Kerrisdale Capital's Report And Its Effect On D-Wave Quantum (QBTS) Stock Price

Table of Contents

Kerrisdale Capital's Report: Key Allegations and Findings

Kerrisdale Capital, renowned for its meticulous research and often controversial short-selling positions, published a report leveling serious accusations against D-Wave Quantum. The report alleged significant shortcomings in D-Wave's technology and business model, questioning the viability of its quantum computing systems. The report’s central thesis focused on the company’s exaggerated claims regarding the capabilities of its quantum annealers.

Here are some of the key allegations highlighted in the report:

-

Allegation 1: Overstated Technological Capabilities: The report claimed D-Wave's quantum annealers were significantly less powerful than advertised, failing to deliver on promised performance benchmarks. Specific examples, if cited in the report, should be included here. For example, if the report claimed inaccuracies in solving specific types of problems, this would be detailed here.

-

Allegation 2: Misleading Marketing and Financial Reporting: Kerrisdale alleged D-Wave engaged in misleading marketing practices, exaggerating the capabilities of its technology to attract investors and secure funding. This section would require specific details from the original report. Examples of questionable marketing claims should be listed.

-

Allegation 3: Unsustainable Business Model: The report questioned the long-term sustainability of D-Wave's business model, suggesting limited market demand for its quantum annealing technology and an overreliance on government grants and research funding. This section could further elaborate on the concerns around D-Wave's revenue streams and profitability.

[Insert link to Kerrisdale Capital's report here, if publicly available].

Market Reaction to Kerrisdale Capital's Report

The release of Kerrisdale Capital's report triggered an immediate and sharp negative reaction in the market. QBTS stock experienced a significant percentage drop within hours of the report's publication. Trading volume spiked dramatically, indicating heightened investor activity and concern. Short-selling activity around QBTS increased substantially, reflecting a bearish sentiment among many traders.

The following points summarize the market reaction:

-

Significant Stock Price Plunge: A detailed description of the percentage drop and the timeframe is crucial here. Visual representation with charts (optional but highly recommended) would enhance the article's impact and SEO.

-

Increased Trading Volume: Data on the trading volume change before, during, and after the report’s release should be included, showcasing the market's heightened activity.

-

Surge in Short Interest: Information on the increase in short interest on QBTS following the report, showcasing the negative market sentiment.

Keywords: stock price volatility, trading volume, short interest, market sentiment.

D-Wave Quantum's Response to Kerrisdale Capital's Accusations

D-Wave Quantum issued an official response to Kerrisdale Capital's allegations, typically through a press release or statement on their investor relations page. This response likely attempted to refute the accusations and reassure investors. This section should analyze the effectiveness of D-Wave's response in mitigating the negative market sentiment. Did their response successfully address the concerns raised in the report? Did it manage to restore investor confidence, or did it further damage the company's reputation?

-

Analysis of D-Wave's response: Evaluate the strengths and weaknesses of their response. Did they provide sufficient counterarguments and evidence? Were their explanations convincing to the market?

-

Subsequent Actions: Did D-Wave take any further actions following the report's release, such as internal investigations or adjustments to their business strategy?

Keywords: press release, investor relations, damage control, public relations.

Long-Term Implications for D-Wave Quantum (QBTS)

The long-term implications of Kerrisdale Capital's report on D-Wave Quantum are significant and multifaceted. The report’s impact extends beyond the immediate stock price drop. It casts a shadow on investor confidence and potentially impacts future funding rounds and partnerships. The incident also raises broader questions about the maturity and reliability of the quantum computing sector as a whole.

-

Impact on Investor Confidence: How did this event affect investor sentiment towards D-Wave and the quantum computing industry in general?

-

Future Funding and Partnerships: Will this affect D-Wave's ability to secure funding or form partnerships?

-

Implications for the Quantum Computing Sector: Will this incident increase regulatory scrutiny or lead to more cautious investment in quantum computing companies?

Conclusion: Understanding the Kerrisdale Capital Impact on D-Wave Quantum (QBTS) Stock

Kerrisdale Capital's report had a profoundly negative impact on D-Wave Quantum's stock price, triggering a significant market downturn and raising serious questions about the company's technology, business model, and future prospects. The report's key allegations, the market's sharp reaction, and D-Wave's response all contributed to this dramatic event. The long-term effects on D-Wave and the quantum computing sector remain to be seen, highlighting the risks involved in investing in this emerging technology.

Before investing in QBTS or similar companies, investors should conduct thorough due diligence and carefully consider Kerrisdale Capital's analysis of QBTS, as well as D-Wave Quantum’s stock price performance in the context of the broader quantum computing market. Understanding the impact of short-selling reports on quantum computing stocks is critical for informed investment decisions.

Featured Posts

-

Conseil Municipal De Biarritz Debat Sur Le Budget Logements Saisonniers Et Sainte Eugenie

May 20, 2025

Conseil Municipal De Biarritz Debat Sur Le Budget Logements Saisonniers Et Sainte Eugenie

May 20, 2025 -

Important Information For Big Bear Ai Bbai Investors Regarding Legal Action

May 20, 2025

Important Information For Big Bear Ai Bbai Investors Regarding Legal Action

May 20, 2025 -

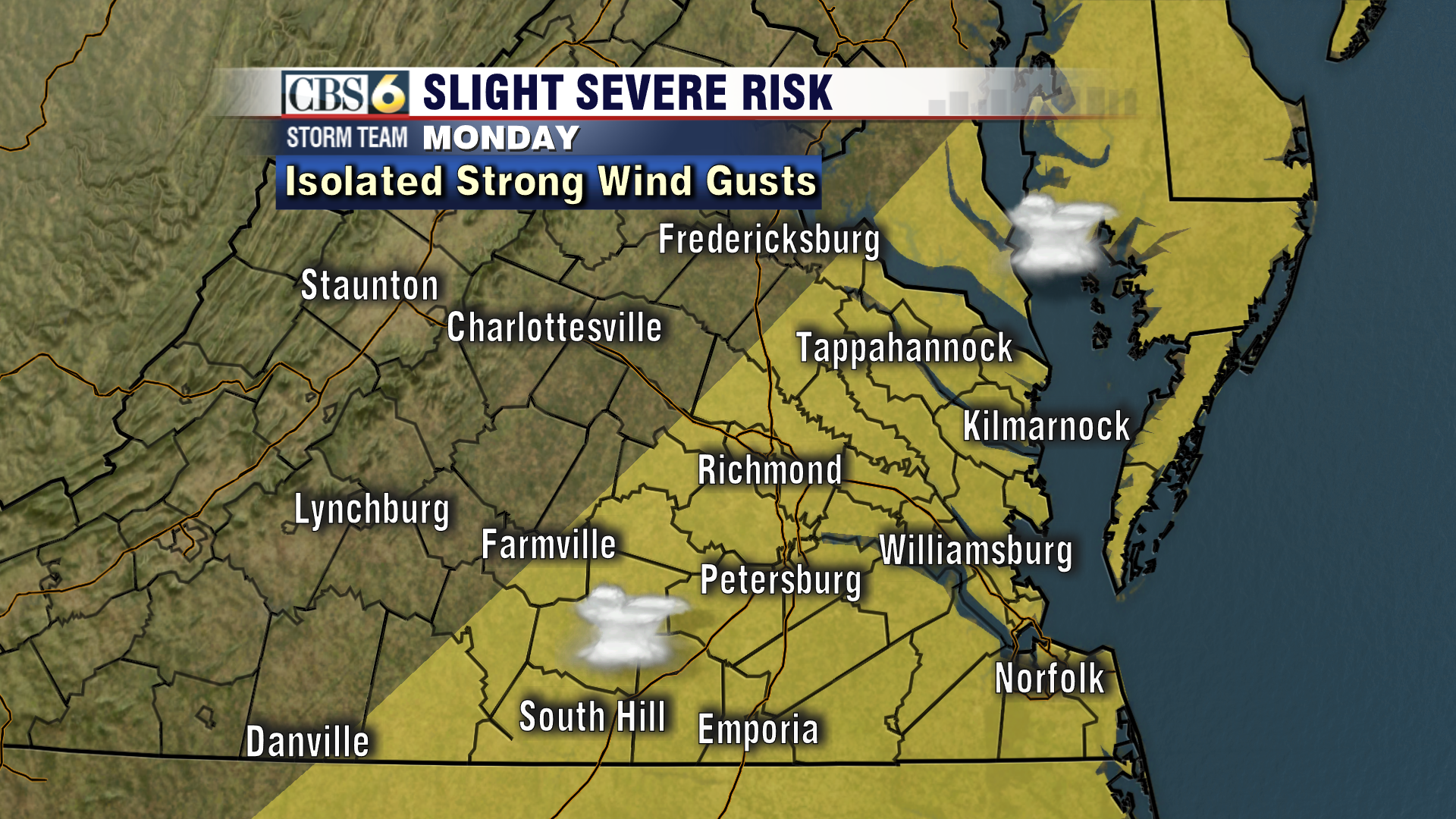

Storm Chance Overnight Severe Weather Potential Monday

May 20, 2025

Storm Chance Overnight Severe Weather Potential Monday

May 20, 2025 -

The D Wave Quantum Inc Qbts Stock Market Performance This Week

May 20, 2025

The D Wave Quantum Inc Qbts Stock Market Performance This Week

May 20, 2025 -

Porsches Brand Evolution The Impact Of Trade Wars On Its Ferrari Mercedes Strategy

May 20, 2025

Porsches Brand Evolution The Impact Of Trade Wars On Its Ferrari Mercedes Strategy

May 20, 2025

Latest Posts

-

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025