Navigating The World Of Live Now, Pay Later: A Practical Approach

Table of Contents

Understanding Live Now, Pay Later Services

Live Now, Pay Later (often shortened to BNPL) services allow consumers to purchase goods and services and pay for them in installments, typically over a short period, usually interest-free if paid on time. This offers a tempting alternative to traditional credit cards or loans.

How BNPL Works

BNPL schemes typically operate by partnering with retailers. At checkout, you choose the BNPL option, providing some basic personal information. The provider then pays the retailer, and you agree to repay them in installments according to a pre-determined schedule.

- Definition of BNPL and its different forms: BNPL encompasses various models, including fixed-installment plans, revolving credit lines (similar to credit cards but with shorter repayment terms), and point-of-sale financing.

- Step-by-step explanation of the typical BNPL transaction: The process usually involves selecting BNPL at checkout, providing identification and payment details, and receiving a virtual or physical card. Repayments are typically automated via bank debit or credit card.

- Comparison of different BNPL providers (fees, credit checks, etc.): Providers like Afterpay, Klarna, Affirm, and PayPal Pay in 4 offer varying terms, including different interest rates, late fees, and credit check requirements. Comparison shopping is crucial.

- Key features and differences between BNPL and traditional credit: BNPL often involves less stringent credit checks than traditional credit cards but carries the risk of high fees and damage to your credit score if payments are missed.

The Benefits of Utilizing Live Now, Pay Later

Live Now, Pay Later offers several advantages, making it appealing to many consumers.

Financial Flexibility and Convenience

BNPL can provide financial flexibility and convenience, particularly for managing unexpected expenses or spreading the cost of larger purchases.

- Budgeting assistance and improved cash flow management: By breaking down payments, BNPL can help manage cash flow, avoiding the immediate impact of a large purchase on your bank account.

- Ability to make larger purchases without impacting savings: BNPL allows you to acquire higher-priced items without dipping into savings.

- Convenience and ease of use during online shopping: The seamless integration of BNPL into online checkouts makes the purchasing process incredibly convenient.

- Potential for building credit history (if reported to credit bureaus): Some BNPL providers report payment activity to credit bureaus, potentially helping you build or improve your credit score.

The Risks and Potential Drawbacks of Live Now, Pay Later

Despite the convenience, Live Now, Pay Later comes with significant risks if not managed responsibly.

Debt Accumulation and High Interest Rates

Overusing BNPL services can lead to debt accumulation and high interest charges.

- Potential for high interest charges and late payment fees: Missing payments can result in substantial penalties, significantly increasing the total cost of the purchase.

- Impact on credit score if payments are missed or defaulted: Late or missed payments can severely damage your credit score, making it harder to obtain loans or credit cards in the future.

- Difficulty managing multiple BNPL accounts and repayment schedules: Keeping track of multiple repayment schedules can be challenging, increasing the risk of missed payments.

- Risk of impulsive buying and overspending: The ease of using BNPL can encourage impulsive purchases, leading to overspending and financial difficulties.

Responsible Use of Live Now, Pay Later Services

To maximize the benefits and mitigate the risks of Live Now, Pay Later, responsible usage is crucial.

Tips for Avoiding BNPL Pitfalls

By adopting responsible financial habits, you can leverage the advantages of BNPL without falling into debt traps.

- Creating a budget and tracking expenses: Budgeting is essential to ensure you can comfortably afford your BNPL repayments.

- Prioritizing repayments to avoid late fees: Prioritize BNPL repayments to avoid incurring late payment charges.

- Limiting the number of BNPL accounts used: Managing multiple accounts can be overwhelming. Stick to one or two if possible.

- Using BNPL only for essential purchases: Avoid using BNPL for non-essential items.

- Exploring alternative financing options when necessary: Consider traditional loans or credit cards if BNPL isn't the right fit.

Conclusion

Live Now, Pay Later services offer convenient payment options, providing flexibility in managing expenses. However, the ease of access can lead to debt accumulation and damage to your credit score if not used responsibly. By understanding the intricacies of Live Now, Pay Later and practicing responsible financial habits, you can navigate this increasingly popular financial tool effectively. Remember to compare providers, create a budget, and track your spending carefully to avoid the potential pitfalls. Further research into reputable financial websites can provide additional guidance on managing your personal finances effectively.

Featured Posts

-

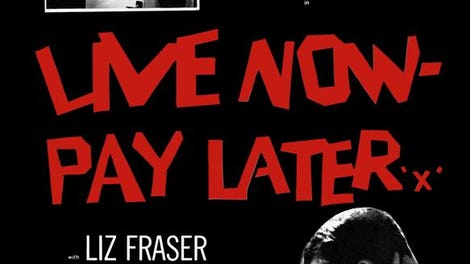

Zarazhenie Koryu V Mongolii Ekstrenniy Prizyv K Deystviyam

May 30, 2025

Zarazhenie Koryu V Mongolii Ekstrenniy Prizyv K Deystviyam

May 30, 2025 -

Understanding The Decrease In Excessive Heat Warnings

May 30, 2025

Understanding The Decrease In Excessive Heat Warnings

May 30, 2025 -

Gorillazs 25th Anniversary House Of Kong Exhibition And London Shows

May 30, 2025

Gorillazs 25th Anniversary House Of Kong Exhibition And London Shows

May 30, 2025 -

Dringend Gesucht 13 Jaehrige Vermisst Seit Sonnabend

May 30, 2025

Dringend Gesucht 13 Jaehrige Vermisst Seit Sonnabend

May 30, 2025 -

Jins Coldplay Guest Appearance A Promise Of Btss Return

May 30, 2025

Jins Coldplay Guest Appearance A Promise Of Btss Return

May 30, 2025

Latest Posts

-

Brascada La Receta Original Del Bocadillo De Valencia

May 31, 2025

Brascada La Receta Original Del Bocadillo De Valencia

May 31, 2025 -

La Brascada Ingredientes Y Elaboracion Del Bocadillo Valenciano

May 31, 2025

La Brascada Ingredientes Y Elaboracion Del Bocadillo Valenciano

May 31, 2025 -

Como Preparar Una Autentica Brascada Valenciana Guia Paso A Paso

May 31, 2025

Como Preparar Una Autentica Brascada Valenciana Guia Paso A Paso

May 31, 2025 -

Receta Tradicional De La Brascada Valenciana Un Bocadillo Autentico

May 31, 2025

Receta Tradicional De La Brascada Valenciana Un Bocadillo Autentico

May 31, 2025 -

Descubre La Receta De Carcamusas Un Manjar Toledano Con Alto Contenido En Proteinas

May 31, 2025

Descubre La Receta De Carcamusas Un Manjar Toledano Con Alto Contenido En Proteinas

May 31, 2025