Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an investment fund's assets. For ETFs, it's a crucial indicator of the fund's underlying value. It essentially shows the value of the ETF's holdings per share.

NAV Calculation: A Step-by-Step Guide

Calculating the NAV of an ETF like the Amundi Dow Jones Industrial Average UCITS ETF involves these steps:

- Total Market Value of Assets: First, determine the total market value of all the underlying assets held by the ETF. This includes the current market price of each stock within the Dow Jones Industrial Average index.

- Subtract Liabilities: Next, deduct any liabilities associated with the ETF, such as management fees and expenses.

- Divide by Outstanding Shares: Finally, divide the net asset value (total assets minus liabilities) by the total number of outstanding ETF shares. This gives the NAV per share.

Daily NAV Calculation and Market Fluctuations

The NAV of ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF, is usually calculated daily, typically at the close of the market. This daily NAV reflects the changes in the market value of the underlying assets. If the market price of the constituent stocks in the Dow Jones Industrial Average rises, the ETF's NAV will generally increase, and vice versa. This daily NAV fluctuation directly impacts the share price, though they may not always be identical. Understanding this relationship between asset value, share price, and daily NAV is critical for effective investment management.

Net Asset Value (NAV) and the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF aims to track the performance of the Dow Jones Industrial Average index. It invests in a portfolio of stocks mirroring this index, offering investors diversified exposure to 30 leading US companies.

How NAV Reflects Performance

The daily NAV changes directly reflect the performance of the underlying Dow Jones Industrial Average index. While the ETF's market price might fluctuate throughout the trading day, the daily NAV provides a more accurate picture of the fund's intrinsic value at the end of the trading day. Investors use NAV changes to monitor their investment performance and assess the fund's overall success in tracking the index. The relationship between NAV and share price is important for assessing market efficiency and liquidity within the ETF.

Accessing NAV Information

You can typically find the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF on the Amundi website, major financial news websites, and through your brokerage account.

NAV vs. Market Price: Understanding the Difference

While NAV and market price are closely related, they are not always identical. Differences can arise due to:

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Trading Volume: High trading volume generally leads to a smaller difference between NAV and market price, while low volume can create larger discrepancies.

Using NAV to Make Informed Investment Decisions

Understanding NAV is crucial for making sound investment choices.

Tracking Investment Performance

By monitoring the NAV over time, investors can track their investment's growth or decline. This allows for a clear evaluation of the return on investment relative to the index itself.

Comparing ETFs

NAV allows for comparisons between different ETFs tracking similar indices. This helps investors assess which ETF provides better value or performance relative to the expense ratios.

Understanding Risk

Fluctuations in NAV represent the investment's risk. Large NAV swings indicate higher volatility, while stable NAV suggests lower risk.

Long-Term vs. Short-Term Perspective

Analyzing NAV requires a long-term perspective. While short-term market fluctuations will impact the NAV, focusing on the long-term trend provides a more accurate assessment of the investment’s overall performance.

Conclusion: Mastering Net Asset Value (NAV) for Amundi Dow Jones Industrial Average UCITS ETF Investing

Understanding Net Asset Value is fundamental for successful investing in ETFs like the Amundi Dow Jones Industrial Average UCITS ETF. Knowing how NAV is calculated, its relationship to the market price, and how to use it to monitor performance and manage risk is essential. Monitor your Net Asset Value regularly to gauge the health of your investment. Understanding your ETF's NAV is key to making informed decisions. To learn more about calculating Net Asset Value and the Amundi Dow Jones Industrial Average UCITS ETF, visit the Amundi website or consult a financial advisor.

Featured Posts

-

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025 -

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025 -

Masivne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025

Masivne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025 -

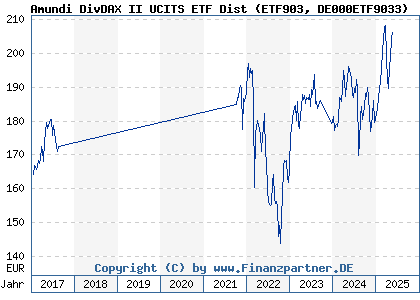

Amundi Djia Ucits Etf Dist Factors Affecting Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf Dist Factors Affecting Net Asset Value

May 24, 2025 -

Three Day Slide Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Three Day Slide Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Latest Posts

-

Ces Unveiled Europe Les Innovations Qui Faconneront Le Futur

May 24, 2025

Ces Unveiled Europe Les Innovations Qui Faconneront Le Futur

May 24, 2025 -

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain Devoilees

May 24, 2025

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain Devoilees

May 24, 2025 -

Nouveautes Technologiques A Decouvrir Au Ces Unveiled Europe A Amsterdam

May 24, 2025

Nouveautes Technologiques A Decouvrir Au Ces Unveiled Europe A Amsterdam

May 24, 2025 -

Ces Unveiled Europe 2024 Date Lieu Et Nouveautes Attendues

May 24, 2025

Ces Unveiled Europe 2024 Date Lieu Et Nouveautes Attendues

May 24, 2025 -

Mathieu Avanzi Moderniser L Enseignement Du Francais

May 24, 2025

Mathieu Avanzi Moderniser L Enseignement Du Francais

May 24, 2025