Pogoda V Yaroslavskoy Oblasti Snegopady I Ikh Posledstviya

May 09, 2025 -

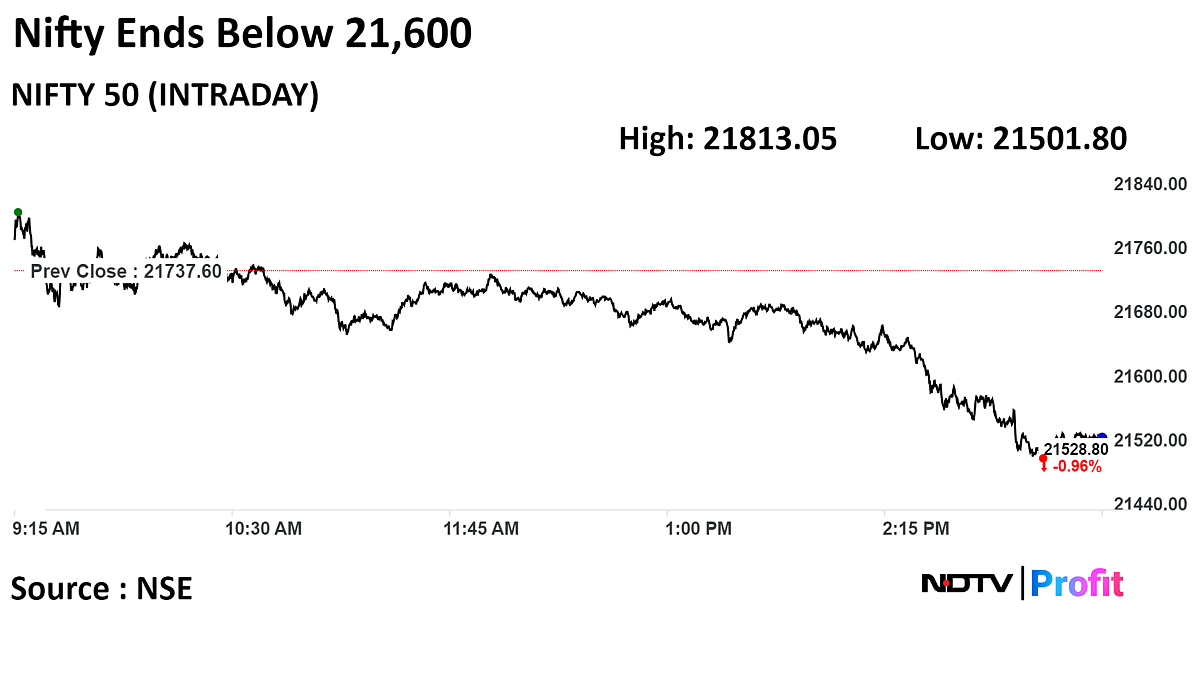

Bajaj Twins Drag On Sensex And Nifty 50 Flat Close Amidst Geopolitical Concerns

May 09, 2025

Bajaj Twins Drag On Sensex And Nifty 50 Flat Close Amidst Geopolitical Concerns

May 09, 2025 -

Elizabeth City Weekend Shooting Arrest Announced

May 09, 2025

Elizabeth City Weekend Shooting Arrest Announced

May 09, 2025 -

Vozvraschenie Stivena Kinga V X Oskorblenie Ilona Maska

May 09, 2025

Vozvraschenie Stivena Kinga V X Oskorblenie Ilona Maska

May 09, 2025