Oil Market Update For May 16: Prices, Trends, And Analysis

Table of Contents

Current Oil Prices and Price Volatility

As of May 16th, benchmark crude oil prices showed [Insert actual Brent and WTI prices here, e.g., Brent crude oil at $75 per barrel and WTI crude oil at $72 per barrel]. Compared to the previous day/week [Insert comparison data showing percentage change], this represents a [Increase/Decrease] in price. This volatility underscores the need for constant monitoring of the crude oil price forecast.

Several factors contributed to this price movement:

- Geopolitical Events: [Mention specific geopolitical events impacting prices, e.g., ongoing conflicts, political instability in a major oil-producing region]. These events create uncertainty and can significantly influence oil price volatility.

- OPEC+ Decisions: The recent decisions by OPEC+ regarding production quotas [Explain the decision and its impact on supply and price]. This highlights the significant role of OPEC+ production in shaping the global oil market.

- Economic Data: Recent economic indicators from major oil-consuming nations [Mention specific data, e.g., GDP growth, manufacturing PMI] suggest [Explain the impact of these indicators on oil demand]. These economic factors strongly influence the oil demand forecast.

- Seasonal Demand: The increase/decrease in seasonal demand for oil [Explain seasonal factors impacting demand, e.g., summer driving season] also played a role in influencing prices.

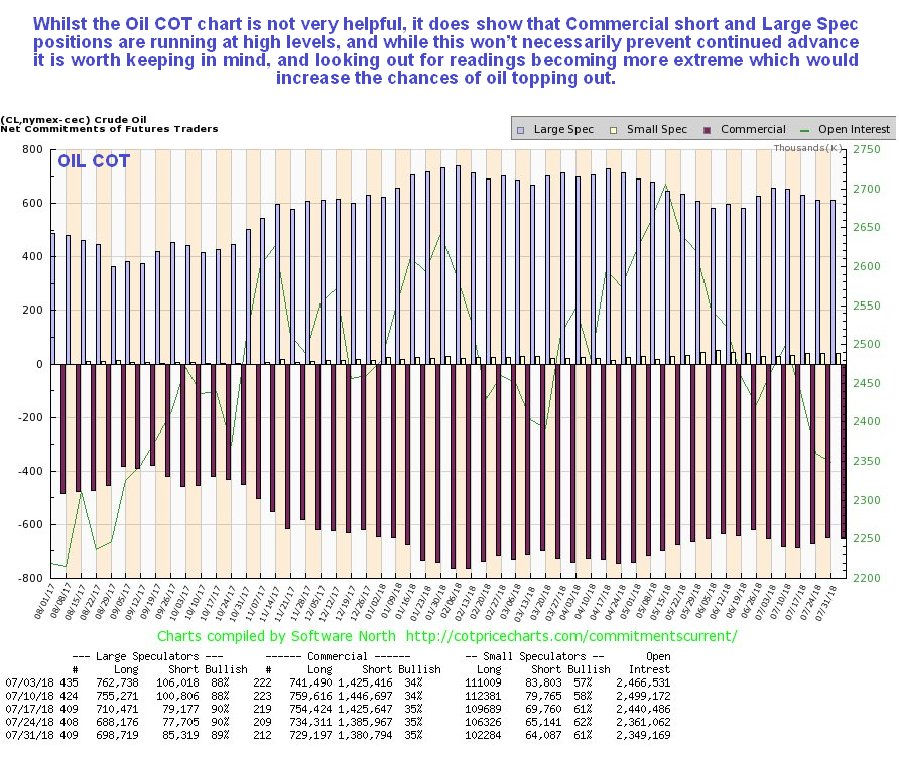

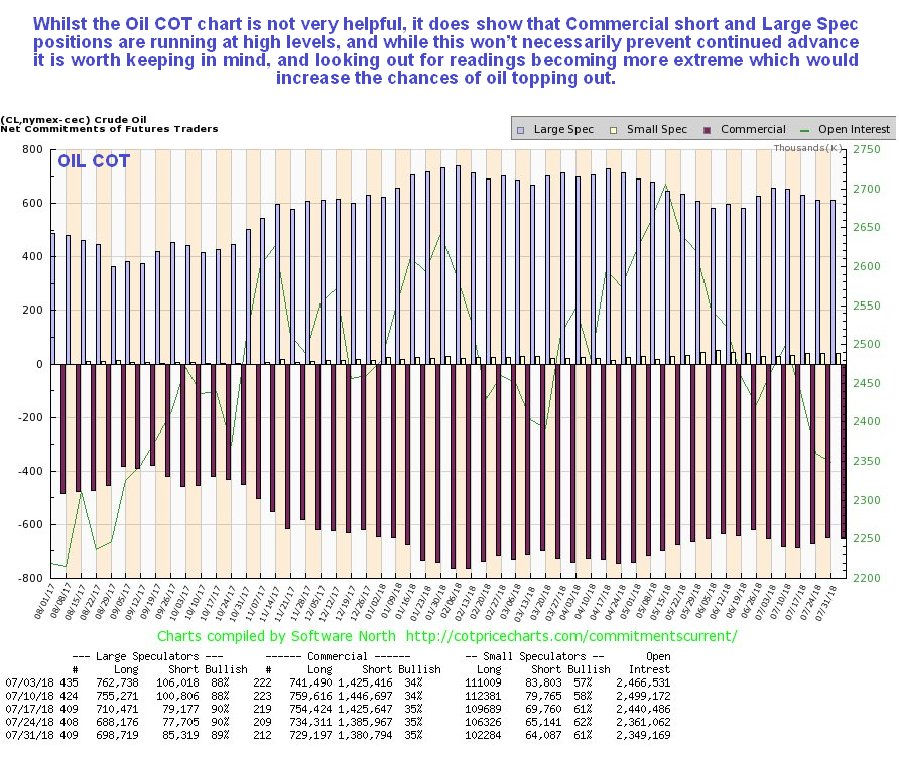

[Insert a chart or graph visually representing the price fluctuations of Brent and WTI crude oil around May 16th].

Key Market Trends Influencing Oil Prices

The global oil supply and demand dynamics remain a key driver of oil prices. Current trends include:

- Supply Disruptions: [Discuss any significant supply disruptions, e.g., sanctions on Russian oil, production outages due to natural disasters]. These disruptions directly impact the global oil production levels.

- OPEC+ and Russia's Role: The policies and actions of major oil-producing countries like OPEC+, Russia, and the USA significantly impact the market. [Explain their current strategies and their influence on prices].

- Economic Growth in Major Consumers: The economic growth (or slowdown) in major oil-consuming nations like China, the USA, and the EU plays a critical role in shaping oil demand forecast. A strong global economy usually leads to higher oil demand and prices.

Geopolitical Factors and Their Influence

Geopolitical risks remain a significant factor influencing oil market instability. Specifically:

- [Mention specific geopolitical events impacting prices, elaborating on their influence. For example: The ongoing conflict in [region] has led to supply disruptions and uncertainty, pushing prices higher. Sanctions imposed on [country] have further tightened the global oil supply.]

- [Discuss the impact of sanctions, trade wars, and political risks, providing concrete examples]. These factors contribute to oil politics and influence the overall oil market.

- [Mention any potential future geopolitical events that could influence oil prices, providing a reasoned analysis of their potential impact].

Analysis and Market Forecast for May 16th and Beyond

Based on the current market conditions, the short-term oil price prediction for the coming weeks suggests [State your prediction with justification, referencing the previously discussed factors]. However, significant uncertainties remain:

- Unpredictability of geopolitical events.

- Potential changes in OPEC+ production policies.

- Unexpected shifts in global economic growth.

These uncertainties make precise oil market forecasting challenging, and this oil future price projection should be viewed with caution. The oil market outlook remains highly dependent on the evolution of these factors.

Conclusion: Understanding the Oil Market Update for May 16th and Making Informed Decisions

This oil market update for May 16 highlights the considerable price volatility and the multifaceted factors influencing the oil prices. Geopolitical events, OPEC+ decisions, economic data, and seasonal demand all play significant roles. Understanding these dynamics is crucial for making informed decisions related to oil prices, oil market analysis, and crude oil trading. Stay informed about the latest oil market update to navigate this volatile landscape effectively. Regularly check reputable sources for the latest updates to make sound judgments regarding your investments or business strategies related to crude oil. Remember, a comprehensive understanding of the oil market update empowers you to make better decisions.

Featured Posts

-

From Scatological Data To Insightful Podcast The Power Of Ai

May 17, 2025

From Scatological Data To Insightful Podcast The Power Of Ai

May 17, 2025 -

Cassidy Hutchinson Plans Memoir On Her Jan 6th Committee Testimony

May 17, 2025

Cassidy Hutchinson Plans Memoir On Her Jan 6th Committee Testimony

May 17, 2025 -

May 16 Oil Market Report News And In Depth Analysis

May 17, 2025

May 16 Oil Market Report News And In Depth Analysis

May 17, 2025 -

16 Million Penalty For T Mobile A Three Year Data Breach Investigation

May 17, 2025

16 Million Penalty For T Mobile A Three Year Data Breach Investigation

May 17, 2025 -

Reeses Post Game Comments After Chicago Sky Matchup

May 17, 2025

Reeses Post Game Comments After Chicago Sky Matchup

May 17, 2025

Latest Posts

-

Heartfelt Message Angel Reese Cheers On Brothers Ncaa Win

May 17, 2025

Heartfelt Message Angel Reese Cheers On Brothers Ncaa Win

May 17, 2025 -

Angel Reeses Brother Wins Ncaa Game Her Sweet Mom Message

May 17, 2025

Angel Reeses Brother Wins Ncaa Game Her Sweet Mom Message

May 17, 2025 -

Family First Angel Reeses Message To Mom After Brothers Ncaa Win

May 17, 2025

Family First Angel Reeses Message To Mom After Brothers Ncaa Win

May 17, 2025 -

Reese Shows Motherly Love Supporting Brothers Ncaa Game Win

May 17, 2025

Reese Shows Motherly Love Supporting Brothers Ncaa Game Win

May 17, 2025 -

The Chrisean Rock Interview Controversy Angel Reeses Response

May 17, 2025

The Chrisean Rock Interview Controversy Angel Reeses Response

May 17, 2025