Is Palantir Stock A Good Investment Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Understanding Palantir's financial health is crucial when evaluating its investment potential. Let's delve into its recent performance and explore future projections.

Q4 2022 Earnings and Revenue Growth

Palantir's Q4 2022 earnings report revealed [Insert actual figures here, e.g., a revenue increase of X% year-over-year]. While [mention specific aspects, e.g., profitability may have been impacted by increased investment in R&D], the overall revenue growth signals [positive or negative, depending on the report] momentum. This performance needs to be viewed in the context of the broader macroeconomic environment and compared to previous quarters' results to gain a clearer picture of Palantir's financial trajectory. Key metrics like revenue growth, operating margin, and cash flow are crucial for determining the long-term health of the company. Analyzing these figures against industry benchmarks provides valuable context.

Government Contracts and Commercial Growth

Palantir's revenue is derived from two key sources: government contracts and commercial partnerships. Government contracts have historically formed a significant portion of Palantir's revenue, providing a stable base of income. However, its growing commercial business is increasingly important for long-term growth and revenue diversification. Securing new commercial clients and expanding existing partnerships are crucial for sustained success. The success of this strategy will determine the sustainability of Palantir's future revenue growth.

- Specific figures from the latest earnings report: [Insert specific data points from the Q4 2022 report, emphasizing revenue split between government and commercial sectors].

- Analysis of key performance indicators (KPIs): [Analyze key performance indicators such as customer acquisition cost (CAC), customer lifetime value (CLTV), and churn rate].

- Comparison to previous quarters and industry benchmarks: [Compare Palantir's performance to its previous quarters and to industry peers like other big data analytics companies].

- Expert opinions on future revenue projections: [Cite forecasts from reputable financial analysts regarding Palantir’s projected revenue growth].

Risk Assessment: Potential Downsides of Investing in Palantir Before May 5th

Despite its potential, investing in Palantir stock involves significant risks. A thorough risk assessment is crucial before committing capital.

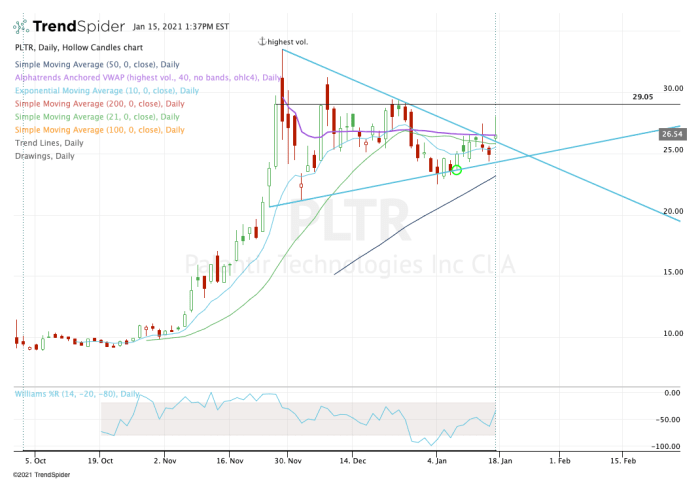

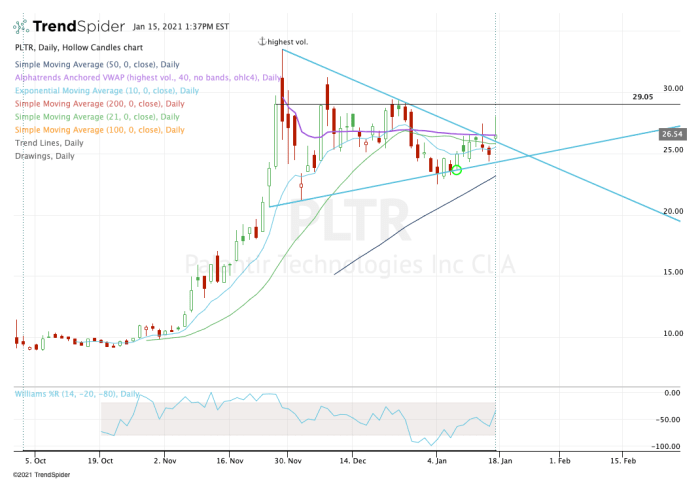

Valuation and Stock Price Volatility

Palantir's stock price has historically exhibited significant volatility. This is partly due to its high growth potential but also reflects the inherent uncertainties associated with its business model and the broader technology market. Comparing Palantir's current valuation metrics (e.g., Price-to-Sales ratio) to its historical performance and those of its competitors is essential to understand whether its stock is currently overvalued or undervalued.

Competition and Market Saturation

The data analytics market is highly competitive. Companies like [mention key competitors, e.g., Snowflake, Databricks] pose a significant threat. The risk of market saturation and a potential decrease in Palantir's market share needs careful consideration. The company's ability to innovate and maintain its competitive edge is critical for its long-term success.

- Potential threats to Palantir's business model: [Discuss potential challenges, such as increased competition, changing regulatory landscapes, and technological disruptions].

- Factors contributing to stock price volatility: [Analyze factors that influence Palantir's stock price, such as earnings reports, news announcements, and overall market sentiment].

- Risks associated with investing in a high-growth, potentially volatile stock: [Highlight the potential for significant losses due to market downturns or company-specific issues].

Wall Street Sentiment and Analyst Recommendations

Understanding Wall Street's sentiment towards Palantir is vital for any investment decision.

Analyst Ratings and Price Targets

Leading Wall Street analysts have issued a range of recommendations for Palantir stock, from "buy" to "sell," with varying price targets. [Summarize the consensus rating and range of price targets from reputable analysts]. It is important to understand the rationale behind these recommendations before making an investment decision.

Institutional Investor Activity

The activity of institutional investors, such as hedge funds and mutual funds, provides another valuable indicator of market sentiment. Monitoring whether these institutions are accumulating or divesting themselves of Palantir stock can provide insights into the overall market outlook. [Mention data on institutional buying or selling activity if available].

- Specific analyst recommendations and rationale: [Detail specific analyst recommendations and the reasoning behind those assessments].

- Summary of institutional investor activity (buy/sell ratios): [Summarize the net buying or selling pressure from institutional investors].

- Overall sentiment from Wall Street towards Palantir: [Give a concise summary of the overall Wall Street sentiment concerning Palantir].

Conclusion: Should You Invest in Palantir Stock Before May 5th?

Based on the analysis, Palantir stock presents both opportunities and risks before May 5th. The company's revenue growth, particularly in the commercial sector, is promising. However, the inherent volatility of the stock, intense market competition, and a potentially high valuation warrant caution. Investors should carefully consider their risk tolerance and investment horizon before making a decision. Analyzing the information released before May 5th, particularly any Q1 2023 earnings reports, will be crucial for refining your investment strategy. Do your due diligence before investing in Palantir stock and learn more about Palantir's investment potential before May 5th. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Bitcoin Madenciliginin Gelecegi Karlilik Ve Zorluklar

May 09, 2025

Bitcoin Madenciliginin Gelecegi Karlilik Ve Zorluklar

May 09, 2025 -

Agression Au Lac Kir A Dijon Trois Hommes Victimes D Une Attaque Sauvage

May 09, 2025

Agression Au Lac Kir A Dijon Trois Hommes Victimes D Une Attaque Sauvage

May 09, 2025 -

Falling Iron Ore Prices Analyzing Chinas Steel Output Reduction Strategy

May 09, 2025

Falling Iron Ore Prices Analyzing Chinas Steel Output Reduction Strategy

May 09, 2025 -

Dakota Johnsons Figure Hugging Dress A Red Carpet Highlight

May 09, 2025

Dakota Johnsons Figure Hugging Dress A Red Carpet Highlight

May 09, 2025 -

Dijon Violences Conjugales Le Boxeur Bilel Latreche Juge En Aout

May 09, 2025

Dijon Violences Conjugales Le Boxeur Bilel Latreche Juge En Aout

May 09, 2025