Amundi Dow Jones Industrial Average UCITS ETF: NAV Calculation And Implications

Table of Contents

Understanding Net Asset Value (NAV) in ETFs

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. It's a crucial figure because it reflects the true worth of the ETF's holdings. The calculation is straightforward: Total Assets - Total Liabilities = NAV. This means that the NAV represents the net value of the ETF after deducting all liabilities from its total assets.

For index-tracking ETFs like the Amundi Dow Jones Industrial Average UCITS ETF, the NAV calculation is particularly significant. It directly reflects the collective value of the ETF's holdings, which mirror the components of the Dow Jones Industrial Average. The ETF manager aims to maintain a portfolio that closely tracks the index's composition.

- NAV reflects the underlying asset value of the ETF. This ensures transparency for investors.

- Daily NAV calculation ensures transparency and fair pricing. The daily calculation provides an up-to-date valuation.

- NAV is crucial for determining ETF share price. While the market price may fluctuate, the NAV provides a benchmark.

- Differences between NAV and market price can indicate arbitrage opportunities. If the market price significantly deviates from the NAV, savvy investors might exploit these discrepancies.

The Amundi Dow Jones Industrial Average UCITS ETF: A Deep Dive into NAV Calculation

The Amundi Dow Jones Industrial Average UCITS ETF's NAV calculation follows a standard methodology for index-tracking ETFs. The ETF's holdings directly reflect the 30 constituent companies of the Dow Jones Industrial Average. The value of each holding is weighted according to its proportion within the index.

The calculation considers several factors:

- Breakdown of asset classes within the ETF and their weighting. The ETF primarily holds equities of the Dow Jones 30 companies.

- Impact of dividend payouts on NAV. Dividends received by the ETF increase its total assets and, consequently, the NAV.

- How corporate actions (e.g., stock splits, mergers) affect NAV. These events necessitate adjustments to the ETF's holdings and influence the NAV calculation.

- Frequency of NAV calculation and publication. The NAV is typically calculated and published daily, ensuring up-to-date information for investors.

- Role of currency exchange rates. If the ETF holds assets denominated in currencies other than the base currency of the ETF, exchange rate fluctuations will impact the NAV.

- Impact of fees and expenses on NAV. Management fees and other expenses reduce the overall asset value and thus, the NAV.

Factors Influencing NAV Fluctuations

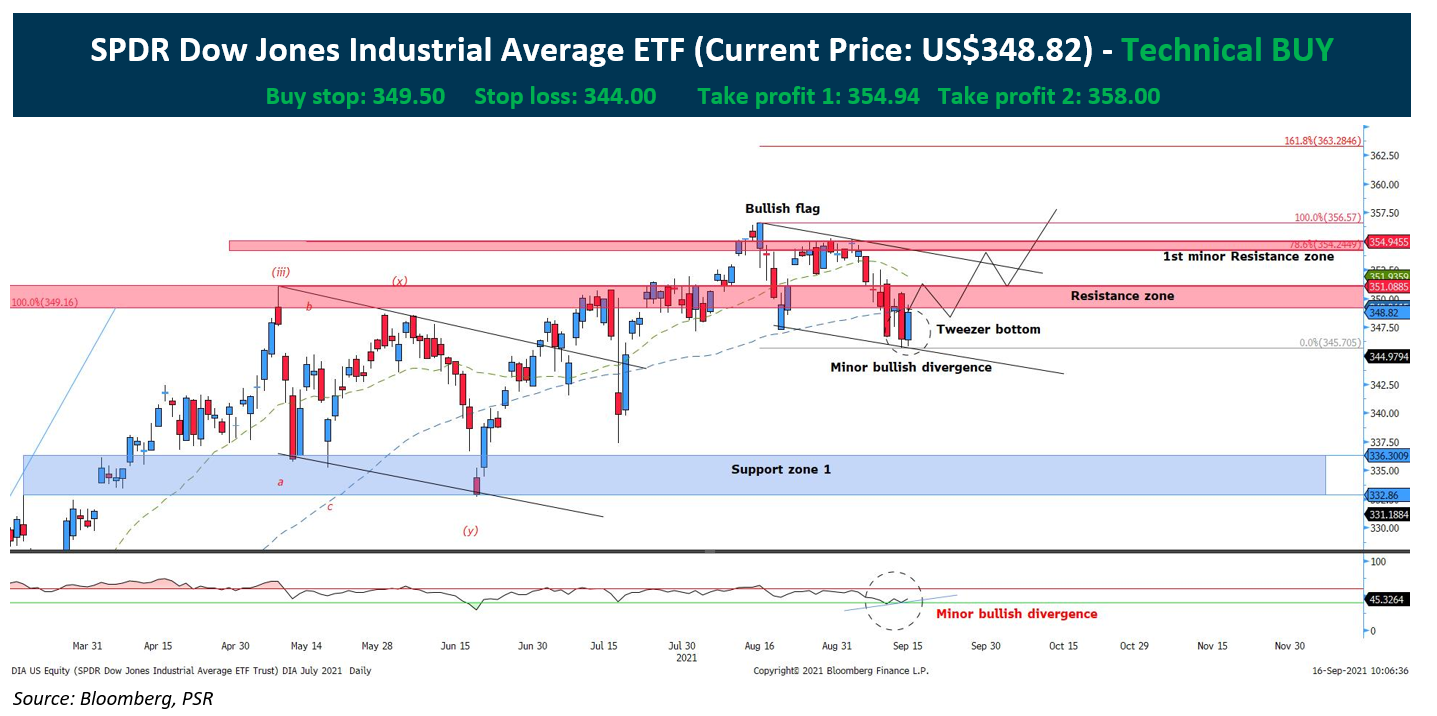

The primary driver of NAV fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF is the performance of the Dow Jones Industrial Average itself. However, other factors play a role:

- Correlation between Dow Jones performance and ETF NAV. A positive correlation exists; a rise in the Dow Jones typically leads to an increase in the ETF's NAV.

- Sensitivity analysis: How changes in the market impact the NAV. A significant market downturn will likely lead to a decrease in the ETF's NAV.

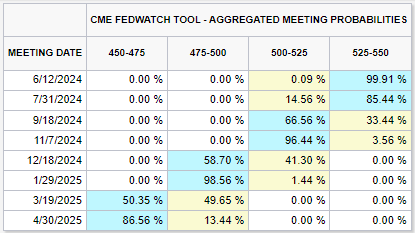

- Importance of monitoring market trends to predict NAV changes. Staying informed about economic indicators, geopolitical events, and industry trends can help investors anticipate NAV fluctuations. Interest rate changes and economic indicators can also impact the overall market and therefore influence the NAV.

Implications of NAV for Amundi Dow Jones Industrial Average UCITS ETF Investors

Understanding the NAV is critical for several reasons:

- Using NAV to track investment returns. By comparing the initial NAV with the current NAV, investors can assess their returns.

- Comparing NAV performance against benchmarks. Comparing the ETF's NAV performance against the Dow Jones Industrial Average itself helps evaluate tracking efficiency.

- Assessing the cost-effectiveness of the ETF based on NAV changes. By comparing NAV performance against fees, investors can gauge the ETF's value.

- NAV's role in tax implications. Changes in NAV can have tax implications, especially concerning capital gains or losses. This should be considered as part of a wider investment and tax strategy.

Conclusion

Understanding the Net Asset Value (NAV) calculation of the Amundi Dow Jones Industrial Average UCITS ETF is essential for making informed investment decisions. By analyzing the factors influencing its NAV and its implications for performance evaluation, investors can better manage their portfolios and maximize returns. Regularly monitoring the NAV, alongside market trends, will help you make strategic buy and sell decisions regarding your investment in the Amundi Dow Jones Industrial Average UCITS ETF or similar index-tracking ETFs. Learn more about efficient ETF investing and the importance of understanding the Amundi Dow Jones Industrial Average UCITS ETF's NAV calculation today!

Featured Posts

-

Classifica Forbes 2025 I 10 Uomini Piu Ricchi Del Mondo

May 24, 2025

Classifica Forbes 2025 I 10 Uomini Piu Ricchi Del Mondo

May 24, 2025 -

Major Crash Closes Road One Person Hospitalized

May 24, 2025

Major Crash Closes Road One Person Hospitalized

May 24, 2025 -

Dow Jones Rallies On Positive Pmi Maintaining Cautious Upward Trend

May 24, 2025

Dow Jones Rallies On Positive Pmi Maintaining Cautious Upward Trend

May 24, 2025 -

Escape To The Country Financing Your Rural Property Purchase

May 24, 2025

Escape To The Country Financing Your Rural Property Purchase

May 24, 2025 -

Brezhnev Ryazanov I Garazh Istoriya Mesti Myagkovu I Tsenzury

May 24, 2025

Brezhnev Ryazanov I Garazh Istoriya Mesti Myagkovu I Tsenzury

May 24, 2025

Latest Posts

-

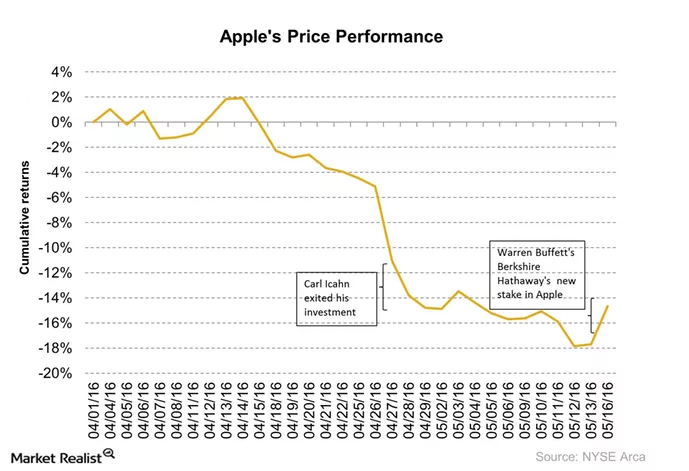

The Future Of Berkshire Hathaways Apple Investment Under New Leadership

May 24, 2025

The Future Of Berkshire Hathaways Apple Investment Under New Leadership

May 24, 2025 -

Berkshire Hathaways Apple Stock Assessing The Impact Of Buffetts Succession

May 24, 2025

Berkshire Hathaways Apple Stock Assessing The Impact Of Buffetts Succession

May 24, 2025 -

Analyzing Berkshire Hathaways Apple Holdings Post Buffett Ceo Transition

May 24, 2025

Analyzing Berkshire Hathaways Apple Holdings Post Buffett Ceo Transition

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Retirement

May 24, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Retirement

May 24, 2025