LVMH's Q1 Performance: A Detailed Analysis Of The 8.2% Share Drop

Table of Contents

Declining Sales Growth in Key Markets

The slowdown in key markets significantly impacted LVMH's Q1 2024 results. This section analyzes the weakening demand in China and Europe, exploring the contributing factors and their effects on specific product categories.

Weakening Demand in China

China, a crucial market for luxury goods, witnessed a considerable slowdown in consumer spending, directly impacting LVMH's sales figures.

- Specific Product Categories Affected: The decline was particularly noticeable in fashion and leather goods, with slightly less pronounced effects on the wines and spirits division. High-end jewelry also showed signs of softening demand.

- Geopolitical Factors and Economic Uncertainties: Lingering effects of the pandemic, coupled with ongoing geopolitical tensions and a slower-than-expected economic recovery, created uncertainty among Chinese consumers, leading to reduced spending on luxury items.

- Performance Comparison: Comparing Q1 2024 to Q1 2023 reveals a significant drop in revenue from the Chinese market, representing a substantial deviation from the growth trajectory observed in previous years. This signals a potentially longer-term trend requiring careful attention.

Europe and US Market Slowdown

Inflationary pressures and concerns about a potential recession in Europe and the US also contributed to the decline in LVMH's Q1 performance.

- Sales Figures in Europe and the US: While less dramatic than the decline in China, both the European and US markets exhibited slower-than-expected sales growth, reflecting a broader trend of reduced consumer spending on discretionary items.

- Performance of Different Brands: The impact varied across different LVMH brands. Some brands catering to a more price-sensitive consumer segment experienced a steeper decline than others positioned at the ultra-high end of the market.

- Shifts in Consumer Preferences: Consumers are becoming increasingly discerning, favoring brands demonstrating sustainability and social responsibility, potentially influencing purchasing decisions within the LVMH portfolio.

Impact of Supply Chain Disruptions and Rising Costs

The ongoing impact of global supply chain disruptions and the increase in raw material costs further squeezed LVMH's profitability in Q1 2024.

Raw Material Price Increases

Significant increases in the cost of raw materials, such as leather, precious metals, and certain fabrics, directly impacted LVMH's profit margins.

- Examples of Rising Raw Material Costs: The price of high-quality leather, crucial for many LVMH brands, increased significantly, impacting production costs. Similar increases were observed in the cost of precious metals used in jewelry and other luxury items.

- Cost Mitigation Strategies: LVMH is actively exploring strategies to mitigate these cost increases, including negotiating with suppliers, optimizing production processes, and potentially adjusting pricing strategies.

Logistics and Production Challenges

Persistent supply chain bottlenecks and logistical challenges hampered production and timely delivery of goods, further affecting sales and profitability.

- Impact on Sales and Profitability: Delays in receiving raw materials and delivering finished products directly impacted sales volume and contributed to decreased overall profitability for the quarter.

- Supply Chain Resilience Strategies: LVMH is investing in strengthening its supply chain resilience, exploring alternative sourcing options, and diversifying its logistics networks to minimize future disruptions.

Currency Fluctuations and Their Influence

Unfavorable exchange rates played a significant role in impacting LVMH's reported earnings for Q1 2024.

Euro vs. Dollar

Fluctuations between the Euro and the US dollar created headwinds for LVMH, negatively impacting the translation of international sales into reported earnings. A stronger dollar relative to the Euro reduced the value of sales generated in Europe when converted to the company's reporting currency.

Other Currency Impacts

Fluctuations in other relevant currencies, such as the Chinese Yuan and the British Pound, also contributed to the complexity of LVMH's financial reporting and negatively impacted profitability. The volatility in global currency markets presented an additional challenge to accurate financial forecasting.

Investor Sentiment and Market Reaction

The market's reaction to LVMH's Q1 results reflects significant investor concerns.

Analyst Ratings and Forecasts

Following the release of the Q1 report, several leading financial analysts downgraded their ratings for LVMH stock, reflecting concerns about the company's future performance and the sustainability of its growth trajectory. Forecasts for future quarters were also revised downwards.

Stock Price Volatility

LVMH's share price experienced considerable volatility in the period following the release of the Q1 report, with the 8.2% drop highlighting the market's negative response to the weaker-than-expected results. This volatility reflects the uncertainty surrounding the company's short-term prospects and the overall luxury goods market.

Conclusion

LVMH's Q1 2024 performance was significantly impacted by a confluence of factors including weakening demand in key markets like China and the US, rising costs, and unfavorable currency fluctuations. The resulting 8.2% share price drop underscores the challenges faced by even the most established luxury brands in a volatile global economic environment. While the outlook for the luxury sector remains uncertain, LVMH's strong brand portfolio and established market position position it for potential recovery in subsequent quarters. Effective management of supply chain vulnerabilities, adaptation to changing consumer preferences, and successful navigation of global economic headwinds will be crucial for LVMH's future performance. Stay tuned for further analysis of LVMH's Q2 performance and the ongoing evolution of the luxury market.

Featured Posts

-

Macron Faces Criticism From Former French Prime Minister

May 24, 2025

Macron Faces Criticism From Former French Prime Minister

May 24, 2025 -

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 24, 2025

Find Housing Finance Solutions And Family Fun At The Iam Expat Fair

May 24, 2025 -

Hot Wheels Ferrari New Releases Have Arrived Mamma Mia

May 24, 2025

Hot Wheels Ferrari New Releases Have Arrived Mamma Mia

May 24, 2025 -

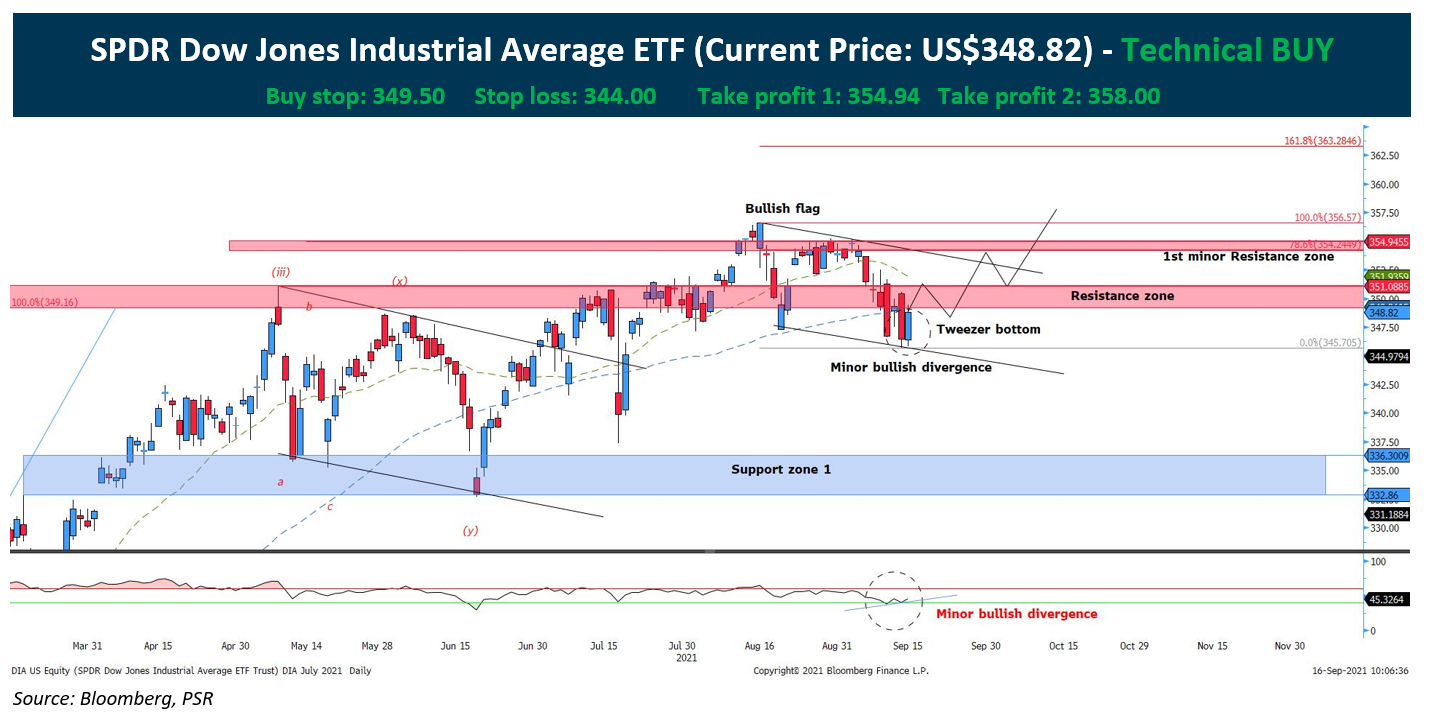

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Calculation And Implications

May 24, 2025 -

The Importance Of Green Spaces Lessons From A Seattle Womans Pandemic Experience

May 24, 2025

The Importance Of Green Spaces Lessons From A Seattle Womans Pandemic Experience

May 24, 2025

Latest Posts

-

Experience Local And Global Travel The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025

Experience Local And Global Travel The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 24, 2025 -

New Ae Xplore Campaign Boosts Travel From England Airpark And Alexandria International Airport

May 24, 2025

New Ae Xplore Campaign Boosts Travel From England Airpark And Alexandria International Airport

May 24, 2025 -

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025

England Airpark And Alexandria International Airports New Ae Xplore Campaign Fly Local Explore The World

May 24, 2025 -

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025

Ae Xplore Campaign Takes Off Connecting Local Communities Through England Airpark And Alexandria International Airport

May 24, 2025 -

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 24, 2025

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 24, 2025