Palantir Stock: Weighing The Risks And Rewards Of A Potential 40% Jump In 2025

Table of Contents

Palantir's Growth Potential: Fueling the 40% Prediction

Several key factors could contribute to a substantial increase in Palantir's stock price by 2025. These factors, combined, paint a picture of significant growth potential for the company, making Palantir stock an intriguing prospect for investors willing to take on moderate to high risk.

Government Contracts: A Cornerstone of Palantir's Revenue

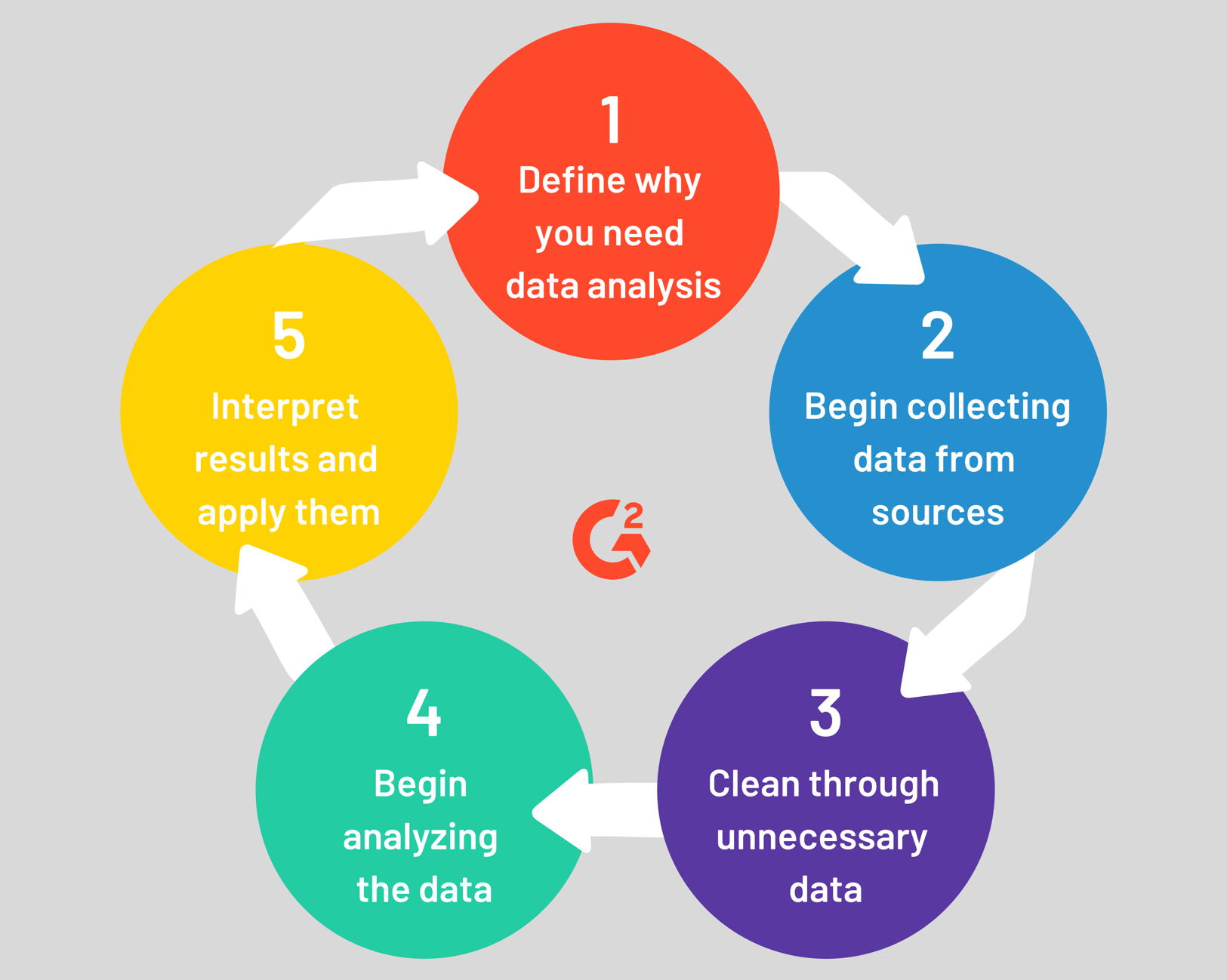

Government contracts form a crucial part of Palantir's revenue stream. The increasing demand for advanced data analytics within government sectors – particularly defense, intelligence, and cybersecurity – fuels this growth engine. Government agencies rely on Palantir's platforms to analyze vast datasets, improve operational efficiency, and enhance national security.

- Examples of major government contracts: Palantir has secured significant contracts with agencies like the CIA, the Department of Defense, and various international governments. These contracts provide a steady stream of revenue and demonstrate the platform's value in high-stakes environments.

- Future contract opportunities: The expanding need for advanced data analytics in areas like counter-terrorism, cybersecurity threat detection, and predictive policing presents significant future opportunities for Palantir to secure even more lucrative government contracts.

- Projected revenue growth from government partnerships: Analysts predict a substantial increase in revenue from government partnerships over the next few years, further supporting the potential for a significant rise in Palantir's stock price.

Expanding Commercial Market Penetration: A Key Driver of Growth

Beyond the government sector, Palantir is actively expanding its commercial client base. This expansion is crucial for long-term sustainable growth and reducing reliance on government contracts alone. Their strategy involves targeting key industries with a strong need for advanced data analysis capabilities.

- Key industries benefiting from Palantir's platform: Finance, healthcare, and energy are key sectors where Palantir's platform offers significant value, improving decision-making, streamlining operations, and identifying new revenue streams for its clients.

- Future market expansion plans: Palantir's aggressive expansion into new commercial markets, coupled with targeted marketing efforts, indicates a robust growth strategy for the coming years.

- Projected revenue increase from commercial clients: The successful adoption of Palantir's platform by commercial clients is expected to drive a substantial increase in revenue, contributing significantly to the projected 40% stock price surge.

Technological Innovation and Product Development: Maintaining a Competitive Edge

Palantir's commitment to ongoing research and development (R&D) is vital in maintaining its competitive advantage in the rapidly evolving data analytics market. Continuous innovation ensures that Palantir remains at the forefront of technological advancements, attracting and retaining clients.

- Examples of new products or features: Regular updates and the introduction of new features and modules ensure the platform remains highly competitive and caters to the ever-changing needs of its clients.

- Competitive advantages offered by Palantir's technology: Palantir's proprietary technology offers distinct advantages over its competitors, enabling faster data processing, more sophisticated analytics, and enhanced security.

- Projected impact on market share and revenue: The continuous innovation and technological advancements are expected to significantly impact Palantir's market share and revenue generation capabilities.

Risks and Challenges Facing Palantir Stock

While the potential for significant growth is undeniable, several risks and challenges could impact Palantir's stock price. A balanced perspective requires acknowledging these potential headwinds.

Competition in the Data Analytics Market: Navigating a Crowded Landscape

The data analytics market is highly competitive, with established players and emerging startups vying for market share. Palantir faces competition from both large technology companies and specialized analytics firms.

- List of main competitors: Competitors include giants like Microsoft, AWS, and Google, as well as specialized analytics firms offering similar services.

- Their market share: The competitive landscape presents a challenge for Palantir, requiring the company to constantly innovate and maintain its competitive edge.

- Potential threats to Palantir's dominance: Competition could impact Palantir's ability to secure new contracts and maintain its pricing power.

Economic Uncertainty and its Impact on Palantir's Growth Trajectory

Macroeconomic factors like recessions, inflation, and geopolitical instability can significantly affect Palantir's growth trajectory. Reduced government spending or decreased commercial investment in data analytics could impact revenue.

- Potential economic headwinds: Global economic downturns can lead to decreased spending on technology solutions, potentially affecting Palantir's sales.

- Their impact on government and commercial spending: Reduced government and commercial spending on data analytics could directly impact Palantir's revenue streams.

- The possible effect on Palantir's stock price: Economic uncertainty can negatively influence investor sentiment, potentially leading to a decline in Palantir's stock price.

Dependence on Large Contracts: Managing Revenue Volatility

Palantir's revenue is significantly influenced by large, long-term contracts. The loss of or delays in securing these contracts can lead to revenue volatility, impacting profitability and investor confidence.

- Examples of past contract wins and losses: Analyzing past successes and setbacks in securing and maintaining large contracts can shed light on the inherent risks involved.

- Strategies to mitigate reliance on individual contracts: Palantir is working to diversify its client base and expand into new market segments to reduce its dependence on individual large contracts.

- The potential impact of contract volatility on Palantir stock: Unexpected contract losses or delays can negatively affect investor confidence and lead to price fluctuations.

Conclusion

This analysis of Palantir stock reveals a compelling case for significant growth potential, with a possible 40% increase by 2025 driven by strong government contracts, expanding commercial reach, and continuous technological innovation. However, potential risks remain, including intense competition, macroeconomic uncertainties, and the inherent volatility associated with dependence on large contracts. Investors must carefully weigh these factors before making investment decisions.

Call to Action: Before investing in Palantir stock (PLTR), conduct thorough due diligence and consult with a financial advisor. Understanding the potential rewards and risks associated with Palantir stock is crucial for making informed investment decisions. Learn more about Palantir's future prospects and stay informed on the latest developments concerning Palantir stock and its competitors.

Featured Posts

-

Snls Failed Harry Styles Impression The Singers Response

May 10, 2025

Snls Failed Harry Styles Impression The Singers Response

May 10, 2025 -

Analyzing Abcs Decision Why Re Air High Potential Shows In March 2025

May 10, 2025

Analyzing Abcs Decision Why Re Air High Potential Shows In March 2025

May 10, 2025 -

Ras Baraka Detained Protest At Newark Ice Facility Results In Arrest

May 10, 2025

Ras Baraka Detained Protest At Newark Ice Facility Results In Arrest

May 10, 2025 -

Figmas Ai A Deeper Dive Into Its Competition With Adobe Word Press And Canva

May 10, 2025

Figmas Ai A Deeper Dive Into Its Competition With Adobe Word Press And Canva

May 10, 2025 -

Palantir Stock Forecast 2025 Is A 40 Rise Realistic A Comprehensive Analysis

May 10, 2025

Palantir Stock Forecast 2025 Is A 40 Rise Realistic A Comprehensive Analysis

May 10, 2025