Navigating The Private Credit Boom: 5 Essential Do's And Don'ts For Job Seekers

Table of Contents

Do Your Research: Understanding the Private Credit Landscape

Before diving into your job search, it's crucial to understand the nuances of the private credit landscape. This involves researching different firm types and identifying your niche within the industry.

Types of Private Credit Firms:

The private credit world encompasses various players, each with its own investment strategy and job functions.

- Hedge Funds: These firms often employ sophisticated credit strategies, focusing on distressed debt, special situations, or other niche areas. Job roles can include portfolio manager, credit analyst, and research analyst.

- Private Equity Firms with Credit Arms: Many large private equity firms have dedicated credit arms that provide financing to support their equity investments or pursue independent credit strategies. Roles here often involve a blend of equity and credit expertise.

- Independent Credit Shops: These firms specialize solely in private credit investing, offering a wider range of investment strategies and potentially more specialized roles. They may focus on direct lending, mezzanine financing, or other niche areas within private debt.

The differences in investment strategies directly impact job functions. For example, a distressed debt fund will require analysts with deep understanding of restructuring and bankruptcy, while a direct lending firm might prioritize candidates with strong underwriting and portfolio management experience in alternative credit.

Identifying Your Niche:

The private credit industry offers a wide variety of specialized roles, each requiring unique skill sets and experience.

- Underwriting: This involves analyzing credit risk, structuring debt transactions, and assessing the creditworthiness of borrowers. Requires strong financial modeling skills and a deep understanding of credit fundamentals.

- Portfolio Management: Managing existing loan portfolios, monitoring performance, and making investment decisions. Needs strong analytical abilities, experience with portfolio risk management, and a working knowledge of private lending.

- Legal: Handling legal aspects of private debt transactions, including documentation and compliance. Requires strong legal background in finance and securities laws.

- Compliance: Ensuring adherence to all relevant regulations and compliance standards. Requires a deep understanding of financial regulations and compliance frameworks within alternative asset management.

To identify your niche, consider your existing skills and experience, and research the specific requirements of different roles within private debt.

Networking within the Industry:

Networking is crucial in the private credit industry. It helps you build relationships, learn about unadvertised opportunities, and gain valuable insights.

- Attend industry events: Conferences, seminars, and networking events specifically focused on private credit, alternative credit, or alternative asset management.

- Utilize online platforms: LinkedIn, industry-specific forums, and online communities are great resources for connecting with professionals in the field.

- Conduct informational interviews: Reaching out to professionals in private credit for informational interviews can provide valuable insights and potentially lead to job opportunities.

Effective networking requires preparation, genuine interest, and active engagement with the community.

Don't Underestimate the Importance of Hard Skills

Landing a job in private credit requires a strong foundation of hard skills. These are the technical skills that are directly applicable to the work.

Financial Modeling & Analysis:

Proficiency in financial modeling is paramount. You'll need to build and analyze complex financial models to evaluate potential investments.

- Software Proficiency: Excel (advanced), Bloomberg Terminal, Argus, other specialized financial modeling software.

- Model Types: LBO modeling, DCF analysis, leveraged buyout modeling, credit modeling, and other valuation techniques relevant to private debt.

- Relevant Projects: Showcase your skills through projects that demonstrate your ability to build and interpret complex financial models.

Understanding Credit Fundamentals:

A solid understanding of credit risk, covenants, and debt structures is essential.

- Credit Risk Assessment: Evaluating the creditworthiness of borrowers, including analyzing financial statements, cash flow projections, and other relevant data.

- Debt Structuring: Understanding the various types of debt structures (senior, subordinated, mezzanine, etc.) and their implications for risk and return.

- Covenants: Knowing how covenants protect lenders and the implications of covenant breaches.

- Credit Agreements: Familiarity with the legal documentation governing private credit transactions.

Do Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make sure they highlight your skills and experience effectively.

Highlighting Relevant Experience:

Even if your background isn't directly in private credit, you can highlight transferable skills from other finance roles.

- Transferable skills: Financial analysis, valuation, modeling, portfolio management, risk management, legal, or compliance experience.

- Quantifiable results: Use action verbs and quantify your accomplishments whenever possible (e.g., "Increased portfolio returns by 15%").

Emphasizing Keywords:

Incorporate relevant keywords from job descriptions and industry publications throughout your resume and cover letter.

- Keywords examples: "Private credit," "alternative credit," "direct lending," "mezzanine financing," "credit analyst," "portfolio manager," "LBO modeling," "DCF analysis," "credit risk," "covenants."

- Target keywords: Use keywords specific to the role and the firm you're applying to.

Don't Neglect Your Soft Skills

While hard skills are critical, soft skills are equally important in the collaborative environment of private credit.

Communication and Teamwork:

Effective communication and teamwork are essential for success.

- Communication Skills: Clearly and concisely communicate complex information to both technical and non-technical audiences.

- Teamwork: Collaborate effectively with colleagues across different departments and functions.

- Examples: Highlight situations where you demonstrated strong communication and teamwork skills in previous roles.

Problem-Solving and Critical Thinking:

The ability to analyze situations, identify problems, and develop effective solutions is highly valued.

- Analytical Skills: Demonstrate your ability to analyze large datasets, identify trends, and draw insightful conclusions.

- Problem-Solving Skills: Highlight instances where you successfully solved complex problems in previous roles.

- Critical Thinking: Showcase your ability to think critically and make informed decisions under pressure.

Do Follow Up and Be Persistent

The private credit job market is competitive. Persistence and effective follow-up are crucial.

Importance of Persistence:

Don't get discouraged by rejections. The job search process takes time and effort.

- Follow-up strategies: Send thank-you notes after interviews, follow up on applications, and network consistently.

- Interview skills: Practice your interviewing skills to confidently present your qualifications.

Conclusion

The private credit boom presents exciting career opportunities, but success requires preparation. By following these do's and don'ts, job seekers can significantly increase their chances of landing their dream role in this dynamic field. Remember to thoroughly research the industry, hone your hard and soft skills, tailor your application materials, and be persistent in your job search. Don't miss out on this exciting wave – start navigating the private credit boom today!

Featured Posts

-

Macario Martinez An Unlikely Celebrity Story

Apr 29, 2025

Macario Martinez An Unlikely Celebrity Story

Apr 29, 2025 -

Reliance Industries Earnings Beat Expectations Impact On Indian Equities

Apr 29, 2025

Reliance Industries Earnings Beat Expectations Impact On Indian Equities

Apr 29, 2025 -

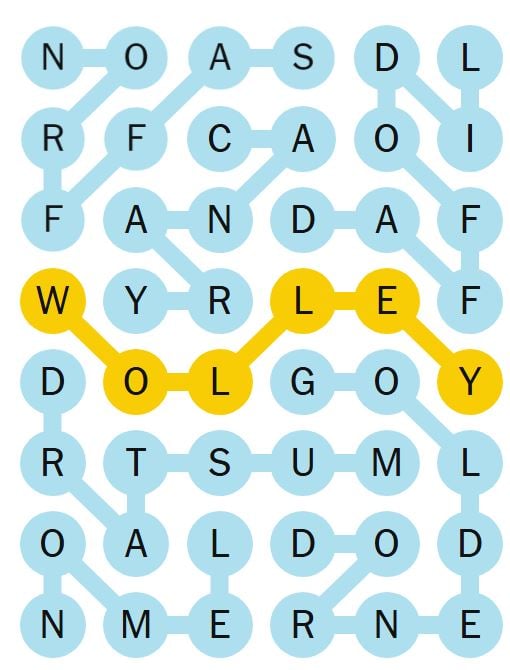

Nyt Strands February 28 2025 Complete Solutions And Spangram

Apr 29, 2025

Nyt Strands February 28 2025 Complete Solutions And Spangram

Apr 29, 2025 -

Black Hawk Helicopter And American Airlines Crash Report Details Catastrophic Failures

Apr 29, 2025

Black Hawk Helicopter And American Airlines Crash Report Details Catastrophic Failures

Apr 29, 2025 -

Downtown Louisville Gas Leak Buildings Evacuated

Apr 29, 2025

Downtown Louisville Gas Leak Buildings Evacuated

Apr 29, 2025

Latest Posts

-

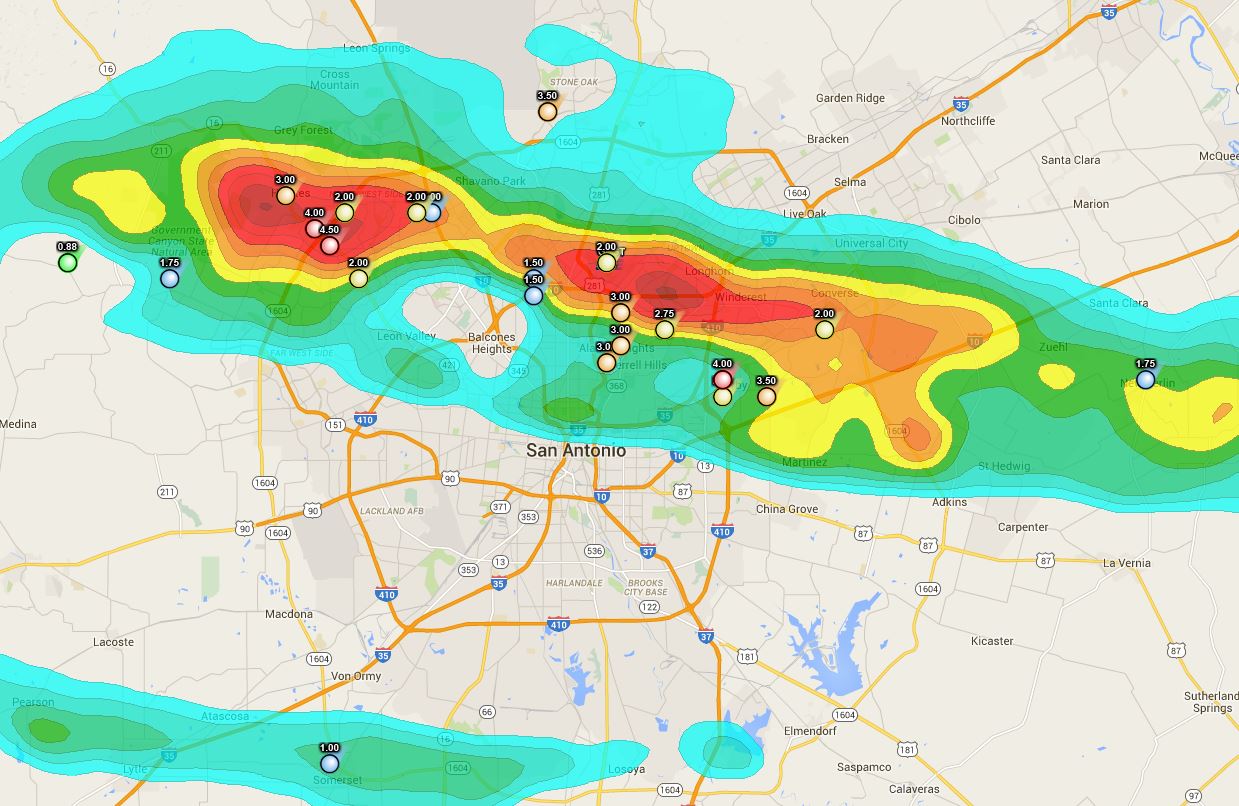

Summers Surprise Hailstorms And Their Effects On Property

May 12, 2025

Summers Surprise Hailstorms And Their Effects On Property

May 12, 2025 -

Assessing The Damage Hailstorms And The Impact On Outdoor Spaces

May 12, 2025

Assessing The Damage Hailstorms And The Impact On Outdoor Spaces

May 12, 2025 -

Ai Digest Efficiently Converting Repetitive Documents Into Informative Poop Podcasts

May 12, 2025

Ai Digest Efficiently Converting Repetitive Documents Into Informative Poop Podcasts

May 12, 2025 -

The Impact Of Summer Hailstorms On Residential Landscapes

May 12, 2025

The Impact Of Summer Hailstorms On Residential Landscapes

May 12, 2025 -

Preparing For Summer Hail Protecting Pools And Gardens

May 12, 2025

Preparing For Summer Hail Protecting Pools And Gardens

May 12, 2025