Palantir Stock: Evaluating The 30% Dip And Future Potential

Table of Contents

Palantir Technologies (PLTR) has experienced a significant 30% dip in its stock price recently. This dramatic fall has left many investors questioning the future potential of this data analytics powerhouse. Is this a temporary setback, presenting a lucrative buying opportunity, or a sign of deeper underlying issues? This article will delve into the reasons behind the price drop and explore Palantir's prospects for future growth, helping you decide if Palantir stock is right for your portfolio.

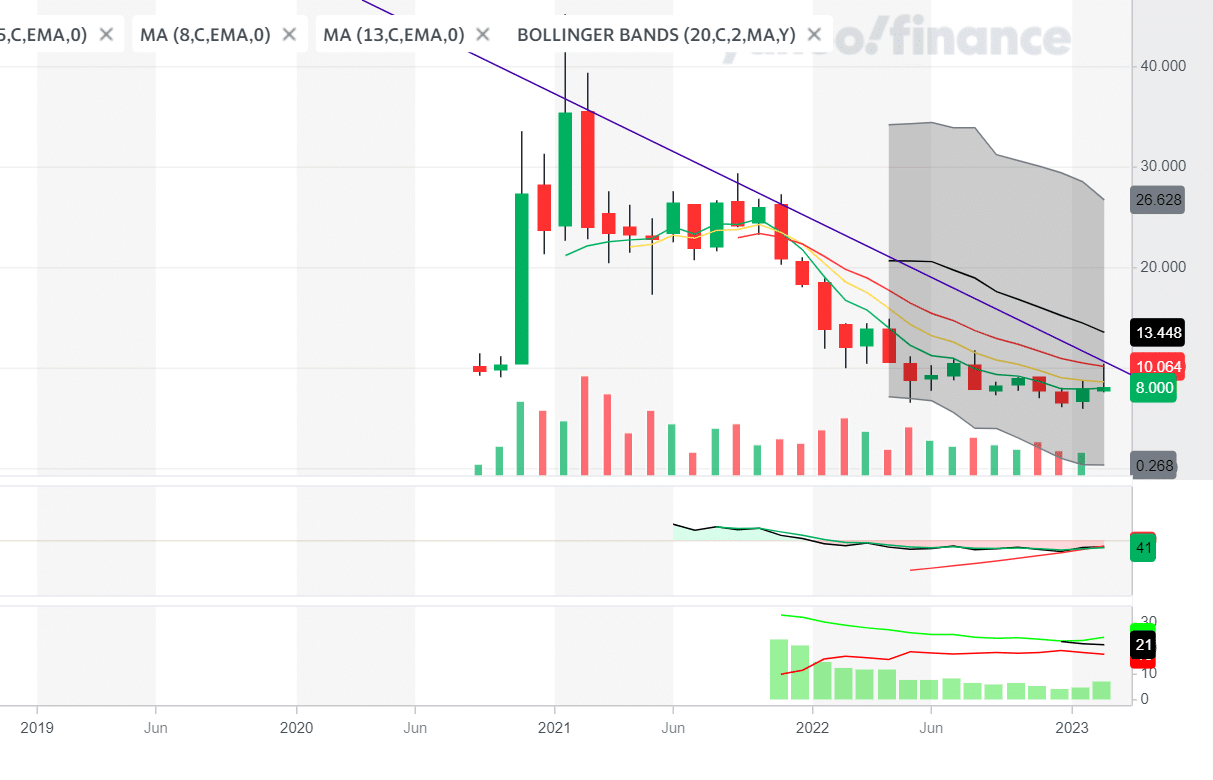

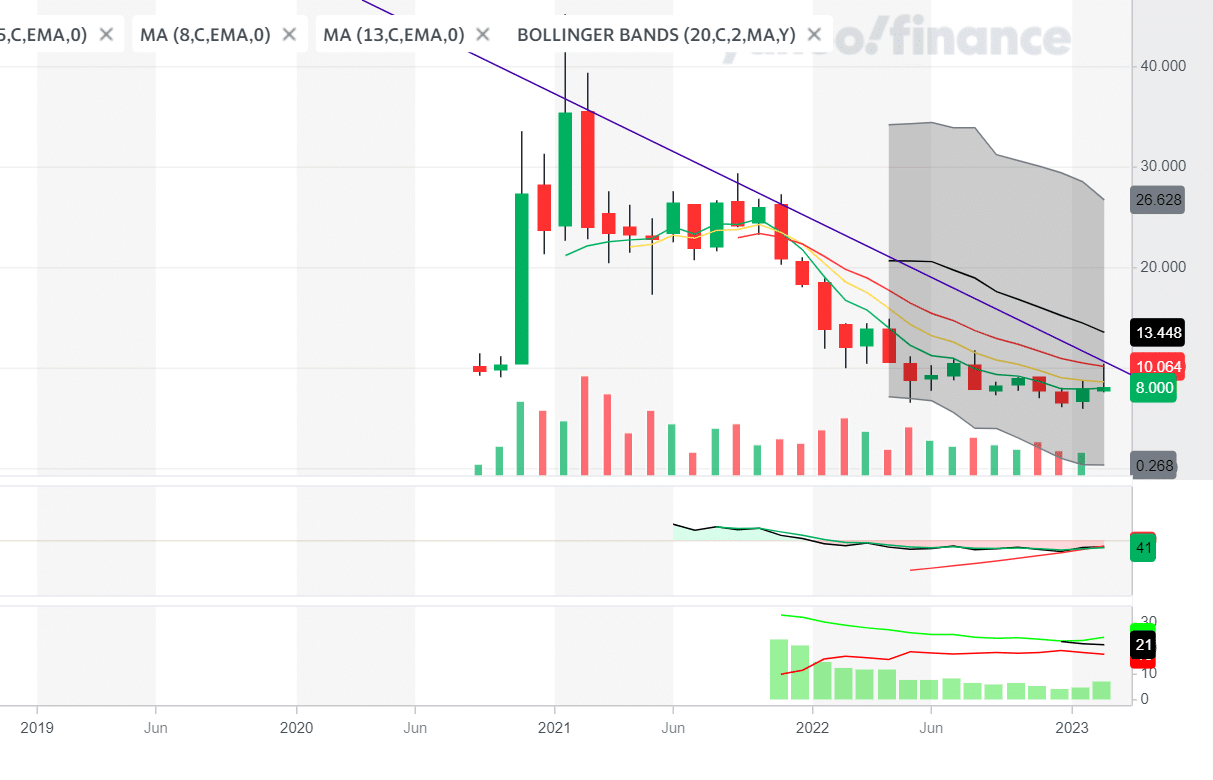

Analyzing the 30% Stock Price Dip

Macroeconomic Factors

The recent downturn in Palantir's stock price isn't isolated; it reflects broader macroeconomic headwinds impacting the technology sector. Increased interest rates, aimed at curbing inflation, have significantly reduced investor appetite for growth stocks like Palantir. This is because higher interest rates increase the cost of borrowing, making expansion more expensive and reducing the present value of future earnings, a key metric for growth stocks.

- Increased risk aversion: Investors are shifting towards safer investments during periods of economic uncertainty.

- Reduced investor appetite for growth stocks: Growth stocks, often characterized by high valuations and future earnings potential, are particularly vulnerable during periods of rising interest rates.

- General market volatility: The overall volatility in the stock market, reflected in the performance of indices like the S&P 500 and Nasdaq Composite, has contributed to the decline in Palantir's price. For instance, the Nasdaq Composite, which heavily weights technology companies, has seen significant fluctuations recently, impacting PLTR stock directly.

Company-Specific Factors

Beyond macroeconomic factors, certain company-specific events might have contributed to the Palantir price drop. While Palantir consistently secures large government contracts, recent quarterly earnings reports might have fallen short of analyst expectations, impacting investor confidence. Any news related to changes in management or increased competition within the data analytics sector could also fuel negative sentiment.

- Quarterly earnings reports: Missed revenue projections or lower-than-expected earnings growth can significantly influence a stock's price.

- Changes in management: Shifts in leadership can cause uncertainty among investors, potentially impacting the stock's performance.

- Competition within the data analytics sector: The data analytics market is highly competitive, and the emergence of new players or innovative technologies from established competitors poses a potential threat to Palantir's market share.

Sentiment and Investor Confidence

Negative media coverage, analyst downgrades, and social media sentiment can all contribute to a decline in investor confidence and drive down a stock's price. Short-term market fluctuations are often heavily influenced by these sentiments. A single negative news article, for example, could trigger a sell-off, particularly in a volatile market environment.

- Negative media reports: Unfavorable news stories can quickly impact investor perception and lead to a sell-off.

- Analyst downgrades: Changes in analyst ratings can signal a shift in sentiment, influencing other investors' decisions.

- Social media sentiment analysis: The tone and volume of conversations about Palantir on social media platforms can provide valuable insights into investor sentiment.

Evaluating Palantir's Long-Term Growth Potential

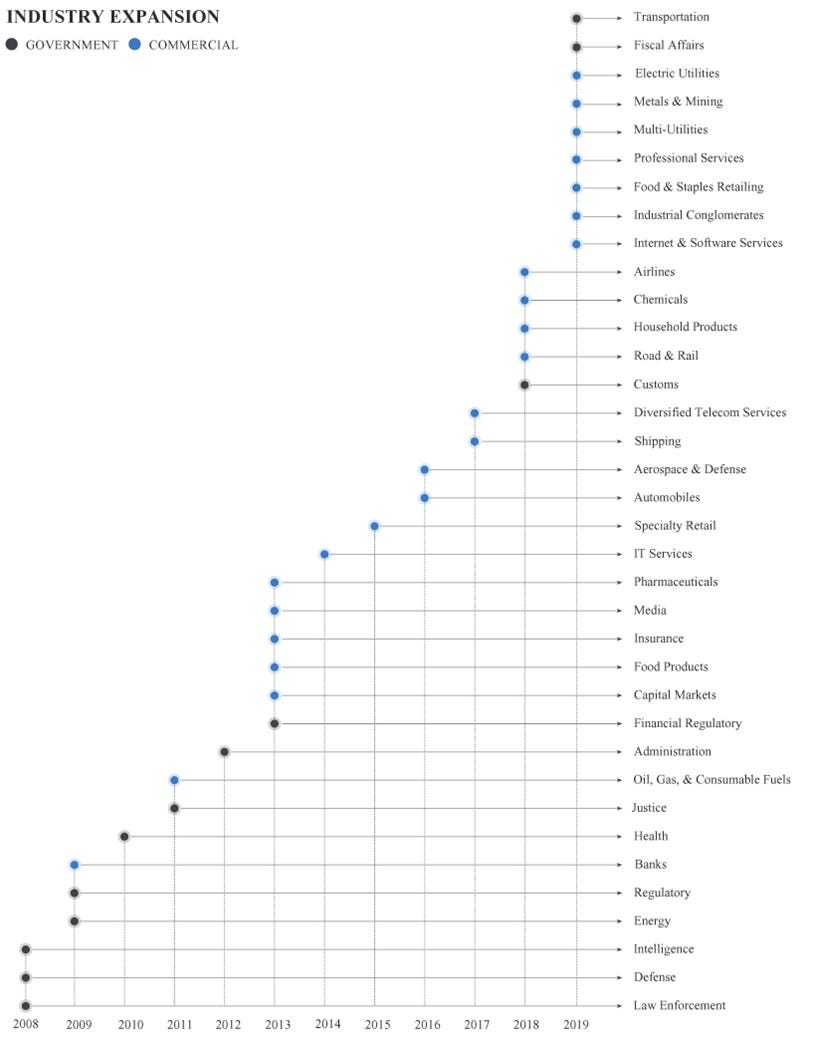

Government Contracts and Partnerships

Palantir boasts a strong presence in government contracts, providing a relatively stable revenue stream. This sector provides a foundation for consistent growth, reducing reliance on the often more volatile commercial market. Continued expansion into new government sectors offers significant long-term potential.

- Ongoing contracts with defense agencies: These long-term contracts offer revenue predictability and reduce risk.

- Potential expansion into new government sectors: Exploring opportunities in healthcare, intelligence, and other government departments presents avenues for growth.

- Stability and predictability of government revenue streams: This steady income stream mitigates the volatility associated with commercial contracts.

Commercial Market Expansion

Palantir's success hinges on its ability to expand its commercial customer base. Progress in key sectors like finance and healthcare, alongside strategic partnerships with major corporations, are vital to future growth.

- Growth in specific industries: Focus on sectors with high adoption potential for data analytics solutions is key.

- Successful partnerships with large corporations: Collaborations with industry leaders can accelerate market penetration and brand recognition.

- Potential for increased revenue from the commercial sector: This sector offers higher growth potential compared to the more stable, yet slower-growing, government sector.

Technological Innovation and Competitive Advantage

Palantir's commitment to technological innovation, particularly in AI and machine learning, is crucial for maintaining its competitive advantage. Its data integration platform and ability to develop new products are key differentiators.

- Focus on Artificial Intelligence (AI): Investing in AI capabilities will be critical for staying competitive and providing advanced data analytics solutions.

- Machine learning capabilities: Utilizing machine learning enhances data analysis, enabling the creation of more effective and valuable solutions.

- Data integration platform: Palantir's platform's ability to integrate data from various sources provides a significant advantage over competitors.

Risk Assessment and Investment Considerations

Valuation and Pricing

Analyzing Palantir's valuation relative to its historical performance and industry peers is crucial. Metrics like the Price-to-Sales ratio (P/S) and Price-to-Earnings ratio (P/E) provide insights into its relative value.

- Price-to-sales ratio (P/S): Comparing Palantir's P/S ratio to similar companies reveals if it's overvalued or undervalued.

- Price-to-earnings ratio (P/E): A high P/E ratio suggests investors expect high future earnings growth.

- Market capitalization: This indicates the overall size and value of the company in the market.

- Potential for further price fluctuations: Given the volatile nature of the tech sector and macroeconomic uncertainty, further price fluctuations are likely.

Competition and Market Dynamics

The data analytics market is highly competitive. Understanding Palantir's position relative to major players like Microsoft, Amazon, and Google is crucial for evaluating its future prospects.

- Major players in the industry: Analyzing the strengths and weaknesses of key competitors is vital.

- Potential threats from emerging technologies: New technologies can disrupt the market and potentially impact Palantir's market share.

- Potential challenges and opportunities for Palantir: Identifying potential challenges and adapting strategies accordingly is essential for sustained growth.

Financial Health and Sustainability

Assessing Palantir's financial health, including its cash flow, profitability, and debt levels, is important for determining its long-term sustainability.

- Cash flow: A strong positive cash flow demonstrates the company's ability to generate revenue and meet its financial obligations.

- Profitability: Sustained profitability is essential for long-term growth and investor confidence.

- Debt levels: High debt levels can increase financial risk and limit growth potential.

- Key factors affecting Palantir's financial prospects: Understanding these factors allows for a better assessment of the company's financial stability.

Conclusion

The recent 30% dip in Palantir stock presents both challenges and opportunities. While macroeconomic factors and company-specific issues contributed to the decline, Palantir's long-term growth potential remains significant, driven by strong government partnerships, expanding commercial markets, and continuous technological innovation. However, investors must carefully assess the risks and consider the company's valuation before making any investment decisions. Thorough due diligence, a long-term perspective, and a diversified investment strategy are crucial when evaluating Palantir stock and other volatile technology investments. Conduct your own research and consult a financial advisor before investing in Palantir stock or any other security.

Featured Posts

-

Kraujingos Plintos Nuotraukos Dakota Johnson Ir Ivykio Aplinkybes

May 09, 2025

Kraujingos Plintos Nuotraukos Dakota Johnson Ir Ivykio Aplinkybes

May 09, 2025 -

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 09, 2025

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 09, 2025 -

Franko Polskoe Partnerstvo Oboronnoe Soglashenie I Ego Znachenie Dlya Evropy

May 09, 2025

Franko Polskoe Partnerstvo Oboronnoe Soglashenie I Ego Znachenie Dlya Evropy

May 09, 2025 -

Bundesliga 2 Overview Colognes Victory Over Hamburg

May 09, 2025

Bundesliga 2 Overview Colognes Victory Over Hamburg

May 09, 2025 -

Will Hertls Injury Sideline The Golden Knights

May 09, 2025

Will Hertls Injury Sideline The Golden Knights

May 09, 2025