Last Week's CoreWeave (CRWV) Stock Rally: A Comprehensive Analysis

Table of Contents

Potential Catalysts Behind the CRWV Stock Rally

Several factors likely contributed to last week's impressive CoreWeave (CRWV) stock rally. Let's examine the key potential catalysts:

Strong Earnings Report and Future Projections

A positive earnings report often fuels significant stock price increases. Last week's announcement from CRWV likely included upbeat news regarding revenue, profitability, and future projections, bolstering investor confidence. Specific details from the report would need to be analyzed, but potential factors include:

- Increased Revenue: A significant year-over-year or quarter-over-quarter increase in revenue, demonstrating strong market demand for CRWV's services.

- Improved Profit Margins: Higher profit margins showcase improved operational efficiency and cost management, a positive signal for investors.

- Upward Revision of Forecasts: Any upward revisions to revenue forecasts or profit margin predictions for the coming quarters demonstrate a positive outlook for the company's future performance. This strengthens investor belief in long-term growth potential.

- Strong Customer Acquisition: Data showing a significant increase in new customers and contracts, indicating robust market penetration and demand.

Increased Investor Interest in AI Infrastructure

The burgeoning field of artificial intelligence (AI) is driving immense demand for robust infrastructure. CoreWeave, with its specialized cloud computing resources, is well-positioned to capitalize on this growth. Increased investor interest in AI infrastructure is a major reason behind CRWV's success. This includes:

- Strategic Partnerships: Collaborations with leading AI companies provide CRWV with access to new markets and technologies, increasing investor confidence in its long-term growth trajectory. Examples would need to be cited from the announcements.

- Market Leadership: Demonstrated market leadership in providing cutting-edge AI infrastructure solutions.

- Scalability and Reliability: Investors are drawn to CRWV's ability to offer scalable and reliable infrastructure solutions for the demanding workloads of AI applications.

Positive Analyst Ratings and Price Target Adjustments

Changes in analyst ratings and price targets significantly influence investor sentiment. A positive shift in analyst opinions can lead to increased buying pressure, pushing the stock price higher. Specific examples are crucial here:

- Upgraded Ratings: Several prominent analysts might have upgraded their ratings for CRWV, citing positive factors such as strong earnings, growth potential, or competitive advantages.

- Increased Price Targets: Adjustments to price targets, reflecting a higher valuation of CRWV, further encourage investors to purchase shares.

- Positive Commentary: Detailed commentary from analysts highlighting CRWV's strong competitive positioning, innovative technologies, and growth prospects contributes to market sentiment.

Market-Wide Trends Favoring Cloud Computing Stocks

Broader market trends can also impact individual stock performances. Positive sentiment towards cloud computing companies as a whole, often fueled by macroeconomic factors, could have influenced the CRWV stock rally.

- Increased Cloud Adoption: The continued increase in cloud adoption across various industries creates a favorable environment for cloud computing companies like CRWV.

- Digital Transformation: Global digital transformation initiatives increase demand for cloud infrastructure, directly benefiting CRWV’s business.

- Favorable Economic Conditions: Positive economic indicators, such as low interest rates or strong GDP growth, generally improve investor sentiment towards growth stocks, including those in the cloud computing sector.

Analyzing the Sustainability of the CRWV Stock Rally

While last week's rally was impressive, assessing its sustainability requires considering both short-term and long-term factors, including potential risks and competitive pressures.

Short-Term vs. Long-Term Growth Potential

The continued upward trajectory of CRWV stock depends on several factors:

- Sustained Demand: The continued strong demand for CRWV's services and ability to meet this demand are critical for sustaining the rally.

- Successful Execution: Successful execution of the company’s long-term growth strategy is crucial for continued growth.

- Market Volatility: Market-wide volatility and broader economic factors can significantly impact short-term stock price movements. It's important to remember that short-term price fluctuations are often unpredictable.

Risks and Challenges Facing CoreWeave

Despite the positive outlook, CRWV faces several challenges:

- Competition: Intense competition from established players in the cloud computing market poses a significant risk.

- Technological Advancements: Rapid technological advancements require continuous innovation to maintain a competitive edge.

- Economic Downturns: Economic downturns can significantly reduce demand for cloud computing services, impacting CRWV's revenue and profitability. The company needs to have strategies in place to navigate these periods.

Comparison with Competitors in the Cloud Computing Sector

Analyzing CRWV's performance against competitors like AWS, Azure, and Google Cloud is essential. CRWV needs to demonstrate competitive advantages, including:

- Niche Specialization: Focus on niche areas within cloud computing to avoid direct competition with major players.

- Technological Innovation: Continuously developing and implementing cutting-edge technologies to stay ahead of competitors.

- Strategic Partnerships: Forging strategic partnerships to expand market reach and access new technologies.

Conclusion: Understanding the Future of CoreWeave (CRWV) Stock

Last week's CRWV stock rally was likely driven by a combination of strong earnings, increased investor interest in AI infrastructure, positive analyst sentiment, and broader market trends favoring cloud computing companies. While the outlook appears positive, investors should carefully assess both the short-term and long-term growth potential, considering the inherent risks and competitive pressures. The sustainability of this rally depends on CRWV's ability to continue demonstrating strong performance, successfully navigate market challenges, and maintain its competitive edge. Conduct thorough research, understand the company's financials and future prospects, and make informed investment decisions regarding CoreWeave (CRWV) stock. Remember that due diligence is essential before investing in CRWV or any other stock. Further reading on CRWV's financial reports and industry analysis is recommended before making any investment decisions.

Featured Posts

-

The Power Of Music Exploring The Sound Perimeter Of Human Connection

May 22, 2025

The Power Of Music Exploring The Sound Perimeter Of Human Connection

May 22, 2025 -

Improving Wilderness Safety Collaborative Efforts With Bear Spray And Training

May 22, 2025

Improving Wilderness Safety Collaborative Efforts With Bear Spray And Training

May 22, 2025 -

David Walliams Attack On Simon Cowell A Britains Got Talent Controversy

May 22, 2025

David Walliams Attack On Simon Cowell A Britains Got Talent Controversy

May 22, 2025 -

Itineraires Cyclistes Loire Vignoble Nantais Et Estuaire

May 22, 2025

Itineraires Cyclistes Loire Vignoble Nantais Et Estuaire

May 22, 2025 -

Understanding Core Weave Crwv S Recent Stock Market Performance

May 22, 2025

Understanding Core Weave Crwv S Recent Stock Market Performance

May 22, 2025

Latest Posts

-

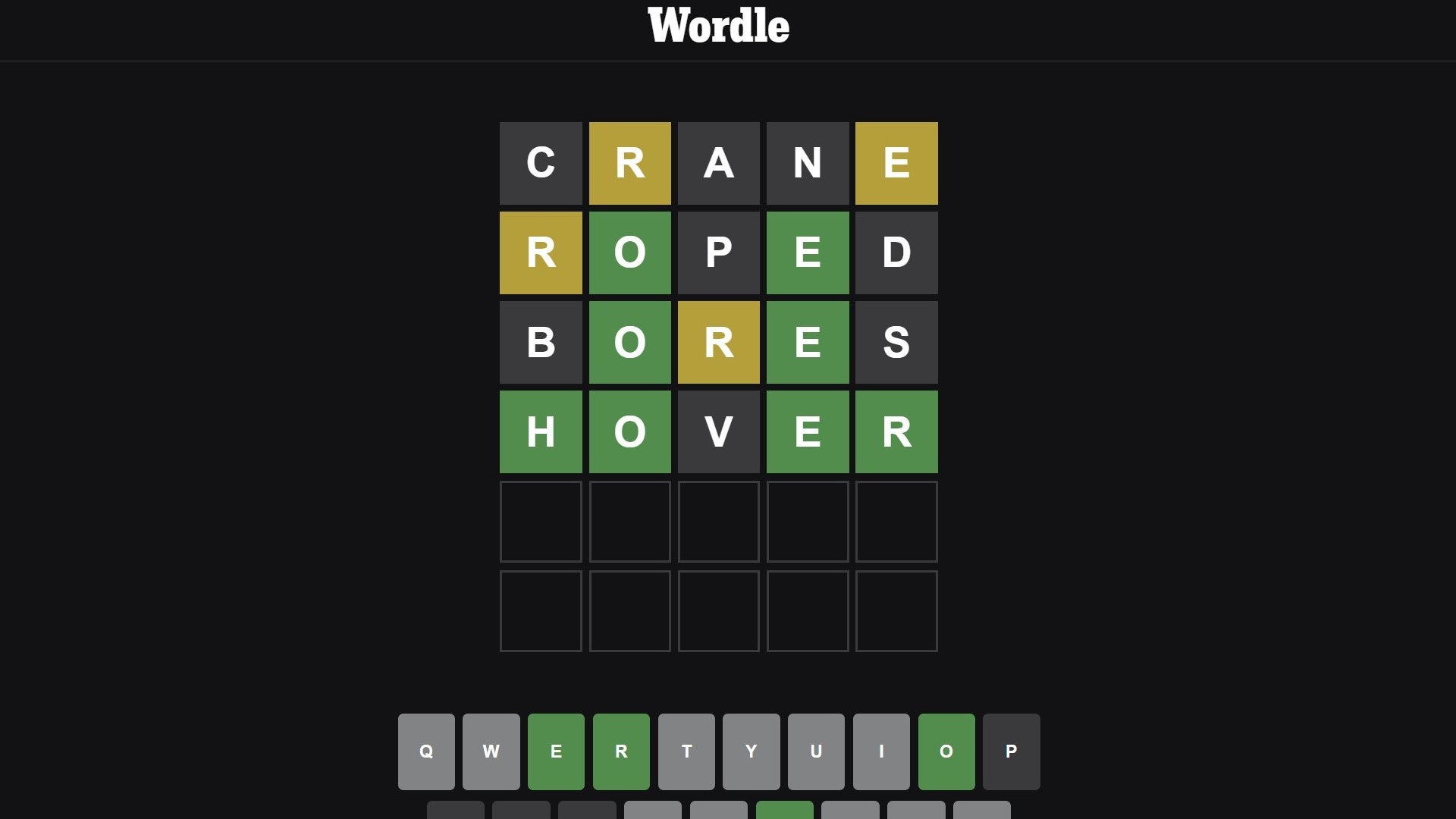

Solve Wordle 1356 Hints Clues And The Answer For March 6th

May 22, 2025

Solve Wordle 1356 Hints Clues And The Answer For March 6th

May 22, 2025 -

Wordle 1408 Answer And Clues April 27th Sunday

May 22, 2025

Wordle 1408 Answer And Clues April 27th Sunday

May 22, 2025 -

Wordle Hints And Solution Thursday March 6th Wordle 1356

May 22, 2025

Wordle Hints And Solution Thursday March 6th Wordle 1356

May 22, 2025 -

Solve Wordle 1408 April 27th Clues And Answer

May 22, 2025

Solve Wordle 1408 April 27th Clues And Answer

May 22, 2025 -

Wordle 1408 April 27th Hints And Solution

May 22, 2025

Wordle 1408 April 27th Hints And Solution

May 22, 2025