Live Nation Facing Increased Pressure: Will The Company Break Up?

Table of Contents

Mounting Antitrust Concerns and Regulatory Scrutiny

Live Nation's dominance in the live music industry is drawing increasing scrutiny from antitrust regulators worldwide. The company's vast network of venues, ticketing services (Ticketmaster), and artist management arms raises significant concerns about monopolistic practices and anti-competitive behavior. This scrutiny is fueled by several factors:

- Increased ticket prices and fees: Public outcry over exorbitant ticket prices and hidden fees has intensified, leading to increased regulatory pressure. Consumers are increasingly frustrated by the lack of transparency and the perceived exploitation by Live Nation.

- Allegations of monopolistic practices: Live Nation has faced allegations of using its market power to stifle competition, squeezing out smaller promoters and venues. These allegations include accusations of predatory pricing and exclusive contracts that limit artist choices.

- Ongoing lawsuits and investigations: Several government agencies are conducting ongoing investigations and lawsuits against Live Nation, focusing on anti-competitive behavior and potential violations of antitrust laws. The outcomes of these legal battles could significantly impact the company's future.

- Potential for fines and forced divestitures: If found guilty of antitrust violations, Live Nation could face substantial fines and be forced to divest certain business units, potentially leading to a restructuring or breakup of the company. This could involve separating Ticketmaster from its venue operations or other divisions.

- Comparison to past antitrust cases: The situation facing Live Nation echoes past antitrust cases involving major entertainment companies. Analyzing these precedents provides valuable insights into the potential outcomes and ramifications for Live Nation.

Financial Pressures and Economic Uncertainty

Beyond regulatory hurdles, Live Nation is also grappling with significant financial pressures stemming from the current economic climate. Inflation, rising interest rates, and a potential economic downturn are impacting the company's performance and future projections:

- Decreased consumer spending: Reduced disposable income is impacting ticket sales, forcing Live Nation to adjust its strategies and pricing models. The current economic uncertainty makes predicting future sales difficult and casts a shadow over the company's financial stability.

- Rising operational costs: Inflationary pressures are driving up operational costs across the board, from venue maintenance to artist fees, squeezing profit margins. This impacts Live Nation's ability to maintain profitability and invest in growth.

- Investor concerns: Investors are expressing concerns about Live Nation's long-term viability given the combination of regulatory challenges and economic headwinds. This uncertainty is reflected in the company's stock performance and access to capital.

- Debt levels and credit rating: Live Nation's debt levels and credit rating are under scrutiny. High levels of debt could increase vulnerability during economic downturns and further complicate the company’s financial situation.

- Reduced artist touring: Economic factors may also lead to reduced artist touring activity, impacting revenue streams for Live Nation. Artists may postpone or cancel tours if they perceive a decline in audience demand or profitability.

The Changing Landscape of the Music Industry

The music industry is undergoing a dramatic transformation, and Live Nation must adapt to survive. The rise of streaming services and other disruptions challenge the company's traditional business model:

- Competition from smaller promoters: Smaller, independent promoters and venues are emerging as viable alternatives, offering more personalized experiences and potentially lower prices. This increased competition threatens Live Nation's market share.

- Virtual and online concerts: The increasing popularity of virtual and online concerts provides consumers with alternative entertainment options, impacting the demand for in-person events. This shifts the landscape and requires Live Nation to integrate digital solutions effectively.

- Changes in artist contracts: Artists are negotiating more favorable contracts, seeking better revenue-sharing models and reducing their reliance on traditional promoters. This shift in power dynamics necessitates strategic adaptation from Live Nation.

- Need for innovation: Live Nation needs to innovate and adapt its offerings to remain competitive. This may involve investing in new technologies, diversifying its revenue streams, or creating more engaging experiences for audiences.

- Mergers and acquisitions: Live Nation might consider mergers or acquisitions to expand its reach, diversify its offerings, or neutralize emerging competitors. This proactive approach could strengthen its position in the changing market.

The Potential for a Live Nation Breakup

Given the confluence of antitrust concerns, financial pressures, and industry shifts, the possibility of a Live Nation breakup is a serious consideration. Several scenarios are possible:

- Divestiture of business units: Live Nation might divest specific business units, such as Ticketmaster, to appease regulators and reduce antitrust concerns. This would involve a significant restructuring of the company.

- Complete restructuring: A more drastic measure could involve a complete restructuring of the company, potentially separating its various divisions into independent entities. This would drastically alter the live music industry's landscape.

- Advantages and disadvantages: A breakup could offer benefits like increased competition and lower prices, but it could also lead to inefficiencies and disruption for artists and consumers.

- Likelihood of a breakup: The likelihood of a breakup hinges on the outcome of ongoing legal battles, the company's ability to adapt to market changes, and its overall financial performance.

- Precedent cases: Analyzing cases where large corporations have undergone similar restructurings provides a valuable framework for assessing the potential consequences of a Live Nation breakup.

Conclusion

Live Nation is undeniably facing significant challenges, including antitrust concerns, economic headwinds, and a rapidly changing music industry landscape. These pressures raise serious questions about the company's long-term viability and the potential for a breakup. While a complete split is not guaranteed, the company's future trajectory will depend heavily on its ability to adapt and address these critical issues.

Call to Action: Stay informed on the developments surrounding Live Nation's future. Keep following this space for updates on the ongoing pressure on Live Nation and the potential implications of a company breakup. Understanding the dynamics affecting Live Nation is crucial for anyone involved in or interested in the future of the live music industry.

Featured Posts

-

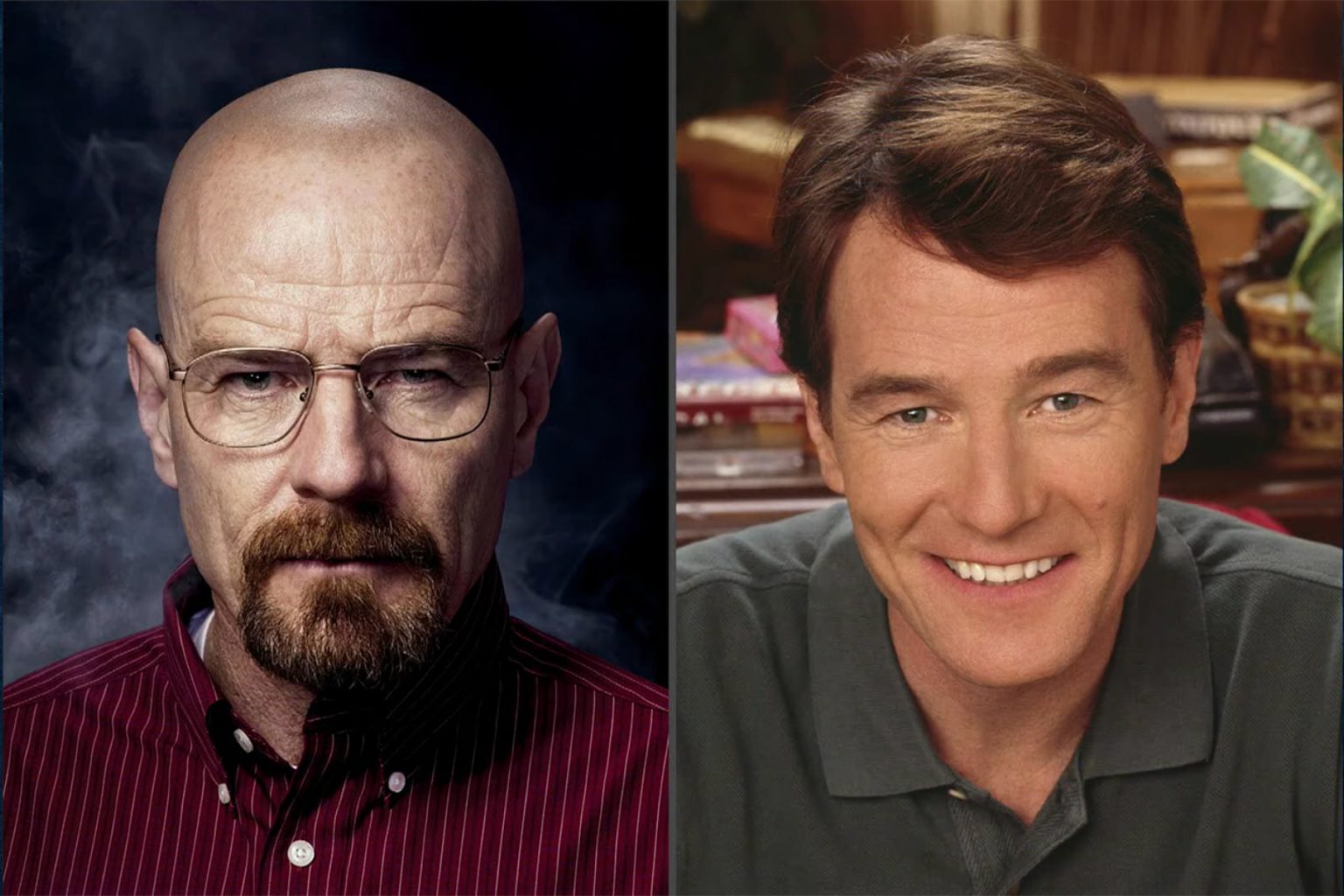

Bryan Cranston Net Worth 2025 How Much Has He Earned

May 29, 2025

Bryan Cranston Net Worth 2025 How Much Has He Earned

May 29, 2025 -

Lush Nyc 30 Minute Bubble Bath Experience For 75

May 29, 2025

Lush Nyc 30 Minute Bubble Bath Experience For 75

May 29, 2025 -

Live Nation Entertainment Lyv Investment Options And Market Analysis

May 29, 2025

Live Nation Entertainment Lyv Investment Options And Market Analysis

May 29, 2025 -

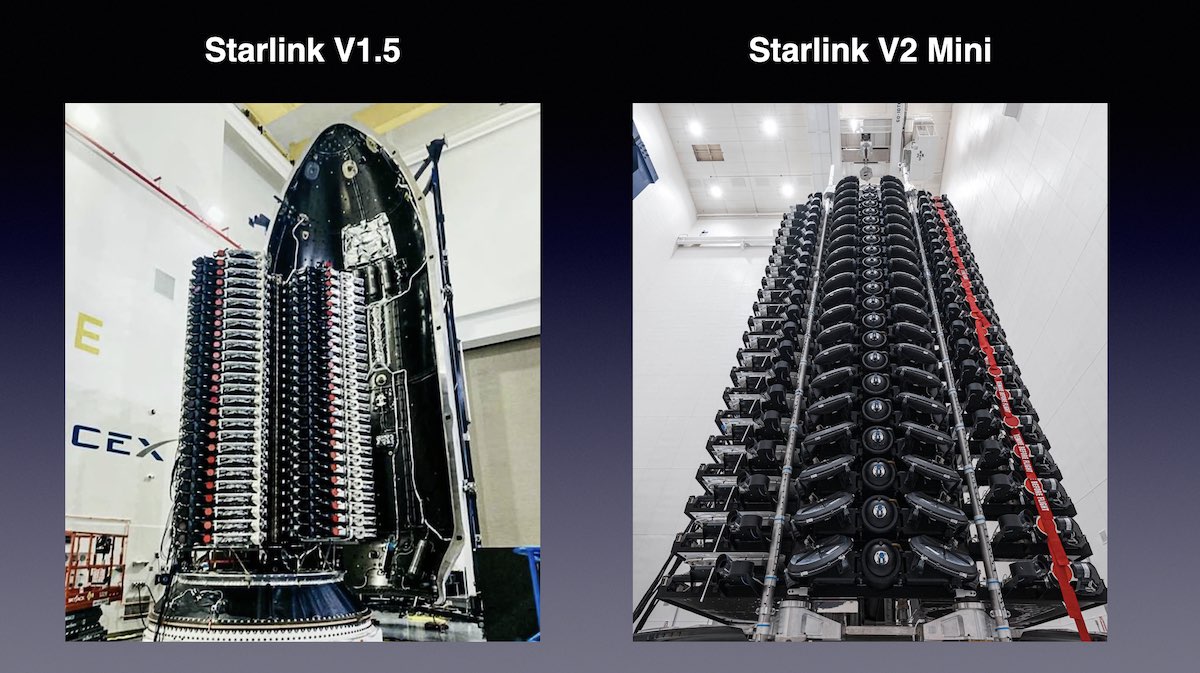

27 More Starlink Satellites In Orbit Space Xs Latest Falcon 9 Launch

May 29, 2025

27 More Starlink Satellites In Orbit Space Xs Latest Falcon 9 Launch

May 29, 2025 -

Resultats Financiers Du Premier Trimestre 2024 De Nrj Group Baisse De 6 9

May 29, 2025

Resultats Financiers Du Premier Trimestre 2024 De Nrj Group Baisse De 6 9

May 29, 2025

Latest Posts

-

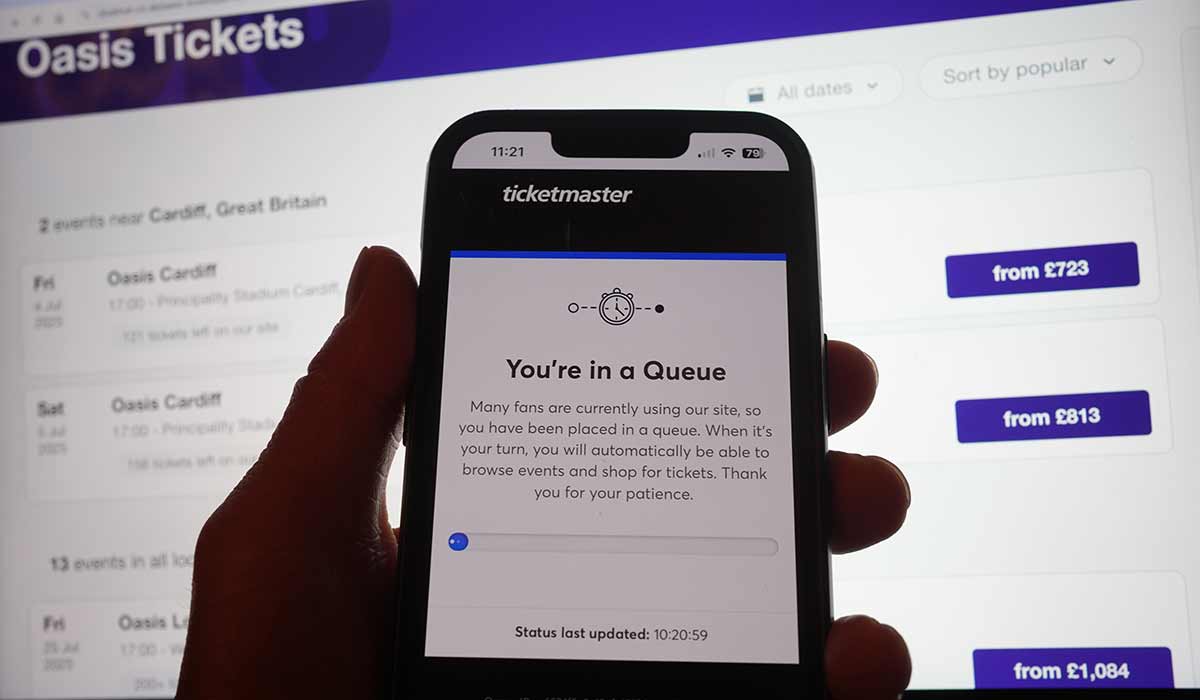

Ticketmasters Oasis Tour Ticket Sales A Consumer Protection Lawsuit Analysis

May 30, 2025

Ticketmasters Oasis Tour Ticket Sales A Consumer Protection Lawsuit Analysis

May 30, 2025 -

Protect Yourself Ticketmasters Warning On Counterfeit Tickets

May 30, 2025

Protect Yourself Ticketmasters Warning On Counterfeit Tickets

May 30, 2025 -

Virtual Venue De Ticketmaster Experiencia Inmersiva En La Compra De Boletos

May 30, 2025

Virtual Venue De Ticketmaster Experiencia Inmersiva En La Compra De Boletos

May 30, 2025 -

La Guerra De Trump Contra Ticketmaster Detalles De La Orden Ejecutiva Sobre La Reventa De Boletos

May 30, 2025

La Guerra De Trump Contra Ticketmaster Detalles De La Orden Ejecutiva Sobre La Reventa De Boletos

May 30, 2025 -

Oasis Tour Audit Did Ticketmaster Violate Consumer Protection Laws

May 30, 2025

Oasis Tour Audit Did Ticketmaster Violate Consumer Protection Laws

May 30, 2025