No Money? Proven Methods To Improve Your Financial Situation

Table of Contents

Boosting Your Income: Practical Strategies to Earn More

Feeling overwhelmed by debt and limited income? Increasing your earning potential is a crucial step towards improving your financial situation. Here are some practical strategies to earn more money:

Exploring Additional Income Streams

Don't rely solely on your primary income source. Diversifying your income streams can significantly impact your financial health. Consider these options:

-

Freelancing and Gig Work: Platforms like Upwork, Fiverr, and TaskRabbit offer opportunities to monetize your skills. Whether you're a writer, designer, virtual assistant, or handyman, there's likely a gig waiting for you. Research in-demand skills and build a strong online portfolio to attract clients.

-

Part-time Jobs: Even a few extra hours per week can make a difference. Look for flexible part-time jobs, including remote options, that fit your schedule and skillset. Consider roles like customer service representative, tutor, or delivery driver.

-

Renting Out Assets: Do you have a spare room, car, or parking space? Renting these assets can generate passive income. Explore platforms like Airbnb for short-term rentals or consider long-term leasing options.

-

Selling Unused Items Online: Declutter your home and turn unwanted items into cash. Platforms like eBay, Craigslist, Facebook Marketplace, and even local consignment shops can help you sell clothes, electronics, furniture, and more.

-

Investing in Dividend-Paying Stocks: This is a long-term strategy that requires research and understanding of the stock market. Dividend-paying stocks offer a steady stream of income, but it's crucial to invest wisely and diversify your portfolio.

Negotiating a Raise or Better Job

Don't undervalue your skills and experience. Negotiating a raise or seeking a higher-paying job can significantly boost your income.

-

Research Industry Salaries and Benefits: Use online resources like Glassdoor and Salary.com to research average salaries for your position and location. This will give you leverage during salary negotiations.

-

Highlight Accomplishments and Contributions: Before approaching your boss or a potential employer, document your achievements and contributions to your current or previous roles. Quantify your successes whenever possible.

-

Prepare a Confident and Persuasive Case: Practice presenting your case for a raise or new job opportunity. Be confident, articulate, and highlight the value you bring to the table.

-

Networking and Exploring Job Opportunities: Network with professionals in your field and actively search for job openings that offer better compensation and benefits. Utilize LinkedIn and other professional networking platforms.

-

Developing In-Demand Skills: Continuously upgrade your skills to increase your market value. Take online courses, attend workshops, or pursue certifications in areas relevant to your career.

Cutting Expenses: Smart Ways to Save Money

Saving money is just as important as earning more. By identifying and reducing unnecessary spending, you can free up funds for debt repayment and savings.

Identifying and Reducing Unnecessary Spending

Take control of your finances by tracking your spending and identifying areas for improvement.

-

Track Your Spending: Use budgeting apps like Mint or YNAB (You Need A Budget) to monitor your spending for a month. This will reveal areas where you can cut back.

-

Cut Back on Subscriptions: Review your subscriptions for streaming services, gym memberships, and other recurring expenses. Cancel or downgrade any services you rarely use.

-

Reduce Eating Out: Cooking at home is significantly cheaper than eating out. Plan your meals and prepare food in advance to save time and money.

-

Negotiate Lower Bills: Contact your internet, phone, and utility providers to negotiate lower rates. Loyalty programs or switching providers can often lead to savings.

-

Find Cheaper Alternatives: Look for cheaper alternatives for everyday expenses, such as grocery shopping at discount stores and using public transportation instead of driving.

Creating a Realistic Budget and Sticking to It

A well-structured budget is essential for effective financial management.

-

The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

-

Zero-Based Budgeting: Assign every dollar in your budget to a specific category. This helps avoid overspending.

-

Set Financial Goals: Set both short-term and long-term financial goals to stay motivated and track your progress.

-

Use Budgeting Apps and Spreadsheets: Utilize budgeting tools to track your income, expenses, and progress toward your financial goals.

Building a Strong Financial Foundation: Long-Term Strategies for Financial Security

Building a strong financial foundation requires long-term planning and consistent effort.

Paying Down Debt

High-interest debt can significantly hinder your financial progress.

-

Prioritize High-Interest Debt: Focus on paying down high-interest debt like credit cards first to minimize interest charges.

-

Explore Debt Consolidation Options: Consider consolidating high-interest debt into a lower-interest loan to simplify payments.

-

Create a Debt Repayment Plan: Use the snowball or avalanche method to systematically pay down your debt.

-

Negotiate Lower Interest Rates: Contact your creditors to negotiate lower interest rates on your loans.

Saving and Investing

Saving and investing are crucial for long-term financial security.

-

Set Up an Emergency Fund: Aim for 3-6 months of living expenses in an easily accessible emergency fund.

-

Invest in Retirement Accounts: Contribute regularly to retirement accounts like 401(k)s and IRAs to secure your future.

-

Explore Low-Cost Investment Options: Invest in low-cost index funds or ETFs (exchange-traded funds) for diversification and long-term growth.

-

Learn About Personal Finance and Investing: Continuously educate yourself about personal finance and investing to make informed decisions.

Conclusion

Improving your financial situation when you feel like you have no money is achievable with dedication and a strategic approach. By implementing the proven methods outlined in this article – boosting your income, cutting expenses, and building a strong financial foundation – you can take control of your finances and build a more secure future. Don't let a lack of funds define you. Take action today and start building a better financial future. Remember to regularly review your budget and adapt your strategies to meet your evolving needs. Start improving your financial situation now!

Featured Posts

-

Your Guide To A Successful Screen Free Week With Children

May 21, 2025

Your Guide To A Successful Screen Free Week With Children

May 21, 2025 -

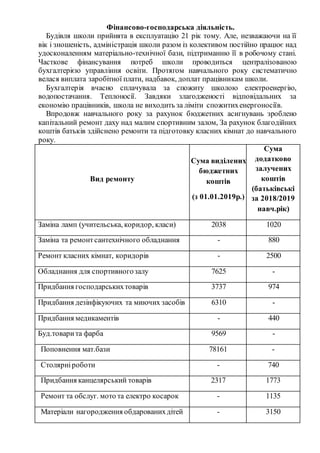

Pivdenniy Mist Detalniy Analiz Remontu Ta Zaluchenikh Resursiv

May 21, 2025

Pivdenniy Mist Detalniy Analiz Remontu Ta Zaluchenikh Resursiv

May 21, 2025 -

How A Lack Of Funds Impacts Your Life And How To Reclaim Control

May 21, 2025

How A Lack Of Funds Impacts Your Life And How To Reclaim Control

May 21, 2025 -

Britons Epic Australian Run Pain Flies And Controversy

May 21, 2025

Britons Epic Australian Run Pain Flies And Controversy

May 21, 2025 -

Appeal Launched Against Sentence For Racial Hatred Tweet By Ex Councillors Wife

May 21, 2025

Appeal Launched Against Sentence For Racial Hatred Tweet By Ex Councillors Wife

May 21, 2025

Latest Posts

-

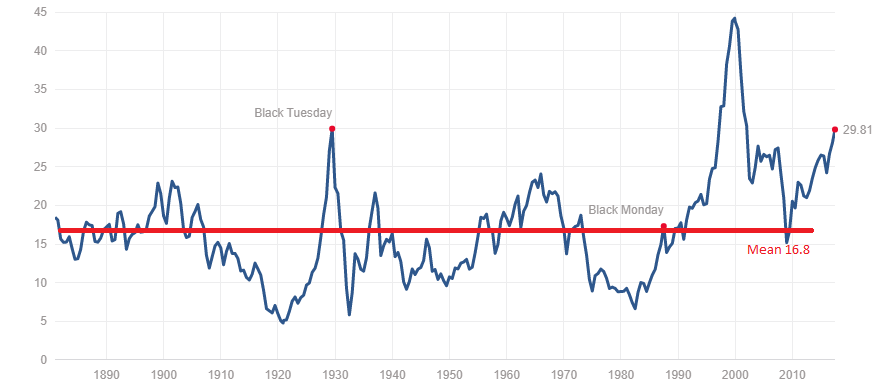

High Stock Market Valuations A Bof A Perspective For Investors

May 21, 2025

High Stock Market Valuations A Bof A Perspective For Investors

May 21, 2025 -

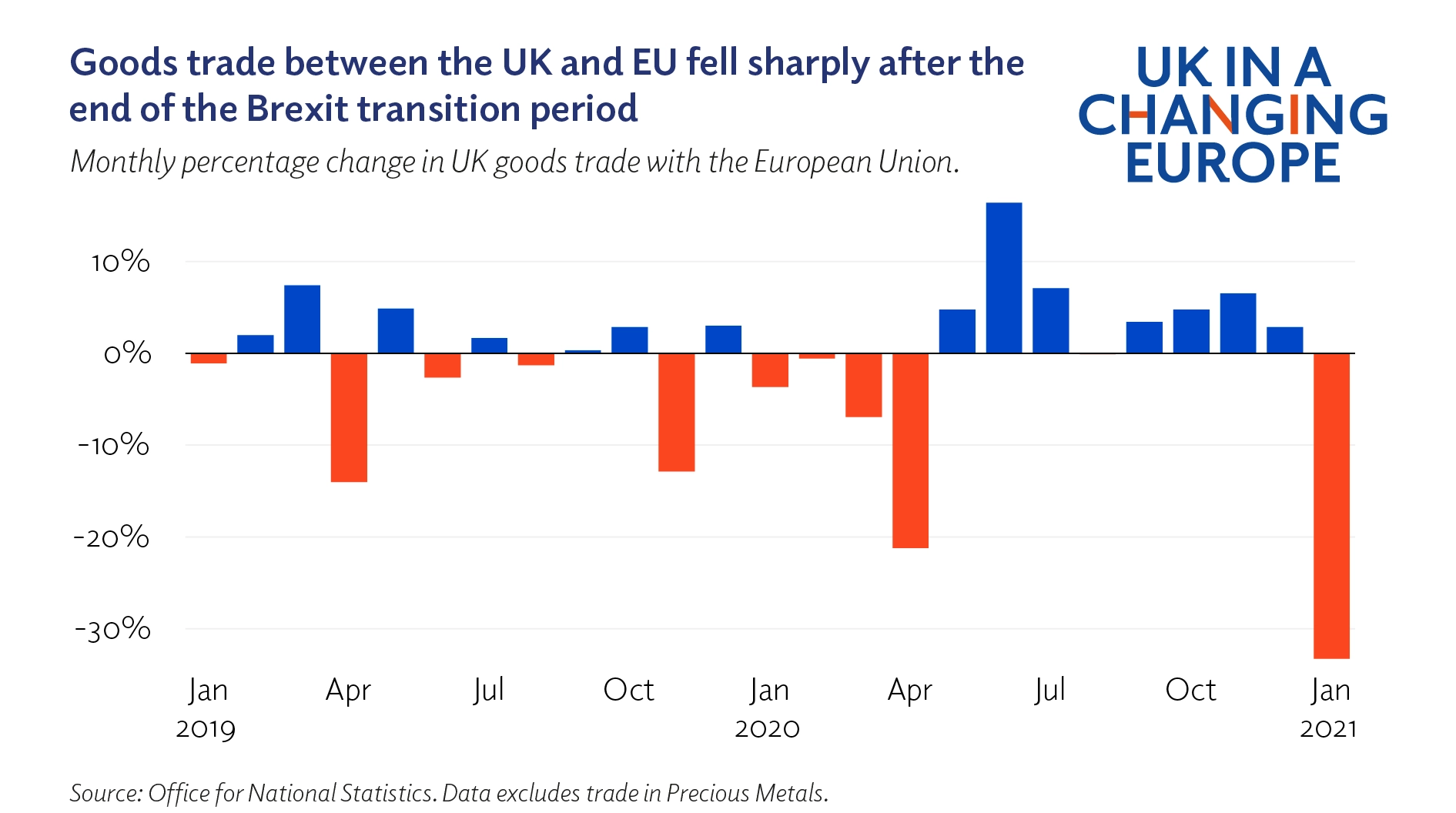

Brexit And The Uk Luxury Goods Market An Export Perspective

May 21, 2025

Brexit And The Uk Luxury Goods Market An Export Perspective

May 21, 2025 -

Analysis Brexits Negative Impact On Uk Luxury Exports To The Eu

May 21, 2025

Analysis Brexits Negative Impact On Uk Luxury Exports To The Eu

May 21, 2025 -

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 21, 2025

Post Brexit Challenges For Uk Luxury Exporters To The Eu

May 21, 2025 -

The Brexit Effect Slowdown In Uk Luxury Goods Exports To The Eu

May 21, 2025

The Brexit Effect Slowdown In Uk Luxury Goods Exports To The Eu

May 21, 2025