Land Your Dream Job: 5 Do's And Don'ts In The Private Credit Industry

Table of Contents

Do's for Securing Private Credit Jobs

1. Network Strategically

Building a strong network is paramount in the private credit industry. Many private credit jobs are never publicly advertised. Therefore, leveraging your network is crucial to uncover hidden opportunities.

- Attend Industry Events: Conferences, seminars, and networking events provide invaluable opportunities to meet professionals in private credit. Look for events focused on private debt, direct lending, or alternative credit strategies.

- Utilize Online Platforms: LinkedIn is your best friend. Actively engage with industry leaders, join relevant groups, and participate in discussions. A well-crafted LinkedIn profile showcasing your skills and experience is essential.

- Informational Interviews: Don't underestimate the power of informational interviews. Reach out to professionals in private credit firms and request a brief conversation to learn more about their work and the industry. This is a great way to learn about private credit analyst jobs, private credit associate jobs, and other roles.

- Leverage Alumni Networks: If you have an alumni network from your university, tap into it! Many professionals are happy to help fellow alumni.

2. Showcase Relevant Skills and Experience

Your resume and cover letter are your first impression. Make them count! Highlighting the right skills is key to securing an interview for private credit jobs.

- Financial Modeling Prowess: Emphasize your proficiency in financial modeling, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other relevant techniques. Private credit firms heavily rely on these skills.

- Credit Analysis Expertise: Showcase your understanding of credit analysis, including credit risk assessment, covenant compliance monitoring, and due diligence processes.

- Debt Instrument Knowledge: Demonstrate your knowledge of various debt instruments, such as senior secured loans, mezzanine debt, and subordinated debt. Your understanding of different structures is critical.

- Quantifiable Achievements: Use metrics to quantify your accomplishments. Instead of simply stating your responsibilities, showcase the impact you had—e.g., "Increased efficiency by 15% through process optimization."

- Tailored Applications: Don't use a generic resume and cover letter. Tailor each application to the specific job description and the firm's investment strategy. This shows genuine interest and attention to detail.

3. Master the Interview Process

The interview process is your chance to shine and demonstrate your capabilities. Preparation is key for success in securing private credit jobs.

- Practice Common Questions: Prepare for behavioral questions (e.g., "Tell me about a time you failed"), technical questions (e.g., "Walk me through a DCF analysis"), and questions about your experience in private credit.

- Thorough Firm Research: Research the firm's investment strategy, recent transactions, and their portfolio companies. Show genuine interest by demonstrating you've done your homework.

- Prepare insightful questions: Asking thoughtful questions demonstrates your engagement and genuine interest in the role. Prepare questions about the firm's culture, investment philosophy, and current market outlook.

- Professionalism is key: Dress professionally, maintain strong eye contact, and present yourself confidently. Your body language speaks volumes.

- Stay updated: Show you are aware of the latest trends. Demonstrate understanding of ESG investing, the impact of interest rate changes, and other relevant market dynamics.

Don'ts for a Successful Private Credit Job Search

1. Neglect Networking

Networking isn't optional; it's essential. Many private credit positions are filled through referrals.

- Don't Rely Solely on Online Applications: Online job boards are helpful but don't replace active networking.

- Don't Be Afraid to Reach Out: Even if you don't have a direct connection, reaching out to someone for informational interviews can open doors.

- Don't Underestimate the Power of Referrals: A referral from a trusted professional significantly increases your chances.

2. Submit Generic Applications

Generic applications show a lack of effort and interest.

- Don't Use Generic Resumes and Cover Letters: Tailor each application to the specific job description and firm.

- Don't Underestimate the Importance of a Strong Cover Letter: The cover letter should highlight your understanding of the firm's investment strategy and how your skills align with their needs.

- Don't Ignore Job Requirements: Carefully read the job description and address each requirement in your application.

3. Underprepare for Interviews

Underprepared interviews leave a negative impression.

- Don't Go Unprepared: Thoroughly research the firm, practice your answers, and prepare thoughtful questions.

- Don't Be Afraid to Ask Clarifying Questions: It’s better to ask for clarification than to give an incorrect answer.

- Don't Neglect Body Language and Demeanor: Present yourself professionally and confidently.

Conclusion

Landing your dream job in the private credit industry requires a strategic and proactive approach. By following these do's and don'ts, focusing on networking, showcasing your relevant skills, and mastering the interview process, you'll significantly increase your chances of success. Don't delay – start building your network, refining your resume, and preparing for those crucial interviews. Take control of your career path and land your dream private credit job today!

Featured Posts

-

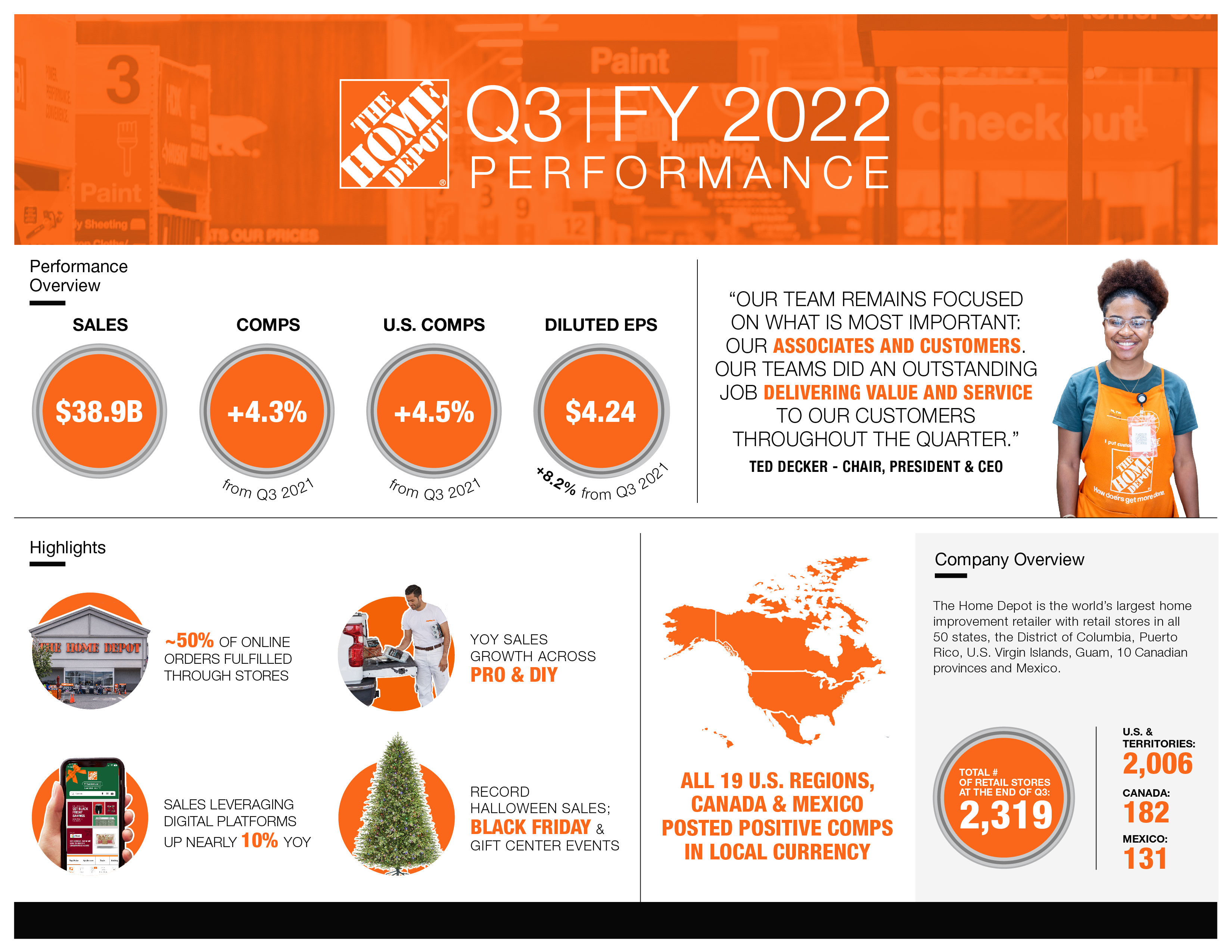

Home Depots Earnings Disappointing Results Tariff Guidance Maintained

May 22, 2025

Home Depots Earnings Disappointing Results Tariff Guidance Maintained

May 22, 2025 -

The Blake Lively Film Controversy A Complete Breakdown Of The Justin Baldoni Lawsuit

May 22, 2025

The Blake Lively Film Controversy A Complete Breakdown Of The Justin Baldoni Lawsuit

May 22, 2025 -

Upcoming Canada Post Strike Implications And Contingency Planning

May 22, 2025

Upcoming Canada Post Strike Implications And Contingency Planning

May 22, 2025 -

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 22, 2025

Risicos Voor De Voedingsindustrie Abn Amro Over Afhankelijkheid Van Arbeidsmigranten

May 22, 2025 -

Google Ai Smart Glasses Prototype A Comprehensive Review

May 22, 2025

Google Ai Smart Glasses Prototype A Comprehensive Review

May 22, 2025

Latest Posts

-

Exploring The Blake Lively Alleged Controversy What We Know

May 22, 2025

Exploring The Blake Lively Alleged Controversy What We Know

May 22, 2025 -

Celebrity Feud Blake Livelys Sisters Rally Around Her

May 22, 2025

Celebrity Feud Blake Livelys Sisters Rally Around Her

May 22, 2025 -

The Blake Lively Allegations Facts Speculation And Public Reaction

May 22, 2025

The Blake Lively Allegations Facts Speculation And Public Reaction

May 22, 2025 -

Blake Livelys Reported Feud Family Offers Unwavering Support

May 22, 2025

Blake Livelys Reported Feud Family Offers Unwavering Support

May 22, 2025 -

Is Blake Lively Involved In Recent Allegations A Look At The Evidence

May 22, 2025

Is Blake Lively Involved In Recent Allegations A Look At The Evidence

May 22, 2025