Palantir Stock Forecast 2025: Is A 40% Rise Realistic? A Comprehensive Analysis

Table of Contents

H2: Palantir's Current Market Position and Financial Performance

Palantir, a leader in providing data analytics and operational software platforms to government and commercial clients, currently holds a significant market position, though its market capitalization fluctuates. To understand the potential for a 40% rise in the Palantir stock forecast 2025, we need to examine its recent financial performance. Analyzing recent quarterly and annual reports is crucial. Key performance indicators (KPIs) provide a clearer picture:

- Revenue growth year-over-year: Consistent double-digit growth is a positive sign, indicating strong demand for Palantir's services.

- Profitability margins: Improving margins demonstrate increasing operational efficiency and profitability.

- Customer acquisition and retention rates: High customer retention suggests strong client satisfaction and a recurring revenue stream, vital for sustained growth.

- Government vs. commercial sector revenue breakdown: Analyzing the balance between these two sectors helps assess the risk profile and growth potential.

Palantir faces competition from established tech giants like Microsoft and Amazon Web Services (AWS), but its specialized platforms and strong government relationships provide a competitive edge. Its market share within the big data and analytics industry is constantly evolving and needs continuous monitoring for the Palantir stock forecast 2025.

H2: Growth Drivers and Potential Catalysts for a 40% Rise

Several factors could propel Palantir towards a 40% stock price increase by 2025:

- Successful expansion into new markets: Penetration into new industries like healthcare and finance could significantly expand its customer base. Each new vertical market presents opportunities outlined in their growth strategy.

- Strategic partnerships and acquisitions: Collaborations with other technology companies could broaden Palantir's capabilities and market reach. Acquisitions could bring valuable technologies and talent.

- Technological advancements and product innovation: Investing in artificial intelligence (AI) and machine learning (ML) could lead to innovative products and enhanced offerings, further cementing its position. The development of AI-powered solutions is particularly important for the Palantir stock forecast 2025.

- Increased government contracts and funding: Continued government investment in national security and data analytics initiatives represents a substantial growth opportunity for Palantir. Securing large contracts is critical.

Each of these catalysts has the potential to significantly impact Palantir's financial performance and, subsequently, its stock price. The success and timing of these initiatives are crucial for a bullish Palantir stock forecast 2025.

H2: Risks and Challenges That Could Hinder Growth

Despite the positive outlook, several challenges could hinder Palantir's growth and impact the Palantir stock forecast 2025:

- Increased competition from established tech giants: The competitive landscape is intense, and maintaining a competitive edge is crucial.

- Economic downturns and reduced government spending: Economic instability could lead to reduced government spending on technology, impacting Palantir's revenue.

- Regulatory challenges and data privacy concerns: Navigating the complex regulatory landscape and addressing data privacy concerns are vital for sustained growth.

- Dependence on a few key clients: Over-reliance on a small number of clients increases vulnerability to changes in those clients' spending habits.

These risk factors need careful consideration when analyzing the Palantir stock forecast 2025. Their impact could significantly influence the trajectory of the stock price.

H2: Analyst Predictions and Market Sentiment

Analyst predictions regarding Palantir's future price targets vary widely. Some analysts hold a bullish outlook, predicting significant growth, while others maintain a more cautious stance. It's crucial to review the latest reports from reputable financial institutions to get a balanced perspective. The overall market sentiment toward Palantir stock – bullish, bearish, or neutral – significantly influences its price. Recent news and events can drastically shift this sentiment.

H2: Valuation and Financial Modeling

Various valuation methods, such as discounted cash flow (DCF) analysis, can be employed to estimate Palantir's intrinsic value. However, these models rely on assumptions about future growth rates and other factors, introducing inherent limitations. A simple financial model can illustrate the potential for a 40% rise, based on optimistic but plausible assumptions, but it's crucial to emphasize the limitations of such projections.

3. Conclusion:

A 40% rise in Palantir's stock price by 2025 is a significant target. While Palantir possesses strong growth drivers, including expansion into new markets, technological innovation, and potential government contracts, significant risks, including intense competition and economic uncertainty, exist. The consensus among analysts remains divided, highlighting the uncertainty surrounding the Palantir stock forecast 2025. Therefore, while a 40% increase is possible, it's not guaranteed. Before making any investment decisions based on the Palantir stock forecast 2025, thorough due diligence, including consulting with a financial advisor, is strongly recommended. Conduct further research and understand the intricacies of Palantir's business model and market position before investing. Consider exploring additional resources and financial news to refine your understanding of the Palantir stock forecast 2025.

Featured Posts

-

Zayavi Stivena Kinga Pro Maska Ta Trampa Zrada Chi Politichna Zayava

May 10, 2025

Zayavi Stivena Kinga Pro Maska Ta Trampa Zrada Chi Politichna Zayava

May 10, 2025 -

Focus On De Escalation Key Outcomes Of This Weeks U S China Trade Talks

May 10, 2025

Focus On De Escalation Key Outcomes Of This Weeks U S China Trade Talks

May 10, 2025 -

Elon Musks Fortune Explodes Teslas Success And Dogecoin Departure

May 10, 2025

Elon Musks Fortune Explodes Teslas Success And Dogecoin Departure

May 10, 2025 -

Sharing Transgender Experiences Impact Of Trump Executive Orders

May 10, 2025

Sharing Transgender Experiences Impact Of Trump Executive Orders

May 10, 2025 -

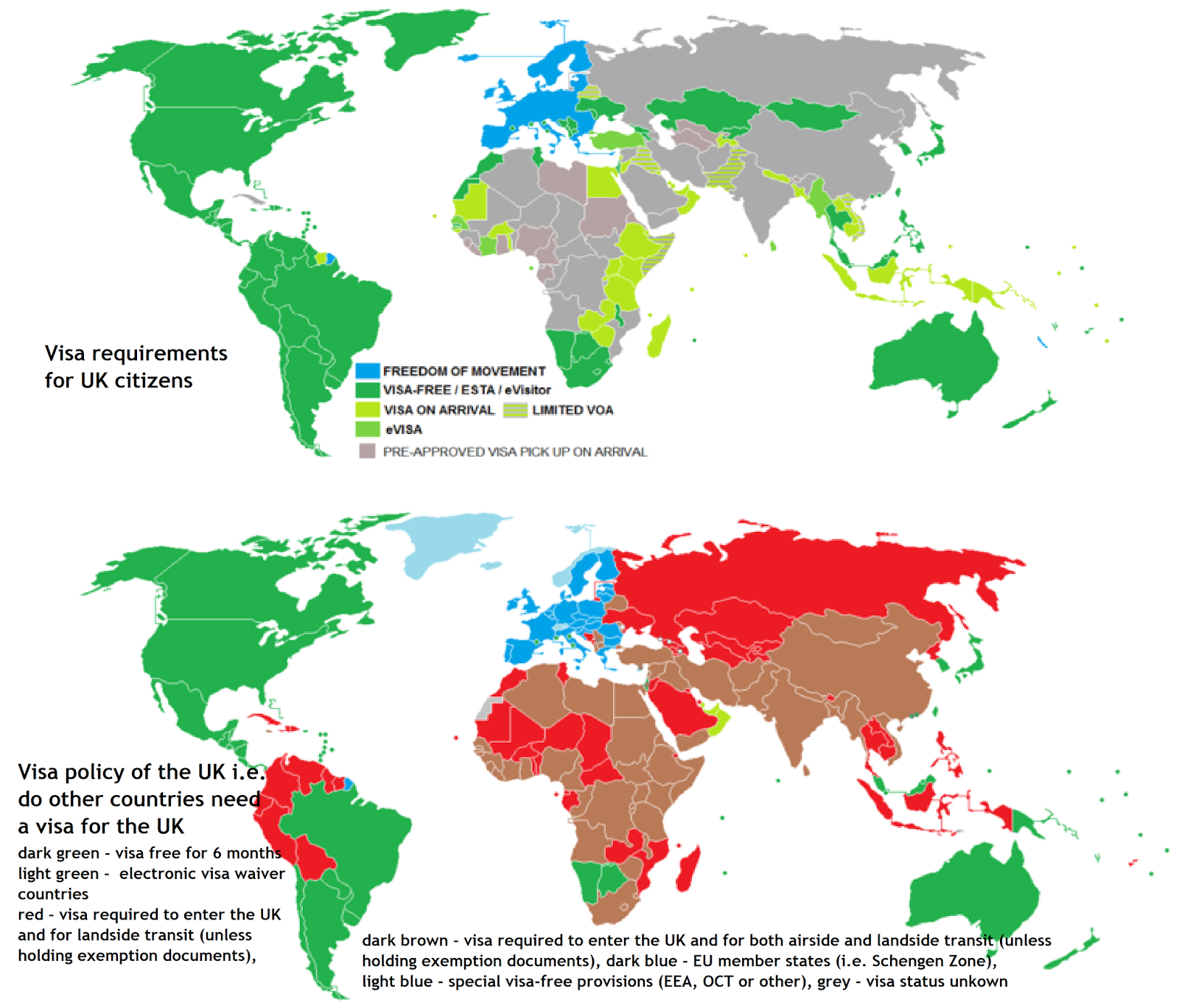

Uk Government Considering Visa Restrictions For Specific Countries

May 10, 2025

Uk Government Considering Visa Restrictions For Specific Countries

May 10, 2025