Post-Record High: Frankfurt Stock Market And DAX Opening

Table of Contents

Analyzing the DAX Performance Post-Record High

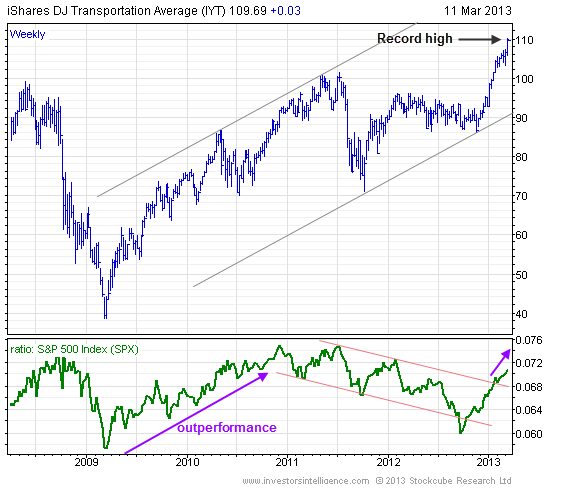

The DAX (Deutscher Aktienindex) is a blue-chip stock market index comprising the 40 largest German companies listed on the Frankfurt Stock Exchange. Its performance is a significant indicator of the health of the German and broader European economy. The recent record high was fueled by several factors, including strong economic data from Germany and the Eurozone, positive global market trends driven by technological advancements and easing geopolitical tensions (at the time of the record), and robust corporate earnings from several DAX constituents.

Analyzing the opening price after the record high is crucial. While the exact figures will vary depending on the specific date, a hypothetical example could be a slight dip of, say, 0.5% from the all-time high. This initial dip, however, does not necessarily indicate a bearish trend.

- Percentage change from the record high at the opening: (Example: -0.5%) This needs to be replaced with the actual data.

- Volume of trades during the opening hours: (Example: 15% higher than the average daily volume) This needs to be replaced with the actual data.

- Key sectors showing the most significant gains or losses: (Example: Technology showing slight gains, while automotive experienced a minor dip). This needs to be replaced with the actual data.

- Comparison with previous post-record high openings: (Example: Similar to previous instances, a slight initial correction was observed followed by consolidation). This needs to be replaced with the actual data and analysis.

Investor Sentiment and Market Volatility

Following a record high, investor sentiment is a key factor determining market direction. While initial optimism might prevail, concerns about a potential market correction are also likely. Analyzing news articles, expert opinions from financial analysts, and market commentary helps gauge overall sentiment. A rise in volatility, often reflected in increased trading volume and a higher VDAX (volatility index) suggests uncertainty.

- Significant news events influencing investor sentiment: (Example: Geopolitical events, changes in interest rates, upcoming elections)

- Changes in trading volumes: (Example: Increased volume indicates higher activity and potential volatility)

- Speculation and predictions regarding future performance: (Example: Analyst predictions on future growth or correction)

- Key indicators like the VDAX (volatility index): (Example: A rising VDAX suggests increasing market uncertainty)

Key Sectors to Watch in the Frankfurt Stock Market

Post-record high, sector-specific analysis is crucial. Certain sectors might benefit more from the overall market strength while others could face headwinds. For example, technology stocks often lead during growth periods but can be more volatile during corrections. Automotive, highly sensitive to global economic conditions, might see increased or decreased performance depending on various factors.

- Performance of individual companies within those sectors: (Example: Specific company performance data)

- Mention specific stocks showing noteworthy movements: (Example: Stock tickers and their performance)

- Analyze sector-specific news influencing their performance: (Example: Industry-related announcements, government regulations)

Opportunities and Risks for Investors

Investing after a record high presents both opportunities and risks. Conservative investors might opt for a wait-and-see approach or focus on defensive sectors. More aggressive investors could consider selectively adding to their portfolios based on thorough research and risk management.

- Specific investment options (e.g., ETFs, individual stocks): (Example: Suitable ETFs tracking the DAX or specific sectors)

- Importance of thorough research and due diligence: (Emphasize the necessity of understanding the companies and market conditions)

- Potential risks like market corrections or geopolitical events: (Highlight the importance of risk mitigation strategies)

Understanding the Frankfurt Stock Market's Future After its Record High

The opening of the Frankfurt Stock Market and DAX performance post-record high is a dynamic situation. While a slight correction is possible, the overall outlook depends heavily on investor sentiment, economic data, and global market trends. Continuously monitoring key indicators like the VDAX, analyzing sector-specific news, and staying informed about macroeconomic factors are crucial for navigating this phase.

Remember, thorough research and a well-diversified portfolio are key to mitigating risks. To stay updated on the "Post-Record High: Frankfurt Stock Market and DAX Opening" and receive further analysis on the DAX and the Frankfurt Stock Exchange's future, subscribe to our newsletter, follow us on social media, or check back regularly for our latest insights. Understanding the dynamics of the DAX opening after reaching record highs is crucial for making informed investment decisions.

Featured Posts

-

Esc 2025 Conchita Wurst And Jjs Eurovision Village Performance

May 24, 2025

Esc 2025 Conchita Wurst And Jjs Eurovision Village Performance

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Eiskaltes Ergebnis Der Ueberraschungssieger In Essen

May 24, 2025

Eiskaltes Ergebnis Der Ueberraschungssieger In Essen

May 24, 2025 -

Understanding The Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav

May 24, 2025

Understanding The Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav

May 24, 2025 -

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Latest Posts

-

Analisi Dei Dazi Stati Uniti Previsioni Prezzi Moda

May 24, 2025

Analisi Dei Dazi Stati Uniti Previsioni Prezzi Moda

May 24, 2025 -

Impatto Dei Dazi Usa Sui Prezzi Dell Abbigliamento

May 24, 2025

Impatto Dei Dazi Usa Sui Prezzi Dell Abbigliamento

May 24, 2025 -

Import Dazi Usa Quanto Costa Importare Abbigliamento

May 24, 2025

Import Dazi Usa Quanto Costa Importare Abbigliamento

May 24, 2025 -

Teatr Mossoveta Proschanie S Sergeem Yurskim

May 24, 2025

Teatr Mossoveta Proschanie S Sergeem Yurskim

May 24, 2025 -

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025