OECD 2025 Forecast: Canada To Escape Recession, But Expect Stagnant Growth

Table of Contents

Key Findings of the OECD 2025 Canada Forecast

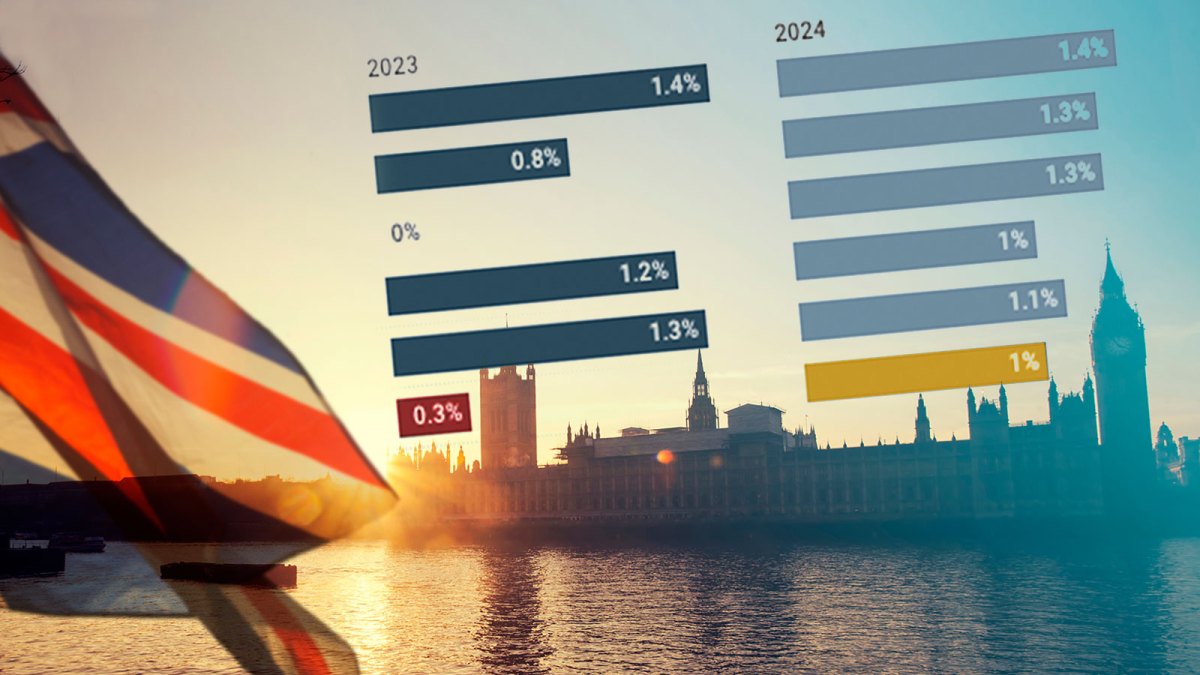

The OECD's 2025 forecast paints a picture of stagnant growth for the Canadian economy, predicting an avoidance of recession but highlighting significant challenges. The report projects a modest annual growth rate, likely below 2%, for the next few years. This represents a considerable slowdown compared to previous years of stronger expansion. Several key factors contribute to this prediction:

- Global Economic Slowdown: The ongoing global economic slowdown significantly impacts Canadian exports, particularly in key sectors like commodities and manufacturing. Reduced global demand directly affects Canada's economic output.

- Inflationary Pressures: Persistent inflationary pressures continue to pose a significant challenge. The Bank of Canada's efforts to control inflation through interest rate hikes, while necessary, also contribute to slower economic growth.

- Strengths of the Canadian Economy: Despite these headwinds, the Canadian economy exhibits resilience in certain areas. The resource sector, particularly energy, remains a significant contributor to GDP. Furthermore, the Canadian labor market has shown remarkable strength, with relatively low unemployment.

- Potential Risks: The OECD forecast acknowledges several potential risks that could negatively impact the Canadian economy. These include escalating geopolitical instability, further supply chain disruptions, and unforeseen shocks to global financial markets.

Impact on Key Economic Sectors in Canada

The OECD 2025 forecast has significant implications for various key sectors within the Canadian economy. Let's examine some of the most affected areas:

Housing Market

The Canadian housing market forecast suggests a period of adjustment. While a dramatic crash is unlikely, expect slower price growth and potentially even some price corrections in certain overheated markets. Mortgage rates in Canada are expected to remain elevated for the foreseeable future, impacting affordability and buyer demand. This could lead to a period of lower transaction volumes.

Employment

The Canadian job market is expected to remain relatively resilient, albeit with slower job growth compared to previous years. Unemployment rates in Canada are anticipated to remain low, but the creation of new jobs might slow down due to the broader economic slowdown. This will likely vary across sectors, with some experiencing job losses while others remain relatively stable.

Inflation

Canadian inflation is projected to gradually decline, but it will likely remain above the Bank of Canada's target for some time. This persistent inflation will continue to impact consumer spending and overall economic growth, potentially squeezing household budgets. The CPI Canada index will be closely watched to monitor progress in taming inflation.

Government Policy and Economic Response

The Canadian government will likely need to implement a combination of fiscal and monetary policies to address the challenges highlighted in the OECD forecast. Potential responses include targeted fiscal stimulus measures focused on infrastructure investment and support for vulnerable sectors. Monetary policy, primarily managed by the Bank of Canada, may continue to adjust interest rates to manage inflation, striking a delicate balance between controlling inflation and supporting economic growth. The OECD may also recommend specific policy interventions to help Canada navigate this economic climate. Potential government initiatives could include:

- Increased investments in green technology and sustainable infrastructure.

- Targeted support programs for small and medium-sized enterprises (SMEs).

- Expansion of social safety nets to mitigate the impact of inflation on vulnerable populations.

Opportunities and Challenges for Canadian Businesses

The OECD 2025 forecast presents both challenges and opportunities for Canadian businesses. While slow growth and inflation present considerable hurdles, adaptable businesses can find ways to thrive.

Challenges: Reduced consumer spending, increased input costs, and tighter credit conditions will necessitate careful financial management.

Opportunities: Businesses that can innovate, adapt to changing consumer demands, and embrace digital transformation will be well-positioned to succeed. Focusing on efficiency, cost reduction, and targeted marketing will be crucial.

Strategies for business adaptation and resilience include:

- Diversifying revenue streams and markets.

- Investing in technology and automation.

- Focusing on sustainable practices to reduce costs and attract environmentally conscious consumers.

Conclusion: Navigating the OECD 2025 Forecast for Canada's Economy

The OECD 2025 forecast for Canada indicates a period of sluggish growth and challenges related to inflation, but also highlights the avoidance of a recession. Understanding the implications of this forecast is crucial for both businesses and policymakers. Businesses must proactively adapt their strategies to navigate this economic climate, focusing on resilience and innovation. Policymakers must carefully consider fiscal and monetary policies to support growth while controlling inflation. Understand the implications of the OECD's Canada economic forecast for 2025 and plan accordingly. Learn more about the complete OECD report here [link to OECD report].

Featured Posts

-

1 Million Lottery Ticket Six Weeks Remain To Claim Your Prize

May 28, 2025

1 Million Lottery Ticket Six Weeks Remain To Claim Your Prize

May 28, 2025 -

Googles Veo 3 Ai Video Generator A Boon For Low Budget Filmmakers

May 28, 2025

Googles Veo 3 Ai Video Generator A Boon For Low Budget Filmmakers

May 28, 2025 -

Cubs Vs Diamondbacks Game Prediction Outright Cubs Victory

May 28, 2025

Cubs Vs Diamondbacks Game Prediction Outright Cubs Victory

May 28, 2025 -

Voici Les 5 Smartphones Avec La Meilleure Autonomie En 2024

May 28, 2025

Voici Les 5 Smartphones Avec La Meilleure Autonomie En 2024

May 28, 2025 -

Direct Lender Payday Loans Guaranteed Approval For Bad Credit

May 28, 2025

Direct Lender Payday Loans Guaranteed Approval For Bad Credit

May 28, 2025

Latest Posts

-

Up To 30 Off Enjoy A Lavish Hotel Stay This Spring

May 31, 2025

Up To 30 Off Enjoy A Lavish Hotel Stay This Spring

May 31, 2025 -

Book Now And Save 30 Off Lavish Spring Hotel Stays

May 31, 2025

Book Now And Save 30 Off Lavish Spring Hotel Stays

May 31, 2025 -

The Reality Of Ai Navigating The Challenges Of Responsible Ai Development

May 31, 2025

The Reality Of Ai Navigating The Challenges Of Responsible Ai Development

May 31, 2025 -

Luxury Hotel Spring Break 30 Off Your Stay

May 31, 2025

Luxury Hotel Spring Break 30 Off Your Stay

May 31, 2025 -

Why Ai Doesnt Learn And How This Impacts Responsible Ai Practices

May 31, 2025

Why Ai Doesnt Learn And How This Impacts Responsible Ai Practices

May 31, 2025