Palantir Stock Before May 5th: Is It A Buy Or Sell?

Table of Contents

Palantir's Recent Performance and Financial Health

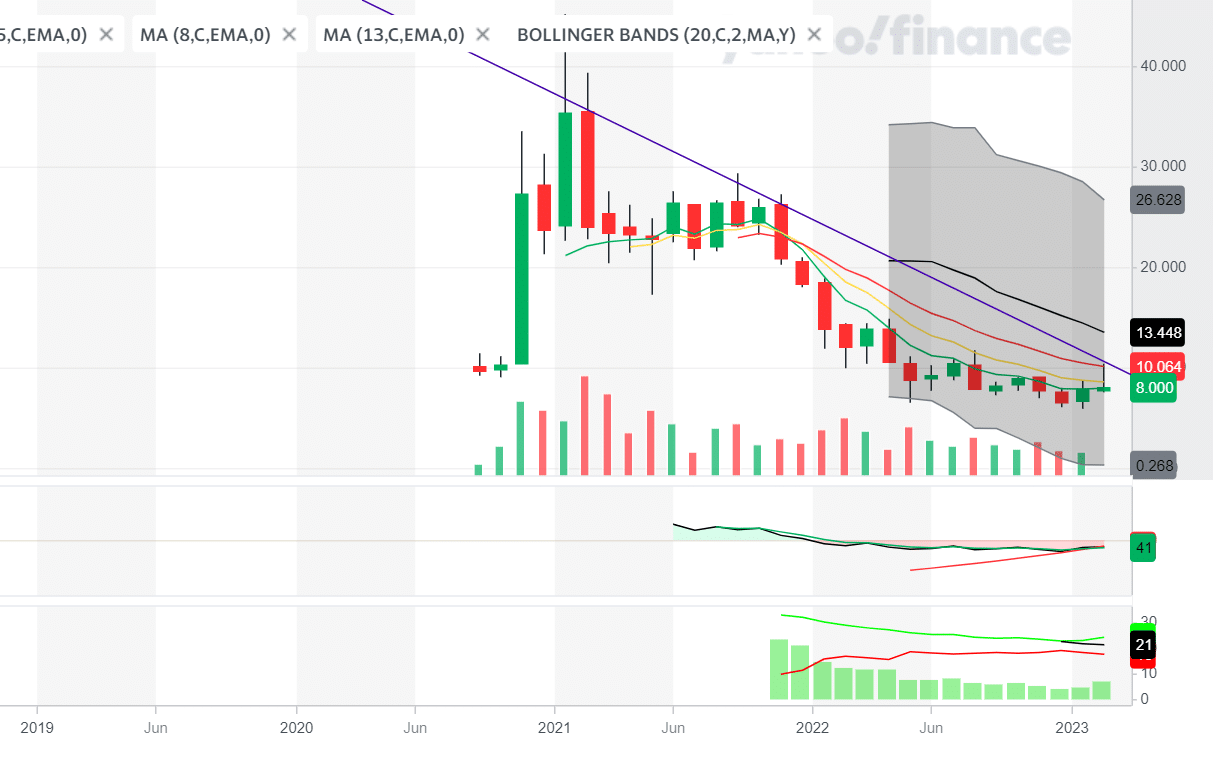

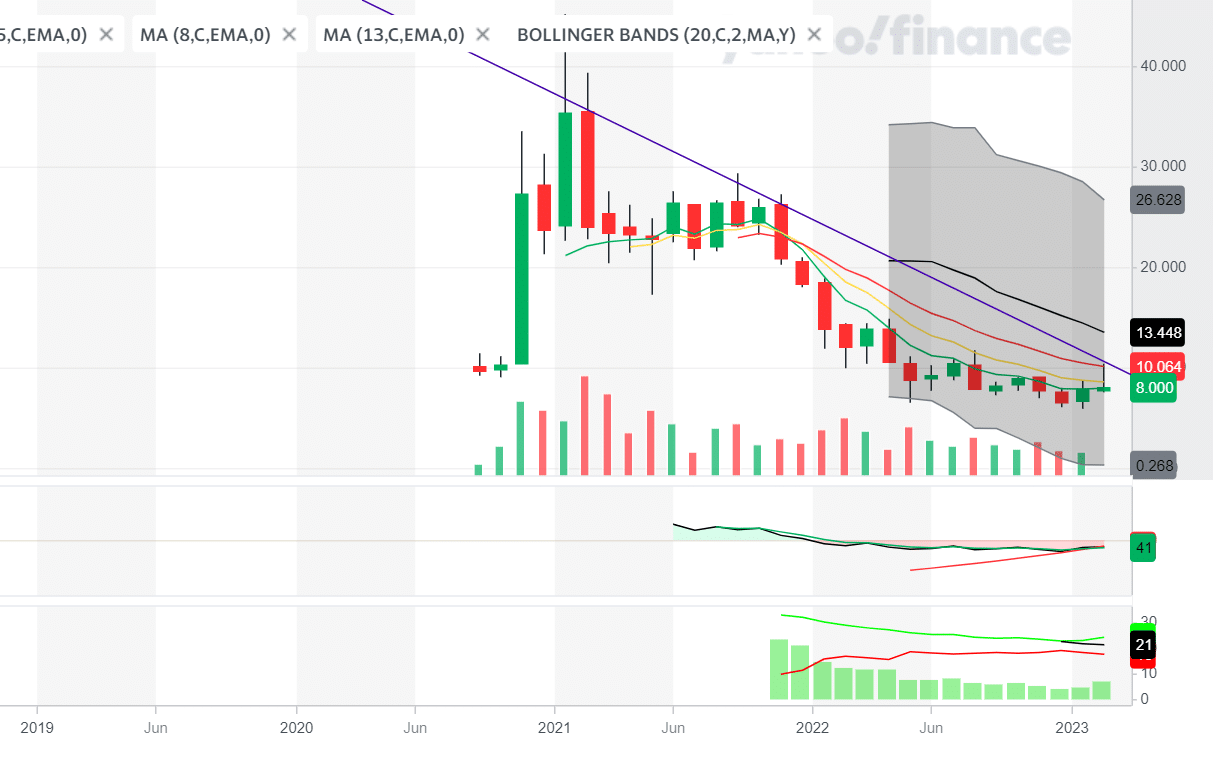

Palantir's recent stock performance has been a mixed bag, reflecting the complexities of its business model and the broader market conditions. While the company has demonstrated consistent revenue growth, profitability remains elusive for the data analytics giant. Analyzing key financial metrics is essential for understanding the company’s overall health and future potential.

To fully grasp Palantir's financial health, let's look at some key indicators:

-

Revenue growth rate (Q4 2023 vs. Q4 2022): [Insert data here – replace with actual figures and a percentage change. Include a chart or graph if possible showing revenue growth over time]. This metric reveals the speed at which Palantir is expanding its operations and securing new contracts.

-

Profit margin analysis: [Insert data here – analyze gross profit margin, operating profit margin, and net profit margin. Discuss any trends and potential causes for profitability challenges. Again, visual aids such as charts would be beneficial]. Palantir's path to profitability is a key concern for many investors.

-

Debt-to-equity ratio: [Insert data here – and provide context on the company's financial leverage. A high ratio suggests higher risk]. This ratio is a measure of the company’s financial risk.

-

Key customer acquisition trends: [Describe any significant trends in customer acquisition, focusing on the types of clients and sectors. Mention government contracts versus commercial clients]. Understanding where Palantir's revenue is coming from is crucial.

Market Sentiment and Analyst Predictions

Market sentiment towards Palantir stock is currently [insert description - bullish, bearish, or neutral]. This sentiment is influenced by a variety of factors, including recent financial reports, analyst ratings, and overall market trends.

Let's examine what analysts are saying:

-

Average analyst price target: [Insert the average price target from reputable sources like Yahoo Finance, Bloomberg, or MarketWatch]. This reflects the consensus expectation for Palantir's future stock price.

-

Number of buy, hold, and sell ratings: [Insert the number of each rating from various sources, showing the distribution of analyst opinions]. A divergence of opinions highlights the uncertainty surrounding Palantir's prospects.

-

Key factors influencing analyst predictions: [Discuss the main factors analysts consider, including revenue growth, profitability projections, competition, and market conditions]. This provides insight into the rationale behind their ratings.

-

Impact of macroeconomic factors: [Analyze how factors like inflation, interest rates, and recessionary fears are impacting investor confidence in Palantir and the broader tech sector]. Macroeconomic conditions can significantly affect investor sentiment.

Potential Catalysts Affecting Palantir Stock Before May 5th

The anticipation surrounding May 5th likely stems from [mention the specific event, e.g., earnings report release, product launch, or major contract announcement]. This event could act as a significant catalyst, potentially impacting Palantir's stock price considerably.

Let's break down the potential impacts:

-

Expected date and time of earnings release: [State the expected date and time if known]. This is a critical time for investors.

-

Potential impact of earnings on stock price: [Discuss the possible scenarios - exceeding expectations leading to price increases, or disappointing results leading to price decreases]. The market reaction will depend on the numbers.

-

Other potential catalysts (e.g., new contracts, partnerships): [Mention any other potential events that could influence the stock price]. Unexpected developments could also play a major role.

-

Risks associated with investing before the event: [Highlight the inherent volatility and risks involved in investing before a major event like an earnings release]. Investors should be prepared for potential price swings.

Alternative Investment Options in the Data Analytics Sector

While Palantir holds a strong position in the data analytics market, it's important to consider alternative investment opportunities within this rapidly growing sector. Several companies offer compelling alternatives, each with unique strengths and weaknesses.

Here's a quick comparison:

-

List of key competitors (e.g., Snowflake, Databricks): [List at least two or three key competitors and briefly describe their business models]. These companies represent different approaches within the data analytics field.

-

Comparison of market capitalization and growth potential: [Compare the market caps and projected growth rates of Palantir and its competitors]. This shows the relative size and potential of each company.

-

Comparison of profitability and financial stability: [Compare the profitability and financial strength of Palantir to its competitors]. This helps evaluate the relative risk and reward of each investment.

Conclusion: Making the Palantir Stock Decision Before May 5th

Based on our analysis of Palantir's recent performance, market sentiment, upcoming catalysts, and alternative investment options, the decision to buy, sell, or hold Palantir stock before May 5th remains complex. While Palantir shows promise in its revenue growth and technological capabilities, concerns remain regarding profitability and market volatility. The upcoming event on May 5th will likely significantly impact the stock price, presenting both substantial potential rewards and considerable risks. Therefore, we advise a cautious approach.

It is crucial to conduct your own thorough due diligence before making any investment decisions regarding Palantir stock. Consider your personal risk tolerance and investment goals. Consult with a qualified financial advisor before investing in any stock, and remember to diversify your portfolio to mitigate risk. Remember to consult reputable financial news sources and analyst reports to stay updated on Palantir's progress and the overall market conditions. This analysis should not be considered financial advice.

Featured Posts

-

Jeanine Pirros Stock Market Warning Ignore The Market For The Next Few Weeks

May 10, 2025

Jeanine Pirros Stock Market Warning Ignore The Market For The Next Few Weeks

May 10, 2025 -

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025

Oilers Vs Kings Series Betting Odds And Predictions

May 10, 2025 -

Wynne Evans Dropped From Go Compare Ads After Sexism Scandal

May 10, 2025

Wynne Evans Dropped From Go Compare Ads After Sexism Scandal

May 10, 2025 -

Interest Rate Decision Fed Weighs Inflation And Unemployment Risks

May 10, 2025

Interest Rate Decision Fed Weighs Inflation And Unemployment Risks

May 10, 2025 -

2 Stocks Poised To Surpass Palantirs Value In 3 Years A Prediction

May 10, 2025

2 Stocks Poised To Surpass Palantirs Value In 3 Years A Prediction

May 10, 2025