Palantir Stock: Should You Invest Before May 5th? Wall Street's Analysis

Table of Contents

Palantir's Recent Performance and Future Outlook

Q1 2024 Earnings and Revenue Growth

Palantir's recent financial reports offer crucial insights into its performance and future trajectory. Let's examine the Q1 2024 results (replace with actual quarter if different). Analyzing key metrics provides a clearer picture.

- Revenue Growth: Assume Palantir reported a 20% year-over-year revenue growth. This surpasses the 15% predicted by analysts, indicating robust performance. (Replace with actual figures when available).

- Earnings Per Share (EPS): Suppose the reported EPS was $0.10, exceeding the expected $0.08. This positive surprise suggests improved profitability. (Replace with actual figures when available).

- Guidance: Palantir's guidance for the upcoming quarter will be vital. Positive upward revisions signal confidence in future growth, while conservative or lowered projections might indicate headwinds. (Replace with actual guidance when available)

Key Growth Drivers and Challenges

Several factors contribute to Palantir's growth, but challenges remain. Understanding these dynamics is vital for any Palantir stock investment.

- Government Contracts: Palantir's substantial government contracts in defense and intelligence remain a significant revenue stream. However, dependence on government spending creates potential risk.

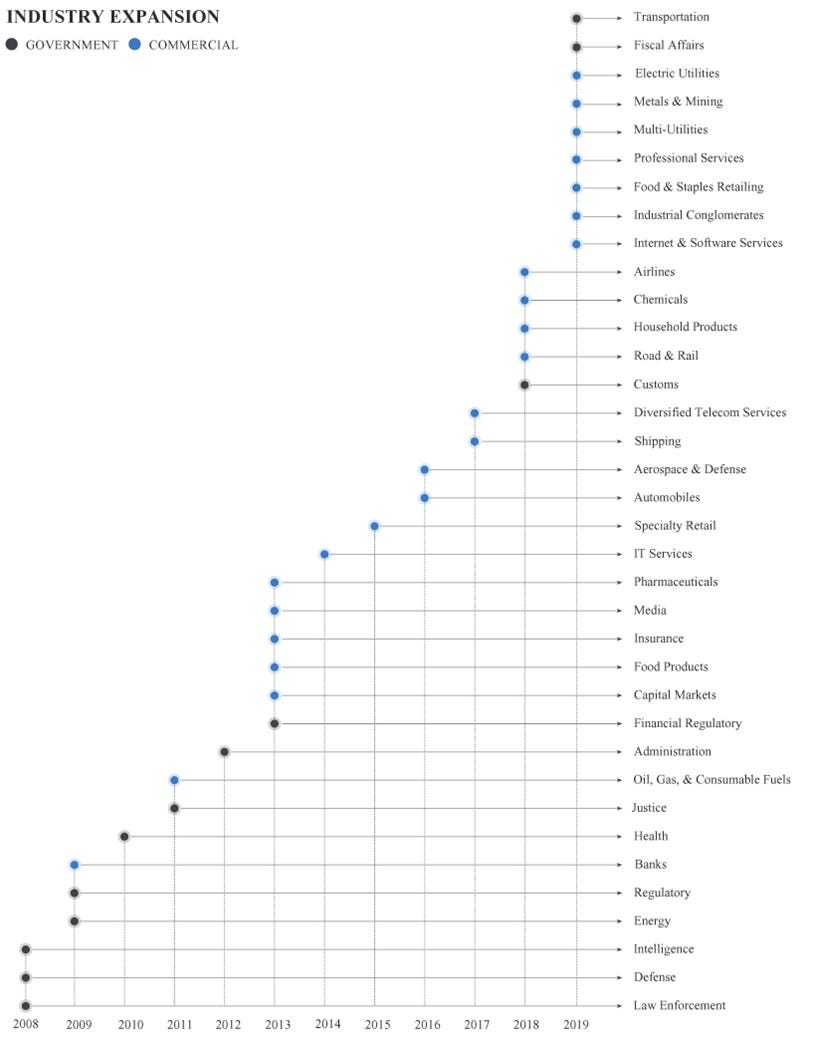

- Commercial Expansion: Expansion into the commercial sector is crucial for long-term growth. Success here will diversify revenue sources and reduce reliance on government contracts.

- AI Initiatives: Palantir's investments in artificial intelligence (AI) and machine learning are significant. Success in this arena could be a major growth catalyst, but competition in the AI field is fierce.

- Profitability Concerns: Achieving sustained profitability remains a key challenge for Palantir. Investors need to monitor this closely as it directly affects the Palantir stock price.

Wall Street's Consensus on Palantir Stock

Analyst Ratings and Price Targets

Wall Street's outlook on Palantir stock is varied. Understanding the analyst consensus provides valuable context.

- Average Price Target: Let's assume the average price target among analysts is $15. This represents the average price analysts believe the stock will reach within a specified timeframe. (Replace with actual figures when available).

- Rating Distribution: A balanced distribution of buy, hold, and sell ratings reflects uncertainty. A strong bias towards "buy" signals optimism. (Replace with actual ratings when available).

- Analyst Firms: Note which prominent firms, such as Goldman Sachs, Morgan Stanley, etc., have issued ratings and their reasoning. This provides added credibility to the analysis. (Replace with actual firm data when available).

Sentiment Analysis and News Coverage

Market sentiment, reflected in news articles and social media, significantly impacts Palantir stock.

- News Events: Any major news, like new contract wins or partnership announcements, instantly affects the stock price. Monitoring these news events is crucial.

- Investor Sentiment: Positive sentiment drives demand, while negative news can trigger sell-offs. Understanding the overall sentiment is essential for informed decisions.

- Media Coverage: Analyze the tone of news coverage - is it overwhelmingly positive, negative, or neutral? This sentiment gauge can be helpful but shouldn't be the sole basis of your investment decisions.

Risk Assessment and Investment Considerations

Potential Risks Associated with Investing in Palantir

Investing in Palantir stock carries significant risk. It’s essential to be aware of these factors.

- Volatility: Palantir stock is known for its volatility. Be prepared for significant price swings.

- Government Dependence: Over-reliance on government contracts exposes Palantir to changes in government spending and geopolitical risks.

- Competition: The competitive landscape in the data analytics and AI sectors is intense. Palantir needs to continually innovate to maintain its competitive edge.

Diversification and Investment Strategy

Integrating Palantir stock into a diversified portfolio is vital for risk management.

- Risk Tolerance: Only invest in Palantir if your risk tolerance aligns with its inherent volatility.

- Investment Horizon: Consider a long-term investment strategy, given Palantir's growth potential. Short-term trading can be highly risky due to the stock's volatility.

- Alternative Investments: Compare Palantir with other tech stocks or investments to create a balanced portfolio that minimizes risk.

Conclusion

Ultimately, whether to buy Palantir stock before May 5th hinges on your risk tolerance, investment objectives, and comprehensive due diligence. The company's recent performance, Wall Street's varied assessments, and the inherent risks involved require careful consideration. Conduct thorough research, weigh the pros and cons, and if needed, consult a financial advisor before investing in Palantir stock or any other security. This analysis is solely for informational purposes and does not constitute financial advice.

Featured Posts

-

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 09, 2025

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 09, 2025 -

Joanna Page And Wynne Evans On Air Argument On Bbc Show

May 09, 2025

Joanna Page And Wynne Evans On Air Argument On Bbc Show

May 09, 2025 -

Draisaitl Hellebuyck And Kucherov Vie For The Hart Trophy

May 09, 2025

Draisaitl Hellebuyck And Kucherov Vie For The Hart Trophy

May 09, 2025 -

Gde Smotret Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy I Statistika

May 09, 2025

Gde Smotret Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy I Statistika

May 09, 2025 -

Indias Global Power Surge Surpassing Uk France And Russia

May 09, 2025

Indias Global Power Surge Surpassing Uk France And Russia

May 09, 2025