Palantir Stock: Weighing The Risks Before May 5th Earnings

Table of Contents

Palantir's Recent Performance and Market Sentiment

Palantir stock has seen a rollercoaster ride recently. Analyzing its recent performance is crucial to understanding the current market sentiment surrounding PLTR. We've seen periods of significant gains followed by dips, highlighting the inherent volatility associated with this high-growth technology stock.

-

Recent Stock Price Movements: [Insert chart showing Palantir stock price movements over the past few months. Clearly label highs and lows]. Note the significant fluctuations and highlight any major events that coincided with price changes.

-

Analyst Ratings and Predictions: Leading up to the earnings report, analysts have offered a mixed bag of predictions for Palantir stock. [Cite specific analyst ratings and target prices from reputable sources, noting the range of predictions]. This divergence in opinions underscores the uncertainty surrounding the company's future performance.

-

Key News Impacts:

- Mention any recent contract wins (e.g., large government contracts or significant commercial partnerships). Quantify the value of these contracts where possible and explain their potential impact on future revenue.

- Discuss any significant partnerships formed or regulatory changes that may have affected Palantir's stock price.

- Briefly discuss the broader market conditions (e.g., overall economic outlook, tech sector performance) and how they might influence investor sentiment towards Palantir.

Key Financial Metrics to Watch in the Earnings Report

The May 5th earnings report will provide crucial insights into Palantir's financial health. Investors should closely scrutinize the following key metrics:

-

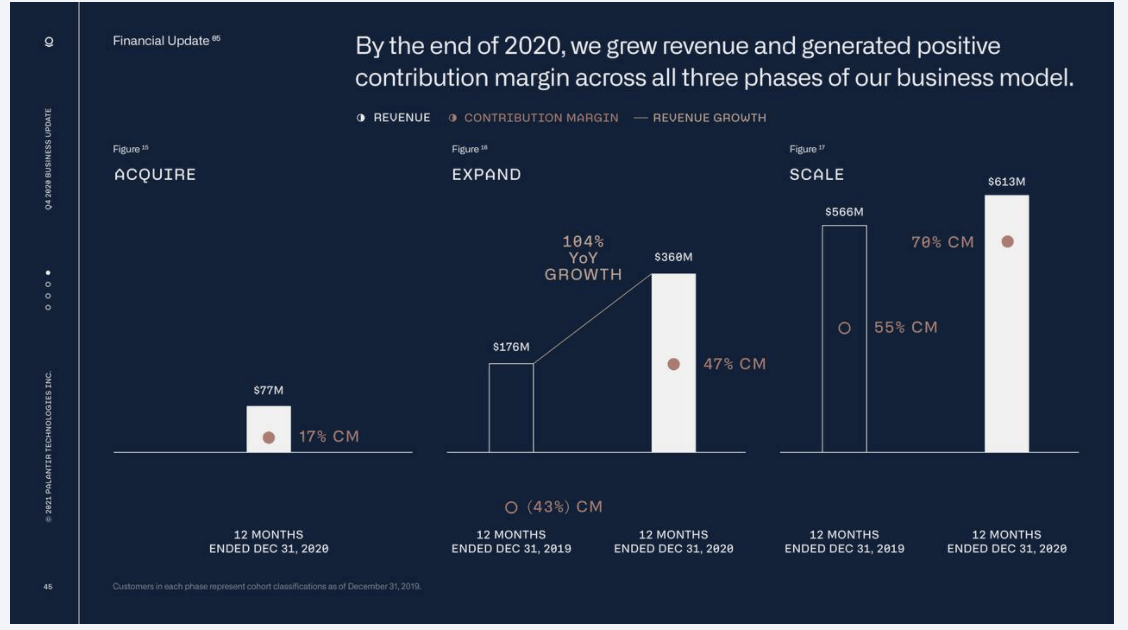

Revenue Growth: Analyze the year-over-year and quarter-over-quarter revenue growth. [Cite previous quarters' revenue figures]. A strong revenue growth rate is a positive indicator of the company's ability to expand its customer base and increase sales.

-

Profitability: Examine Palantir's net income and profitability margins. [Cite previous quarters' figures]. Moving towards profitability is a key factor for long-term investor confidence.

-

Operating Margins: Assess the efficiency of Palantir's operations by analyzing its operating margins. Improving margins indicate cost-cutting measures and improved operational efficiency. [Cite previous quarters' figures].

-

Cash Flow: Examine Palantir's cash flow from operations and its overall cash position. A healthy cash flow is critical for sustaining growth and navigating potential economic downturns. [Cite previous quarters' figures].

-

Expectations: Based on analyst predictions [cite sources], what are the expectations for each of these metrics in the upcoming earnings report? Explain how surpassing or missing expectations could significantly impact the Palantir stock price.

Assessing Palantir's Long-Term Growth Potential

Palantir operates in the rapidly growing big data analytics market, offering significant long-term growth potential. However, evaluating this potential requires careful consideration of various factors.

-

Market Position: Palantir holds a unique position in the big data market, particularly with its strong presence in government contracts and increasing penetration into the commercial sector.

-

Competitive Advantages: Discuss Palantir's proprietary technology, its strong customer relationships, and its data security capabilities as key competitive advantages.

-

Government Contracts: Analyze the importance of government contracts to Palantir's revenue stream. Discuss the long-term implications of these contracts and any potential risks associated with government spending fluctuations.

-

Commercial Sector Growth: Assess Palantir's progress in expanding its commercial client base. Discuss the potential for growth in this sector and any challenges the company may face in competing with established players.

-

Competitive Landscape: Acknowledge the competition from established players in the big data analytics market. Discuss the potential challenges Palantir might face from competitors with larger market share and resources.

Understanding the Risks Associated with Investing in Palantir Stock

Investing in Palantir stock carries inherent risks. Understanding these risks is crucial before making any investment decisions.

-

Volatility: Palantir stock is known for its volatility, meaning its price can fluctuate significantly in short periods. This volatility is amplified by the company's high-growth nature and dependence on large contracts.

-

Financial Position: Thoroughly analyze Palantir's financial statements, looking for any potential vulnerabilities. High debt levels or inconsistent profitability can pose significant risks.

-

Economic Downturn Risk: High-growth technology stocks, like Palantir, can be particularly vulnerable during economic downturns. Explain how reduced government spending or decreased commercial investment could impact Palantir’s revenue and stock price.

-

Legal and Regulatory Risks: Discuss any potential legal or regulatory challenges facing Palantir, such as data privacy concerns or antitrust investigations. These risks could negatively affect the company's operations and stock price.

Conclusion

Investing in Palantir stock involves a careful assessment of both its potential and inherent risks. The upcoming earnings report will be a pivotal moment, impacting investor sentiment and stock price. Analyzing key financial metrics, understanding market sentiment, and considering the company's long-term growth potential are crucial steps in making an informed decision.

Call to Action: Before making any investment decisions regarding Palantir stock, thoroughly research the company and weigh the risks based on the information presented in this article and your own due diligence. Remember to consult with a financial advisor before investing in Palantir or any other stock. Stay informed about Palantir stock and its performance following the May 5th earnings release. Your understanding of Palantir stock will be vital in navigating the complexities of this investment.

Featured Posts

-

Should Investors Buy Palantir Stock Ahead Of May 5th Earnings

May 10, 2025

Should Investors Buy Palantir Stock Ahead Of May 5th Earnings

May 10, 2025 -

Analyzing The China Market Lessons From Bmw Porsche And Competitors

May 10, 2025

Analyzing The China Market Lessons From Bmw Porsche And Competitors

May 10, 2025 -

Can Canh Nhan Sac Thang Hang Cua Lynk Lee Sau Chuyen Gioi

May 10, 2025

Can Canh Nhan Sac Thang Hang Cua Lynk Lee Sau Chuyen Gioi

May 10, 2025 -

Elizabeth City Police Search For Vehicle Break In Suspect

May 10, 2025

Elizabeth City Police Search For Vehicle Break In Suspect

May 10, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 10, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 10, 2025