Pound Gains Momentum: Traders Reduce Expectations Of Bank Of England Rate Cuts Following Inflation Report

Table of Contents

Inflation Report Highlights

Unexpectedly High Inflation Figures

The report revealed inflation figures higher than anticipated, suggesting that the UK economy is not cooling down as quickly as previously predicted.

- Higher-than-expected CPI: The Consumer Price Index (CPI) figure exceeded market forecasts, indicating persistent inflationary pressures.

- Persistent inflationary pressures in core goods and services: Inflation wasn't solely driven by volatile energy prices; core inflation remained stubbornly high, signaling broader inflationary pressures within the UK economy.

- Impact of energy prices: While energy prices have eased somewhat from their peak, their lingering impact continues to contribute to elevated inflation.

The Office for National Statistics (ONS) reported a CPI figure of X% (replace X with the actual figure), significantly higher than the predicted Y% (replace Y with the predicted figure). This deviation from forecasts underscores the resilience of inflationary pressures within the UK economy and has major implications for monetary policy.

Impact on Market Expectations

The surprisingly strong inflation data led to a reassessment of the BoE's future monetary policy trajectory.

- Reduced likelihood of further interest rate cuts: The market's expectation of further rate cuts by the BoE has diminished considerably.

- Potential for future rate hikes: Some analysts are now predicting the possibility of future interest rate increases by the BoE to combat persistent inflation.

- Impact on gilt yields: The increased likelihood of higher interest rates has led to a rise in gilt yields, impacting the attractiveness of UK government bonds.

This shift in expectations dramatically alters the investment landscape, making the Pound a more attractive asset for investors seeking higher returns. The reduced expectation of rate cuts significantly impacts investor sentiment, contributing to the Pound Gains Momentum.

Trader Response and Market Reaction

Pound Sterling Appreciation

The Pound immediately strengthened against major currencies like the US dollar and the Euro following the release of the inflation report.

- GBP/USD exchange rate movements: The GBP/USD exchange rate saw a significant increase, demonstrating a strengthening Pound against the US dollar. (Insert specific numbers and chart if available)

- GBP/EUR exchange rate movements: Similarly, the GBP/EUR exchange rate also saw positive movement, reflecting Pound appreciation against the Euro. (Insert specific numbers and chart if available)

- Volume traded: Increased trading volume accompanied the Pound's appreciation, indicating heightened market activity driven by the inflation report's impact.

This rapid and substantial appreciation of the Pound is a direct consequence of the revised expectations regarding BoE interest rate cuts.

Shift in Rate Cut Probabilities

Market analysts revised their predictions for future BoE interest rate cuts downwards.

- Changes in market implied probability: Market-implied probabilities, derived from interest rate futures contracts, showed a marked decrease in the likelihood of further rate reductions.

- Impact on future policy meetings: The BoE's upcoming monetary policy meetings will now be closely scrutinized for any indication of a potential shift in its stance.

- Adjustments in trading strategies: Traders are adjusting their strategies in light of this new information, potentially leading to further Pound appreciation.

The shift in market-implied probabilities reflects a widespread reassessment of the economic outlook and the BoE's likely response. This reassessment is a key factor driving the current Pound Gains Momentum.

Long-Term Implications for the Pound

Economic Outlook Uncertainty

The inflation report highlights lingering uncertainty about the UK's economic trajectory.

- Potential for continued inflationary pressures: The persistence of inflation raises concerns about the potential for further price increases, impacting consumer spending and economic growth.

- Impact of global economic factors: Global economic conditions, including energy prices and geopolitical events, will continue to influence the UK's economic performance.

- Risks of a recession: The continued high inflation and the BoE's response could increase the risk of a recession in the UK.

The prevailing uncertainty makes predicting the long-term impact on the Pound challenging.

BoE's Next Steps

The BoE's response to this inflation data will be crucial in determining the Pound's future performance.

- Potential for altering the monetary policy stance: The BoE may need to reconsider its monetary policy stance if inflation remains stubbornly high.

- Future communication from the BoE: The BoE's communication regarding its future plans will be crucial in shaping market expectations and influencing the Pound's value.

- Impact of political factors: Political developments and government policies can also influence the UK economy and impact the Pound's value.

The BoE's actions will be pivotal in determining whether the current Pound Gains Momentum is sustainable.

Conclusion

The unexpected strength in the latest inflation report has significantly impacted market sentiment, leading to a notable Pound Gains Momentum. The higher-than-expected inflation figures have reduced expectations of further Bank of England rate cuts, resulting in a strengthening of the Pound against major currencies. While uncertainty remains regarding the UK's economic future, this shift demonstrates the powerful influence of inflation data on currency markets. To stay abreast of the latest developments and understand how these fluctuations might affect your investments, continue monitoring the economic indicators and the Bank of England’s announcements. Stay informed to capitalize on future Pound Gains Momentum opportunities.

Featured Posts

-

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trump Tariff Decision

May 24, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

O Chem Povestvuet Publikatsiya Gryozy Lyubvi Ili Ilicha V Trude

May 24, 2025

O Chem Povestvuet Publikatsiya Gryozy Lyubvi Ili Ilicha V Trude

May 24, 2025 -

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025

Legendas F1 Motor Egyedi Porsche Koezuti Modell

May 24, 2025 -

Hl Ystmr Sewd Daks Alalmany

May 24, 2025

Hl Ystmr Sewd Daks Alalmany

May 24, 2025

Latest Posts

-

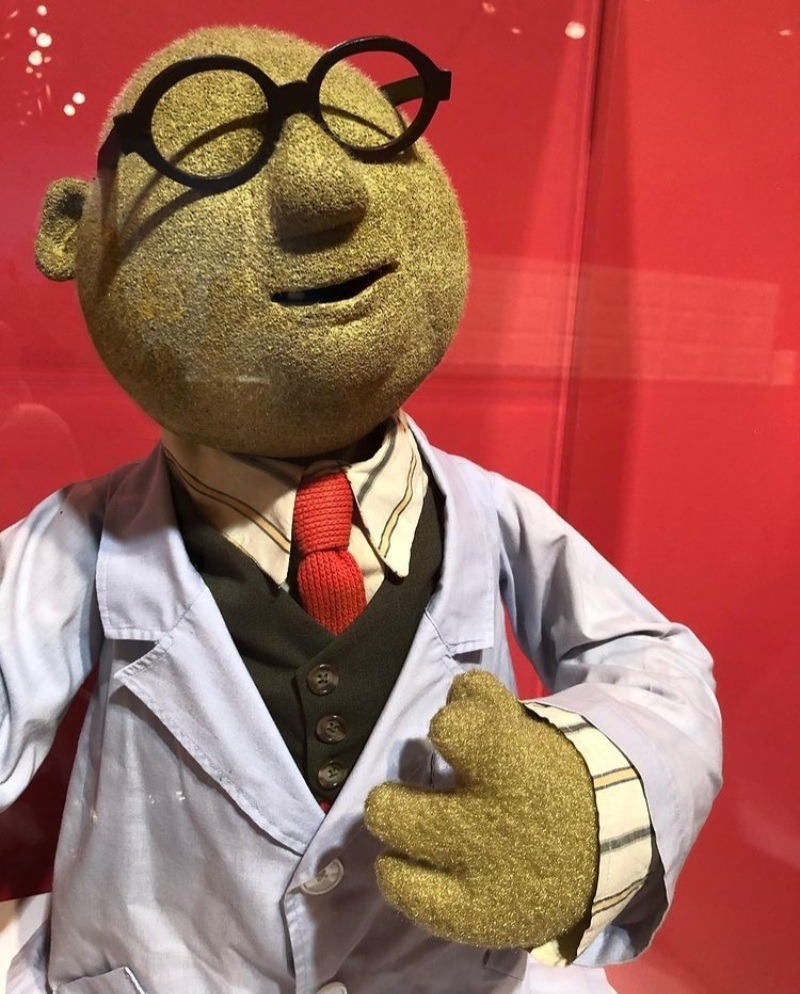

Kermit The Frog University Of Marylands 2024 Commencement Speaker

May 24, 2025

Kermit The Frog University Of Marylands 2024 Commencement Speaker

May 24, 2025 -

Muppet Legend Kermit The Frog To Address University Of Maryland Graduates

May 24, 2025

Muppet Legend Kermit The Frog To Address University Of Maryland Graduates

May 24, 2025 -

University Of Maryland Names Kermit The Frog As Commencement Speaker

May 24, 2025

University Of Maryland Names Kermit The Frog As Commencement Speaker

May 24, 2025 -

University Of Maryland Announces Kermit The Frog As 2025 Commencement Speaker

May 24, 2025

University Of Maryland Announces Kermit The Frog As 2025 Commencement Speaker

May 24, 2025 -

Billie Jean King Cup Kazakhstan Defeats Australia In Qualifying Match

May 24, 2025

Billie Jean King Cup Kazakhstan Defeats Australia In Qualifying Match

May 24, 2025