Palantir Technologies Stock: Buy, Sell, Or Hold? An In-Depth Look

Table of Contents

Palantir Technologies' Business Model and Revenue Streams

Palantir Technologies is a data analytics company specializing in providing software platforms for data integration, analysis, and visualization. Its core offerings are Gotham, focused primarily on government clients, and Foundry, targeting commercial enterprises. Understanding Palantir's revenue model is crucial for assessing its Palantir Technologies stock valuation. The company operates primarily through large, long-term contracts, which provides stability but also presents a risk of dependence on a few key clients.

- Government contracts: Government contracts represent a significant portion of Palantir's revenue, offering a degree of stability due to their long-term nature. However, future growth in this sector depends on government budgets and procurement processes. Securing new government contracts is key to the future performance of Palantir Technologies stock.

- Commercial contracts: Palantir is increasingly focusing on commercial contracts to diversify its revenue streams and reduce reliance on government spending. Growth in this sector is essential for the long-term success of the Palantir Technologies stock. Key commercial clients and the success of the Foundry platform will be vital factors to monitor.

- Software licenses vs. services revenue: Palantir generates revenue from both software licenses and services, with the latter often providing higher margins. The balance between these two revenue streams is important to analyze when evaluating Palantir Technologies stock.

- Recurring revenue: A growing portion of Palantir's revenue is recurring, providing increased predictability and stability for future earnings. The percentage of recurring revenue is a key metric to watch for those considering investing in Palantir Technologies stock.

Financial Performance and Key Metrics

Analyzing Palantir's financial statements is essential for any investor considering Palantir Technologies stock. Key financial ratios and metrics provide valuable insights into the company's financial health and growth trajectory.

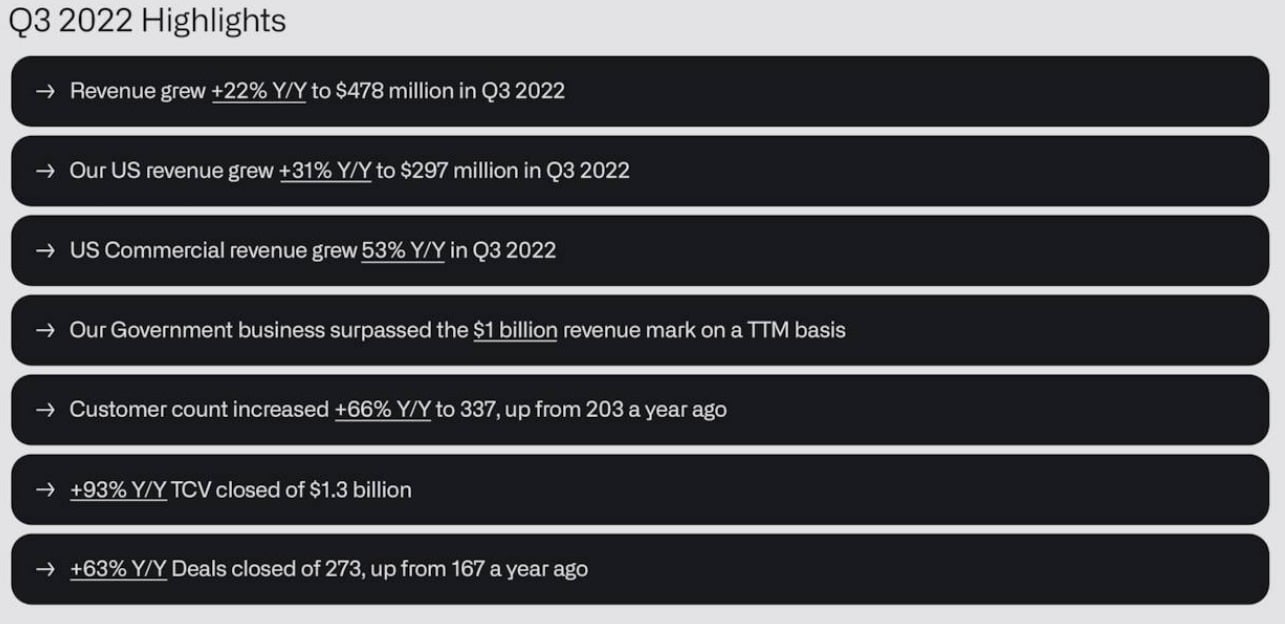

- Revenue growth trends over the past few years: Examining the historical revenue growth will reveal the rate of expansion and its consistency. This is crucial for understanding the potential for future growth of Palantir Technologies stock.

- Profitability margins and their evolution: Analyzing profit margins (gross, operating, and net) helps investors understand Palantir's ability to translate revenue into profits. Improving profit margins are a positive sign for Palantir Technologies stock.

- Debt levels and implications for the company's financial health: High debt levels can pose a risk, impacting the company's financial flexibility. A low debt-to-equity ratio is usually a positive indicator for Palantir Technologies stock.

- Free cash flow generation and its importance for shareholder returns: Strong free cash flow generation is essential for reinvestment, debt reduction, and potential shareholder returns. Consistent and growing free cash flow is a strong sign for Palantir Technologies stock. Investors should carefully consider the Price-to-Sales ratio in relation to free cash flow growth.

Competitive Landscape and Market Position

Palantir operates in a competitive big data and analytics market. Understanding its competitive advantages and disadvantages is vital for assessing Palantir Technologies stock.

- Key competitors and their strengths and weaknesses: Analyzing competitors like AWS, Microsoft, and other data analytics firms provides context for Palantir's market position. Identifying their strengths and weaknesses allows for a more informed evaluation of Palantir Technologies stock.

- Palantir's technological advantages and differentiators: Palantir's proprietary technology, including its data integration and analysis capabilities, is a key differentiator. Evaluating the strength and defensibility of this technology is critical for assessing the long-term prospects of Palantir Technologies stock.

- Market trends and their impact on Palantir’s future: The continued growth of the big data market presents significant opportunities for Palantir. Conversely, changes in technology or regulatory environments can pose risks.

- Potential for future acquisitions or partnerships: Strategic acquisitions or partnerships can expand Palantir's capabilities and market reach, enhancing the potential of Palantir Technologies stock.

Future Growth Prospects and Risks

Investing in Palantir Technologies stock involves considering both its growth potential and associated risks.

- Opportunities for expansion into new markets and sectors: Palantir has the potential to expand into various sectors like healthcare and finance. Identifying these opportunities and their likelihood is crucial for assessing Palantir Technologies stock.

- Potential technological disruptions and their impact: The rapid pace of technological change presents both opportunities and risks. Considering potential disruptions and their impact on Palantir's competitive advantage is crucial.

- Risks associated with government contracts and regulatory changes: Government contracts can be subject to political and regulatory changes, creating uncertainty for Palantir.

- Dependence on key clients and their potential impact: Palantir's reliance on a few large clients presents a risk. The loss of a key client could significantly impact the company's financial performance and the valuation of Palantir Technologies stock.

Analyst Ratings and Price Targets

Consulting analyst ratings and price targets can provide valuable insights, though they shouldn't be the sole basis for investment decisions.

- Overview of buy, sell, and hold ratings from leading analysts: A summary of analyst opinions offers a broader perspective on market sentiment towards Palantir Technologies stock.

- Average price target and its range: The average price target provides a consensus view of Palantir's future price, though it's crucial to remember that price targets vary significantly.

- Comparison of analyst ratings with historical performance: Comparing analyst ratings with past performance helps assess the accuracy of their predictions, providing context for evaluating Palantir Technologies stock.

Conclusion

This in-depth analysis of Palantir Technologies stock has explored various factors impacting its value, including financial performance, competitive landscape, and growth potential. While Palantir shows promise in the big data analytics sector, potential investors must carefully weigh the considerable risks associated with this high-growth, high-risk stock. Ultimately, the decision of whether to buy, sell, or hold Palantir Technologies stock depends on your individual risk tolerance and investment strategy. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to Palantir Technologies stock. Do your own due diligence before investing in Palantir Technologies stock.

Featured Posts

-

Pam Bondis Plan To Kill American Citizens A Detailed Examination

May 10, 2025

Pam Bondis Plan To Kill American Citizens A Detailed Examination

May 10, 2025 -

Uterus Transplantation A Pathway To Parenthood For Transgender Women

May 10, 2025

Uterus Transplantation A Pathway To Parenthood For Transgender Women

May 10, 2025 -

Analyzing The 40 Palantir Stock Price Prediction For 2025 A Detailed Guide

May 10, 2025

Analyzing The 40 Palantir Stock Price Prediction For 2025 A Detailed Guide

May 10, 2025 -

Wynne Evans New Evidence To Clear Name After Strictly Scandal

May 10, 2025

Wynne Evans New Evidence To Clear Name After Strictly Scandal

May 10, 2025 -

The Wall Street Comeback Implications For Bear Market Investors

May 10, 2025

The Wall Street Comeback Implications For Bear Market Investors

May 10, 2025