Navigate The Private Credit Boom: 5 Essential Do's And Don'ts

Table of Contents

Do: Thoroughly Vet Potential Private Credit Investments

Due diligence is paramount in the world of private credit investments. Don't skip this crucial step; thorough due diligence protects your investment and minimizes potential losses. The private debt market, while offering high returns, also presents unique challenges compared to traditional investment avenues.

Due Diligence is Paramount:

-

Independently verify financial statements and projections: Don't rely solely on information provided by the borrower. Engage independent auditors or financial analysts to validate the data. This is particularly crucial for understanding the true financial health and creditworthiness of the borrower. Misrepresenting financial information is a significant risk in private credit transactions.

-

Assess the management team's experience and track record: A strong and experienced management team significantly increases the chances of successful repayment. Research their past performance in similar ventures and assess their ability to navigate potential challenges.

-

Analyze the underlying collateral and its value: Understand the nature and value of the collateral securing the loan. Obtain independent appraisals to ensure the collateral's value accurately reflects the loan amount. Private credit often relies heavily on the value of the underlying assets.

-

Understand the terms of the loan agreement completely: Carefully review all aspects of the loan agreement, including interest rates, repayment schedules, covenants, and default provisions. Seek legal counsel to ensure you fully understand the implications of each clause. This is critical for mitigating risk in private credit transactions.

-

Consider engaging independent legal and financial advisors: Navigating the complexities of private credit requires specialized expertise. Independent advisors can provide valuable insights and help you make informed decisions.

Understand the Risk Profile:

Private credit investments inherently carry higher risk than traditional debt instruments. Understanding and managing this risk is crucial.

-

Assess the borrower's creditworthiness and financial stability: Conduct a thorough credit analysis to determine the borrower's ability to repay the loan. Consider factors such as debt-to-equity ratio, cash flow, and industry trends.

-

Evaluate the potential for defaults and losses: Develop realistic scenarios that consider potential economic downturns or industry-specific challenges. Private credit investments are exposed to higher default risks than traditional bonds or other fixed income instruments.

-

Diversify your portfolio across different borrowers and sectors: Don't put all your eggs in one basket. Spread your investments across various borrowers and industries to reduce the impact of a single default. This is a crucial risk management strategy in private credit.

-

Consider the impact of rising interest rates: Rising interest rates can increase borrowing costs and impact the borrower's ability to repay the loan. Factor this into your risk assessment.

Don't: Overlook Liquidity Considerations

Private Credit is Typically Illiquid:

Unlike publicly traded securities, accessing your capital in private credit can be difficult and time-consuming. Private debt investments often have longer lock-up periods, making liquidity a major concern.

-

Only invest capital you can afford to tie up for the long term: Private credit investments are not suitable for investors who require frequent access to their funds. Plan for the potential illiquidity inherent in these investments.

-

Factor in potential delays in realizing returns: Returns on private credit investments can be delayed due to the illiquid nature of the market. Build this into your investment projections.

-

Consider the impact on your overall portfolio liquidity: Ensure that your allocation to private credit does not compromise the overall liquidity of your investment portfolio.

Plan for Potential Exit Strategies:

Develop a plan for how you will exit your private credit investments when the time comes. A well-defined exit strategy is crucial for mitigating risk and maximizing returns.

-

Understand the terms for repayment and potential refinancing: Review the loan agreement carefully to understand the terms for repayment and any options for refinancing.

-

Explore options for selling your investment to secondary markets: While illiquid, there are secondary markets for some private credit investments. Research the feasibility of selling your investment before making the initial investment.

Do: Seek Professional Advice

Leverage Expertise:

Navigating the complexities of private credit requires specialized knowledge. Don't hesitate to seek professional guidance.

-

Consult with experienced financial advisors specializing in private credit: Experienced advisors can provide valuable insights and help you navigate the complexities of this market.

-

Engage legal counsel to review loan agreements and other legal documents: Legal counsel can ensure that your interests are protected and that you understand the legal implications of your investments.

-

Seek tax advice to understand the tax implications of your investments: Private credit investments can have complex tax implications. Tax advisors can help you optimize your tax strategy.

Don't: Neglect Regulatory Compliance

Stay Informed About Regulations:

The private credit market is subject to various regulations and compliance requirements. Staying informed is crucial for avoiding legal issues and penalties.

-

Stay updated on changes in relevant laws and regulations: Regulations in the private credit space are constantly evolving. Maintain awareness of these changes to ensure compliance.

-

Ensure your investment activities are compliant with all applicable rules: Seek guidance from legal and regulatory experts to ensure that your investments comply with all relevant laws and regulations.

-

Seek legal guidance to ensure compliance: Don't assume you understand all the regulatory requirements. Seek professional legal advice to ensure compliance.

Do: Diversify Your Private Credit Portfolio

Spread Your Risk:

Diversification is key to mitigating the risks associated with private credit investments.

-

Invest in different types of private credit instruments (e.g., direct lending, mezzanine debt): Diversifying across different types of private debt can help reduce overall portfolio risk.

-

Diversify across different industries and borrowers: Don't concentrate your investments in a single industry or borrower. Spread your risk across multiple sectors and borrowers to mitigate the impact of any single default.

-

Consider geographic diversification: If possible, consider diversifying your investments across different geographic regions to reduce the impact of regional economic downturns.

Conclusion

The private credit boom presents significant opportunities, but success requires careful planning and a thorough understanding of the risks involved. By following these five essential do's and don'ts – thoroughly vetting investments, considering liquidity, seeking professional advice, ensuring regulatory compliance, and diversifying your portfolio – you can significantly increase your chances of navigating this dynamic market successfully. Don't miss out on the potential rewards; learn to effectively navigate the private credit boom today!

Featured Posts

-

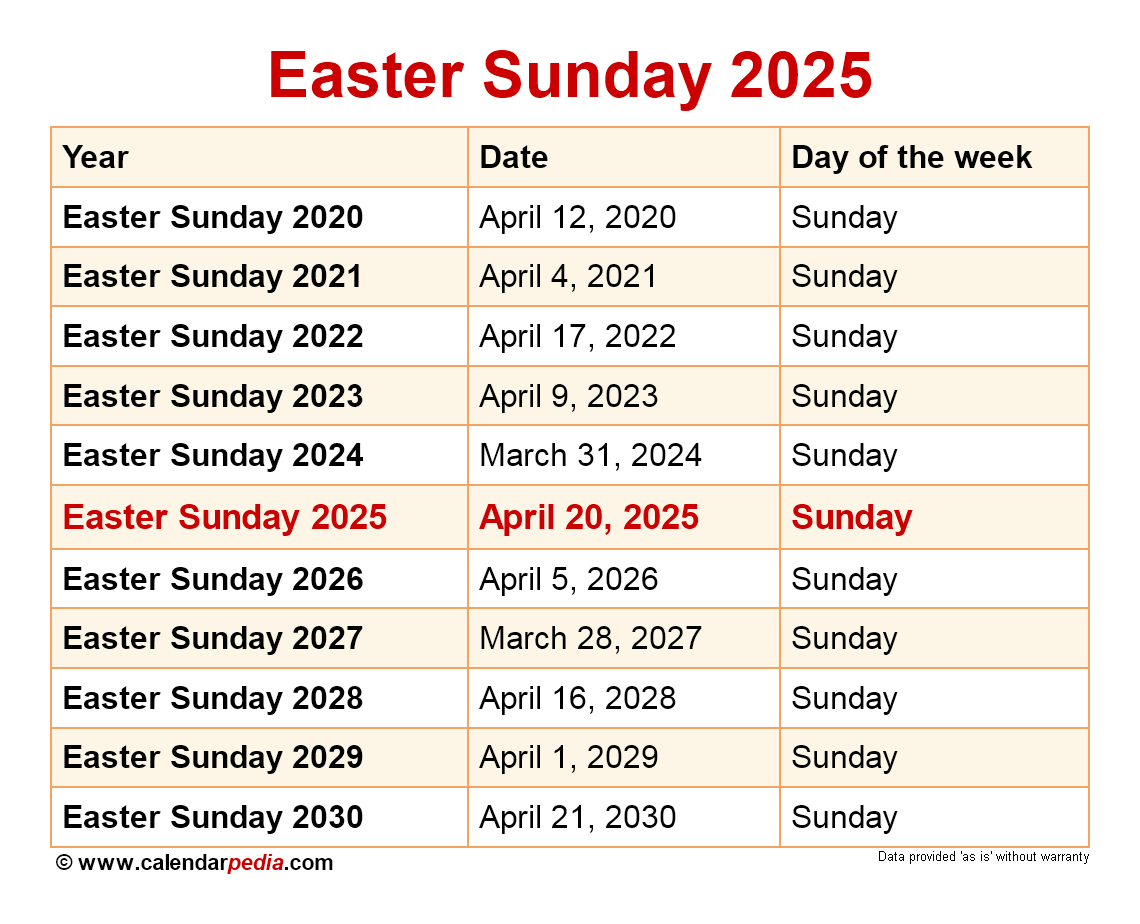

P E I Easter 2024 Holiday Schedule And Service Updates

Apr 23, 2025

P E I Easter 2024 Holiday Schedule And Service Updates

Apr 23, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Trends And Future Outlook

Apr 23, 2025

Chinas Impact On Bmw And Porsche Sales Market Trends And Future Outlook

Apr 23, 2025 -

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 23, 2025

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 23, 2025 -

Gold Price Soars To 3500 Amidst Stock Market Volatility

Apr 23, 2025

Gold Price Soars To 3500 Amidst Stock Market Volatility

Apr 23, 2025 -

Blue Origin Postpones Launch Technical Glitch Forces Delay

Apr 23, 2025

Blue Origin Postpones Launch Technical Glitch Forces Delay

Apr 23, 2025

Latest Posts

-

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 10, 2025 -

The Snl Impression Harry Styles Couldnt Stand His Reaction

May 10, 2025

The Snl Impression Harry Styles Couldnt Stand His Reaction

May 10, 2025 -

Delaying Farcical Misconduct Proceedings Nottingham Families Plea

May 10, 2025

Delaying Farcical Misconduct Proceedings Nottingham Families Plea

May 10, 2025 -

Harry Styles Seventies Style Mustache Makes A Statement

May 10, 2025

Harry Styles Seventies Style Mustache Makes A Statement

May 10, 2025 -

Harry Styles Debuts Retro Mustache In London

May 10, 2025

Harry Styles Debuts Retro Mustache In London

May 10, 2025