Posthaste: Understanding The Potential For A Canadian Home Price Correction

Table of Contents

Main Points:

2.1. Overvaluation and Affordability Crisis:

High Home Prices Relative to Income:

The gap between average home prices and average household incomes in major Canadian cities has widened dramatically. This affordability crisis is a significant driver of potential correction.

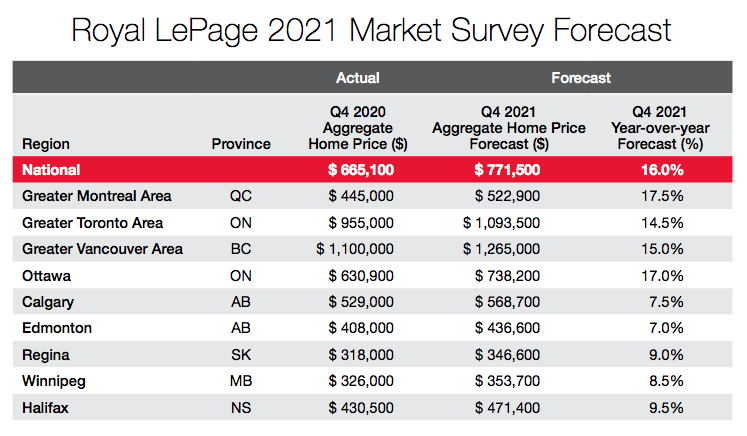

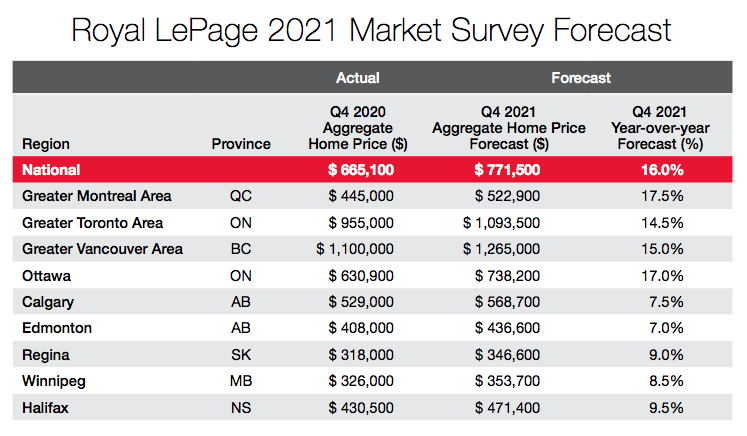

- Toronto: Home price-to-income ratios have soared to unprecedented levels, making homeownership increasingly unattainable for many.

- Vancouver: Similar trends are observed in Vancouver, where exorbitant prices continue to outpace income growth.

- Calgary: While experiencing less dramatic increases than Toronto and Vancouver, Calgary still shows a significant disparity between home prices and average household income.

- Historical Comparison: Comparing current ratios to historical data reveals a stark difference, suggesting current prices are significantly detached from long-term affordability trends.

- International Benchmarks: Compared to other developed nations, Canada's home price-to-income ratios are among the highest, indicating a potential for significant correction.

Impact of Rising Interest Rates:

The Bank of Canada's recent interest rate hikes are significantly impacting mortgage affordability. Higher interest rates translate to substantially increased monthly mortgage payments, reducing borrowing power for potential homebuyers.

- Increased Monthly Payments: Even a small interest rate increase can lead to hundreds, or even thousands, of dollars in added monthly mortgage payments.

- Stress Tests: The stricter mortgage stress tests implemented in recent years aim to mitigate risk, but they also reduce the borrowing capacity of potential buyers, further dampening demand.

- Reduced Purchasing Power: The combined effect of higher interest rates and stress tests significantly reduces the purchasing power of prospective homebuyers.

Increased Housing Inventory:

While still relatively low in many markets, we are seeing a gradual increase in housing inventory across Canada, suggesting a potential shift in the supply-demand dynamic.

- New Builds: Increased construction activity is slowly adding to the housing supply.

- Existing Homes: More homeowners are listing their properties, adding to the available inventory.

- Supply and Demand: An increase in supply, coupled with reduced demand due to higher interest rates, could lead to a price correction.

2.2. Economic Factors Influencing a Correction:

Inflation and Economic Slowdown:

High inflation and the potential for an economic slowdown pose significant risks to the housing market. Inflation erodes purchasing power, while economic slowdown leads to job losses and decreased consumer confidence.

- Reduced Consumer Spending: Inflation forces consumers to prioritize essential spending, reducing discretionary income for housing.

- Job Losses: A potential economic recession could lead to job losses, further impacting housing demand.

- Decreased Consumer Confidence: Uncertainty about the economy can lead to decreased consumer confidence, delaying major purchases like homes.

Government Policies and Regulations:

Government policies, such as mortgage stress tests and foreign buyer taxes, influence market dynamics. While intended to stabilize the market, their impact is complex and often debated.

- Effectiveness of Past Interventions: Analysis of past government policies reveals varying degrees of success in influencing housing prices.

- Potential for Future Policy Changes: Further government intervention, either in the form of additional regulations or stimulus measures, remains a possibility, potentially influencing the trajectory of the market.

2.3. Signs of a Potential Correction (or Lack Thereof):

Decreasing Sales Activity:

A slowdown in home sales activity across many Canadian markets is a key indicator of potential correction.

- Year-over-Year Sales Decline: Data shows a significant year-over-year decline in home sales in several key markets.

- Regional Variations: While some regions are experiencing steeper declines than others, the overall trend points towards a cooling market.

Price Adjustments and Market Sentiment:

While not widespread, price adjustments and shifts in market sentiment are becoming more visible.

- Price Reductions: Some sellers are beginning to reduce their asking prices to attract buyers in a slower market.

- Shifting Buyer and Seller Confidence: Buyer confidence is waning while seller confidence is also decreasing as they face a slower market with less demand.

Conclusion: Navigating the Potential for a Canadian Home Price Correction

Several key factors, including overvaluation, rising interest rates, increased housing inventory, economic uncertainty, and government policies, all contribute to the potential for a Canadian home price correction. The impacts of a correction could be significant, affecting buyers, sellers, and investors alike. Understanding the intricacies of the Canadian housing market correction is crucial for making informed decisions. Stay informed about market trends, conduct thorough research, and consult with financial professionals before making significant real estate decisions. Further research into understanding the Canadian housing market correction, including analyzing regional variations and the impact of specific government policies, is recommended. Prepare for a potential Canadian home price adjustment by staying informed and seeking professional advice.

Featured Posts

-

Thlathy Jdyd Dmn Qaymt Mntkhb Alwlayat Almthdt Alamrykyt Llmrt Alawla

May 22, 2025

Thlathy Jdyd Dmn Qaymt Mntkhb Alwlayat Almthdt Alamrykyt Llmrt Alawla

May 22, 2025 -

Us China Trade Soars A Race Against The Clock For Export Deals

May 22, 2025

Us China Trade Soars A Race Against The Clock For Export Deals

May 22, 2025 -

Abn Amro Rapporteert Forse Stijging In Occasionverkopen

May 22, 2025

Abn Amro Rapporteert Forse Stijging In Occasionverkopen

May 22, 2025 -

Southport Stabbing Mothers Tweet Results In Jail Sentence And Loss Of Home

May 22, 2025

Southport Stabbing Mothers Tweet Results In Jail Sentence And Loss Of Home

May 22, 2025 -

Understanding Core Weaves Crwv Significant Stock Jump Last Week

May 22, 2025

Understanding Core Weaves Crwv Significant Stock Jump Last Week

May 22, 2025

Latest Posts

-

Used Car Lot Fire Emergency Crews On Scene

May 22, 2025

Used Car Lot Fire Emergency Crews On Scene

May 22, 2025 -

Firefighters Respond To Major Car Dealership Fire

May 22, 2025

Firefighters Respond To Major Car Dealership Fire

May 22, 2025 -

Susquehanna Valley Storm Damage Resources For Homeowners And Businesses

May 22, 2025

Susquehanna Valley Storm Damage Resources For Homeowners And Businesses

May 22, 2025 -

Recent Susquehanna Valley Storm Damage Extent Of The Destruction And Ongoing Efforts

May 22, 2025

Recent Susquehanna Valley Storm Damage Extent Of The Destruction And Ongoing Efforts

May 22, 2025 -

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Insurance

May 22, 2025

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Insurance

May 22, 2025