Wedbush's Bullish Apple Outlook: Is It Still A Buy After Price Target Reduction?

Table of Contents

Wedbush's Initial Bullish Apple Outlook and its Rationale

Wedbush Securities initially held a strongly bullish stance on Apple, predicting significant growth and issuing a high price target. This optimistic Apple stock forecast was primarily based on several key factors:

- Strong iPhone Sales: Wedbush analysts anticipated continued robust demand for iPhones, particularly in emerging markets, fueled by innovative features and strong brand loyalty.

- Exponential Services Revenue Growth: The firm highlighted the explosive growth of Apple's services segment, including Apple Music, iCloud, and the App Store, as a major driver of future profitability. This recurring revenue stream is a significant factor in the Apple stock analysis.

- Wearables and Accessories Momentum: The consistent success of Apple Watch, AirPods, and other wearables contributed to the positive Apple analyst rating.

- Expansion into New Markets: Wedbush's projections included the potential for significant market penetration in under-served regions globally.

These factors, supported by detailed financial modeling and market research, underpinned Wedbush's initial high Apple price target and positive Apple stock forecast. Key analysts like Dan Ives, known for his expertise in the tech sector, were instrumental in shaping this initial bullish Apple outlook. Their analysis incorporated various metrics, including projected unit sales, average selling prices, and market share projections, contributing to a strong overall positive assessment of Apple’s future.

The Price Target Reduction: Reasons and Implications

Despite the initial bullish sentiment, Wedbush recently lowered its Apple price target. This reduction, though still representing a positive outlook, represents a significant decrease from the previous projection. Several factors contributed to this revision:

- Macroeconomic Concerns: Global economic uncertainty, including inflation and potential recessionary pressures, dampened growth expectations across various sectors, including technology.

- Supply Chain Challenges: Lingering supply chain disruptions impacted production and delivery timelines, potentially affecting sales projections.

- Increased Competition: The intensifying competition in the smartphone market and other segments forced a recalibration of Apple's projected market share.

The market reacted to the announcement with a slight dip in Apple's stock price, highlighting the significant influence Wedbush holds in shaping investor sentiment. This Apple price target reduction, though less dramatic than some feared, indicates a degree of caution in the face of ongoing global challenges. The shift in the Apple stock price prediction underscores the sensitivity of the market to even subtle changes in the outlook of major financial institutions like Wedbush.

Analyzing the Long-Term Outlook for Apple

Despite the price target reduction, Apple's long-term prospects remain robust due to several fundamental strengths:

- Unmatched Brand Loyalty: Apple enjoys unparalleled brand loyalty, ensuring a significant and consistent customer base.

- Strong Ecosystem: The seamless integration across Apple's devices and services creates a powerful ecosystem, encouraging customer retention.

- Consistent Innovation: Apple's history of introducing groundbreaking products continues to fuel excitement and demand.

However, potential risks and challenges remain:

- Economic Slowdown: A prolonged global economic downturn could significantly impact consumer spending on discretionary items like Apple products.

- Heightened Competition: Intense competition from Android manufacturers and other tech companies pressures Apple’s market share.

- Regulatory Scrutiny: Increasing regulatory scrutiny concerning data privacy, antitrust, and app store policies poses a risk to Apple's operations.

Apple's diverse portfolio, encompassing iPhones, iPads, Macs, wearables, and services, offers diversification and potential for future growth. The long-term growth of Apple's services division alone presents significant upside potential. Analyzing the Apple investment requires a careful weighing of both opportunities and risks.

Is Apple Still a Buy? Considering the Revised Outlook

The revised Wedbush Apple outlook presents a more nuanced perspective on the company's prospects. While the price target reduction signals some caution, Apple's fundamental strengths and long-term growth potential in areas like Apple Services revenue still suggest a compelling investment case for many long-term investors.

However, the increased risk associated with the current macroeconomic climate necessitates careful consideration. Alternative investment strategies should be explored, and investors should only allocate capital they can afford to lose. The current level of risk associated with buying Apple stock requires a thorough understanding of potential downsides.

A balanced perspective, weighing both bullish and bearish arguments, is crucial. While the Apple price target reduction is a cause for some concern, the long-term growth potential remains a compelling factor for many.

Wedbush's Bullish Apple Outlook: A Final Verdict

Wedbush's revised outlook, while less bullish than its initial prediction, still suggests a positive, albeit more cautious, view of Apple's future. The reduction in the Apple price target reflects legitimate macroeconomic and competitive concerns. However, Apple's core strengths – its brand loyalty, ecosystem, and innovative capacity – remain significant long-term advantages.

Whether Apple remains a "buy" depends heavily on individual risk tolerance and investment horizons. The decision to buy Apple stock requires careful consideration of the information available. This analysis does not serve as financial advice; conduct thorough research and consider consulting a financial advisor before making investment decisions.

Stay informed on the latest developments in Wedbush's Apple outlook and conduct your own thorough research before making any investment decisions. Remember, investing in Apple stock, like any investment, carries inherent risk.

Featured Posts

-

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out Allegations Of Poisoning

May 24, 2025 -

Facing Retribution The Risks Of Challenging The Status Quo

May 24, 2025

Facing Retribution The Risks Of Challenging The Status Quo

May 24, 2025 -

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 24, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And The Top Artists To Watch

May 24, 2025 -

Pilbaras Future Rio Tinto Addresses Andrew Forrests Environmental Concerns

May 24, 2025

Pilbaras Future Rio Tinto Addresses Andrew Forrests Environmental Concerns

May 24, 2025 -

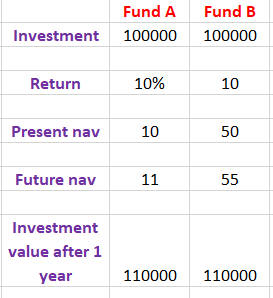

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

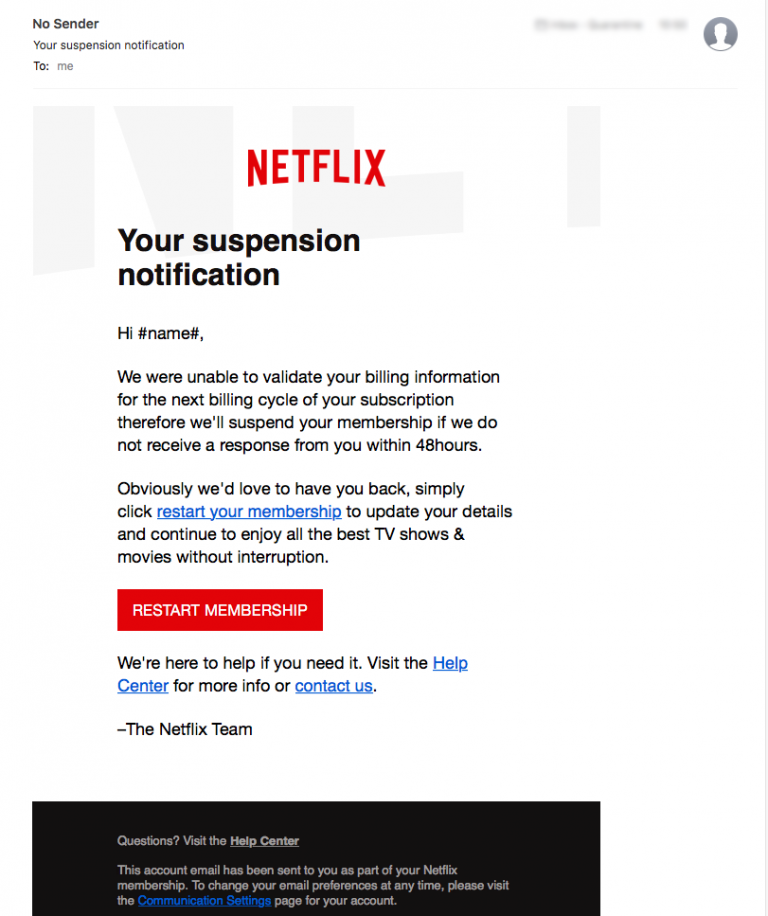

Corporate Email Compromise Crook Makes Millions From Office365 Breaches

May 24, 2025

Corporate Email Compromise Crook Makes Millions From Office365 Breaches

May 24, 2025 -

Resistance Mounts Car Dealerships Push Back Against Ev Sales Quotas

May 24, 2025

Resistance Mounts Car Dealerships Push Back Against Ev Sales Quotas

May 24, 2025 -

Cybercriminals Office365 Scheme Nets Millions Say Authorities

May 24, 2025

Cybercriminals Office365 Scheme Nets Millions Say Authorities

May 24, 2025 -

Federal Investigation Millions Lost In Corporate Email Data Breach

May 24, 2025

Federal Investigation Millions Lost In Corporate Email Data Breach

May 24, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen In Cybercrime Ring

May 24, 2025

Office365 Executive Inboxes Targeted Millions Stolen In Cybercrime Ring

May 24, 2025