Maximize Dividend Income: A Simple, High-Profit Strategy

Table of Contents

Selecting High-Yield Dividend Stocks

Choosing the right stocks is crucial for maximizing your dividend income. This involves understanding dividend yield, analyzing dividend sustainability, and employing effective diversification strategies.

Understanding Dividend Yield

- Dividend yield represents the annual dividend per share, relative to the stock's current market price. It's expressed as a percentage and is a key metric for comparing dividend-paying stocks.

- Yield vs. Payout Ratio: While yield shows how much you receive annually, the payout ratio indicates the percentage of a company's earnings paid out as dividends. A high yield combined with a sustainable payout ratio (generally under 60%) is ideal.

- Calculating Dividend Yield: Dividend Yield = (Annual Dividend per Share / Stock Price) x 100

For example, a stock with a $2 annual dividend and a $50 price has a 4% yield ($2/$50 * 100). Resources like Yahoo Finance, Google Finance, and dedicated stock screeners provide this data. Many high-yield dividend stocks can be found using these tools. Look for sectors known for consistent dividends, such as utilities, consumer staples, and real estate investment trusts (REITs).

Analyzing Dividend Sustainability

Before investing, thoroughly assess a company's financial health to ensure its dividend payments are sustainable.

- Key Financial Ratios: Analyze the payout ratio (dividends paid as a percentage of earnings), debt-to-equity ratio (measuring financial leverage), and free cash flow (cash available for dividends after operating expenses).

- Consistent Dividend Growth History: A company's track record of consistently increasing its dividends signals financial strength and commitment to shareholder returns. Avoid companies with erratic or rapidly declining dividend payments.

Chasing exceptionally high yields without considering sustainability is risky. A company might cut or suspend its dividend if it faces financial difficulties, leading to significant losses.

Diversification for Risk Management

Diversifying your dividend portfolio across various sectors and companies significantly reduces risk.

- Benefits of Diversification: Diversification minimizes the impact of poor performance in one sector or company on your overall portfolio. It also potentially increases your overall returns by exposing you to different growth opportunities.

- Diversification Strategies: Consider diversifying across sectors (e.g., technology, healthcare, financials), geographies (domestic vs. international), and market capitalizations (large-cap, mid-cap, small-cap).

For example, don't invest all your money in just one sector. A diversified portfolio might include technology, consumer goods, and healthcare companies to mitigate risk.

Reinvesting Dividends for Compounding Growth

Reinvesting dividends is crucial for accelerating wealth accumulation through the power of compounding.

The Power of Dividend Reinvestment Plans (DRIPs)

DRIPs, or Dividend Reinvestment Plans, automate the reinvestment of dividends to purchase additional shares.

- How DRIPs Work: When a company offers a DRIP, your dividends are automatically used to buy more shares of that company's stock. This eliminates brokerage fees associated with manual reinvestment.

- Benefits of Compounding: Compounding allows your returns to generate even more returns over time. Reinvesting dividends increases your ownership, resulting in higher future dividend payments.

Many large companies offer DRIPs; check with the company's investor relations department for details. There might be minimal administrative fees, but the tax implications are generally the same as if you received the dividends directly.

Strategic Dividend Reinvestment

Strategic reinvestment maximizes long-term growth.

- When to Reinvest: Generally, reinvesting during market corrections or dips can be advantageous, allowing you to purchase more shares at lower prices.

- Alternative Strategies: Consider using dividends for debt repayment or other financial goals if you have high-interest debt. Prioritize eliminating high-interest debt before aggressive reinvestment.

For example, if the market experiences a downturn, reinvesting your dividends can significantly boost your long-term returns.

Tax-Efficient Strategies for Dividend Income

Understanding and minimizing the tax impact of your dividend income is crucial for maximizing your after-tax returns.

Understanding Tax Implications

Dividend income is taxed, but the tax rate depends on the type of dividend and your tax bracket.

- Qualified vs. Non-Qualified Dividends: Qualified dividends, generally from established companies, are taxed at lower rates than non-qualified dividends.

- Tax Brackets and Rates: Your tax bracket determines your specific tax rate on dividend income. Tax-advantaged accounts can significantly reduce your overall tax liability.

Consult a tax professional for personalized advice.

Tax-Loss Harvesting

Tax-loss harvesting is a strategy to offset capital gains with capital losses, reducing your overall tax liability.

- How Tax-Loss Harvesting Works: Selling investments that have lost value generates a capital loss that can offset capital gains from other investments. This can reduce your taxable income.

- Example: If you have capital gains of $5,000 and capital losses of $3,000, your taxable capital gains are reduced to $2,000.

Tax-loss harvesting requires careful planning and should ideally be done with the guidance of a financial advisor.

Conclusion

Maximizing dividend income requires a strategic approach encompassing the selection of high-yield, sustainable dividend stocks, consistent dividend reinvestment, and tax-efficient strategies. By carefully selecting companies with a history of consistent dividend increases, utilizing DRIPs for compounding, and employing tax-efficient strategies, you can significantly increase your passive income. Start maximizing your dividend income today! Implement these simple, high-profit strategies to build a strong and sustainable passive income stream. [Link to a dividend stock screener or relevant resource].

Featured Posts

-

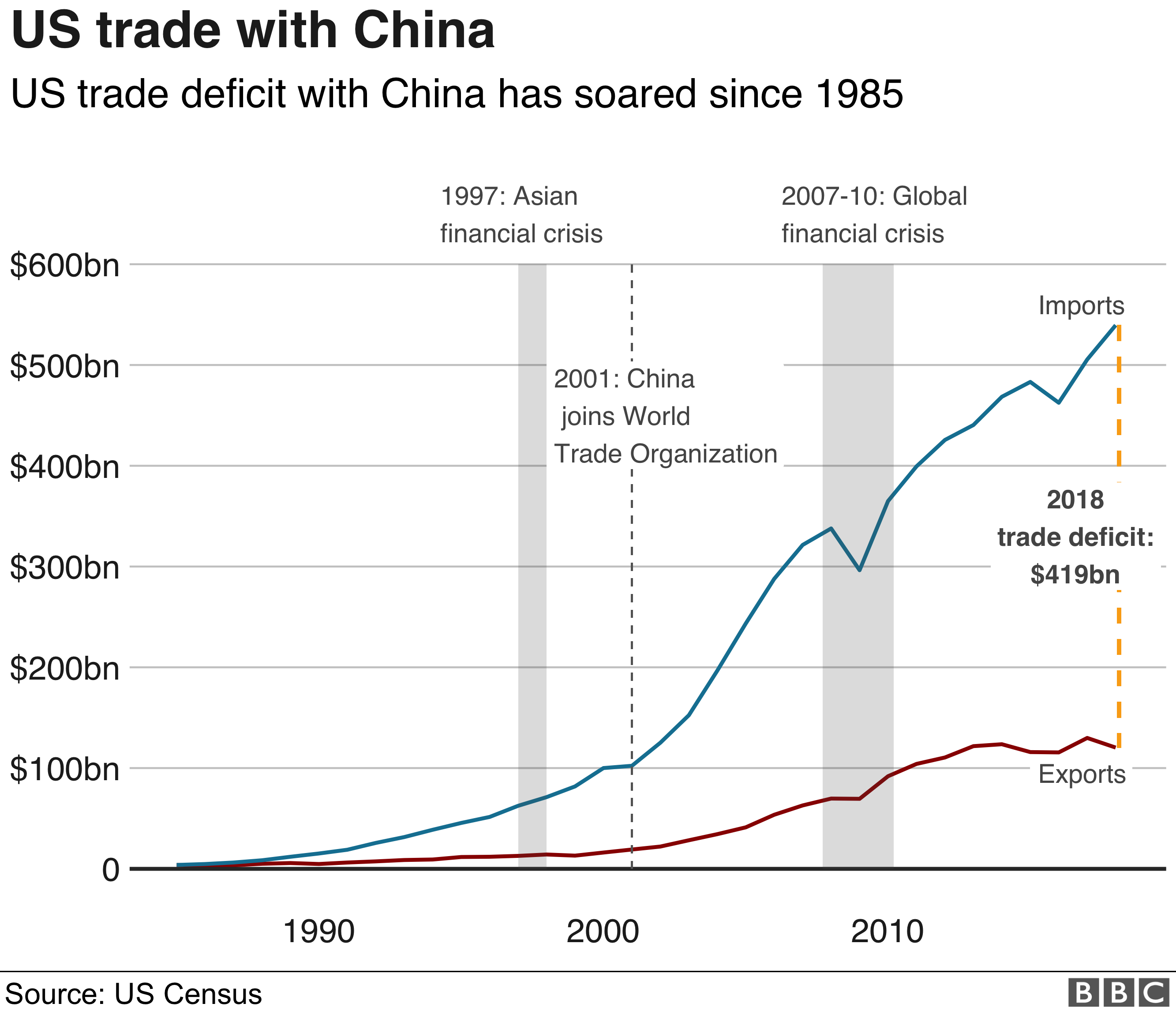

Us China Trade War 80 Tariff Impact On Stock Market Today

May 11, 2025

Us China Trade War 80 Tariff Impact On Stock Market Today

May 11, 2025 -

Schandaal Prins Andrew Verjaardagskaarten Spionage En Geheime Ontmoetingen

May 11, 2025

Schandaal Prins Andrew Verjaardagskaarten Spionage En Geheime Ontmoetingen

May 11, 2025 -

Us Debt Ceiling August Deadline Looms Warns Treasury Official

May 11, 2025

Us Debt Ceiling August Deadline Looms Warns Treasury Official

May 11, 2025 -

Tom Cruises Unique Gesture After Suri Cruises Birth

May 11, 2025

Tom Cruises Unique Gesture After Suri Cruises Birth

May 11, 2025 -

Investing In Growth A Guide To The Countrys Best Business Locations

May 11, 2025

Investing In Growth A Guide To The Countrys Best Business Locations

May 11, 2025