May 16th Oil Market: A Comprehensive Analysis

Table of Contents

Oil Price Movements on May 16th

The May 16th oil market witnessed considerable price fluctuations across benchmark crude oils. Both Brent crude and West Texas Intermediate (WTI) experienced a rollercoaster ride throughout the trading day. Analyzing the "May 16th oil prices" requires a granular look at intraday movements.

- Brent Crude: Opened at $75.50 per barrel, reaching a high of $77.20 before experiencing a moderate dip to $76.00 by midday. A late surge pushed the closing price to $76.80.

- WTI Crude: Commenced trading at $72.00 per barrel. It mirrored Brent's volatility, peaking at $73.50 before settling at $73.20 at the close.

Significant Price Changes:

- 10:00 AM: A sharp increase in Brent crude was observed, attributed to early reports of potential OPEC+ production cuts. This contributed significantly to the "May 16th oil price volatility."

- 2:00 PM: A slight dip in WTI crude followed a news report indicating unexpectedly high US oil inventories.

[Insert chart/graph visualizing Brent and WTI price movements throughout May 16th]. The visualization will clearly showcase the "May 16th oil prices" and their volatility. Keywords used: May 16th oil prices, Brent crude price, WTI crude price, oil price volatility.

Supply and Demand Factors Influencing the May 16th Oil Market

The "May 16th oil market" dynamics were heavily influenced by a complex interplay of supply and demand factors. Global oil supply on May 16th was somewhat constrained due to ongoing sanctions on certain oil-producing nations. OPEC+ production levels were a significant consideration, with rumors of potential output adjustments circulating throughout the day.

- OPEC+ Influence: Speculation regarding potential production cuts by OPEC+ significantly impacted the "oil supply" narrative and subsequently, prices. The uncertainty surrounding their decision fueled considerable price volatility.

- Global Oil Demand: Global oil consumption remained relatively robust, despite concerns about slowing economic growth in certain regions. The interplay between "oil demand" and potential supply restrictions shaped the market's trajectory.

- Sanctions Impact: Existing sanctions on several oil-producing countries continued to exert pressure on the overall "oil production" capacity, creating a tighter supply situation and supporting higher prices.

Keywords used: Oil supply, oil demand, OPEC+, oil production, global oil consumption.

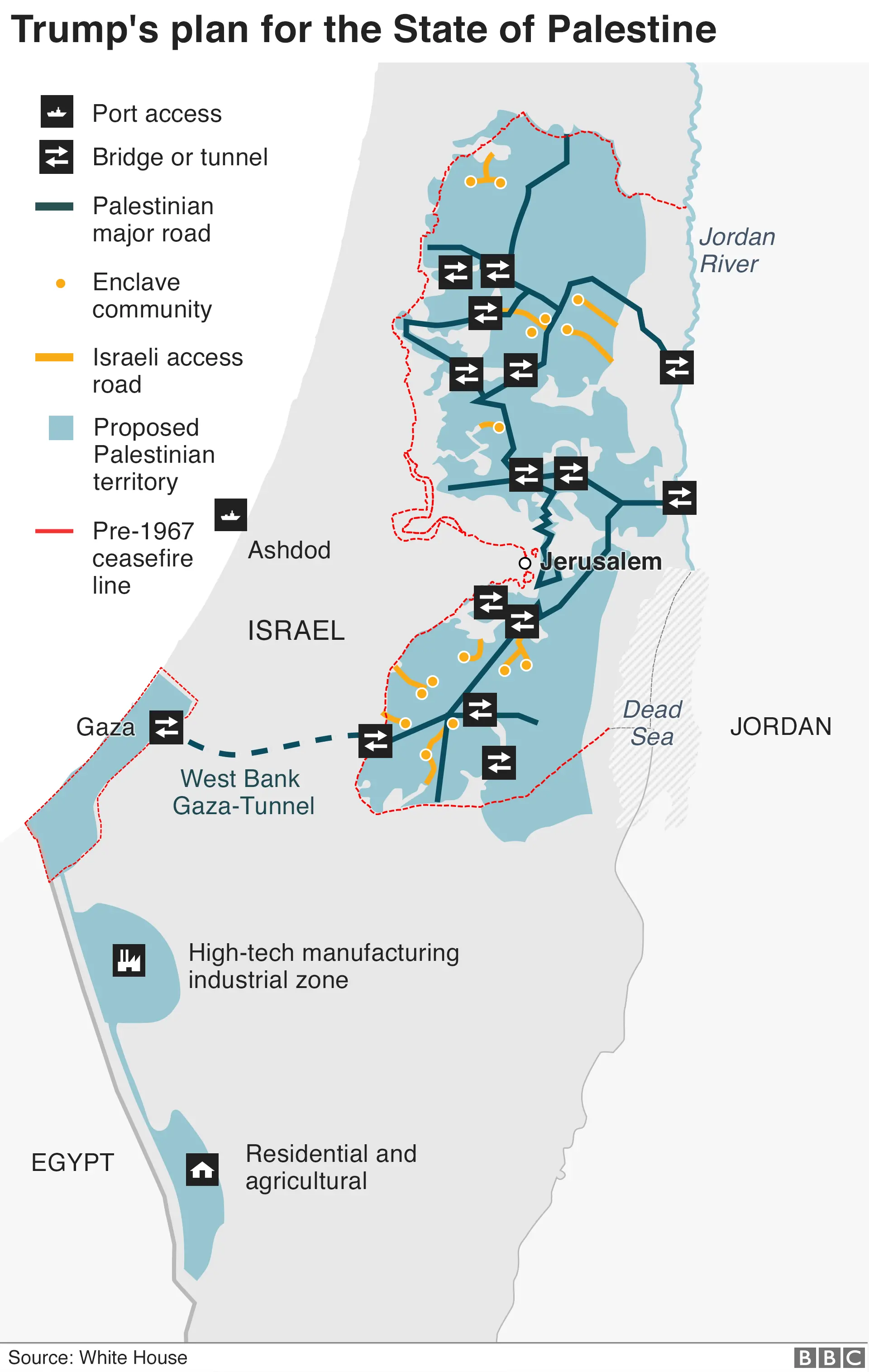

Geopolitical Impacts on the May 16th Oil Market

Geopolitical events played a crucial role in shaping the "May 16th oil market." Tensions in several oil-producing regions contributed to uncertainty and volatility. The potential for supply disruptions due to ongoing geopolitical instability exerted upward pressure on prices.

- Geopolitical Uncertainty: Concerns surrounding escalating tensions in [mention specific region] amplified "geopolitical risk" perceptions, influencing investor sentiment and leading to price increases.

- Supply Chain Disruptions: The potential for disruptions to global "global oil supply chain" due to geopolitical instability added to the market's nervousness, boosting prices as a precautionary measure.

Keywords used: Geopolitical risk, oil market volatility, sanctions, global oil supply chain.

Impact of Specific Geopolitical Events (if applicable)

[If a specific major geopolitical event occurred on May 16th, this section should provide a detailed analysis of its impact on the oil market. For example: The announcement of new sanctions on Country X led to an immediate 2% increase in Brent crude prices, reflecting the market's concerns about potential supply disruptions. The "oil price reaction" was swift and sharp, indicating high sensitivity to geopolitical developments.] Keywords used: (Specific event name), oil price reaction, market sentiment.

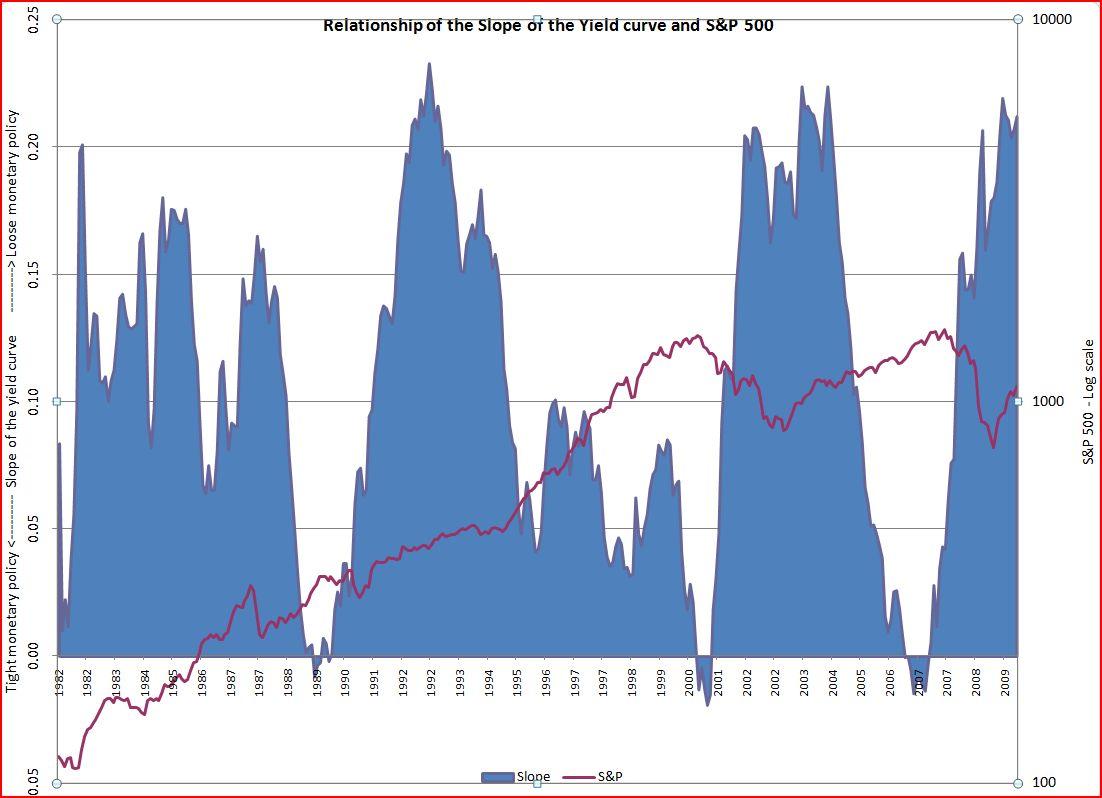

Economic Indicators and Their Influence

Several key economic indicators released around May 16th impacted investor sentiment and consequently, the "oil market forecast." While correlation isn't always direct, these indicators provide valuable context.

- Inflation Data: The release of inflation data from [mention country/region] influenced investor expectations regarding future interest rate hikes. Higher inflation often leads to concerns about slowing economic growth, which can impact "oil demand" and, therefore, prices.

- GDP Growth: GDP growth figures from major economies also played a role. Stronger-than-expected growth can boost oil demand, while weaker growth can dampen it. The correlation between "economic indicators" and oil price movements is often indirect but significant.

Keywords used: Economic indicators, oil market forecast, investor sentiment, inflation, GDP.

Conclusion: Recap and Future Outlook for the Oil Market Following May 16th

The "May 16th oil market" was characterized by significant price volatility driven by a complex interplay of factors. Supply concerns stemming from geopolitical tensions and potential OPEC+ production adjustments, coupled with relatively robust demand, contributed to higher prices. Economic indicators, while not directly correlated, added to the overall market sentiment.

Looking ahead, the outlook for oil prices remains uncertain. The potential for further geopolitical developments and the decisions of OPEC+ will play crucial roles in shaping the short-term trajectory of the oil market. Long-term trends will depend on the pace of global economic growth and the transition to cleaner energy sources.

Stay tuned for our next analysis of the oil market, providing further insights into the ever-evolving dynamics of this critical commodity. Follow us for daily updates on oil prices and learn more about how to interpret the daily oil market with our resources.

Featured Posts

-

Donald Trumps Middle East Policy The May 15 2025 Trip In Context

May 17, 2025

Donald Trumps Middle East Policy The May 15 2025 Trip In Context

May 17, 2025 -

Japans Steep Yield Curve A Growing Concern For Investors And The Economy

May 17, 2025

Japans Steep Yield Curve A Growing Concern For Investors And The Economy

May 17, 2025 -

Exclusive Donor Access A Look At Vip Experiences At Trumps Military Events

May 17, 2025

Exclusive Donor Access A Look At Vip Experiences At Trumps Military Events

May 17, 2025 -

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025

Honda Production Shift Us Tariffs And Canadian Export Opportunities

May 17, 2025 -

How To Find Affordable Products Without Compromising Quality

May 17, 2025

How To Find Affordable Products Without Compromising Quality

May 17, 2025

Latest Posts

-

Mitchell Robinsons Season Debut New York Knicks See Return After Ankle Injury

May 17, 2025

Mitchell Robinsons Season Debut New York Knicks See Return After Ankle Injury

May 17, 2025 -

Thibodeaus Response To Bridges Concern Regarding Knicks Starters Playing Time

May 17, 2025

Thibodeaus Response To Bridges Concern Regarding Knicks Starters Playing Time

May 17, 2025 -

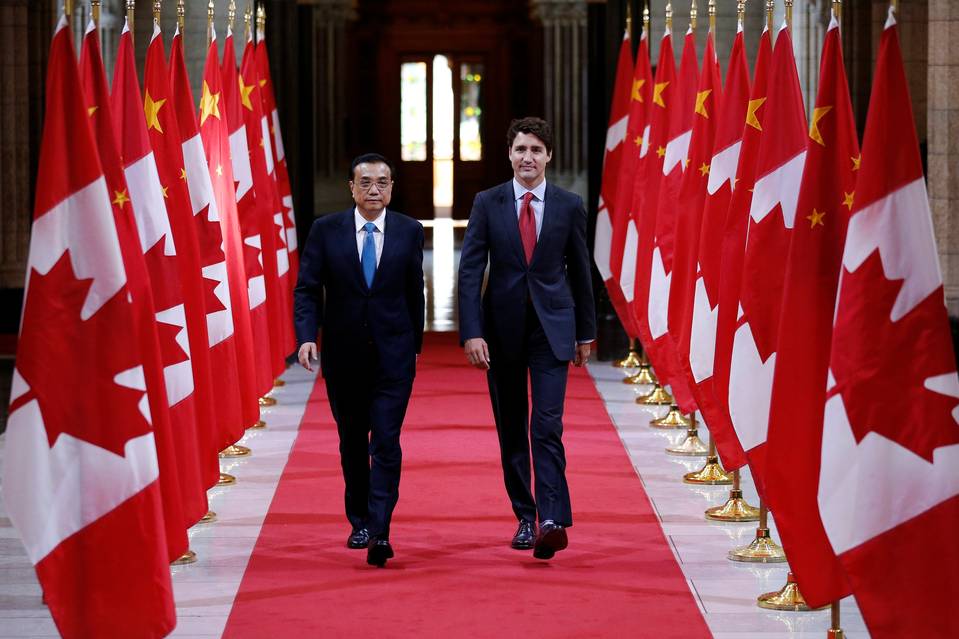

Canada China Trade Deal On The Horizon Ambassadors Recent Statement

May 17, 2025

Canada China Trade Deal On The Horizon Ambassadors Recent Statement

May 17, 2025 -

Mikal Bridges Advocates For Reduced Minutes For Knicks Key Players

May 17, 2025

Mikal Bridges Advocates For Reduced Minutes For Knicks Key Players

May 17, 2025 -

Chinese Ambassadors Proposal Formal Trade Agreement With Canada

May 17, 2025

Chinese Ambassadors Proposal Formal Trade Agreement With Canada

May 17, 2025