Live Nation Entertainment (LYV): Investment Options And Market Analysis

Table of Contents

Understanding Live Nation Entertainment (LYV) and its Business Model

Live Nation Entertainment is a global leader in live entertainment, boasting a diversified business model that spans several key segments. Their core operations include:

- Concerts: Live Nation is the world's largest producer and promoter of live music concerts, encompassing a vast array of artists, genres, and venues. This segment forms a significant portion of their revenue.

- Ticketing: Through Ticketmaster, Live Nation controls a massive share of the global ticketing market. This provides a recurring revenue stream and valuable data on consumer preferences.

- Sponsorships: Live Nation leverages its extensive network and brand recognition to secure lucrative sponsorships for concerts and events, generating additional income streams.

- Artist Management: The company manages numerous artists, further solidifying its position within the music industry ecosystem.

- Venue Ownership and Operation: Live Nation owns and operates a large number of venues worldwide, providing crucial infrastructure for its concert promotion business and offering additional revenue streams.

This integrated business model provides significant competitive advantages:

- Market leader in live music: Live Nation's scale and reach are unmatched, giving them significant pricing power and negotiating leverage.

- Ticketing giant through Ticketmaster: Ticketmaster's dominance in the ticketing market provides a reliable revenue stream and valuable data insights.

- Diverse revenue streams mitigate risk: Live Nation's multiple revenue streams help buffer against potential downturns in any single segment.

- Strong brand recognition and customer loyalty: The Live Nation brand is synonymous with live music experiences, fostering strong customer loyalty.

- Exposure to various artist genres and demographics: The company's broad reach across musical genres and demographics ensures diversification and resilience.

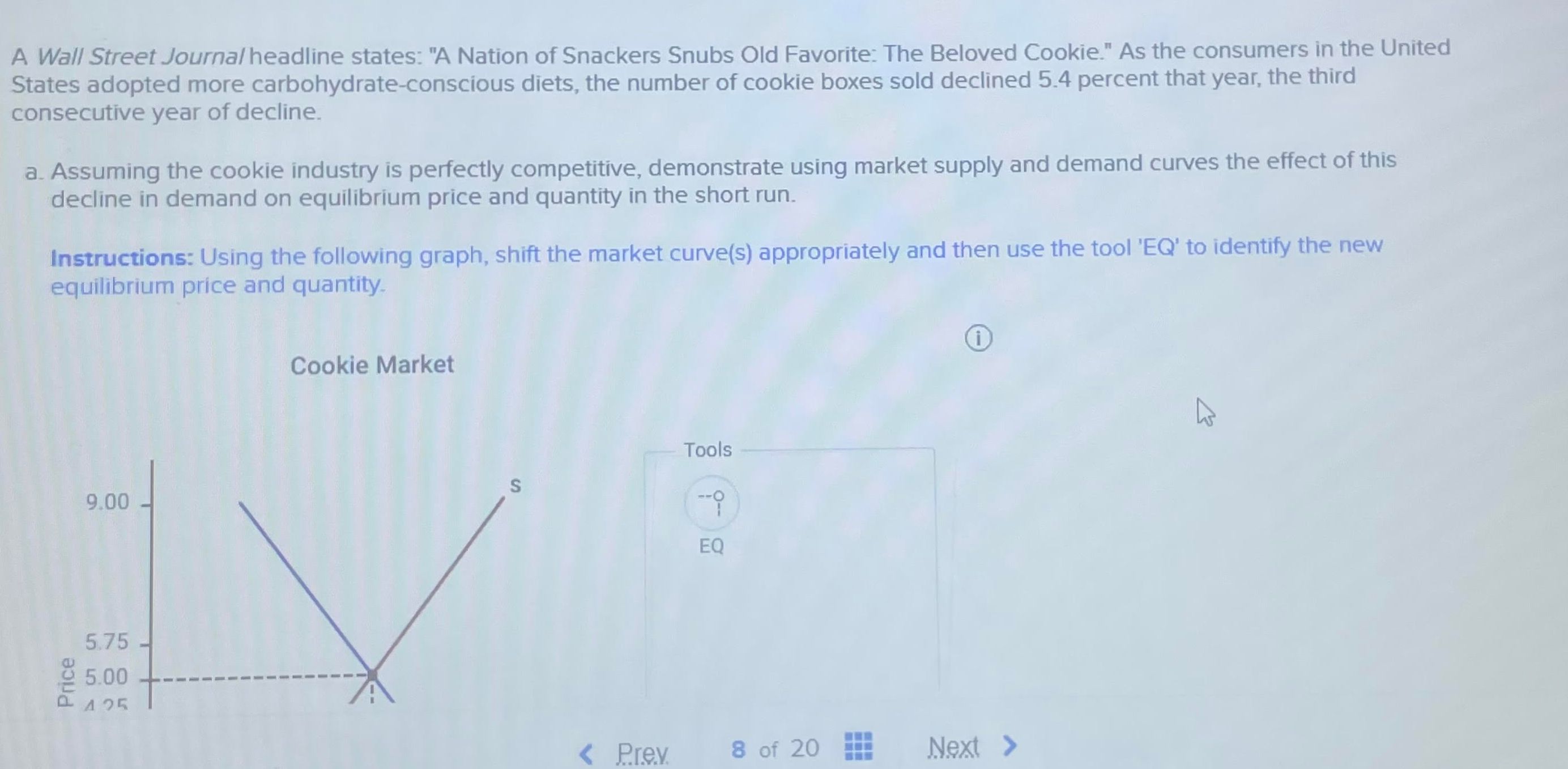

Analyzing Live Nation's Stock Performance (LYV Stock)

Analyzing LYV stock requires examining both its historical performance and key financial indicators. Historical stock prices show periods of volatility, influenced by various factors including economic conditions and global events.

- Historical LYV stock price fluctuations: Charts and graphs illustrating historical LYV stock price performance can reveal trends and patterns, providing valuable insights into its volatility and risk profile. (Note: This section would ideally include actual charts and graphs.)

- Key financial ratios and metrics (P/E ratio, EPS): Examining the Price-to-Earnings (P/E) ratio and Earnings Per Share (EPS) helps assess the company's valuation and profitability.

- Dividend history and payout ratio (if applicable): If Live Nation pays dividends, analyzing their history and payout ratio is crucial for investors seeking income from their investment.

- Impact of major events (e.g., pandemics) on stock price: The COVID-19 pandemic significantly impacted Live Nation's business, illustrating the industry's sensitivity to unforeseen events. Studying the stock's response to such events is essential.

- Comparison to competitor stock performance: Benchmarking Live Nation's performance against competitors helps assess its relative strength and market positioning.

Investment Options for Live Nation Entertainment (LYV)

Investors have several options for gaining exposure to Live Nation:

- Buying LYV stock directly: This offers direct ownership and potential for higher returns, but also carries higher risk.

- Investing in ETFs that include LYV: Exchange-Traded Funds (ETFs) offer diversified exposure to the entertainment sector, reducing risk compared to direct stock ownership.

- Utilizing options trading strategies (calls, puts): Options trading can provide leveraged returns, but it's riskier and requires a deeper understanding of the market.

- Considering dollar-cost averaging for risk mitigation: Dollar-cost averaging helps mitigate risk by spreading investments over time, reducing the impact of market volatility.

- Importance of diversification within your portfolio: Diversifying investments across different asset classes and sectors is crucial for minimizing risk.

Risk Assessment of Investing in LYV

Investing in LYV, like any stock, carries inherent risks:

- Economic sensitivity of the entertainment industry: The entertainment industry is cyclical and sensitive to economic downturns. Recessions can significantly impact consumer spending on live events.

- Competition from other entertainment companies: Live Nation faces competition from other entertainment companies, both in concert promotion and ticketing.

- Regulatory risks and potential lawsuits: The company operates in a regulated environment and is subject to potential legal challenges.

- Dependence on large-scale events and artist availability: The success of Live Nation is heavily reliant on the availability of major artists and the ability to secure large-scale events.

- Impact of external factors like inflation and interest rates: Macroeconomic factors like inflation and interest rates can influence consumer spending and investment decisions.

Future Outlook and Growth Potential for Live Nation (LYV)

Live Nation's future growth prospects appear promising, driven by several factors:

- Projections for future revenue growth: Analysts often provide growth projections based on the company's performance and market trends.

- Potential for expansion into new markets or segments: Live Nation can pursue growth by expanding into new geographical markets or diversifying into related entertainment sectors.

- Impact of technological advancements (e.g., streaming, virtual concerts): The company is exploring opportunities in areas such as virtual concerts and streaming, adapting to evolving consumer preferences.

- Long-term strategic goals and initiatives: Understanding Live Nation's long-term strategic goals provides insights into potential future performance.

- Sustainable growth strategies and environmental considerations: Increased focus on sustainability and environmental responsibility can provide long-term advantages.

Conclusion

Investing in Live Nation Entertainment (LYV) offers significant potential returns, but also presents inherent risks. Understanding the company's business model, analyzing its stock performance, and considering various investment options are crucial for making informed decisions. By carefully weighing the potential rewards against the associated risks, and diversifying your portfolio accordingly, you can determine if Live Nation stock aligns with your investment goals. Conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions related to Live Nation Entertainment (LYV) or any other stock. Remember to always research before investing in Live Nation stock (LYV).

Featured Posts

-

Save Big On Nike Dunks Revolves Mega Sneaker Sale

May 29, 2025

Save Big On Nike Dunks Revolves Mega Sneaker Sale

May 29, 2025 -

Cafu Reveals His Real Madrid Mvp Mbappe And Vinicius Overlooked

May 29, 2025

Cafu Reveals His Real Madrid Mvp Mbappe And Vinicius Overlooked

May 29, 2025 -

Is Live Nation A Monopoly Examining The Wall Street Journals Concerns

May 29, 2025

Is Live Nation A Monopoly Examining The Wall Street Journals Concerns

May 29, 2025 -

Bayrn Mywnykh Ela Aetab Alteaqd Me Jwnathan Tah

May 29, 2025

Bayrn Mywnykh Ela Aetab Alteaqd Me Jwnathan Tah

May 29, 2025 -

Experts Issue First Ever Canadian Guidelines On Long Covid Management

May 29, 2025

Experts Issue First Ever Canadian Guidelines On Long Covid Management

May 29, 2025

Latest Posts

-

Is Sparks Mad Album Worth Listening To A Comprehensive Review

May 30, 2025

Is Sparks Mad Album Worth Listening To A Comprehensive Review

May 30, 2025 -

Sparks Mad Album Review Strengths Weaknesses And Overall Impression

May 30, 2025

Sparks Mad Album Review Strengths Weaknesses And Overall Impression

May 30, 2025 -

Sparks Mad A Critical Review Of Their Latest Album

May 30, 2025

Sparks Mad A Critical Review Of Their Latest Album

May 30, 2025 -

Deutsche Bank Depositary Receipts Virtual Investor Conference Live Webcasts On May 15 2025

May 30, 2025

Deutsche Bank Depositary Receipts Virtual Investor Conference Live Webcasts On May 15 2025

May 30, 2025 -

Epiroc Selects Deutsche Bank For Its Level 1 Adr Programs

May 30, 2025

Epiroc Selects Deutsche Bank For Its Level 1 Adr Programs

May 30, 2025