Next Key Price Levels For Apple Stock (AAPL)

Table of Contents

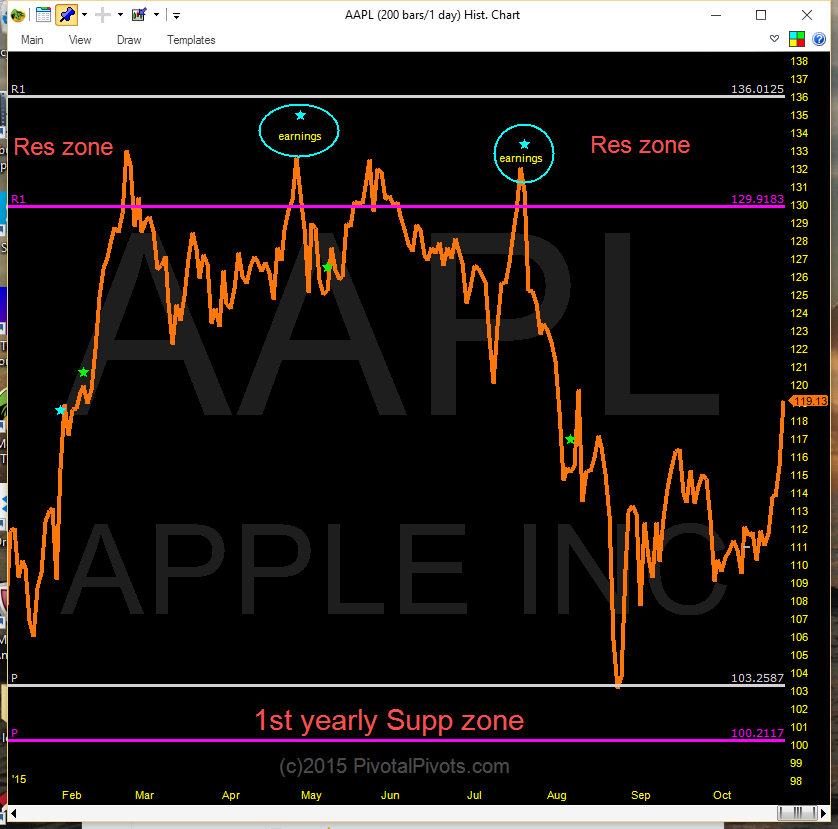

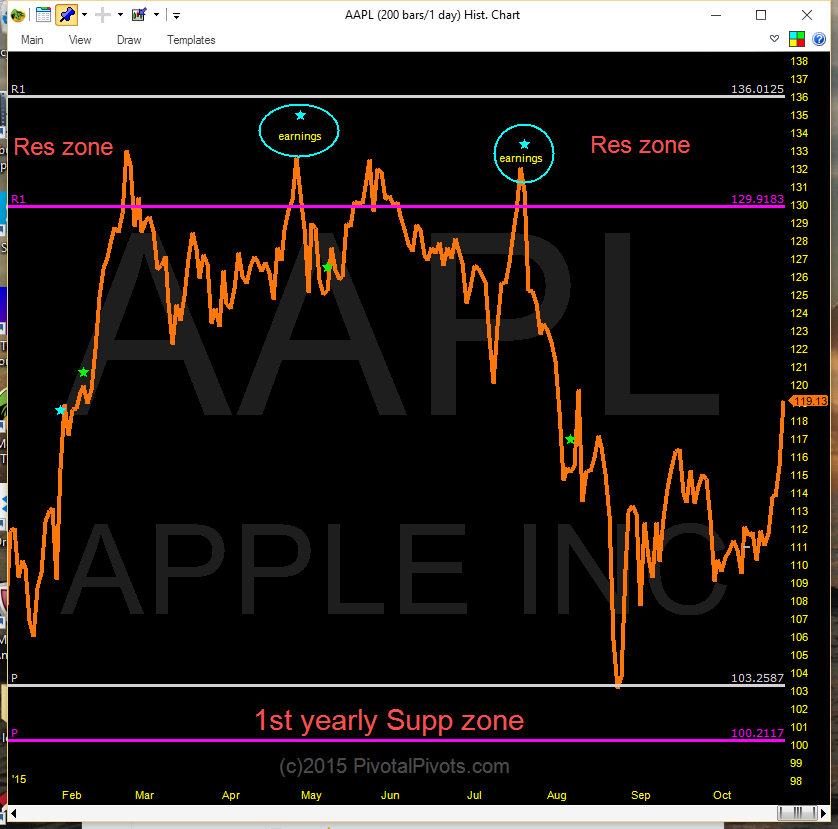

Analyzing Current Market Conditions and AAPL's Performance

The current market sentiment is cautiously optimistic, with concerns about inflation and interest rates still lingering. However, the tech sector has shown signs of resilience, and Apple, with its strong brand loyalty and diverse product portfolio, is generally considered a relatively safe bet. Recent Apple news includes the successful launch of the iPhone 14 series and the strong performance of its services segment, both contributing positively to the AAPL stock price.

-

Recent earnings reports and their implications for AAPL's valuation: Apple's recent earnings reports have exceeded expectations, boosting investor confidence and potentially pushing the Apple stock price levels higher. Analysts are closely watching key metrics like iPhone sales, services revenue growth, and overall profitability to assess AAPL's future valuation.

-

Impact of macroeconomic factors (inflation, interest rates) on Apple's stock: While inflation and interest rate hikes pose a risk to the overall market, Apple's strong financial position and loyal customer base offer some insulation. However, these factors could still impact consumer spending and subsequently affect Apple's sales and stock price.

-

Competitor analysis and its potential influence on AAPL's price: Competition from companies like Samsung and Google in various market segments remains a factor. However, Apple's strong brand recognition and ecosystem often provide a competitive advantage, mitigating the impact of rivals on AAPL stock price levels.

[Insert chart illustrating AAPL's price performance over the last year, including key indicators like moving averages and trading volume.]

Identifying Key Support and Resistance Levels

Understanding support and resistance levels is crucial for predicting future price movements. Support levels represent prices where buying pressure is expected to overcome selling pressure, preventing further declines. Resistance levels are the opposite – prices where selling pressure is likely to outweigh buying pressure, hindering further price increases.

-

Explanation of how support and resistance levels are determined (using charts and indicators): Technical analysts use various charts and indicators, such as moving averages and Fibonacci retracements, to identify these key levels. Historical price data plays a crucial role in determining potential support and resistance zones for AAPL stock.

-

Identification of short-term, medium-term, and long-term support/resistance levels for AAPL: Based on recent price action, potential short-term support could be around [Price level], while medium-term support might lie around [Price level]. Resistance levels could be seen around [Price level] (short-term) and [Price level] (medium-term). Long-term support and resistance levels will depend on broader market trends and Apple’s overall performance.

-

Discussion of potential breakout scenarios from these levels: If the price breaks above a resistance level, it suggests a strong bullish momentum, potentially leading to significant price increases. Conversely, a break below a support level could indicate a bearish trend and further price declines.

[Insert chart highlighting key support and resistance areas for AAPL, clearly labeled.]

Predicting Potential Price Targets for Apple Stock

Based on the analysis of current market conditions, technical indicators, and Apple's performance, we propose the following potential price targets for AAPL:

-

Conservative price target (realistic, short-term): [Price level] – This target assumes a relatively stable market and modest growth for Apple.

-

Moderate price target (medium-term potential): [Price level] – This target anticipates stronger growth driven by new product launches and continued success in the services sector.

-

Aggressive price target (long-term, bullish scenario): [Price level] – This target is based on a more optimistic outlook, with significant market expansion and increased demand for Apple products.

-

Potential downside risks and their impact on price targets: Downside risks include macroeconomic headwinds, increased competition, and unforeseen negative events affecting Apple's business. These risks could push the price towards lower support levels.

Risk Assessment and Investment Strategies

Investing in AAPL stock, like any investment, carries inherent risks.

-

Risk factors (market volatility, company-specific risks, geopolitical events): Market volatility, negative news about Apple's products or finances, and global geopolitical events can all impact AAPL's stock price.

-

Strategies for long-term investors (buy-and-hold, dollar-cost averaging): Long-term investors may employ a buy-and-hold strategy or dollar-cost averaging to mitigate risk and capitalize on long-term growth.

-

Strategies for short-term traders (technical analysis, options trading): Short-term traders may utilize technical analysis and options trading, but this involves higher risk.

-

Importance of diversification within an investment portfolio: Diversifying your investment portfolio across different asset classes is crucial to manage overall risk.

Conclusion

This analysis suggests potential Apple stock price levels ranging from a conservative [Price Level] to an aggressive [Price Level], depending on market conditions and Apple's performance. Remember that these are projections, and actual price movements can vary significantly. Understanding key support and resistance levels is crucial for making informed investment decisions. Always consider the inherent risks and diversify your portfolio.

Call to Action: Stay informed about the next key price levels for Apple Stock (AAPL) by following our updates and conducting your own thorough research before investing. Regularly monitor the Apple stock price levels and adapt your strategy as needed. Remember, investing in the stock market involves risk, so always do your due diligence. Understanding Apple stock price levels is a key element of smart investing.

Featured Posts

-

Memorial Day 2025 Air Travel Avoid These Busy Dates

May 24, 2025

Memorial Day 2025 Air Travel Avoid These Busy Dates

May 24, 2025 -

Philips Future Health Index 2025 Ai And The Urgent Need For Healthcare Leadership

May 24, 2025

Philips Future Health Index 2025 Ai And The Urgent Need For Healthcare Leadership

May 24, 2025 -

Explore The 2025 Porsche Cayenne Detailed Interior And Exterior Photos

May 24, 2025

Explore The 2025 Porsche Cayenne Detailed Interior And Exterior Photos

May 24, 2025 -

New Southwest Airlines Policy Restrictions On Portable Chargers In Carry On Bags

May 24, 2025

New Southwest Airlines Policy Restrictions On Portable Chargers In Carry On Bags

May 24, 2025 -

Wedbushs Bullish Apple Outlook Is It Still A Buy After Price Target Reduction

May 24, 2025

Wedbushs Bullish Apple Outlook Is It Still A Buy After Price Target Reduction

May 24, 2025

Latest Posts

-

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025 -

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

May 24, 2025

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

May 24, 2025