Los Angeles Wildfires: A Reflection Of Our Times Through Disaster Betting Markets

Table of Contents

H2: The Rise of Disaster Betting Markets and Their Predictive Power

H3: Understanding Predictive Markets

Predictive markets, also known as information markets or prediction markets, leverage the collective wisdom of crowds to forecast future events. Participants buy and sell contracts based on their belief in the likelihood of a specific outcome. The price of these contracts, fluctuating based on supply and demand, acts as a prediction of the event's probability. This concept, often referred to as the "wisdom of the crowds," suggests that aggregated predictions from a diverse group can be remarkably accurate, even surpassing the forecasts of experts.

- Disaster betting markets specifically focus on catastrophic events, including wildfires, hurricanes, earthquakes, and pandemics. They offer a unique tool for risk assessment, quantifying the perceived probability of disaster occurrence.

- While not always perfectly accurate, studies suggest that predictive markets often outperform traditional forecasting methods, particularly in scenarios with high uncertainty. This is because they incorporate diverse perspectives and adapt in real-time to new information.

- Successful predictions using disaster betting markets have been documented for events like elections and sporting events, highlighting their potential value in disaster preparedness.

- However, biases and limitations exist. Factors like market manipulation, limited participation, and the inherent difficulty in predicting complex events can influence the accuracy of predictions.

H2: Los Angeles Wildfires: A Case Study in Disaster Prediction and Risk Assessment

H3: Analyzing Wildfire Risk Through Betting Markets

Disaster betting markets, while not yet widely established for hyper-local wildfire predictions, offer a compelling framework for analyzing Los Angeles wildfire risk. By monitoring fluctuations in the odds of major wildfire events within the LA region (where such markets exist), we can potentially gain valuable insights.

- Data reflecting the odds of significant wildfire outbreaks in Los Angeles, as predicted by these markets, could reveal trends correlated with environmental factors. (Further research is needed to acquire and present such data).

- The relationship between odds and factors like prolonged drought conditions (measured by the Palmer Drought Severity Index), the prevalence of Santa Ana winds, and the expansion of urban sprawl into wildfire-prone areas needs rigorous analysis.

- These markets may reflect public perception of wildfire risk, providing valuable data for informing public awareness campaigns and emergency preparedness initiatives.

H2: The Socioeconomic Impact of Wildfires and Disaster Betting Markets

H3: Insurance Implications and Market Volatility

The escalating risk of Los Angeles wildfires significantly impacts the insurance industry and related markets. This impact is both direct (through increased claims) and indirect (through higher premiums and market volatility).

- Wildfires lead to substantial property damage, driving up insurance premiums and impacting property values, particularly in high-risk areas.

- Disaster betting markets can potentially inform insurance pricing strategies by providing an alternative assessment of risk, helping to refine actuarial models and improve risk management.

- These markets could potentially influence government policy related to disaster preparedness, mitigation strategies, and the allocation of resources for wildfire prevention.

H2: Climate Change and the Future of Los Angeles Wildfires: A Betting Market Perspective

H3: Forecasting Future Wildfire Risk

Climate change projections paint a concerning picture for Los Angeles. Rising temperatures, altered precipitation patterns, and increased drought frequency are all exacerbating wildfire risk.

- Climate change is a significant driver of increased wildfire intensity and frequency, and this is likely to be reflected in future disaster betting market odds.

- Changes in temperature, precipitation, and vegetation patterns, as predicted by climate models, can be incorporated into predictive market analyses to forecast the likelihood of future wildfires in Los Angeles.

- These forecasts can inform long-term planning efforts, including improved land management practices, building codes, and community wildfire preparedness initiatives.

3. Conclusion

Analyzing disaster betting markets offers a unique and potentially valuable perspective on the increasing threat of Los Angeles wildfires. While limitations exist, these markets can reflect the collective wisdom of the crowd, incorporate a wide range of information, and potentially foreshadow future risks. By studying the fluctuations in these markets and correlating them with environmental and socioeconomic factors, we can gain a deeper understanding of the complex interplay of forces driving the escalation of wildfire risk in Los Angeles. Further research into the utilization of these markets, alongside traditional forecasting methods, is crucial for improving our preparedness and mitigation strategies concerning Los Angeles wildfire risk. Understanding Los Angeles wildfire risk necessitates a multifaceted approach, and the insights offered by disaster betting markets represent a significant, albeit nascent, component of that effort.

Featured Posts

-

Review Kawasaki Versys X 250 2025 Warna Baru Performa Tangguh

May 30, 2025

Review Kawasaki Versys X 250 2025 Warna Baru Performa Tangguh

May 30, 2025 -

Como Obtener Tu Reembolso Por La Cancelacion Del Festival Axe Ceremonia 2025 En Ticketmaster

May 30, 2025

Como Obtener Tu Reembolso Por La Cancelacion Del Festival Axe Ceremonia 2025 En Ticketmaster

May 30, 2025 -

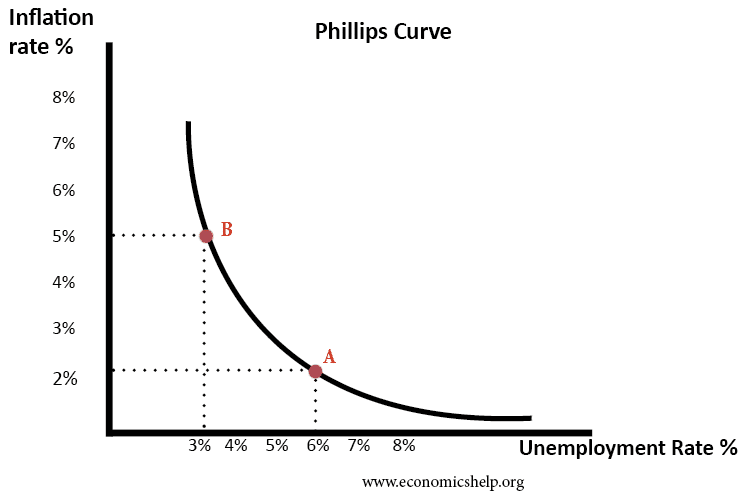

Higher Inflation And Unemployment Fueling Economic Uncertainty

May 30, 2025

Higher Inflation And Unemployment Fueling Economic Uncertainty

May 30, 2025 -

From Page To Screen Gisele Pelicots Account Of Rape To Become Hbo Series

May 30, 2025

From Page To Screen Gisele Pelicots Account Of Rape To Become Hbo Series

May 30, 2025 -

Philippe Caveriviere Et Philippe Tabarot S Affrontent Replay Video Du 24 Avril 2025

May 30, 2025

Philippe Caveriviere Et Philippe Tabarot S Affrontent Replay Video Du 24 Avril 2025

May 30, 2025