Euronext Amsterdam Stocks Jump 8% Following Trump Tariff Decision

Table of Contents

The Trump Tariff Decision and its Immediate Impact on Euronext Amsterdam

The specific Trump tariff decision that triggered the Euronext Amsterdam stock surge involved [Insert specific details of the tariff decision here – e.g., a suspension of tariffs on certain goods, a delay in implementing new tariffs, etc.]. This decision, while seemingly targeted at a specific sector or region, had a ripple effect across global markets, impacting investor sentiment and significantly influencing the Euronext Amsterdam exchange.

The initial market reaction was swift and dramatic. The surge began around [Time of surge] and peaked at approximately [Peak percentage increase] within [Timeframe]. Overall market volatility was [Describe volatility – high, low, moderate] as investors reacted to the news.

- Specific examples of stocks that experienced significant gains: [List specific examples, e.g., ASML Holding, Unilever, ING Group – include stock tickers if possible].

- Sectors disproportionately affected: The technology sector, in particular companies involved in [Specific technology area affected by the tariff decision], saw significant gains. The financial sector also showed considerable positive movement, with banks like [Example bank] experiencing a noticeable rise in share prices.

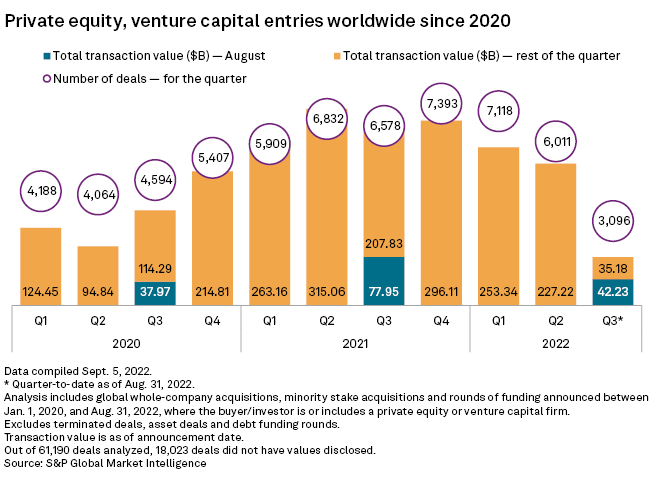

- Illustrative Chart/Graph: [Insert a chart or graph showcasing the stock market movement on the day of the announcement. Clearly label the axes and highlight the 8% increase].

Analyzing the Reasons Behind the Euronext Amsterdam Stock Jump

The positive market response to the Trump tariff decision could be attributed to several factors. The most prominent reason was likely a sense of relief among investors who had anticipated more negative trade-related outcomes. This relief was further amplified by [mention any specific anticipation of future policy changes related to the decision]. Speculative trading also likely contributed to the surge, with investors looking to capitalize on the initial market reaction.

Investor sentiment played a crucial role. Following the announcement, investor confidence in the European market, specifically the Euronext Amsterdam, saw a marked improvement. This renewed optimism led to increased buying activity, fueling the upward trend in stock prices.

- Expert Opinions: [Quote relevant financial analysts or economists on their assessment of the situation and reasons for the surge. Include credible sources].

- Company-Specific Impacts: [Analyze how specific companies listed on Euronext Amsterdam were affected, linking their performance to their exposure to the factors influenced by the tariff decision].

- Unforeseen Consequences: [Mention any unexpected consequences or contributing factors that may have influenced the stock market reaction].

Long-Term Implications and Future Outlook for Euronext Amsterdam Stocks

The sustainability of the upward trend in Euronext Amsterdam stocks following the Trump tariff decision remains uncertain. While the immediate reaction was positive, several risks and challenges could impact future performance. Geopolitical instability, ongoing economic uncertainty globally, and future policy decisions, both domestically and internationally, all pose potential threats.

- Future Stock Performance Predictions: [Provide cautious predictions based on market analysis, considering various scenarios and emphasizing the inherent uncertainties].

- Investment Advice (Disclaimer): This analysis is for informational purposes only and does not constitute financial advice. Investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions related to Euronext Amsterdam stocks or any other investment.

- Potential Regulatory Changes: [Mention any anticipated changes in regulations or policies that could impact the Euronext Amsterdam market in the future].

Sector-Specific Analysis of the Euronext Amsterdam Market Reaction

Different sectors within the Euronext Amsterdam market reacted differently to the Trump tariff decision. While some sectors experienced significant gains, others saw more muted or even negative responses.

- Detailed Sector Analysis: [Provide a breakdown of how key sectors performed—Energy, Technology, Financials, etc. Highlight which companies performed well and which lagged].

- Comparison with Other Exchanges: [Compare the performance of Euronext Amsterdam with other major European stock exchanges like the London Stock Exchange or the Frankfurt Stock Exchange, to assess the uniqueness of the market reaction].

- Graphical Representations: [Include bar charts or other visuals comparing the performance of different sectors, clearly illustrating the winners and losers].

Conclusion: Understanding the Euronext Amsterdam Stock Surge After the Trump Tariff Decision

The 8% surge in Euronext Amsterdam stocks following the Trump tariff decision was a significant event, driven by a combination of relief, anticipation of future policy changes, and speculative trading. While the immediate impact was positive, the long-term implications remain uncertain due to ongoing geopolitical instability and economic factors. The market's volatility underscores the importance of informed investment decisions. To stay informed about Euronext Amsterdam stocks and future tariff decisions, we encourage you to subscribe to reputable financial newsletters, follow market analyses from trusted sources, and consult with financial advisors specializing in Euronext Amsterdam stock market analysis and investing in Euronext Amsterdam stocks. Understanding the intricacies of the Euronext Amsterdam stock market is crucial for successful investment strategies.

Featured Posts

-

Malaysias Najib Razak Implicated In French Submarine Bribery Case

May 24, 2025

Malaysias Najib Razak Implicated In French Submarine Bribery Case

May 24, 2025 -

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 24, 2025 -

Porsche 956 Nin Tavan Sergisinin Arkasindaki Nedenler

May 24, 2025

Porsche 956 Nin Tavan Sergisinin Arkasindaki Nedenler

May 24, 2025 -

Housing Finance And Family Fun Await At The Iam Expat Fair

May 24, 2025

Housing Finance And Family Fun Await At The Iam Expat Fair

May 24, 2025 -

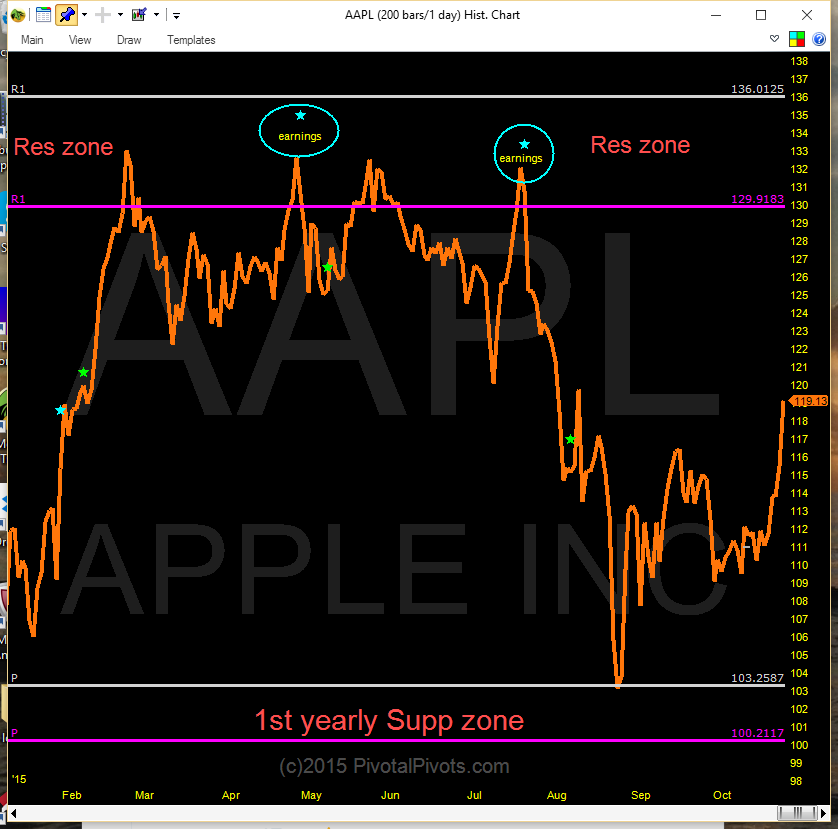

Next Key Price Levels For Apple Stock Aapl

May 24, 2025

Next Key Price Levels For Apple Stock Aapl

May 24, 2025

Latest Posts

-

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

May 24, 2025 -

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025

The Thames Water Case Executive Bonuses And The Water Crisis

May 24, 2025 -

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025

Dismissing Stock Market Valuation Concerns Insights From Bof A

May 24, 2025 -

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Justified A Critical Analysis

May 24, 2025 -

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025

The Thames Water Bonus Controversy Examining Executive Compensation

May 24, 2025