Podcast: How To Benefit From Current Low Inflation Rates

Table of Contents

Saving Strategies in a Low Inflation Environment

Low inflation rates present a unique opportunity to boost your savings. While inflation erodes the purchasing power of your money over time, low inflation means your savings retain their value better than during periods of high inflation. Let's explore some effective saving strategies.

Maximize Your Savings Accounts

High-yield savings accounts and money market accounts are excellent tools for maximizing your returns in a low inflation environment. These accounts offer interest rates that are typically higher than standard savings accounts.

-

Compare Interest Rates: Don't settle for the first rate you see. Shop around and compare interest rates offered by different banks and credit unions, including online banks which often offer competitive rates.

-

Automate Your Savings: Set up automatic transfers from your checking account to your savings account each month. This ensures consistent saving without requiring constant manual effort. This automated approach is crucial for building wealth during low inflation.

-

Consider Certificates of Deposit (CDs): For longer-term savings goals, CDs can provide higher interest rates than savings accounts. However, remember that you'll typically face penalties for early withdrawal.

-

Key Considerations:

- Consider online banks for potentially higher interest rates.

- Regularly review your savings strategy and adjust as needed to optimize returns in this low inflation environment.

- Explore different CD terms to find the best fit for your financial goals.

Debt Reduction Strategies

Low inflation makes debt repayment more manageable. The real cost of your debt remains relatively stable, allowing you to allocate more of your income towards principal repayment.

-

Prioritize High-Interest Debt: Focus on paying down high-interest debt first, such as credit card debt, to minimize the overall interest paid.

-

Debt Consolidation: Consider consolidating your debts into a single loan with a lower interest rate. This can simplify repayment and potentially save you money on interest.

-

Impact of Low Inflation on Debt Repayment: Low inflation reduces the impact of debt over time. Your debt's real value doesn't increase as rapidly as it would during periods of high inflation.

-

Actionable Steps:

- Create a detailed debt repayment plan.

- Use budgeting tools to track your progress and identify areas for improvement.

- Explore balance transfer options to potentially lower your interest rates.

Investment Opportunities During Low Inflation

While low inflation can be beneficial for savers, it also presents opportunities for investors. Let's explore some investment options to consider.

Investing in Stocks

Stocks can provide strong returns over the long term, even during periods of low inflation. However, remember that stock prices can fluctuate, so diversification is essential.

-

Diversification is Key: Spread your investments across various sectors and asset classes to mitigate risk.

-

Risk Tolerance: Consider your risk tolerance before investing in stocks. Are you comfortable with potential price fluctuations?

-

Investment Vehicles: Index funds and ETFs offer diversified exposure to the stock market, while individual stock selection allows for more targeted investments.

-

Tips for Stock Market Investing:

- Conduct thorough research before investing in individual stocks.

- Consider consulting a financial advisor for personalized guidance.

- Regularly monitor your portfolio's performance and make adjustments as needed.

Real Estate Investment

Real estate can be a good hedge against inflation, even low inflation. Rental income can provide a steady stream of cash flow, and property values tend to appreciate over time.

-

Market Research: Thoroughly research local market trends to identify promising investment opportunities.

-

Due Diligence: Conduct comprehensive due diligence on any property before investing.

-

Rental Income and Appreciation: Consider the potential for both rental income and property value appreciation when evaluating real estate investments. Rental income can offset mortgage payments and generate positive cash flow.

-

Real Estate Investment Strategies:

- Explore Real Estate Investment Trusts (REITs) for diversification.

- Factor in property taxes, insurance, and maintenance costs when assessing profitability.

Other Investment Options

Bonds and commodities offer alternative investment avenues during periods of low inflation.

-

Bonds: Bonds provide a fixed income stream and can help balance risk in a portfolio. However, bond yields may be low during periods of low inflation.

-

Commodities: Commodities, such as gold and oil, can act as inflation hedges. However, their prices can be volatile.

-

Diversification is Crucial: These investment options can provide valuable diversification to your overall portfolio, reducing your reliance on any single asset class. It’s wise to consider their correlation to other assets in your portfolio.

Protecting Your Purchasing Power

Even with low inflation, it's crucial to protect your purchasing power. This involves mindful spending and diversifying your income.

Budget and Spending Habits

Mindful budgeting is crucial, regardless of the inflation rate. Tracking your spending can reveal areas where you can cut back and save more.

-

Budgeting Apps: Use budgeting apps to track expenses and create a realistic budget.

-

Track Spending: Regularly review your spending habits to identify areas for potential savings.

-

Impact of Low Inflation on Purchasing Power: Even with low inflation, your purchasing power can still be affected. Careful budgeting and saving strategies help offset this impact.

-

Financial Literacy: Strengthening your financial literacy through research and educational resources will empower you to make informed decisions.

Diversifying Income Streams

Multiple income streams provide a safety net against economic fluctuations and help maintain your purchasing power even during periods of low inflation.

-

Side Hustles: Explore side hustles or freelance work to supplement your income.

-

Investing for Income: Investing in dividend-paying stocks or rental properties can generate passive income.

-

Starting a Business: Consider starting a small business to create another income stream.

-

Skill Assessment: Identify your skills and talents and explore how you can monetize them.

Conclusion

This article has explored several key strategies for benefiting from current low inflation rates. By implementing smart saving techniques, strategically investing your money, and protecting your purchasing power through mindful budgeting and diversification, you can navigate this economic climate successfully. Remember, understanding and leveraging low inflation rates is crucial for long-term financial health. Start maximizing your financial well-being today by actively utilizing the strategies discussed in this article about low inflation rates!

Featured Posts

-

Mila Kunis 10 Best Film And Television Roles

May 27, 2025

Mila Kunis 10 Best Film And Television Roles

May 27, 2025 -

Ice Cubes Last Friday A New Chapter In The Making

May 27, 2025

Ice Cubes Last Friday A New Chapter In The Making

May 27, 2025 -

Germaniya Otkladyvaet Postavku Sistem Patriot Zayavlenie Ministra Oborony

May 27, 2025

Germaniya Otkladyvaet Postavku Sistem Patriot Zayavlenie Ministra Oborony

May 27, 2025 -

The Shelton Stefani Family Vacation Details Revealed

May 27, 2025

The Shelton Stefani Family Vacation Details Revealed

May 27, 2025 -

The Controversy Surrounding Kai Cenat And His Friends Racist Comments

May 27, 2025

The Controversy Surrounding Kai Cenat And His Friends Racist Comments

May 27, 2025

Latest Posts

-

Rebalancing The Scales Reducing U S Dominance In Canadas Future

May 29, 2025

Rebalancing The Scales Reducing U S Dominance In Canadas Future

May 29, 2025 -

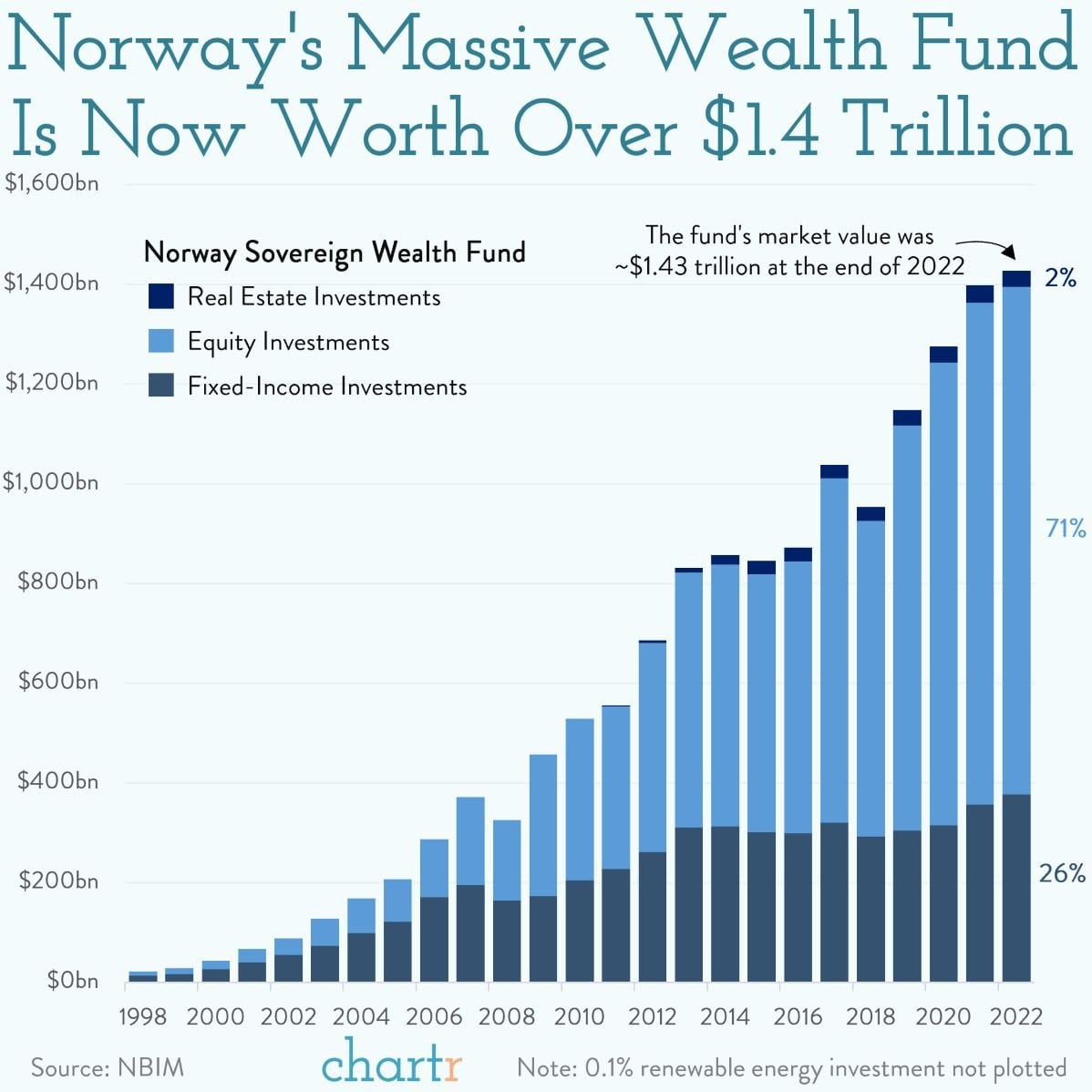

Inter Rent Reit Acquisition Sovereign Wealth Fund And Executive Chairs Bid

May 29, 2025

Inter Rent Reit Acquisition Sovereign Wealth Fund And Executive Chairs Bid

May 29, 2025 -

U S Investment In Canada A Call For Change

May 29, 2025

U S Investment In Canada A Call For Change

May 29, 2025 -

Weihong Liu The Billionaire Behind The Hudsons Bay Lease Purchases

May 29, 2025

Weihong Liu The Billionaire Behind The Hudsons Bay Lease Purchases

May 29, 2025 -

Five Year Funding Plan Telus Bolsters Network Capacity And Coverage

May 29, 2025

Five Year Funding Plan Telus Bolsters Network Capacity And Coverage

May 29, 2025