Microsoft Among Top Software Stocks: Weathering The Tariff Storm

Table of Contents

Microsoft's Diversified Revenue Streams: A Shield Against Tariff Impacts

Microsoft's success isn't tied to a single product or market; its strength lies in its incredibly diversified revenue streams. This diversification serves as a significant buffer against the negative impacts of tariffs.

Cloud Computing (Azure): A Growth Engine Insulated from Tariffs

Microsoft Azure, the company's cloud computing platform, is a major contributor to its overall growth and a prime example of its tariff resilience. Azure's global infrastructure, spanning numerous data centers worldwide, minimizes its dependence on any single geographic region. This means that disruptions in one area have little effect on the overall performance of the platform.

- Increased Azure adoption: Azure's market share continues to grow, solidifying its position as a leading cloud provider.

- Strong growth projections: Analysts predict continued robust growth for Azure in the coming years, fueled by increased enterprise adoption and expanding cloud services.

- Global market share data: Recent reports indicate Azure's consistent growth in global market share, further highlighting its resilience to regional economic challenges. This makes "Microsoft Azure" a key player among "cloud computing stocks" and positions it as one of the "tariff-resistant stocks" in the current market climate.

Office 365 and Productivity Suite: Recurring Revenue and Global Demand

Microsoft's Office 365 and its broader productivity suite represent another crucial aspect of its diversified revenue model. The subscription-based nature of these services provides a reliable stream of recurring revenue, less susceptible to the immediate fluctuations caused by tariffs. The global demand for these productivity tools further ensures consistent income regardless of regional economic uncertainties.

- Global user base: Millions of businesses and individuals worldwide rely on Office 365, creating a vast and diversified customer base.

- Consistent subscription revenue: The predictable nature of subscription revenue provides financial stability, shielding Microsoft from the volatility affecting businesses reliant on one-time sales.

- Minimal impact from tariffs: The digital nature of Office 365 significantly reduces its vulnerability to tariff-related disruptions in hardware manufacturing or supply chains. This makes it a prime example of a "recurring revenue stock" that thrives even in volatile market conditions.

Gaming (Xbox): A Relatively Insulated Sector

Microsoft's gaming division, centered around the Xbox platform, also contributes to its overall resilience. While hardware components might be subject to some tariff impacts, the global appeal of Xbox games and services minimizes the overall effect.

- Xbox Game Pass subscriber growth: The growing popularity of Xbox Game Pass, a subscription service offering access to a vast library of games, further diversifies revenue within the gaming sector.

- Global gaming market trends: The global gaming market exhibits strong growth, indicating continued revenue potential for Xbox irrespective of localized tariff issues.

- Diversification across hardware and software: Microsoft's strategy in gaming involves both hardware (consoles) and software (games and services), reducing its reliance on any single component and mitigating risk related to supply chain disruptions. This illustrates how "Microsoft gaming" contributes to its position as one of the "diversified tech stocks" best positioned for long-term growth.

Microsoft's Strong Financial Position and Strategic Investments

Beyond diversification, Microsoft's financial strength and strategic investments further bolster its resilience to economic shocks.

Robust Cash Flow and Financial Stability

Microsoft boasts impressive cash reserves and consistently strong cash flow, enabling it to navigate economic downturns and absorb potential losses related to tariff impacts.

- Recent financial reports highlighting key metrics: Analysis of Microsoft's recent financial reports reveals robust revenue growth, healthy profit margins, and low debt levels.

- Debt levels: Microsoft's conservative debt management ensures financial flexibility, allowing it to capitalize on opportunities and weather economic storms. This makes "Microsoft financials" a key indicator of its strength as one of the "strong balance sheet stocks" in the technology sector and one of the "financially stable tech companies."

Strategic Acquisitions and Technological Innovation

Microsoft's proactive investment strategy, encompassing strategic acquisitions and substantial R&D spending, ensures its continued technological leadership and adaptation to changing market dynamics.

- Examples of strategic acquisitions: Microsoft's history of strategic acquisitions demonstrates its ability to expand its capabilities and enter new markets.

- Investments in AI and other emerging technologies: Microsoft's significant investments in artificial intelligence, cloud computing, and other emerging technologies position it for future growth and competitive advantage. This makes "Microsoft acquisitions" and "tech innovation" significant contributors to its status as one of the "future-proof stocks" in the market.

Comparative Analysis: Microsoft vs. Tariff-Vulnerable Competitors

Compared to competitors heavily reliant on manufacturing or specific geographic regions significantly impacted by tariffs, Microsoft demonstrates superior resilience. Many hardware-focused companies have experienced significant supply chain disruptions and increased production costs due to tariffs. Microsoft, with its predominantly software-based business model and global infrastructure, has been far less affected. (A chart comparing Microsoft's stock performance to that of tariff-vulnerable competitors would be included here). This "tech stock comparison" clearly demonstrates the impact of tariffs on the tech sector and highlights the advantages of a diversified business model. This comparative analysis emphasizes the difference between "Microsoft" and its more "tariff impact on tech" vulnerable counterparts. Ultimately, this "market leader comparison" reinforces Microsoft's leading position.

Conclusion: Investing in Microsoft - A Smart Strategy Amidst Uncertainty

In conclusion, Microsoft's diversified revenue streams, strong financial position, and strategic investments provide a powerful shield against the negative impacts of tariffs and other global economic uncertainties. Its position as one of the top software stocks is not only secure but also likely to strengthen in the long term. The company's ability to adapt and innovate ensures its continued leadership in the tech sector. Considering "invest in Microsoft," particularly given the current "Microsoft stock outlook," is a smart strategy for investors seeking stability and growth in a volatile market. For those looking for "top performing software stocks," Microsoft stands out as a reliable and promising long-term investment. Consider adding Microsoft to your portfolio as part of a diversified investment strategy, leveraging its ability to navigate the complexities of the global economic landscape and remain among the top software stocks.

Featured Posts

-

Pre Game Analysis A Deep Dive Into The San Jose Earthquakes

May 15, 2025

Pre Game Analysis A Deep Dive Into The San Jose Earthquakes

May 15, 2025 -

Turtsiya Vyvedet Voyska S Kipra Diskussiya Na Haqqin Az Prodolzhaetsya

May 15, 2025

Turtsiya Vyvedet Voyska S Kipra Diskussiya Na Haqqin Az Prodolzhaetsya

May 15, 2025 -

Exclusive Report Tensions Rise As Trump Allies Confront Rfk Jr On Pesticides

May 15, 2025

Exclusive Report Tensions Rise As Trump Allies Confront Rfk Jr On Pesticides

May 15, 2025 -

Money Laundering Lapses Cost Paytm Payments Bank R5 45 Crore Fiu Ind Penalty

May 15, 2025

Money Laundering Lapses Cost Paytm Payments Bank R5 45 Crore Fiu Ind Penalty

May 15, 2025 -

This Under The Radar App Could Change The Tech Landscape And Impact Meta

May 15, 2025

This Under The Radar App Could Change The Tech Landscape And Impact Meta

May 15, 2025

Latest Posts

-

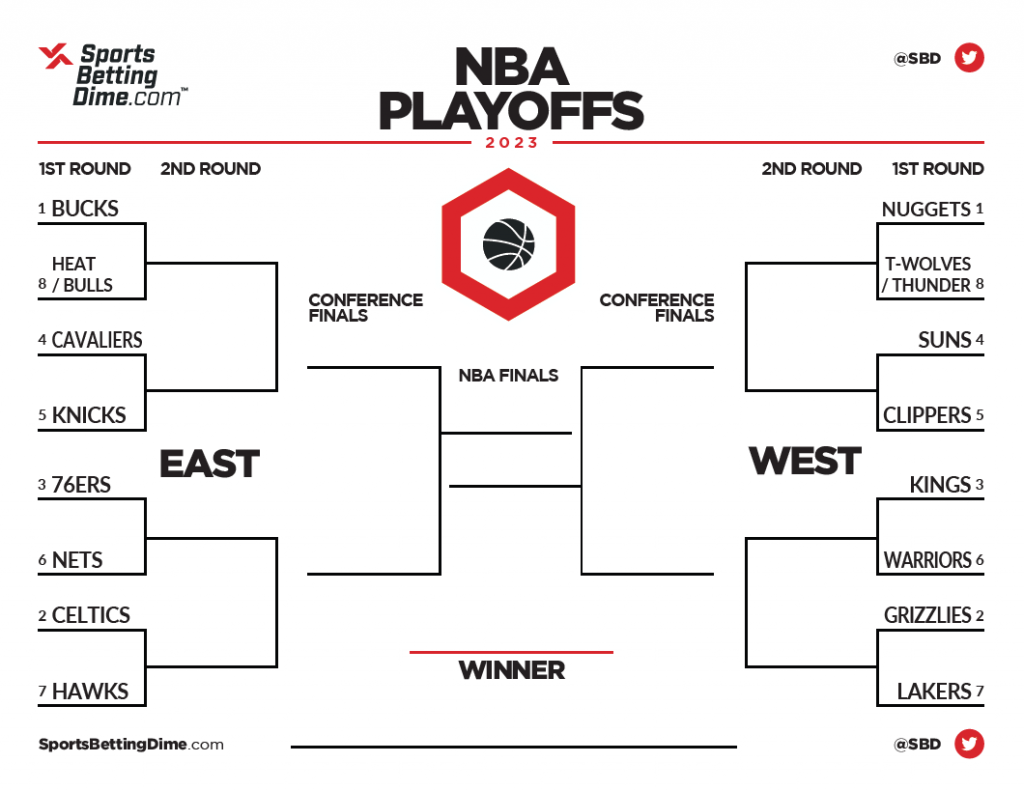

Nba And Nhl Round 2 Playoffs Betting Preview And Best Bets

May 15, 2025

Nba And Nhl Round 2 Playoffs Betting Preview And Best Bets

May 15, 2025 -

Smart Money Nba And Nhl Round 2 Playoff Betting Guide

May 15, 2025

Smart Money Nba And Nhl Round 2 Playoff Betting Guide

May 15, 2025 -

Schwerer Tram Unfall Berlin Brandenburg Strassensperrungen Und Auswirkungen Auf Den Bahnverkehr

May 15, 2025

Schwerer Tram Unfall Berlin Brandenburg Strassensperrungen Und Auswirkungen Auf Den Bahnverkehr

May 15, 2025 -

Tram Unfall In Berlin And Brandenburg Aktuelle Verkehrsbehinderungen

May 15, 2025

Tram Unfall In Berlin And Brandenburg Aktuelle Verkehrsbehinderungen

May 15, 2025 -

Best Bets Nba And Nhl Second Round Playoffs Predictions

May 15, 2025

Best Bets Nba And Nhl Second Round Playoffs Predictions

May 15, 2025