Japan's Bond Market: Steep Yield Curve Poses Challenges

Table of Contents

The Mechanics of a Steepening Yield Curve in Japan's Bond Market

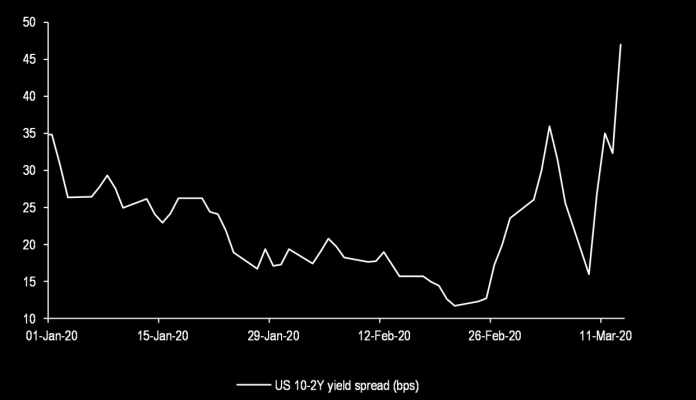

A yield curve graphically represents the relationship between the interest rates (yields) and the time to maturity of bonds. Different shapes signify varying economic conditions. A normal yield curve slopes upward, indicating higher yields for longer-term bonds. An inverted yield curve slopes downward, suggesting investors anticipate lower future interest rates. A flat yield curve shows little difference in yields across maturities.

In the context of Japanese Government Bonds (JGBs), a steep yield curve means a significant difference between the yields of short-term JGBs and long-term JGBs. This steepening is driven by several key factors:

-

Bank of Japan (BOJ) Policy Shifts and Potential Exit Strategies from Quantitative Easing (QE): The BOJ's prolonged quantitative easing program, designed to stimulate the economy, has kept interest rates artificially low. However, recent shifts towards a more flexible monetary policy, including adjustments to its yield curve control (YCC) program, signal a potential exit from QE. This shift contributes to the upward pressure on longer-term JGB yields, steepening the curve.

-

Inflationary Pressures and Rising Global Interest Rates: Global inflationary pressures and rising interest rates in other major economies are impacting Japan. Increased import costs and expectations of future interest rate hikes are pushing up long-term JGB yields. This is further exacerbated by the weakening of the Yen against other currencies.

-

Increased Government Borrowing to Fund Social Security and Infrastructure Projects: Japan faces significant demographic challenges and an aging population, leading to increased government spending on social security and infrastructure projects. This increased government borrowing adds to the supply of JGBs, potentially influencing yields across the curve, but particularly impacting longer-term rates.

Challenges Posed by the Steep Yield Curve

The steepening yield curve in Japan's bond market poses several significant challenges:

Impact on the Japanese Economy:

-

Increased Borrowing Costs for Businesses and Consumers: Higher interest rates, particularly on longer-term debt, increase borrowing costs for businesses, potentially hindering investment and economic growth. Consumers will also face higher costs for mortgages and other loans.

-

Potential Strain on Government Finances: The government's increased borrowing costs due to higher yields on JGBs can strain public finances, potentially leading to reduced spending in other areas.

-

Risk of Higher Inflation: While the BOJ is aiming for a moderate level of inflation, a rapidly steepening yield curve can fuel inflationary pressures if borrowing costs are passed on to consumers and businesses.

Challenges for Investors:

-

Increased Risk of Capital Losses on Long-Term JGBs: Rising interest rates typically lead to a decline in the price of existing bonds. Investors holding long-term JGBs face a greater risk of capital losses if interest rates continue to rise.

-

Difficulty in Predicting Future Interest Rate Movements: The unpredictable nature of the BOJ's policy shifts and global economic conditions makes predicting future interest rate movements challenging for investors, increasing uncertainty in the market.

-

Need for Sophisticated Risk Management Strategies: Navigating the complexities of Japan's bond market requires sophisticated risk management strategies to mitigate the potential for capital losses and manage interest rate risk effectively.

Impact on Pension Funds and Insurance Companies

Pension funds and insurance companies are particularly vulnerable to a steepening yield curve due to their long-term liabilities. Rising interest rates impact their ability to meet their future obligations. These institutions rely heavily on long-term JGBs for matching assets to liabilities; however, rising yields can reduce the value of their bond portfolios, creating a significant mismatch and threatening their solvency. Mitigating this risk requires careful asset-liability management, diversification into other asset classes, and potentially adjusting their investment strategies to incorporate derivatives or alternative strategies.

Opportunities Presented by the Steep Yield Curve

Despite the challenges, a steep yield curve also presents some opportunities:

-

Higher Yields on Long-Term JGBs Compared to Short-Term Bonds: Investors seeking higher returns can find attractive yields on longer-term JGBs, although they must carefully consider the associated interest rate risk.

-

Potential for Capital Appreciation if Interest Rate Increases Slow or Reverse: If interest rate increases slow or reverse, the prices of long-term JGBs could appreciate, offering potential capital gains for investors who bought at higher yields.

-

Opportunities in Specific Sectors Benefiting from the Changing Interest Rate Environment: Certain sectors, such as financial institutions, may benefit from a rising interest rate environment. Careful selection of investments in these sectors could provide attractive returns.

Successfully navigating this market requires active portfolio management, potentially incorporating strategies like laddering (investing in bonds with staggered maturities), duration management, and utilizing derivative instruments to hedge against interest rate risk.

Conclusion

The steepening yield curve in Japan's bond market presents a complex scenario with both significant challenges and potential opportunities. The interplay of BOJ policy, global interest rates, and domestic economic factors necessitates careful analysis and strategic decision-making for investors and policymakers alike. Understanding the mechanics of this phenomenon and its implications is crucial for navigating the evolving landscape of Japan's bond market. Stay informed about the developments in Japan's bond market and adopt a proactive approach to managing your investments in this dynamic environment. Further research into the intricacies of Japan's bond market will allow you to make more informed decisions and successfully navigate the challenges posed by the steep yield curve.

Featured Posts

-

Is A New Cold War Brewing Over Rare Earth Minerals

May 17, 2025

Is A New Cold War Brewing Over Rare Earth Minerals

May 17, 2025 -

Exclusive Averted Midair Collision The Air Traffic Controllers Story

May 17, 2025

Exclusive Averted Midair Collision The Air Traffic Controllers Story

May 17, 2025 -

Investing In The Future Identifying The Countrys Top Business Locations

May 17, 2025

Investing In The Future Identifying The Countrys Top Business Locations

May 17, 2025 -

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025 -

The Lasting Impact Of Ichiro Suzuki A Mariners Legends Continued Influence

May 17, 2025

The Lasting Impact Of Ichiro Suzuki A Mariners Legends Continued Influence

May 17, 2025

Latest Posts

-

Departamento De Educacion Nuevas Medidas Para Prestamos Estudiantiles Morosos

May 17, 2025

Departamento De Educacion Nuevas Medidas Para Prestamos Estudiantiles Morosos

May 17, 2025 -

Fountain City Classic Scholarship Preparing For Your Midday Interview

May 17, 2025

Fountain City Classic Scholarship Preparing For Your Midday Interview

May 17, 2025 -

Gobierno A Recuperar Prestamos Estudiantiles Impagados Implicaciones Para Deudores

May 17, 2025

Gobierno A Recuperar Prestamos Estudiantiles Impagados Implicaciones Para Deudores

May 17, 2025 -

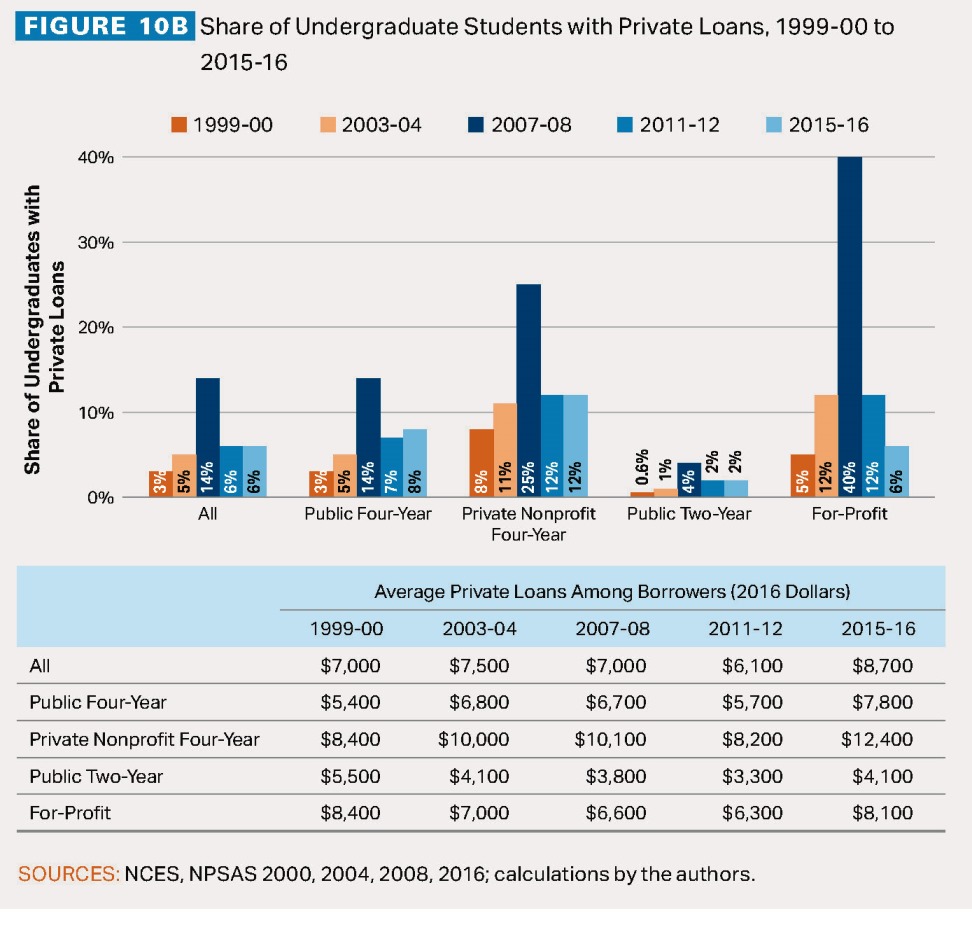

Refinance Federal Student Loans Comparing Private And Federal Options

May 17, 2025

Refinance Federal Student Loans Comparing Private And Federal Options

May 17, 2025 -

Analyzing Trumps Hints On Privatizing Federal Student Loans

May 17, 2025

Analyzing Trumps Hints On Privatizing Federal Student Loans

May 17, 2025