Stock Market Prediction: Two Potential Winners To Beat Palantir's Growth (3-Year Outlook)

Table of Contents

Assessing Palantir's Growth Trajectory and Identifying Key Success Factors

Understanding Palantir's success is crucial for identifying potential outperformers. Analyzing Palantir stock reveals a company fueled by significant growth in Palantir revenue, driven primarily by its strong government contracts and its sophisticated data analytics capabilities. Palantir's valuation reflects investor confidence in its innovative technology and its position in the burgeoning big data and artificial intelligence markets.

-

Recent Financial Performance: Palantir has demonstrated consistent revenue growth, though profitability remains a focus for the company. Analyzing quarterly earnings reports reveals fluctuations, influenced by contract wins and the timing of major deployments. Examining Palantir revenue trends alongside its operating expenses is crucial for assessing its long-term financial health.

-

Key Success Factors: Palantir's success stems from several key elements:

- Government Contracts: A significant portion of Palantir's revenue comes from large government contracts, providing a stable revenue stream.

- Data Analytics Capabilities: Its cutting-edge data analytics platform allows organizations to extract valuable insights from massive datasets.

- Artificial Intelligence (AI): Palantir is increasingly leveraging AI and machine learning to enhance its offerings and provide more sophisticated solutions.

-

Strengths and Weaknesses:

- Strengths: Strong government relationships, innovative technology, and a large addressable market.

- Weaknesses: Dependence on government contracts, high valuation relative to profitability, and competition from established tech giants.

-

Potential Risks: Increased competition, shifts in government spending priorities, and the inherent risks associated with investing in high-growth technology companies.

Company #1: CrowdStrike Holdings, Inc. (CRWD) – A Deep Dive into its Potential

CrowdStrike Holdings, Inc. (CRWD) operates in the cybersecurity sector, a rapidly expanding market with high growth potential. Its cloud-native endpoint protection platform is disrupting the traditional cybersecurity landscape. CRWD's potential to surpass Palantir's growth lies in its substantial market share gains, impressive revenue growth, and strong earnings per share (EPS).

-

Outperforming Palantir's Growth: CrowdStrike's recurring subscription revenue model ensures predictable income streams, and its aggressive expansion into new markets positions it for continued high growth. Its market capitalization reflects investor confidence in its long-term prospects.

-

Supporting Evidence: CrowdStrike consistently demonstrates strong revenue growth, exceeding analysts' expectations. The company's expansion into areas like cloud security and extended detection and response (XDR) further fuels its potential. Analyzing its financials reveals a healthy balance sheet and strong cash flow generation.

-

Competitive Advantages:

- Cloud-Native Platform: Offers superior scalability and flexibility compared to traditional on-premise solutions.

- AI-Powered Threat Detection: Utilizes AI and machine learning to proactively identify and respond to threats.

- Strong Customer Acquisition: A consistently expanding customer base reflects market acceptance.

-

Potential Risks and Challenges: Intense competition in the cybersecurity market, reliance on subscription revenue, and the risk of emerging threats requiring rapid adaptation.

Company #2: Datadog, Inc. (DDOG) – Another Contender for High Growth

Datadog, Inc. (DDOG) provides a monitoring and analytics platform for cloud-scale applications. Its comprehensive platform caters to various needs within IT operations and security, making it a strong contender for high growth. Datadog’s unique selling proposition is its unified approach, providing comprehensive insights into application performance, infrastructure, and security.

-

Outperforming Palantir's Growth: Datadog's strong revenue growth is driven by increasing adoption of cloud computing and the growing need for real-time monitoring and analytics. Its expansion into new product areas and strategic partnerships contribute to its growth potential.

-

Supporting Evidence: Datadog consistently showcases strong financial performance, with significant revenue growth and expanding customer base. The company's strategic acquisitions and robust product development pipeline position it for long-term success.

-

Strengths and Opportunities:

- Unified Platform: Offers a comprehensive solution for monitoring various aspects of IT operations.

- Strong Network Effects: More users lead to greater data and more powerful insights.

- Expanding Product Portfolio: Continuously adding new features and capabilities to meet evolving customer demands.

-

Potential Risks and Uncertainties: Competition from established players in the monitoring and analytics space, dependence on cloud adoption, and potential economic slowdowns impacting customer spending.

Comparative Analysis: CrowdStrike (CRWD) vs. Datadog (DDOG) vs. Palantir

| Company | Revenue Growth (YoY) | Market Cap (USD Billions) | Profitability (Operating Margin) | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Palantir | [Insert Data] | [Insert Data] | [Insert Data] | Government contracts, data analytics | Dependence on government contracts, valuation |

| CrowdStrike (CRWD) | [Insert Data] | [Insert Data] | [Insert Data] | Cloud-native platform, AI-powered threat detection | Competition, subscription revenue reliance |

| Datadog (DDOG) | [Insert Data] | [Insert Data] | [Insert Data] | Unified platform, strong network effects | Competition, economic downturns |

(Note: Replace bracketed information with actual data from reputable financial sources.)

Conclusion: Stock Market Prediction: Making Informed Investment Decisions

Our analysis suggests that CrowdStrike (CRWD) and Datadog (DDOG) possess significant potential to outperform Palantir's growth over the next three years, based on their strong revenue growth, expanding markets, and robust business models. However, remember that stock market prediction is inherently uncertain. Conducting thorough due diligence, including careful review of financial statements, competitive landscapes, and overall market conditions, is paramount before making any investment decisions. Effective risk management and a well-diversified investment strategy are crucial.

Start your own stock market prediction journey by researching CrowdStrike (CRWD) and Datadog (DDOG) to potentially outperform Palantir's growth. Remember to conduct thorough due diligence before investing.

Featured Posts

-

Rejoignez Notre Equipe A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025

Rejoignez Notre Equipe A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025 -

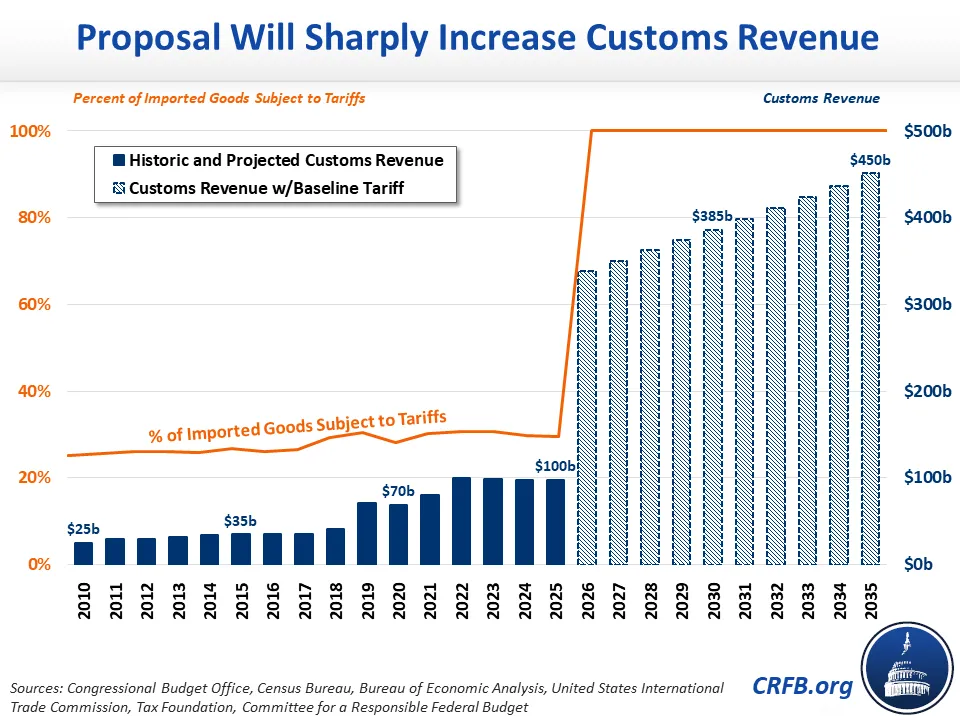

10 Tariff Baseline Trumps Condition For Trade Deals

May 10, 2025

10 Tariff Baseline Trumps Condition For Trade Deals

May 10, 2025 -

L Influence De Dijon Sur La Vie Et L Uvre De Gustave Eiffel

May 10, 2025

L Influence De Dijon Sur La Vie Et L Uvre De Gustave Eiffel

May 10, 2025 -

Fatal Stabbing Woman Charged With Racially Motivated Murder

May 10, 2025

Fatal Stabbing Woman Charged With Racially Motivated Murder

May 10, 2025 -

Top Nhl Storylines To Watch For The Rest Of 2024 25

May 10, 2025

Top Nhl Storylines To Watch For The Rest Of 2024 25

May 10, 2025