D-Wave Quantum, QBTS stock, Kerrisdale Capital, short selling, quantum computing, stock decline, market analysis.

D-Wave Quantum, QBTS stock, Kerrisdale Capital, short selling, quantum computing, stock decline, market analysis.

Kerrisdale Capital's report on D-Wave Quantum leveled serious allegations against the company, casting doubt on its financial health and technological claims. The report detailed concerns spanning various aspects of D-Wave Quantum's operations, raising significant questions about the company's long-term viability. Key accusations included:

[Insert link to Kerrisdale Capital report here, if publicly available]. Keywords: Kerrisdale Capital report, QBTS allegations, financial irregularities, quantum computing technology, business model flaws.

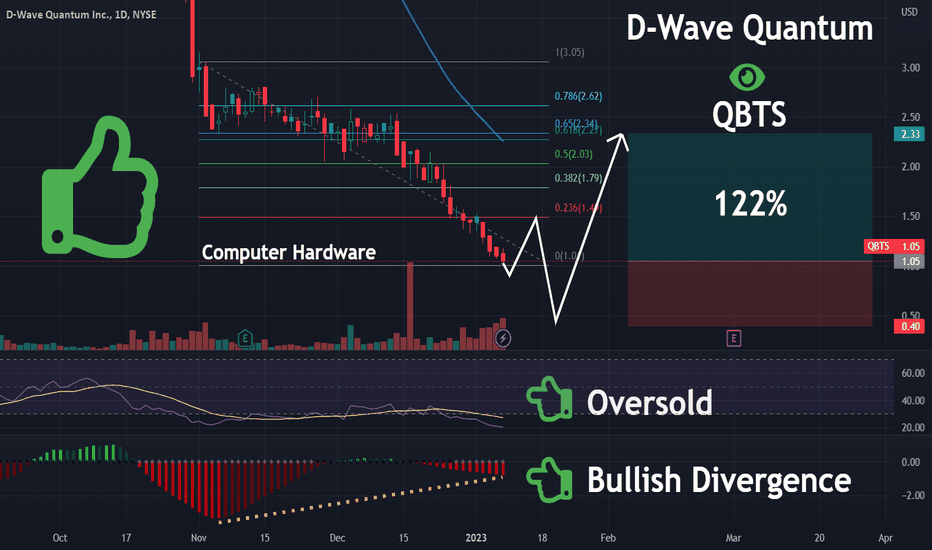

The release of the Kerrisdale Capital report immediately sent shockwaves through the market. QBTS stock experienced a significant plunge, plummeting by [Insert Percentage]% on [Insert Date]. Trading volume surged dramatically following the report's publication, indicating intense investor activity and a high degree of market volatility. D-Wave Quantum has [Insert D-Wave's response, if any, e.g., issued a press release refuting the claims or announced an internal review]. Keywords: QBTS stock price, stock market crash, trading volume, market volatility, investor sentiment.

The sharp decline in QBTS stock price reflects a significant erosion of investor confidence in D-Wave Quantum. While the Kerrisdale Capital report was the primary catalyst, other factors might have contributed to the sell-off. These could include broader concerns about the quantum computing market's overall growth trajectory or anxieties related to the company's competitive landscape. The long-term effects on D-Wave Quantum remain uncertain, but the report undeniably casts a shadow on the company's future prospects and its ability to attract further investment. Keywords: investor confidence, market outlook, long-term investment, risk assessment.

D-Wave Quantum's response to the Kerrisdale Capital report will be crucial in shaping its future. [Insert details of D-Wave's response here, if available]. The effectiveness of their response in addressing the specific concerns raised in the report will significantly influence investor sentiment and the company's ability to regain lost ground. The future of D-Wave Quantum and the quantum computing industry as a whole hinges on how the company navigates this crisis, potentially leading to changes in its business strategy, leadership, or technology development. Further investigations or regulatory scrutiny may also ensue, impacting the company's trajectory. Keywords: D-Wave Quantum response, future outlook, quantum computing industry, company strategy, risk management.

Kerrisdale Capital's report on D-Wave Quantum has had a significant and immediate impact, resulting in a substantial decline in QBTS stock price and raising serious concerns among investors. The allegations of financial irregularities and misleading marketing practices have shaken investor confidence, leaving the future of the company uncertain. This event underscores the importance of thorough due diligence and risk assessment before investing in companies, particularly those operating in emerging and rapidly evolving sectors like quantum computing. Stay informed about further developments in the D-Wave Quantum story, and conduct thorough research before making any investment decisions related to QBTS stock or other companies in the quantum computing sector. Follow for updates and further analysis of Kerrisdale Capital reports.

Debate Over Kartels Trinidad Concert Age Limits And Song Bans Under Consideration

Debate Over Kartels Trinidad Concert Age Limits And Song Bans Under Consideration

Explore Provence A Walking Journey From Mountains To Mediterranean

Explore Provence A Walking Journey From Mountains To Mediterranean

Shes A Love Monster Understanding And Managing Intense Female Emotions In Relationships

Shes A Love Monster Understanding And Managing Intense Female Emotions In Relationships

No Money Proven Methods To Improve Your Financial Situation

No Money Proven Methods To Improve Your Financial Situation

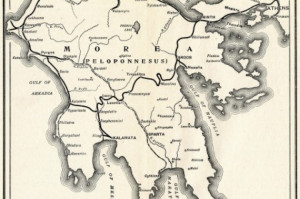

Provlimata Kai Prooptikes Gia To Sidirodromiko Diktyo Tis Elladas

Provlimata Kai Prooptikes Gia To Sidirodromiko Diktyo Tis Elladas

David Walliams Britains Got Talent Departure The Story

David Walliams Britains Got Talent Departure The Story

Bgt Blockbusters What Made It Special

Bgt Blockbusters What Made It Special

David Walliams What Happened On Britains Got Talent

David Walliams What Happened On Britains Got Talent

Analyzing Bgts Blockbusters Special A Critical Look

Analyzing Bgts Blockbusters Special A Critical Look