Nigeria's Petrol Prices: The Roles Of Dangote And NNPC

Table of Contents

NNPC's Influence on Petrol Prices in Nigeria

The Nigerian National Petroleum Company (NNPC) plays a dominant role in Nigeria's petroleum sector, significantly influencing petrol prices. Its actions, particularly concerning subsidies and import reliance, directly impact the cost of fuel for Nigerian consumers.

NNPC's Subsidy Regime and its Impact

For years, Nigeria has implemented a fuel subsidy regime, aiming to keep petrol prices artificially low. However, this policy has proven unsustainable and problematic.

-

Financial Burden: The government's expenditure on fuel subsidies has placed a significant strain on the national budget, diverting funds from other crucial sectors like healthcare and education. This budgetary constraint often necessitates borrowing, further impacting the nation's economic health.

-

Increased Demand: Subsidies have led to increased petrol consumption, exceeding the nation's actual need. This artificially inflated demand puts pressure on supply chains and exacerbates the problem of fuel scarcity.

-

Corruption Potential: The opacity surrounding subsidy management has created opportunities for corruption and mismanagement of funds. Lack of transparency makes it difficult to track the flow of funds and ensure accountability.

-

Lack of Transparency: The lack of transparency in the subsidy regime undermines public trust and makes it difficult to evaluate the policy's effectiveness. Clearer data and reporting are essential for proper assessment and reform.

NNPC's Role as a Major Importer

NNPC's significant role as a major importer of refined petroleum products exposes Nigeria to global market volatility.

-

Foreign Exchange Volatility: Reliance on imports means Nigeria's petrol prices are heavily influenced by fluctuations in the global crude oil market and the value of the Naira against foreign currencies. Exchange rate instability directly translates into price hikes at the pump.

-

Supply Chain Disruptions: Global events, such as geopolitical instability or unforeseen supply chain disruptions, can impact the availability and cost of imported refined products, leading to fuel shortages and price spikes in Nigeria.

-

Price Fluctuations: Global crude oil price fluctuations immediately affect the landed cost of imported petrol, causing instability in local petrol prices. This unpredictability makes it challenging for businesses and individuals to plan effectively.

-

Exchange Rate Risks: The risk of adverse movements in the exchange rate can significantly increase the cost of importing refined petroleum products, further impacting petrol prices. Hedging strategies and diversification are crucial to mitigate these risks.

NNPC's Refinery Capacity and Future Plans

The operational efficiency of NNPC's refineries is crucial to reducing reliance on imports. Currently, the state of NNPC's refineries (Port Harcourt, Warri, and Kaduna) is a significant concern.

-

Rehabilitation Efforts: Efforts are underway to rehabilitate and upgrade these refineries, but progress has been slow, hampered by funding challenges, technical issues, and bureaucratic bottlenecks.

-

Private Sector Partnerships: Public-private partnerships are being explored to improve efficiency and attract the necessary investment for refinery upgrades and expansion.

-

Potential Impact of Increased Local Refining: Increased local refining capacity through successful rehabilitation and expansion efforts has the potential to significantly reduce Nigeria's reliance on imports and stabilize petrol prices.

Dangote Refinery's Potential Impact on the Nigerian Petrol Market

The completion of the Dangote Refinery, the largest in Africa, marks a significant development for Nigeria's petroleum sector.

Scale and Capacity of the Dangote Refinery

The sheer size and capacity of the Dangote Refinery promise to revolutionize the Nigerian petroleum landscape.

-

Production Capacity: Its massive production capacity will significantly reduce Nigeria's dependence on imported refined petroleum products. This increased domestic supply is expected to alleviate fuel scarcity and exert downward pressure on prices.

-

Petrochemical Production: The refinery's integrated petrochemical production capabilities offer opportunities for diversification and increased value addition within the Nigerian economy.

-

Impact on Local Jobs: The refinery's operations are expected to generate a large number of direct and indirect jobs, contributing to economic growth and development.

-

Reduced Reliance on Imports: By significantly reducing the reliance on imported refined petroleum products, the Dangote Refinery can significantly improve Nigeria's energy security and reduce its vulnerability to global price shocks.

Competition and Market Dynamics

The entrance of the Dangote Refinery is expected to inject much-needed competition into the Nigerian fuel market.

-

Market Liberalization: Increased competition can drive down prices, offering consumers more competitive options and potentially leading to a more efficient and transparent market.

-

Price Transparency: A more competitive market fosters transparency, making it easier for consumers to compare prices and make informed decisions.

-

Consumer Protection: Increased competition should ultimately strengthen consumer protection, preventing price gouging and ensuring fairer pricing practices.

-

Potential for Price Wars: While competitive pricing benefits consumers, there's also a potential risk of price wars, which could lead to unsustainable pricing strategies for some players in the market.

Challenges and Opportunities for the Dangote Refinery

Despite its potential, the Dangote Refinery faces several challenges.

-

Infrastructure Needs: Adequate pipeline infrastructure and storage facilities are crucial for efficient distribution of refined products. Investment in these critical areas is essential for the refinery's success.

-

Regulatory Framework: A supportive and transparent regulatory framework is essential to encourage investment and ensure fair competition in the market.

-

Environmental Impact: Minimizing the environmental impact of refinery operations is crucial, demanding robust environmental protection measures.

-

Economic Diversification: The refinery represents a significant step towards economic diversification, reducing dependence on crude oil exports and fostering value addition within the country.

The Future of Petrol Prices in Nigeria

The interplay between NNPC and the Dangote Refinery will significantly shape the future of petrol prices in Nigeria.

-

Government Policies: Government policies related to deregulation, subsidies, and taxation will play a crucial role in determining the final price of petrol.

-

Global Oil Market Dynamics: Global crude oil prices and geopolitical factors will continue to influence petrol prices in Nigeria, even with increased local refining capacity.

-

Private Sector Investment: Further private sector investment in the downstream petroleum sector will enhance competition and potentially lead to lower prices.

-

Consumer Behavior: Changes in consumer demand and consumption patterns will also influence market dynamics and petrol pricing.

Conclusion:

Nigeria's petrol prices are intricately linked to the actions of both NNPC and the Dangote Group. While NNPC's current reliance on imports and subsidy management significantly impacts prices, the Dangote Refinery holds the potential to revolutionize the market through increased local production and competition. The future of Nigeria’s petrol prices hinges on successful refinery operations, effective deregulation, and a transparent pricing mechanism. Understanding the roles of NNPC and Dangote is crucial for navigating the complexities of Nigeria's fuel market and advocating for fairer and more stable petrol prices. Stay informed on the latest developments regarding Nigeria's petrol prices and the impact of key players like NNPC and Dangote.

Featured Posts

-

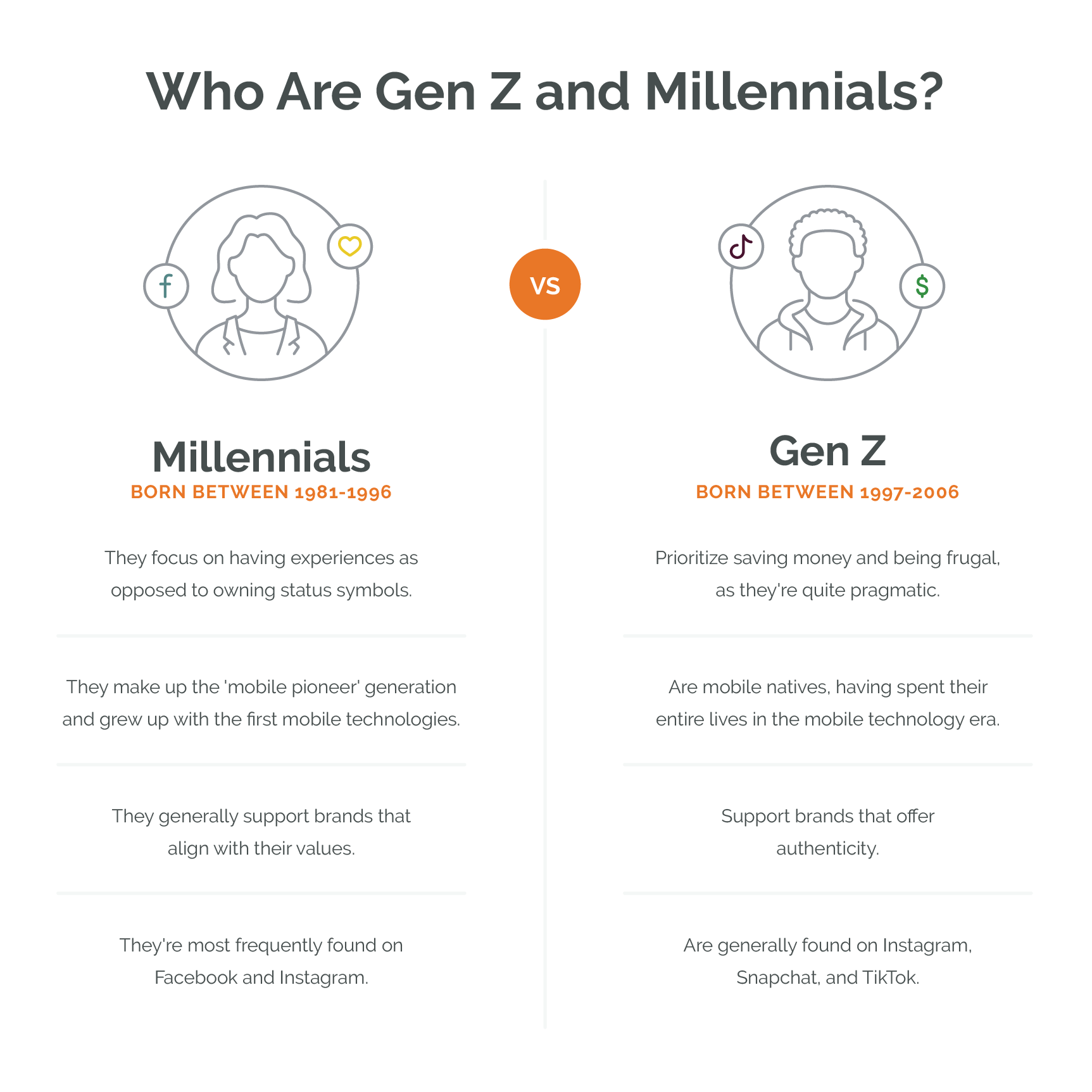

Does Androids Design Update Move The Needle With Gen Z

May 10, 2025

Does Androids Design Update Move The Needle With Gen Z

May 10, 2025 -

Nov Rimeyk Na Stivn King Ot Netflix Data Na Premierata I Podrobnosti

May 10, 2025

Nov Rimeyk Na Stivn King Ot Netflix Data Na Premierata I Podrobnosti

May 10, 2025 -

Indian Insurers Advocate For Simplified Bond Forward Regulations

May 10, 2025

Indian Insurers Advocate For Simplified Bond Forward Regulations

May 10, 2025 -

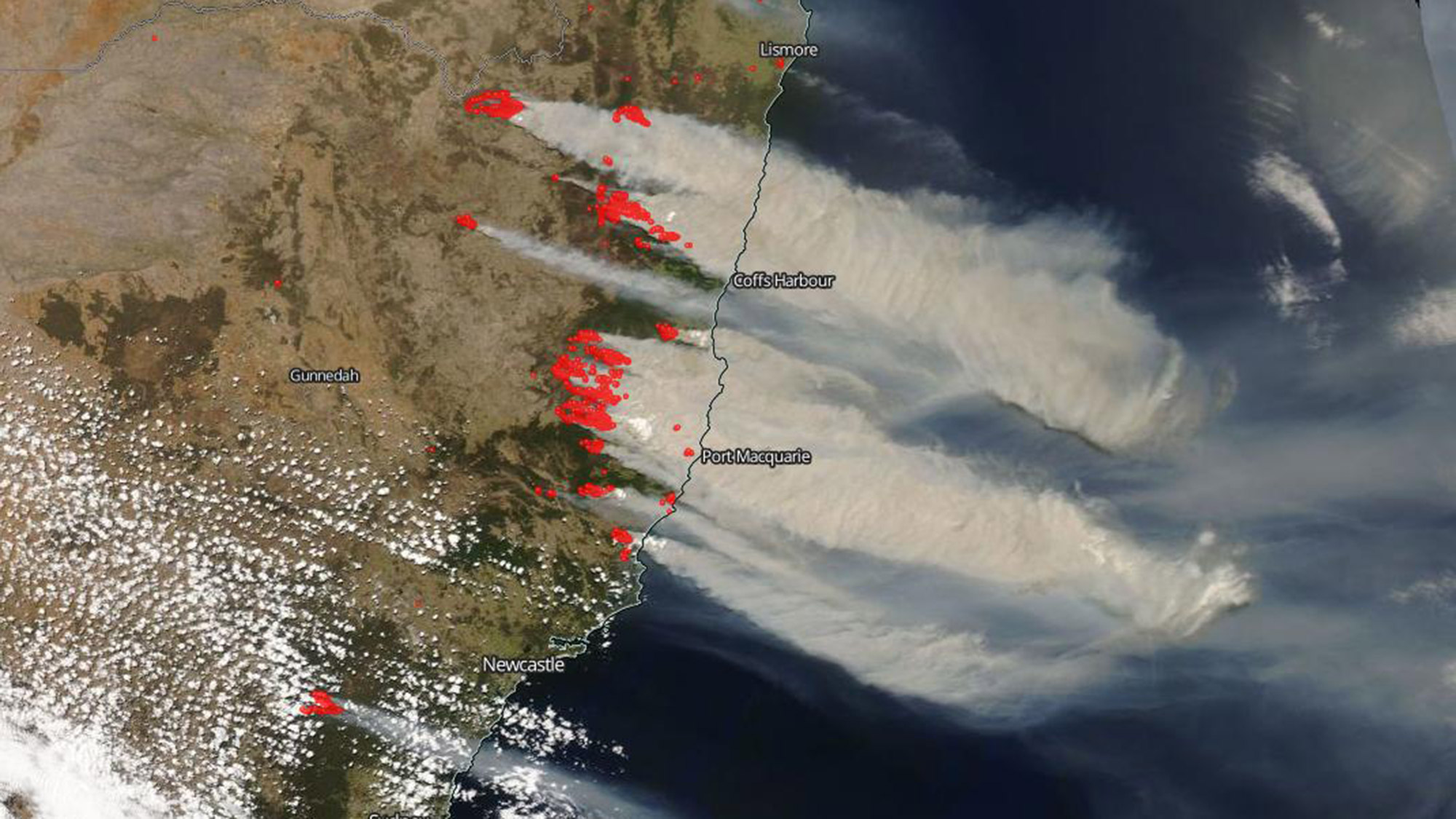

Gambling On Disaster The Case Of The La Wildfires

May 10, 2025

Gambling On Disaster The Case Of The La Wildfires

May 10, 2025 -

First Up Imf To Review Pakistans 1 3 Billion Loan Package Amidst Regional Tensions

May 10, 2025

First Up Imf To Review Pakistans 1 3 Billion Loan Package Amidst Regional Tensions

May 10, 2025