Netflix's Resilience Amidst Big Tech Downturn: A Wall Street Tariff Haven?

Table of Contents

H2: Netflix's Diversification Strategy

Netflix's success isn't solely reliant on streaming subscriptions; it's built on a multifaceted diversification strategy. This strategic approach has proven crucial in navigating the current turbulent tech landscape.

H3: Content Differentiation:

Netflix's focus on original programming and diverse genres acts as a significant differentiator in a crowded streaming market. Their strategy prioritizes high-quality, diverse content to attract and retain a global audience.

- Successful Franchises: Shows like Stranger Things, The Crown, and Squid Game have become global phenomena, driving subscriber growth and brand loyalty.

- International Content Expansion: Netflix invests heavily in producing and acquiring content from around the world, catering to diverse tastes and expanding its global reach. This allows them to tap into various regional markets and minimize dependence on any single region's economic performance.

- Unique Content Formats: Netflix continuously experiments with innovative formats, including interactive stories like Bandersnatch and engaging reality shows, keeping their platform fresh and exciting. This commitment to innovation ensures they remain at the forefront of the streaming industry. Keywords: Netflix original content, global content strategy, content diversification

H3: Revenue Streams Beyond Streaming:

Netflix isn't limiting itself to subscription revenue. It's actively exploring additional revenue streams to bolster its financial resilience.

- Netflix Gaming: The expansion into gaming offers a new avenue for revenue generation and user engagement. This diversification reduces dependence on a single revenue model and provides opportunities for increased revenue streams.

- Interactive Experiences: Beyond gaming, Netflix is exploring interactive experiences within its streaming platform, enhancing user engagement and potentially unlocking new revenue streams.

- Live Events: While still in its early stages, exploring live events opens the door for diverse revenue opportunities, further solidifying Netflix's position as a multifaceted entertainment powerhouse. Keywords: Netflix gaming, diversified revenue streams, future growth strategies

H2: The Tariff Haven Argument

The argument for Netflix as a "tariff haven" rests on several key pillars: its geopolitical stability, its robust subscriber base, and its relative valuation compared to other tech giants.

H3: Geopolitical Stability:

Unlike some tech companies heavily reliant on specific regions or susceptible to trade wars, Netflix boasts a truly global presence.

- Global Reach: With operations in numerous countries, Netflix can weather geopolitical storms that might significantly impact companies concentrated in one area. Its diversified international user base reduces its vulnerability to regional economic downturns.

- Navigating International Regulations: Netflix has demonstrated the ability to navigate complex international regulations and market fluctuations, demonstrating adaptability and resilience in diverse markets. Keywords: global reach, geopolitical risk, international expansion

H3: Strong Subscription Base:

Netflix's substantial and loyal subscriber base provides a significant buffer against economic downturns.

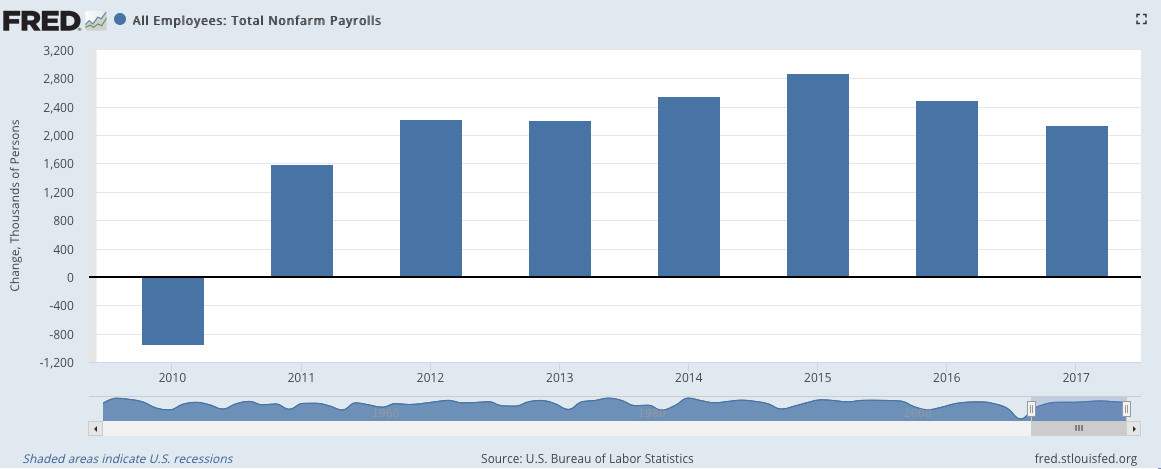

- Subscriber Growth Trends: Despite market volatility, Netflix continues to add subscribers globally, reflecting the continued demand for its streaming service.

- Churn Rate: Netflix maintains a relatively low churn rate, showcasing strong subscriber loyalty and the value proposition of its service.

- Recurring Revenue: The recurring nature of subscription revenue provides a stable and predictable income stream, offering a degree of protection against short-term economic fluctuations. Keywords: subscriber growth, churn rate, recurring revenue

H3: Relative Valuation Compared to Other Tech Stocks:

Analyzing Netflix's valuation against other tech giants reveals a relative stability that strengthens the "tariff haven" argument.

- Netflix Stock Performance: Compared to the overall tech sector, Netflix has shown more resilience during the downturn. (Include relevant financial data and comparisons here, referencing reliable sources).

- Market Capitalization: While its market cap has fluctuated, it has held up relatively well compared to other tech companies, suggesting investor confidence in its long-term prospects.

- Valuation Multiples: (Include relevant data comparing Netflix's valuation multiples to competitors). Keywords: Netflix stock, market capitalization, valuation multiples

H2: Challenges and Risks

While Netflix's resilience is impressive, it's crucial to acknowledge potential challenges.

H3: Competition:

The streaming landscape is intensely competitive.

- Streaming Competition: Netflix faces fierce competition from established players like Disney+, HBO Max, and Amazon Prime Video, as well as new entrants. This necessitates continuous innovation and investment in content.

- Pricing Pressure: The competitive landscape often leads to pricing wars, potentially impacting Netflix's profitability.

- Ad-Supported Streaming: The rise of ad-supported streaming tiers presents another competitive pressure, requiring Netflix to adapt its business model. Keywords: streaming competition, pricing pressure, ad-supported streaming

H3: Economic Uncertainty:

A prolonged or severe economic downturn could impact Netflix's subscriber base.

- Economic Recession: In a deep recession, consumers might cut discretionary spending, including streaming subscriptions.

- Subscriber Retention: Netflix will need to focus on retaining subscribers through enhanced content, improved user experience, and potentially adjusting pricing strategies.

- Revenue Projections: Economic uncertainty makes accurate revenue projections challenging, underscoring the need for cautious financial planning. Keywords: economic recession, subscriber retention, revenue projections

3. Conclusion:

Netflix's diversification strategies, its global reach, and the strength of its subscriber base contribute to its resilience during the broader tech downturn. This resilience might position it favorably compared to other tech companies, making it potentially a safer investment haven – a Wall Street tariff haven, if you will. However, the increasing competition and the potential impact of economic uncertainty remain significant risks. Is Netflix truly a Wall Street tariff haven in this turbulent tech climate? Continue researching Netflix's performance and investment prospects to form your own informed opinion on its resilience and future potential. Understanding the nuances of Netflix's position within the current market landscape is crucial for any investor considering its stock.

Featured Posts

-

Radno Vrijeme Trgovina Za Uskrs I Uskrsni Ponedjeljak Vas Vodic

Apr 23, 2025

Radno Vrijeme Trgovina Za Uskrs I Uskrsni Ponedjeljak Vas Vodic

Apr 23, 2025 -

On Refait La Seance Fdj Schneider Electric Et L Actualite Parisienne Du 17 02

Apr 23, 2025

On Refait La Seance Fdj Schneider Electric Et L Actualite Parisienne Du 17 02

Apr 23, 2025 -

Netflix Weathering The Tech Storm Attracting Investors Amidst Tariff Concerns

Apr 23, 2025

Netflix Weathering The Tech Storm Attracting Investors Amidst Tariff Concerns

Apr 23, 2025 -

The Economic Data Doesnt Reflect Trumps Presence

Apr 23, 2025

The Economic Data Doesnt Reflect Trumps Presence

Apr 23, 2025 -

Elections Legislatives Allemandes J 6 Tout Ce Qu Il Faut Savoir

Apr 23, 2025

Elections Legislatives Allemandes J 6 Tout Ce Qu Il Faut Savoir

Apr 23, 2025

Latest Posts

-

Stock Market Prediction Two Potential Winners To Beat Palantirs Growth 3 Year Outlook

May 10, 2025

Stock Market Prediction Two Potential Winners To Beat Palantirs Growth 3 Year Outlook

May 10, 2025 -

Predicting The Future 2 Stocks Projected To Exceed Palantirs Market Cap In 3 Years

May 10, 2025

Predicting The Future 2 Stocks Projected To Exceed Palantirs Market Cap In 3 Years

May 10, 2025 -

The Embrace Of Divine Mercy Religious Life And Gods Compassion In 1889

May 10, 2025

The Embrace Of Divine Mercy Religious Life And Gods Compassion In 1889

May 10, 2025 -

Palantir Prediction 2 Stocks To Watch For Higher Returns In 3 Years

May 10, 2025

Palantir Prediction 2 Stocks To Watch For Higher Returns In 3 Years

May 10, 2025 -

Stock Market Prediction 2 Companies To Outpace Palantir Within 3 Years

May 10, 2025

Stock Market Prediction 2 Companies To Outpace Palantir Within 3 Years

May 10, 2025